Page 14: of Marine News Magazine (June 2012)

Dredging & Marine Construction

Read this page in Pdf, Flash or Html5 edition of June 2012 Marine News Magazine

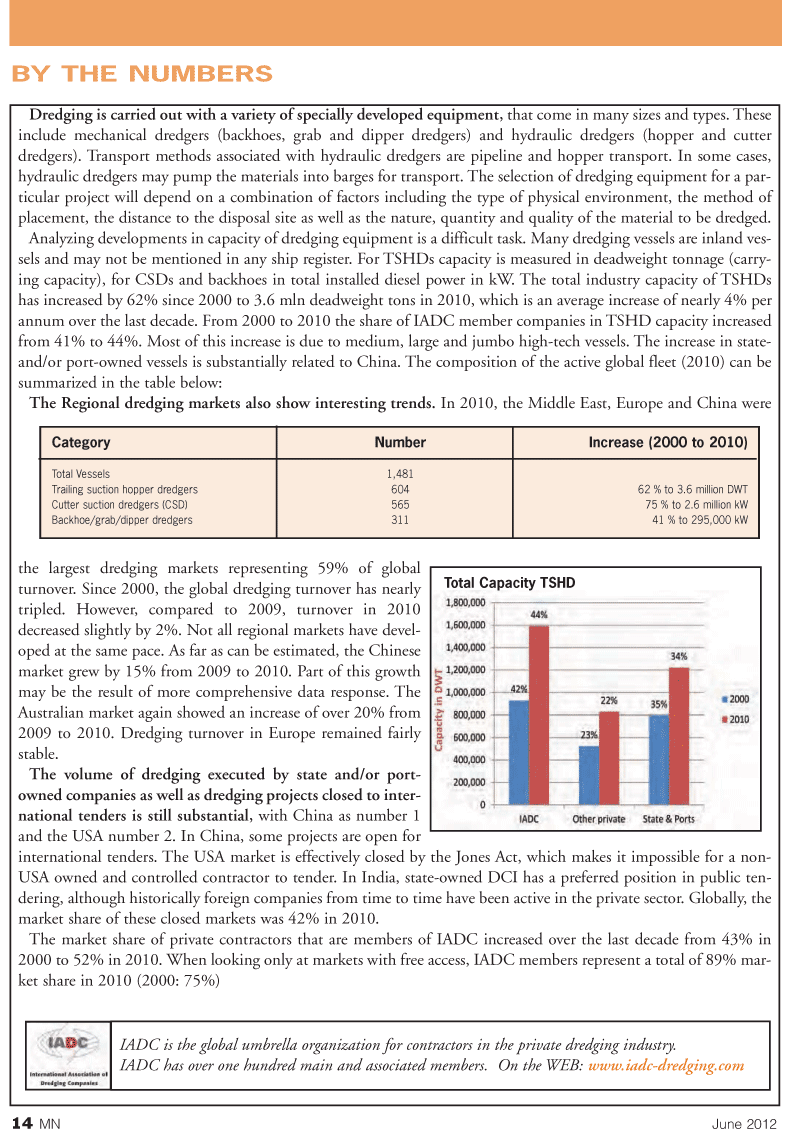

14MNJune 2012BY THE NUMBERS Dredging is carried out with a variety of specially developed equipment, that come in many sizes and types. These include mechanical dredgers (backhoes, grab and dipper dredgers) and hydraulic dredgers (hopper and cutter dredgers). Transport methods associated with hydraulic dredgers are pipeline and hopper transport. In some cases, hydraulic dredgers may pump the materials into barges for transport. The selection of dredging equipment for a par- ticular project will depend on a combination of factors including the type of physical environment, the method of placement, the distance to the disposal site as well as the nature, quantity and quality of the material to be dredged. Analyzing developments in capacity of dredging equipment is a difficult task. Many dredging vessels are inland ves- sels and may not be mentioned in any ship register. For TSHDs capacity is measured in deadweight tonnage (carry- ing capacity), for CSDs and backhoes in total installed diesel power in kW. The total industry capacity of TSHDs has increased by 62% since 2000 to 3.6 mln deadweight tons in 2010, which is an average increase of nearly 4% per annum over the last decade. From 2000 to 2010 the share of IADC member companies in TSHD capacity increased from 41% to 44%. Most of this increase is due to medium, large and jumbo high-tech vessels. The increase in state- and/or port-owned vessels is substantially related to China. The composition of the active global fleet (2010) can be summarized in the table below: The Regional dredging markets also show interesting trends. In 2010, the Middle East, Europe and China were the largest dredging markets representing 59% of global turnover. Since 2000, the global dredging turnover has nearly tripled. However, compared to 2009, turnover in 2010 decreased slightly by 2%. Not all regional markets have devel- oped at the same pace. As far as can be estimated, the Chinesemarket grew by 15% from 2009 to 2010. Part of this growth may be the result of more comprehensive data response. The Australian market again showed an increase of over 20% from 2009 to 2010. Dredging turnover in Europe remained fairly stable. The volume of dredging executed by state and/or port- owned companies as well as dredging projects closed to inter- national tenders is still substantial, with China as number 1and the USA number 2. In China, some projects are open for international tenders. The USA market is effectively closed by the Jones Act, which makes it impossible for a non- USA owned and controlled contractor to tender. In India, state-owned DCI has a preferred position in public ten- dering, although historically foreign companies from time to time have been active in the private sector. Globally, the market share of these closed markets was 42% in 2010. The market share of private contractors that are members of IADC increased over the last decade from 43% in 2000 to 52% in 2010. When looking only at markets with free access, IADC members represent a total of 89% mar- ket share in 2010 (2000: 75%) CategoryNumberIncrease (2000 to 2010) Total Vessels1,481 Trailing suction hopper dredgers60462 % to 3.6 million DWT Cutter suction dredgers (CSD)56575 % to 2.6 million kW Backhoe/grab/dipper dredgers31141 % to 295,000 kW Total Capacity TSHD IADC is the global umbrella organization for contractors in the private dredging industry. IADC has over one hundred main and associated members. On the WEB: www.iadc-dredging.com

13

13

15

15