Page 45: of Maritime Logistics Professional Magazine (Jul/Aug 2017)

PORTS & INFRASTRUCTURE

Read this page in Pdf, Flash or Html5 edition of Jul/Aug 2017 Maritime Logistics Professional Magazine

STATISTICS

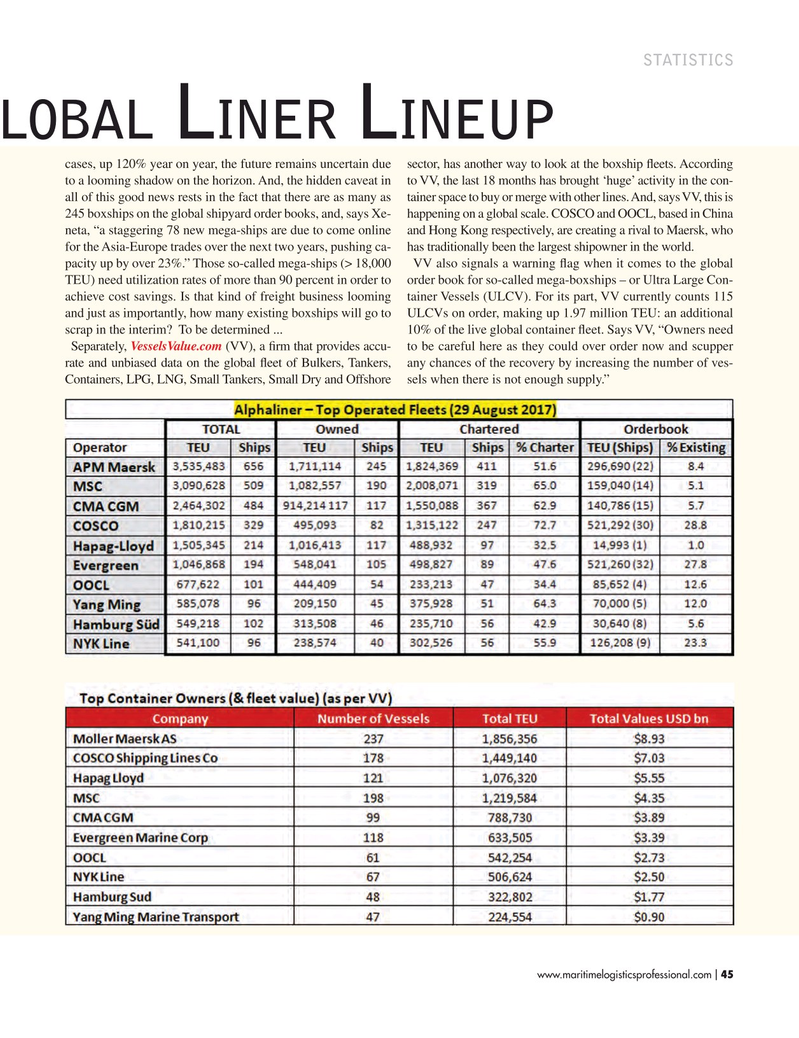

H g l landicapping tHe lobal iner ineup cases, up 120% year on year, the future remains uncertain due sector, has another way to look at the boxship feets. According to a looming shadow on the horizon. And, the hidden caveat in to VV, the last 18 months has brought ‘huge’ activity in the con- all of this good news rests in the fact that there are as many as tainer space to buy or merge with other lines. And, says VV, this is 245 boxships on the global shipyard order books, and, says Xe- happening on a global scale. COSCO and OOCL, based in China neta, “a staggering 78 new mega-ships are due to come online and Hong Kong respectively, are creating a rival to Maersk, who for the Asia-Europe trades over the next two years, pushing ca- has traditionally been the largest shipowner in the world.

pacity up by over 23%.” Those so-called mega-ships (> 18,000 VV also signals a warning fag when it comes to the global

TEU) need utilization rates of more than 90 percent in order to order book for so-called mega-boxships – or Ultra Large Con- achieve cost savings. Is that kind of freight business looming tainer Vessels (ULCV). For its part, VV currently counts 115 and just as importantly, how many existing boxships will go to ULCVs on order, making up 1.97 million TEU: an additional scrap in the interim? To be determined ... 10% of the live global container feet. Says VV, “Owners need

Separately, VesselsValue.com (VV), a frm that provides accu- to be careful here as they could over order now and scupper rate and unbiased data on the global feet of Bulkers, Tankers, any chances of the recovery by increasing the number of ves-

Containers, LPG, LNG, Small Tankers, Small Dry and Offshore sels when there is not enough supply.” www.maritimelogisticsprofessional.com 45

I

44

44

46

46