Page 50: of Maritime Logistics Professional Magazine (Nov/Dec 2018)

Regulatory & Environmental Review

Read this page in Pdf, Flash or Html5 edition of Nov/Dec 2018 Maritime Logistics Professional Magazine

STATISTICS

P , L i orts ogistics and ntermodaL

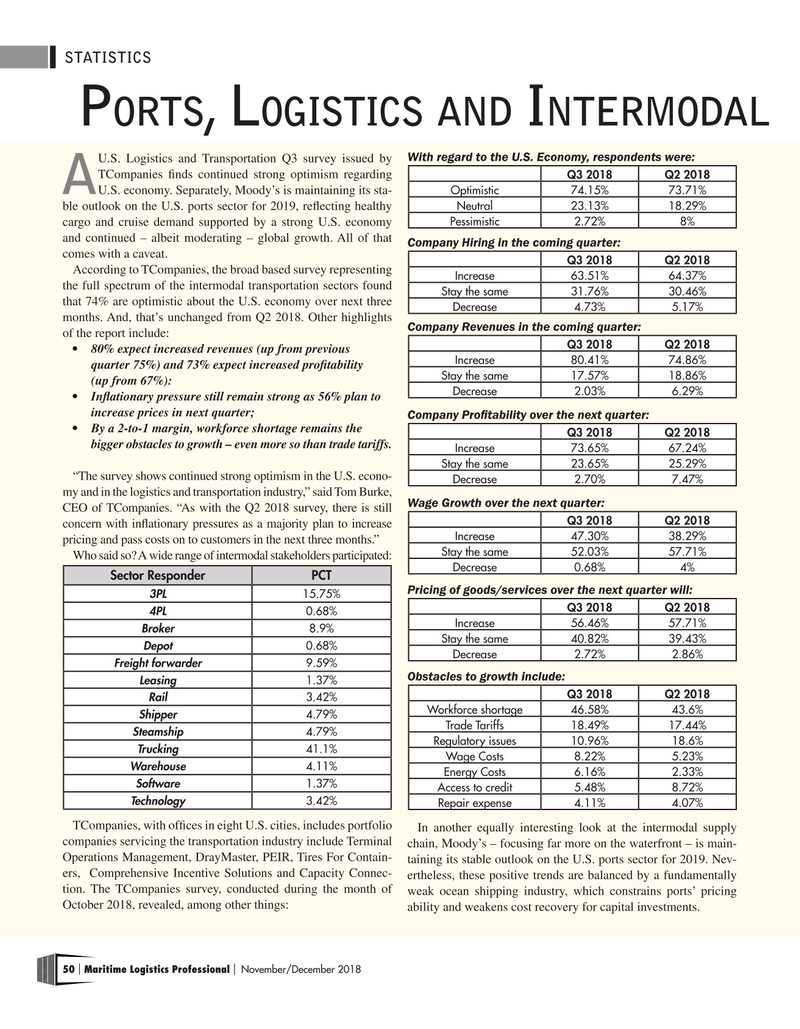

U.S. Logistics and Transportation Q3 survey issued by With regard to the U.S. Economy, respondents were:

TCompanies fnds continued strong optimism regarding

Q3 2018 Q2 2018

A U.S. economy. Separately, Moody’s is maintaining its sta-

Optimistic 74.15% 73.71%

Neutral 23.13% 18.29% ble outlook on the U.S. ports sector for 2019, refecting healthy

Pessimistic 2.72% 8% cargo and cruise demand supported by a strong U.S. economy and continued – albeit moderating – global growth. All of that Company Hiring in the coming quarter: comes with a caveat.

Q3 2018 Q2 2018

According to TCompanies, the broad based survey representing

Increase 63.51% 64.37% the full spectrum of the intermodal transportation sectors found

Stay the same 31.76% 30.46% that 74% are optimistic about the U.S. economy over next three

Decrease 4.73% 5.17% months. And, that’s unchanged from Q2 2018. Other highlights

Company Revenues in the coming quarter: of the report include:

Q3 2018 Q2 2018 • 80% expect increased revenues (up from previous

Increase 80.41% 74.86% quarter 75%) and 73% expect increased proftability

Stay the same 17.57% 18.86% (up from 67%):

Decrease 2.03% 6.29% • Infationary pressure still remain strong as 56% plan to increase prices in next quarter;

Company Proftability over the next quarter: • By a 2-to-1 margin, workforce shortage remains the

Q3 2018 Q2 2018 bigger obstacles to growth – even more so than trade tariffs.

Increase 73.65% 67.24%

Stay the same 23.65% 25.29% “The survey shows continued strong optimism in the U.S. econo-

Decrease 2.70% 7.47% my and in the logistics and transportation industry,” said Tom Burke,

CEO of TCompanies. “As with the Q2 2018 survey, there is still Wage Growth over the next quarter:

Q3 2018 Q2 2018 concern with infationary pressures as a majority plan to increase

Increase 47.30% 38.29% pricing and pass costs on to customers in the next three months.”

Stay the same 52.03% 57.71%

Who said so? A wide range of intermodal stakeholders participated:

Decrease 0.68% 4%

Sector Responder PCT

Pricing of goods/services over the next quarter will: 3PL 15.75%

Q3 2018 Q2 2018 4PL 0.68%

Increase 56.46% 57.71%

Broker 8.9%

Stay the same 40.82% 39.43%

Depot 0.68%

Decrease 2.72% 2.86%

Freight forwarder 9.59%

Obstacles to growth include:

Leasing 1.37%

Q3 2018 Q2 2018

Rail 3.42%

Workforce shortage 46.58% 43.6%

Shipper 4.79%

Trade Tariffs 18.49% 17.44%

Steamship 4.79%

Regulatory issues 10.96% 18.6%

Trucking 41.1%

Wage Costs 8.22% 5.23%

Warehouse 4.11%

Energy Costs 6.16% 2.33%

Software 1.37%

Access to credit 5.48% 8.72%

Technology 3.42%

Repair expense 4.11% 4.07%

TCompanies, with offces in eight U.S. cities, includes portfolio

In another equally interesting look at the intermodal supply companies servicing the transportation industry include Terminal chain, Moody’s – focusing far more on the waterfront – is main-

Operations Management, DrayMaster, PEIR, Tires For Contain- taining its stable outlook on the U.S. ports sector for 2019. Nev- ers, Comprehensive Incentive Solutions and Capacity Connec- ertheless, these positive trends are balanced by a fundamentally tion. The TCompanies survey, conducted during the month of weak ocean shipping industry, which constrains ports’ pricing

October 2018, revealed, among other things: ability and weakens cost recovery for capital investments. 50 Maritime Logistics Professional November/December 2018 | |

49

49

51

51