Page 16: of Marine News Magazine (July 2012)

Propulsion Technology

Read this page in Pdf, Flash or Html5 edition of July 2012 Marine News Magazine

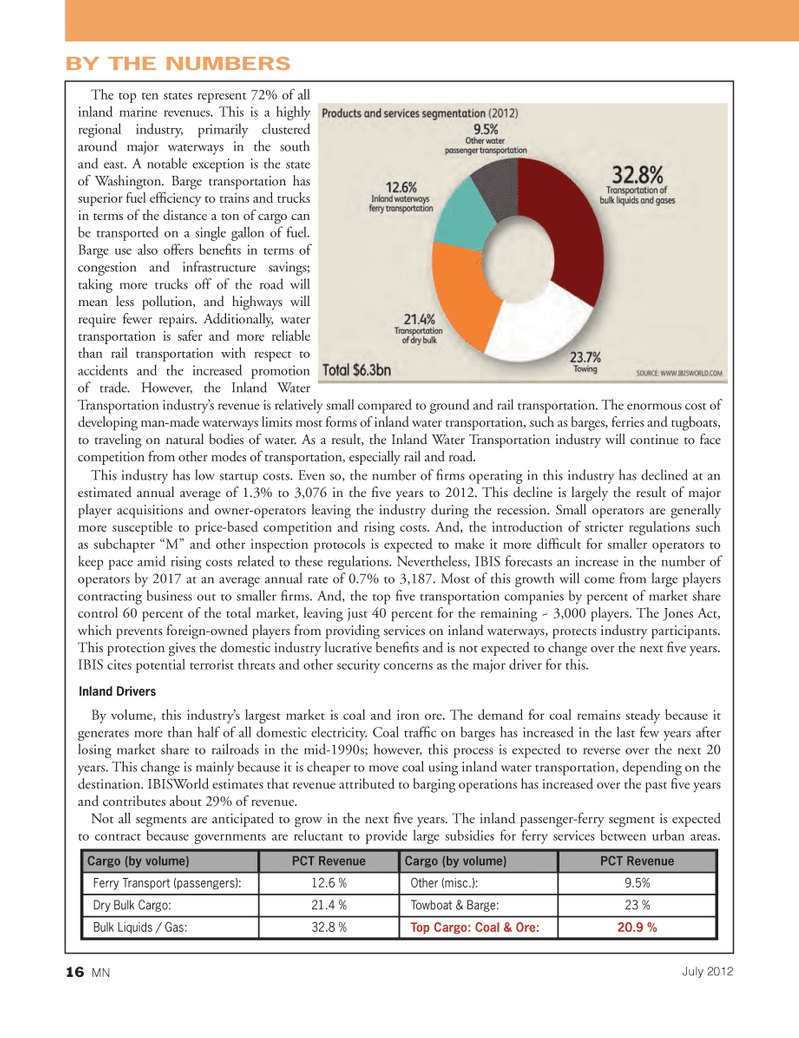

The top ten states represent 72% of all inland marine revenues. This is a highly regional industry, primarily clustered around major waterways in the south and east. A notable exception is the state of Washington. Barge transportation has superior fuel efÞ ciency to trains and trucks in terms of the distance a ton of cargo can be transported on a single gallon of fuel. Barge use also offers beneÞ ts in terms of congestion and infrastructure savings; taking more trucks off of the road will mean less pollution, and highways will require fewer repairs. Additionally, water transportation is safer and more reliable than rail transportation with respect to accidents and the increased promotion of trade. However, the Inland Water Transportation industryÕs revenue is relatively small compared to ground and rail transportation. The enormous cost of developing man-made waterways limits most forms of inland water transportation, such as barges, ferries and tugboats, to traveling on natural bodies of water. As a result, the Inland Water Transportation industry will continue to face competition from other modes of transportation, especially rail and road. This industry has low startup costs. Even so, the number of Þ rms operating in this industry has declined at an estimated annual average of 1.3% to 3,076 in the Þ ve years to 2012. This decline is largely the result of major player acquisitions and owner-operators leaving the industry during the recession. Small operators are generally more susceptible to price-based competition and rising costs. And, the introduction of stricter regulations such as subchapter ÒMÓ and other inspection protocols is expected to make it more difÞ cult for smaller operators to keep pace amid rising costs related to these regulations. Nevertheless, IBIS forecasts an increase in the number of operators by 2017 at an average annual rate of 0.7% to 3,187. Most of this growth will come from large players contracting business out to smaller Þ rms. And, the top Þ ve transportation companies by percent of market share control 60 percent of the total market, leaving just 40 percent for the remaining ~ 3,000 players. The Jones Act, which prevents foreign-owned players from providing services on inland waterways, protects industry participants. This protection gives the domestic industry lucrative beneÞ ts and is not expected to change over the next Þ ve years. IBIS cites potential terrorist threats and other security concerns as the major driver for this. Inland DriversBy volume, this industryÕs largest market is coal and iron ore. The demand for coal remains steady because it generates more than half of all domestic electricity. Coal trafÞ c on barges has increased in the last few years after losing market share to railroads in the mid-1990s; however, this process is expected to reverse over the next 20 years. This change is mainly because it is cheaper to move coal using inland water transportation, depending on the destination. IBISWorld estimates that revenue attributed to barging operations has increased over the past Þ ve years and contributes about 29% of revenue. Not all segments are anticipated to grow in the next Þ ve years. The inland passenger-ferry segment is expected to contract because governments are reluctant to provide large subsidies for ferry services between urban areas. BY THE NUMBERSCargo (by volume) PCT RevenueCargo (by volume) PCT RevenueFerry Transport (passengers): 12.6 %Other (misc.):9.5%Dry Bulk Cargo: 21.4 %Towboat & Barge: 23 %Bulk Liquids / Gas:32.8 %Top Cargo: Coal & Ore: 20.9 %16 MNJuly 2012

15

15

17

17