Page 63: of Maritime Logistics Professional Magazine (Sep/Oct 2018)

Liner Shipping & Logistics

Read this page in Pdf, Flash or Html5 edition of Sep/Oct 2018 Maritime Logistics Professional Magazine

STATISTICS

C W i SoStS ill nCreaSe ubStantially

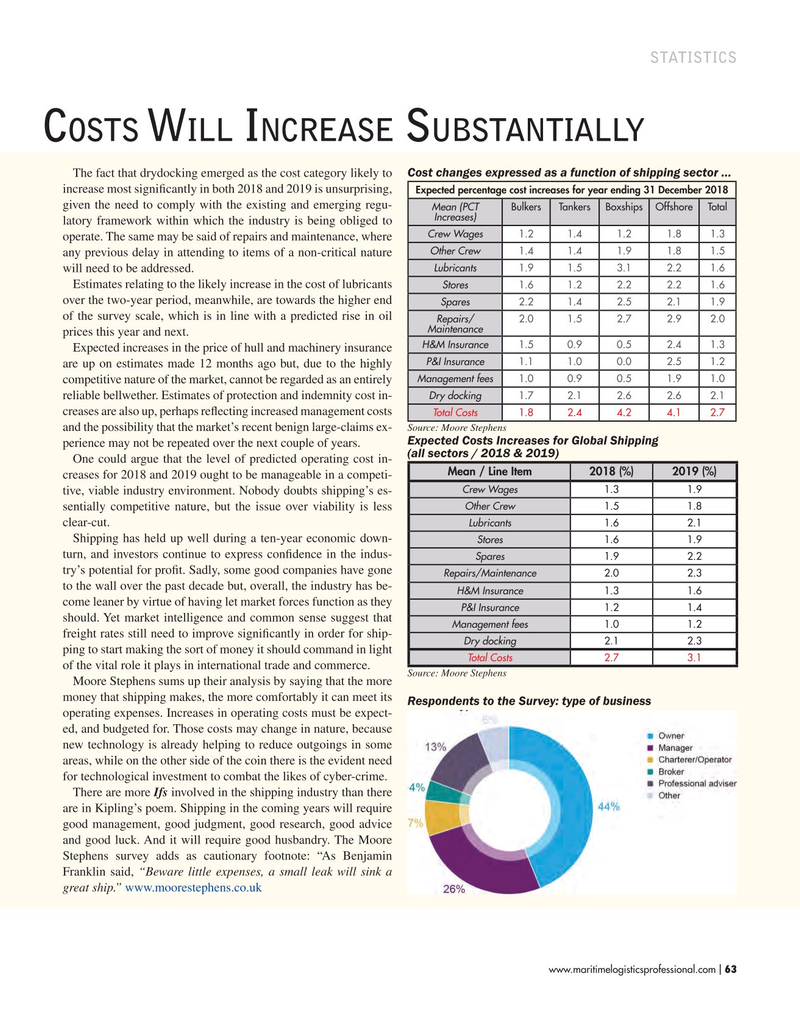

The fact that drydocking emerged as the cost category likely to Cost changes expressed as a function of shipping sector … increase most signifcantly in both 2018 and 2019 is unsurprising,

Expected percentage cost increases for year ending 31 December 2018 given the need to comply with the existing and emerging regu-

Mean (PCT Bulkers Tankers Boxships Offshore Total

Increases) latory framework within which the industry is being obliged to

Crew Wages 1.2 1.4 1.2 1.8 1.3 operate. The same may be said of repairs and maintenance, where

Other Crew 1.4 1.4 1.9 1.8 1.5 any previous delay in attending to items of a non-critical nature

Lubricants 1.9 1.5 3.1 2.2 1.6 will need to be addressed.

Estimates relating to the likely increase in the cost of lubricants

Stores 1.6 1.2 2.2 2.2 1.6 over the two-year period, meanwhile, are towards the higher end

Spares 2.2 1.4 2.5 2.1 1.9 of the survey scale, which is in line with a predicted rise in oil

Repairs/ 2.0 1.5 2.7 2.9 2.0

Maintenance prices this year and next.

H&M Insurance 1.5 0.9 0.5 2.4 1.3

Expected increases in the price of hull and machinery insurance

P&I Insurance 1.1 1.0 0.0 2.5 1.2 are up on estimates made 12 months ago but, due to the highly

Management fees 1.0 0.9 0.5 1.9 1.0 competitive nature of the market, cannot be regarded as an entirely

Dry docking 1.7 2.1 2.6 2.6 2.1 reliable bellwether. Estimates of protection and indemnity cost in- creases are also up, perhaps refecting increased management costs

Total Costs 1.8 2.4 4.2 4.1 2.7

Source: Moore Stephens and the possibility that the market’s recent benign large-claims ex-

Expected Costs Increases for Global Shipping perience may not be repeated over the next couple of years.

(all sectors / 2018 & 2019)

One could argue that the level of predicted operating cost in-

Mean / Line Item 2018 (%) 2019 (%) creases for 2018 and 2019 ought to be manageable in a competi-

Crew Wages 1.3 1.9 tive, viable industry environment. Nobody doubts shipping’s es-

Other Crew 1.5 1.8 sentially competitive nature, but the issue over viability is less clear-cut.

Lubricants 1.6 2.1

Shipping has held up well during a ten-year economic down-

Stores 1.6 1.9 turn, and investors continue to express confdence in the indus-

Spares 1.9 2.2 try’s potential for proft. Sadly, some good companies have gone

Repairs/Maintenance 2.0 2.3 to the wall over the past decade but, overall, the industry has be-

H&M Insurance 1.3 1.6 come leaner by virtue of having let market forces function as they

P&I Insurance 1.2 1.4 should. Yet market intelligence and common sense suggest that

Management fees 1.0 1.2 freight rates still need to improve signifcantly in order for ship-

Dry docking 2.1 2.3 ping to start making the sort of money it should command in light

Total Costs 2.7 3.1 of the vital role it plays in international trade and commerce.

Source: Moore Stephens

Moore Stephens sums up their analysis by saying that the more money that shipping makes, the more comfortably it can meet its

Respondents to the Survey: type of business operating expenses. Increases in operating costs must be expect- ed, and budgeted for. Those costs may change in nature, because new technology is already helping to reduce outgoings in some areas, while on the other side of the coin there is the evident need for technological investment to combat the likes of cyber-crime.

There are more Ifs involved in the shipping industry than there are in Kipling’s poem. Shipping in the coming years will require good management, good judgment, good research, good advice and good luck. And it will require good husbandry. The Moore

Stephens survey adds as cautionary footnote: “As Benjamin

Franklin said, “Beware little expenses, a small leak will sink a great ship.” www.moorestephens.co.uk www.maritimelogisticsprofessional.com 63

I

62

62

64

64