Page 39: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

sessment of their worth. The feet of active ships stands at 243

VESSELSVALUE’S VISION

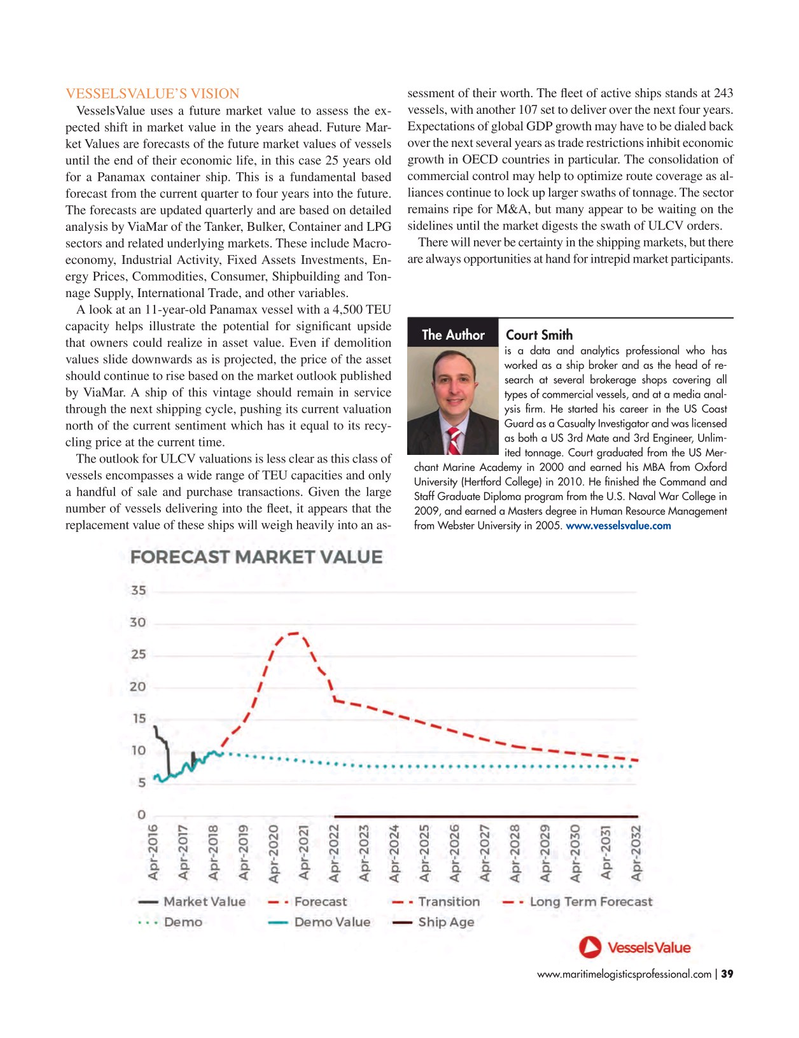

VesselsValue uses a future market value to assess the ex- vessels, with another 107 set to deliver over the next four years. pected shift in market value in the years ahead. Future Mar- Expectations of global GDP growth may have to be dialed back ket Values are forecasts of the future market values of vessels over the next several years as trade restrictions inhibit economic until the end of their economic life, in this case 25 years old growth in OECD countries in particular. The consolidation of for a Panamax container ship. This is a fundamental based commercial control may help to optimize route coverage as al- forecast from the current quarter to four years into the future. liances continue to lock up larger swaths of tonnage. The sector

The forecasts are updated quarterly and are based on detailed remains ripe for M&A, but many appear to be waiting on the analysis by ViaMar of the Tanker, Bulker, Container and LPG sidelines until the market digests the swath of ULCV orders. sectors and related underlying markets. These include Macro- There will never be certainty in the shipping markets, but there economy, Industrial Activity, Fixed Assets Investments, En- are always opportunities at hand for intrepid market participants.

ergy Prices, Commodities, Consumer, Shipbuilding and Ton- nage Supply, International Trade, and other variables.

A look at an 11-year-old Panamax vessel with a 4,500 TEU capacity helps illustrate the potential for signifcant upside

The Author Court Smith that owners could realize in asset value. Even if demolition is a data and analytics professional who has values slide downwards as is projected, the price of the asset worked as a ship broker and as the head of re- should continue to rise based on the market outlook published search at several brokerage shops covering all by ViaMar. A ship of this vintage should remain in service types of commercial vessels, and at a media anal- ysis frm. He started his career in the US Coast through the next shipping cycle, pushing its current valuation

Guard as a Casualty Investigator and was licensed north of the current sentiment which has it equal to its recy- as both a US 3rd Mate and 3rd Engineer, Unlim- cling price at the current time.

ited tonnage. Court graduated from the US Mer-

The outlook for ULCV valuations is less clear as this class of chant Marine Academy in 2000 and earned his MBA from Oxford vessels encompasses a wide range of TEU capacities and only

University (Hertford College) in 2010. He fnished the Command and a handful of sale and purchase transactions. Given the large

Staff Graduate Diploma program from the U.S. Naval War College in number of vessels delivering into the feet, it appears that the 2009, and earned a Masters degree in Human Resource Management replacement value of these ships will weigh heavily into an as- from Webster University in 2005. www.vesselsvalue.com www.maritimelogisticsprofessional.com 39

I

38

38

40

40