Page 46: of Maritime Reporter Magazine (June 1985)

Read this page in Pdf, Flash or Html5 edition of June 1985 Maritime Reporter Magazine

U.S. MERCHANT

SHIPBUILDING

M. Lee Rice

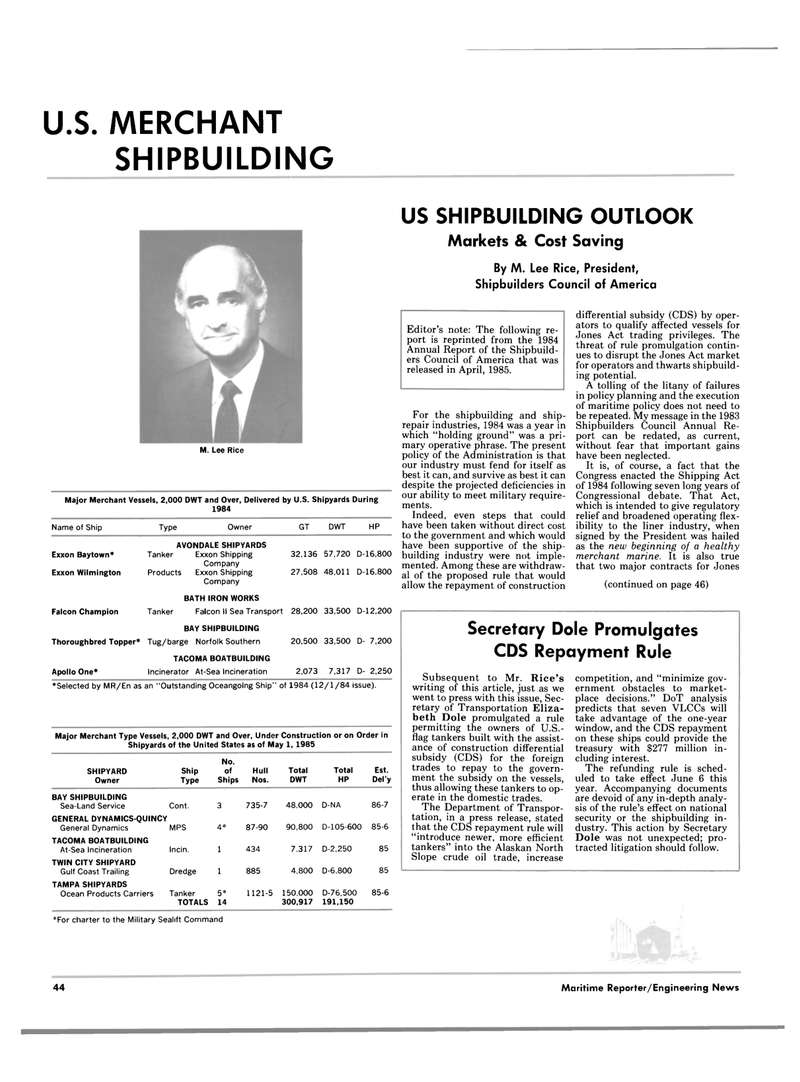

Major Merchant Vessels, 2,000 DWT and Over, Delivered by U.S. Shipyards During 1984

Name of Ship Type Owner GT DWT HP

Exxon Baytown*

Exxon Wilmington

AVONDALE SHIPYARDS

Tanker Exxon Shipping

Company

Products Exxon Shipping

Company

SHIPYARD

Owner

Ship

Type of

Ships

Hull

Nos.

Total

DWT

Total

HP

Est.

Del'y

BAY SHIPBUILDING

Sea-Land Service Cont. 3 735-7 48.000 D-NA 86-7

GENERAL DYNAMICS-QUINCY

General Dynamics MPS 4* 87-90 90,800 D-105-600 85-6

TACOMA BOATBUILDING

At-Sea Incineration Incin. 1 434 7.317 D-2,250 85

TWIN CITY SHIPYARD

Gulf Coast Trailing Dredge 1 885 4,800 D-6,800 85

TAMPA SHIPYARDS

Ocean Products Carriers Tanker

TOTALS 5* 14 1121-5 150,000 300,917

D-76,500 191,150 85-6 *For charter to the Military Sealift Command

US SHIPBUILDING OUTLOOK

Markets & Cost Saving

By M. Lee Rice, President,

Shipbuilders Council of America

Editor's note: The following re- port is reprinted from the 1984

Annual Report of the Shipbuild- ers Council of America that was released in April, 1985. 32,136 57,720 D-16,800 27,508 48,011 D-16,800

For the shipbuilding and ship- repair industries, 1984 was a year in which "holding ground" was a pri- mary operative phrase. The present policy of the Administration is that our industry must fend for itself as best it can, and survive as best it can despite the projected deficiencies in our ability to meet military require- ments.

Indeed, even steps that could have been taken without direct cost to the government and which would have been supportive of the ship- building industry were not imple- mented. Among these are withdraw- al of the proposed rule that would allow the repayment of construction differential subsidy (CDS) by oper- ators to qualify affected vessels for

Jones Act trading privileges. The threat of rule promulgation contin- ues to disrupt the Jones Act market for operators and thwarts shipbuild- ing potential.

A tolling of the litany of failures in policy planning and the execution of maritime policy does not need to be repeated. My message in the 1983

Shipbuilders Council Annual Re- port can be redated, as current, without fear that important gains have been neglected.

It is, of course, a fact that the

Congress enacted the Shipping Act of 1984 following seven long years of

Congressional debate. That Act, which is intended to give regulatory relief and broadened operating flex- ibility to the liner industry, when signed by the President was hailed as the new beginning of a healthy merchant marine. It is also true that two major contracts for Jones (continued on page 46)

BATH IRON WORKS

Falcon Champion Tanker Falcon II Sea Transport 28,200 33,500 D-12,200

BAY SHIPBUILDING

Thoroughbred Topper* Tug/barge Norfolk Southern 20,500 33,500 D- 7,200

TACOMA BOATBUILDING

Apollo One* Incinerator At-Sea Incineration 2,073 7,317 D- 2,250 * Selected by MR/En as an "Outstanding Oceangoing Ship" of 1984 (12/1/84 issue).

Major Merchant Type Vessels, 2,000 DWT and Over, Under Construction or on Order in

Shipyards of the United States as of May 1, 1985

No.

Secretary Dole Promulgates

CDS Repayment Rule

Subsequent to Mr. Rice's writing of this article, just as we went to press with this issue, Sec- retary of Transportation Eliza- beth Dole promulgated a rule permitting the owners of U.S.- flag tankers built with the assist- ance of construction differential subsidy (CDS) for the foreign trades to repay to the govern- ment the subsidy on the vessels, thus allowing these tankers to op- erate in the domestic trades.

The Department of Transpor- tation, in a press release, stated that the CDS repayment rule will "introduce newer, more efficient tankers" into the Alaskan North

Slope crude oil trade, increase competition, and "minimize gov- ernment obstacles to market- place decisions." DoT analysis predicts that seven VLCCs will take advantage of the one-year window, and the CDS repayment on these ships could provide the treasury with $277 million in- cluding interest.

The refunding rule is sched- uled to take effect June 6 this year. Accompanying documents are devoid of any in-depth analy- sis of the rule's effect on national security or the shipbuilding in- dustry. This action by Secretary

Dole was not unexpected; pro- tracted litigation should follow. 44 Maritime Reporter/Engineering News

45

45

47

47