Page 48: of Maritime Logistics Professional Magazine (May/Jun 2018)

Container Ports

Read this page in Pdf, Flash or Html5 edition of May/Jun 2018 Maritime Logistics Professional Magazine

Container Shipping: Finance

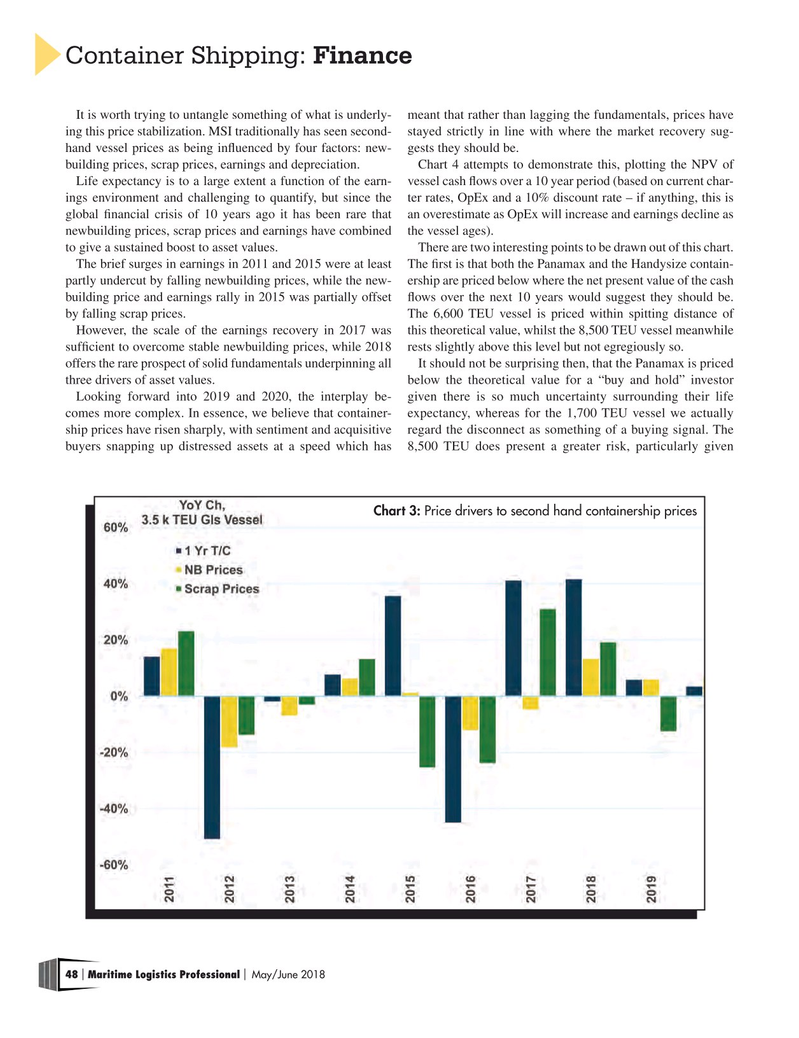

It is worth trying to untangle something of what is underly- meant that rather than lagging the fundamentals, prices have ing this price stabilization. MSI traditionally has seen second- stayed strictly in line with where the market recovery sug- hand vessel prices as being infuenced by four factors: new- gests they should be. building prices, scrap prices, earnings and depreciation. Chart 4 attempts to demonstrate this, plotting the NPV of

Life expectancy is to a large extent a function of the earn- vessel cash fows over a 10 year period (based on current char- ings environment and challenging to quantify, but since the ter rates, OpEx and a 10% discount rate – if anything, this is global fnancial crisis of 10 years ago it has been rare that an overestimate as OpEx will increase and earnings decline as newbuilding prices, scrap prices and earnings have combined the vessel ages).

to give a sustained boost to asset values. There are two interesting points to be drawn out of this chart.

The brief surges in earnings in 2011 and 2015 were at least The frst is that both the Panamax and the Handysize contain- partly undercut by falling newbuilding prices, while the new- ership are priced below where the net present value of the cash building price and earnings rally in 2015 was partially offset fows over the next 10 years would suggest they should be. by falling scrap prices. The 6,600 TEU vessel is priced within spitting distance of

However, the scale of the earnings recovery in 2017 was this theoretical value, whilst the 8,500 TEU vessel meanwhile suffcient to overcome stable newbuilding prices, while 2018 rests slightly above this level but not egregiously so.

offers the rare prospect of solid fundamentals underpinning all It should not be surprising then, that the Panamax is priced three drivers of asset values. below the theoretical value for a “buy and hold” investor

Looking forward into 2019 and 2020, the interplay be- given there is so much uncertainty surrounding their life comes more complex. In essence, we believe that container- expectancy, whereas for the 1,700 TEU vessel we actually ship prices have risen sharply, with sentiment and acquisitive regard the disconnect as something of a buying signal. The buyers snapping up distressed assets at a speed which has 8,500 TEU does present a greater risk, particularly given

Chart 3: Price drivers to second hand containership prices 48 Maritime Logistics Professional May/June 2018 | |

47

47

49

49