Media Buyers

-

)

March 2024 - Marine Technology Reporter page: 4

)

March 2024 - Marine Technology Reporter page: 4world with a minimalist approach in terms of the Contributing Writers Kevin Hardy number of team members sent to speci? c events.. Celia Konowe We have media serving the global maritime, subsea, offshore energy, ports and logistics Edward Lundquist David Strachan markets, which in this context means that

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38named after national birds, archaeological sites and lakes in Central lassNK granted its “SCCS-Full” class notation to America, Crowley said on social media. The newbuilds will Ever Top, a Neopanamax container vessel owned feature ME-GI engines from MAN Energy Solutions that are C by Evergreen and equipped

-

)

April 2024 - Maritime Reporter and Engineering News page: 35

)

April 2024 - Maritime Reporter and Engineering News page: 35SIMULATION e have a close relationship with tech- Realism is prized beyond immersive, photo-realistic visu- nology, evidenced by, for example, als, and providers are introducing increasingly accurate func- the phones we are estimated to un- tionality. FORCE Technology’s upcoming DEN-Mark2 math- lock around

-

)

April 2024 - Maritime Reporter and Engineering News page: 7

)

April 2024 - Maritime Reporter and Engineering News page: 7Conference or email: [email protected] programme, that helps visitors to keep up to date with the latest challenges and emerging opportunities. #Seawork Media partner OpportunitiescXSI\TERHXLIQEVMXMQIWOMPPWFEWI at the Careers & Training Day on Thursday 13 June 2024 MARITIMEJOURNAL COMMERCIAL MARINE BUSINESS that

-

)

April 2024 - Maritime Reporter and Engineering News page: 6

)

April 2024 - Maritime Reporter and Engineering News page: 6, +1.212.477.6700 ext 6810 though my career has been one focused on we offer a pair of insightful articles. The Manager, Information Technology Services media, I must confess a decided disdain ? rst one takes a deep dive into the SOV Vladimir Bibik for the general media and a loathing of market, authored

-

)

April 2024 - Maritime Reporter and Engineering News page: 2

)

April 2024 - Maritime Reporter and Engineering News page: 2NO.4 / VOL. 86 / APRIL 2024 16 Photo on the Cover: U.S. Navy photograph by Brian Suriani/Released Photo this page: Copyright Björn Wylezich/AdobeStock 16 SOVs: Analyzing the Market Drivers Departments As offshore wind grows globally, so too do the dynamics around SOVs. By Philip Lewis 4 Authors & Contribut

-

)

April 2024 - Marine News page: 11

)

April 2024 - Marine News page: 11nies. Will you please discuss these efforts and CARB. We continue to have concerns that you haven’t their impacts? addressed.” And I think the increasing media coverage At AWO, our ? rst mission is to be an advocate for the that we’re seeing and the introduction of legislation in industry. We want to make

-

)

April 2024 - Marine News page: 6

)

April 2024 - Marine News page: 6who writes on maritime and 7 Jeff Vogel security issues. He is a regular contributor to New is a shareholder in Cozen O’Connor’s Transportation Wave Media titles. & Trade Group. He focuses his practice on strategic and operational matters affecting the United States 4 Joe Nicastro maritime industry

-

)

February 2024 - Maritime Reporter and Engineering News page: 25

)

February 2024 - Maritime Reporter and Engineering News page: 25MATTHEW HART, MANAGER & PLATFORM LEADER, MARINE & STATIONARY POWER SYSTEMS, WABTEC fuel blends up to 100% are in operation maintenance intervals to make sure that What’s the biggest challenge today, running on both biodiesel and re- our engines don’t have to be touched in your job? newable diesel blends.

-

)

February 2024 - Maritime Reporter and Engineering News page: 22

)

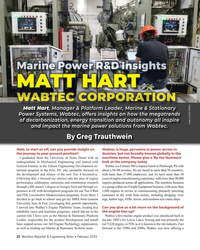

February 2024 - Maritime Reporter and Engineering News page: 22R&D MATT HART Matt Hart, Manager & Platform Leader, Marine & Stationary Power Systems, Wabtec, offers insights on how the megatrends of decarbonization, energy transition and autonomy all inspire Image courtesy Wabtec and impact the marine power solutions from Wabtec. By Greg Trauthwein Matt, to start

-

)

February 2024 - Maritime Reporter and Engineering News page: 2

)

February 2024 - Maritime Reporter and Engineering News page: 2NO.2 / VOL. 86 / FEBRUARY 2024 26 Photo on this page and on the Cover: Courtesy ARC 22 Marine Power: The Future is Now Departments Matt Hart, Wabtec Corporation, offers insights on how the megatrends of decar- bonization, energy transition and autonomy drive engine innovations. 4 Authors & Contributors By

-

)

February 2024 - Marine News page: 41

)

February 2024 - Marine News page: 41Vessels WINDEA Intrepid & WINDEA Courageous The ? rst two designed, BV-classed CTVs for WINDEA CTV. The third newbuild crew and fourth vessels are under construction at St Johns, and transfer vessels construction of the ? fth vessel is well underway at Breaux (CTV) for WIN- Brothers in Louisiana.

