Page 62: of Maritime Logistics Professional Magazine (Sep/Oct 2018)

Liner Shipping & Logistics

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2018 Maritime Logistics Professional Magazine

STATISTICS

M S : V o oore tephenS eSSel perating n a report released in mid-October, International accountant from 20% and frst place last year. Competition ranked in third and shipping consultant Moore Stephens says total vessel op- place at 15% as it had last year. Meanwhile crew supply fell to

Ierating costs in the shipping industry are expected to rise by 12% compared to 19% and second place in last year’s survey. 2.7% in 2018 and by 3.1% in 2019. Responses to the frm’s latest Richard Greiner, Moore Stephens partner, Shipping and Trans- annual Future Operating Costs Survey revealed that drydock- port, says, “The predicted 2.7% and 3.1% increases in operating ing is the cost category likely to increase most signifcantly in costs for 2018 and 2019 respectively compare to an average fall in both 2018 and 2019, accompanied in the latter case by repairs actual operating costs in 2017 of 1.3% across all main ship types and maintenance. recorded in the recent Moore Stephens OpCost study.” Greiner

Moore Stephens contacted key players in the shipping market continues, “One year ago, expectations of operating cost increas- internationally over a 28 day period in September 2018, asking es in 2018 averaged 2.4%, so the increase now in that expectation them to complete a short web-based questionnaire, also provid- to 2.7% must be regarded as sobering – if not unexpected –news. ing information on their business type, headquarters’ location and Projected increases in operating expenditure are part and parcel sector most relevant to their operations to help sharpen the analy- of the workings of any industry, and must be factored into budget sis. According to Moore Stephens, the survey represents a broad projections. But these latest predicted increases, whilst a cause cross section of industry and that their analysis is representative for concern, should not unduly surprise or concern shipping, an of the shipping industry as a whole. industry which has seen – and in many cases endured – much

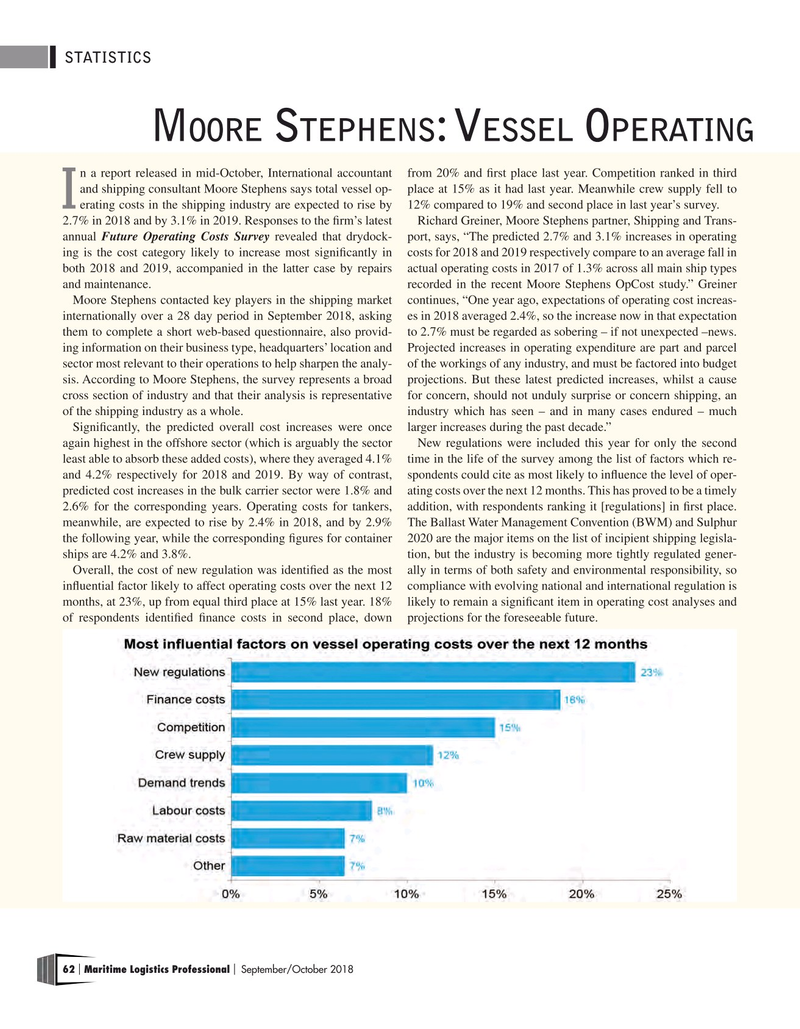

Signifcantly, the predicted overall cost increases were once larger increases during the past decade.” again highest in the offshore sector (which is arguably the sector New regulations were included this year for only the second least able to absorb these added costs), where they averaged 4.1% time in the life of the survey among the list of factors which re- and 4.2% respectively for 2018 and 2019. By way of contrast, spondents could cite as most likely to infuence the level of oper- predicted cost increases in the bulk carrier sector were 1.8% and ating costs over the next 12 months. This has proved to be a timely 2.6% for the corresponding years. Operating costs for tankers, addition, with respondents ranking it [regulations] in frst place. meanwhile, are expected to rise by 2.4% in 2018, and by 2.9% The Ballast Water Management Convention (BWM) and Sulphur the following year, while the corresponding fgures for container 2020 are the major items on the list of incipient shipping legisla- ships are 4.2% and 3.8%. tion, but the industry is becoming more tightly regulated gener-

Overall, the cost of new regulation was identifed as the most ally in terms of both safety and environmental responsibility, so infuential factor likely to affect operating costs over the next 12 compliance with evolving national and international regulation is months, at 23%, up from equal third place at 15% last year. 18% likely to remain a signifcant item in operating cost analyses and of respondents identifed fnance costs in second place, down projections for the foreseeable future.

62 Maritime Logistics Professional September/October 2018 | |

61

61

63

63