-

)

February 2024 - Marine News page: 24

)

February 2024 - Marine News page: 24re- law to have SMSs, in accordance with lationship with the USCG. International Maritime Organization (IMO) treaty Jennifer Gerbis is on NTSB’s media relations team. In obligations, because they transport more than 12 an email she said NTSB and USCG staff work on nearly passengers on foreign

-

)

February 2024 - Marine News page: 6

)

February 2024 - Marine News page: 6of? cer who writes on maritime and ronmental issues. He contributes regularly to this magazine. security issues. He is a regular contributor to New Wave Media titles. 2 Robert Kunkel, president of Alternative Marine Technologies and First 6 Barry Parker Harvest Navigation, served as the Federal

-

)

January 2024 - Marine Technology Reporter page: 64

)

January 2024 - Marine Technology Reporter page: 64MARKETING SOLUTION THE MARINE TECHNOLOGY REPORTER E-MAGAZINE BRINGS IN-DEPTH NEWS AND INFORMATION TO READERS IN A NEW DIGITAL FORMAT, WITH EXPANDED MULTIMEDIA ADVERTISING SOLUTIONS. These special editions will be discrubuted electronically to over 37,000 recipients. Premium positions, full and 1/2 page ads

-

)

January 2024 - Marine Technology Reporter page: 61

)

January 2024 - Marine Technology Reporter page: 61BOOK YOUR VIDEO INTERVIEW TODAY Marine Technology Reporter is the exclusive video media partner of the Oceanology International exhibition and conference and will be delivering extended broadcast coverage from the 2024 event (Oi24). SCAN THE CODE t2"EFWFMPQNFOUXJUI BELOW TO BOOK YOUR INCLUDED IN

-

)

January 2024 - Marine Technology Reporter page: 58

)

January 2024 - Marine Technology Reporter page: 58SHOW PREVIEW OCEANOLOGY INTERNATIONAL 2024 All images courtesy Oceanology International Oi 2024 ceanology International 2024 (Oi24), arguably content across ? ve different conference locations. World-class the world’s biggest and best marine science, scientists, thought leaders and innovators in the

-

)

January 2024 - Marine Technology Reporter page: 57

)

January 2024 - Marine Technology Reporter page: 57, and training programs. In ad- dition to her work as an explorer and diver, Blue Economy. Ms. Moniz has made signi? cant contributions to the media industry as a journalist and ? lm- maker. She was awarded the prestigious Woods Hole Oceanographic Institutions Fellowship for Scienti? c Journalism

-

)

January 2024 - Marine Technology Reporter page: 28

)

January 2024 - Marine Technology Reporter page: 28SUBSEA VEHICLES DEFENSE Knife? sh is a medium-class mine countermeasure UUV designed for deployment off the Littoral Combat Ship. U.S. Navy photo by Mass Communication Specialist 1st Class Brian M. Brooks/RELEASED be applied to Orca XLUUV 1 through 5, which will be built (encapsulated torpedo) mine.

-

)

January 2024 - Marine Technology Reporter page: 22

)

January 2024 - Marine Technology Reporter page: 22INTERVIEW DUANE FOTHERINGHAM, HII MISSION TECHNOLOGIES Image courtesy HII REMUS 620 Last month we visited with Duane Fotheringham, President, Unmanned Systems, HII Mission Technologies division, for insights on the new REMUS 620. Can you summarize the key techni- for the U.S. Navy’s Lion? sh System cal

-

)

January 2024 - Marine Technology Reporter page: 8

)

January 2024 - Marine Technology Reporter page: 8INSIGHTS SUBSEA DEFENSE SILENT, MOBILE, DEADLY: THE RISE OF COMBAT AUVS Copyright Jesper/AdobeStock By David Strachan, Senior Analyst, Strikepod Systems rone warfare has come into its own. The war in targeted by warship point defense systems and helicopter gun- Ukraine, what many analysts are calling

-

)

January 2024 - Marine Technology Reporter page: 4

)

January 2024 - Marine Technology Reporter page: 4, Au- The publisher assumes no respon- Advertising Sales Manager gust, and December by New Wave sibility for any misprints or claims Frank Covella Media, 118 E. 25th St., New York, or actions taken by advertisers. www.marinetechnologynews.com [email protected] NY 10010-1062. Periodicals Post-

-

)

January 2024 - Maritime Reporter and Engineering News page: 43

)

January 2024 - Maritime Reporter and Engineering News page: 43steps to implement the recommendations, such as stating Guard was required to obtain and report. Careful monitoring that it will begin to require shipbuilding programs to com- of migrant interdiction data is all the more important given plete the functional design of major systems before starting recent

-

)

January 2024 - Maritime Reporter and Engineering News page: 32

)

January 2024 - Maritime Reporter and Engineering News page: 32CRUISE FEATURE uilt by Rauma Marine Constructions, in Rauma, control system and bow thruster motors. Finland, and launched in 2021, the 150-meter-long In addition to the engines, Wärtsilä also supplied its LNG- Aurora Botnia boasts a long list of onboard equip- Pac technology for LNG storage, supply