Page 36: of Marine News Magazine (August 2013)

Salvage & Response

Read this page in Pdf, Flash or Html5 edition of August 2013 Marine News Magazine

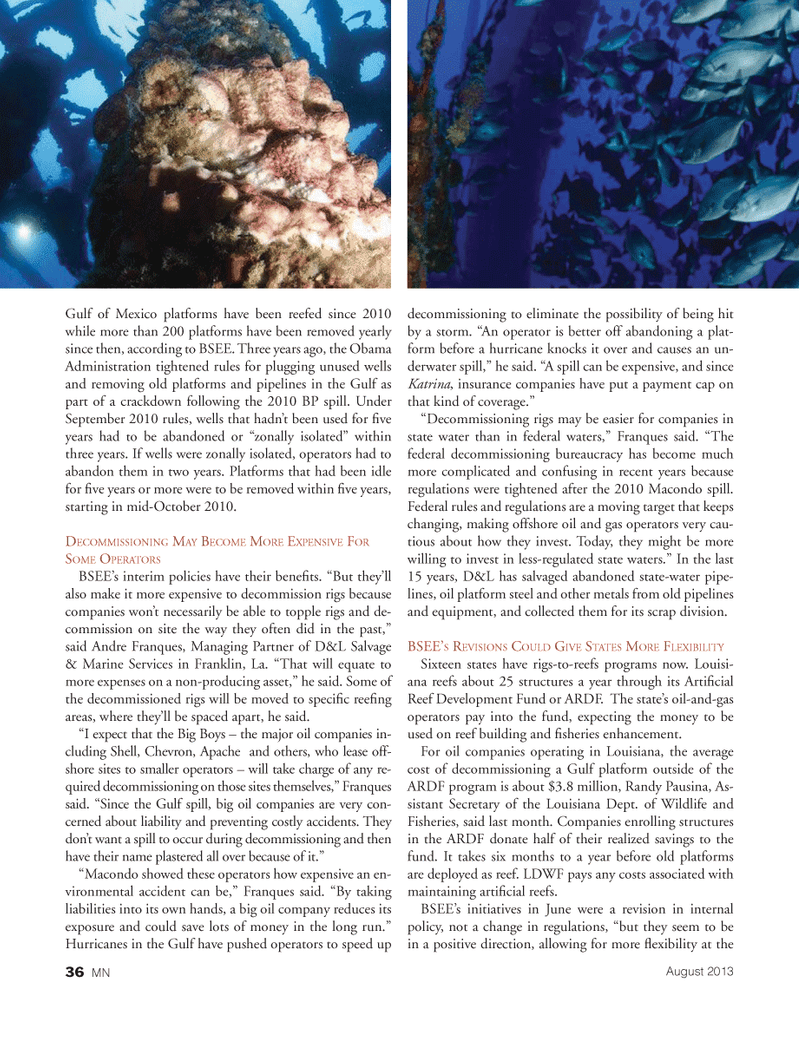

Gulf of Mexico platforms have been reefed since 2010 while more than 200 platforms have been removed yearly since then, according to BSEE. Three years ago, the Obama Administration tightened rules for plugging unused wells and removing old platforms and pipelines in the Gulf as part of a crackdown following the 2010 BP spill. Under September 2010 rules, wells that hadnt been used for ? ve years had to be abandoned or zonally isolated? within three years. If wells were zonally isolated, operators had to abandon them in two years. Platforms that had been idle for ? ve years or more were to be removed within ? ve years, starting in mid-October 2010. DECOMMISSIONING MAY BECOME MORE EXPENSIVE FOR SOME OPERATORS BSEEs interim policies have their bene? ts. But theyll also make it more expensive to decommission rigs because companies wont necessarily be able to topple rigs and de- commission on site the way they often did in the past,? said Andre Franques, Managing Partner of D&L Salvage & Marine Services in Franklin, La. That will equate to more expenses on a non-producing asset,? he said. Some of the decommissioned rigs will be moved to speci? c ree? ng areas, where theyll be spaced apart, he said. I expect that the Big Boys ? the major oil companies in- cluding Shell, Chevron, Apache and others, who lease off- shore sites to smaller operators ? will take charge of any re- quired decommissioning on those sites themselves,? Franques said. Since the Gulf spill, big oil companies are very con- cerned about liability and preventing costly accidents. They dont want a spill to occur during decommissioning and then have their name plastered all over because of it.? Macondo showed these operators how expensive an en- vironmental accident can be,? Franques said. By taking liabilities into its own hands, a big oil company reduces its exposure and could save lots of money in the long run.? Hurricanes in the Gulf have pushed operators to speed up decommissioning to eliminate the possibility of being hit by a storm. An operator is better off abandoning a plat- form before a hurricane knocks it over and causes an un- derwater spill,? he said. A spill can be expensive, and since Katrina, insurance companies have put a payment cap on that kind of coverage.? Decommissioning rigs may be easier for companies in state water than in federal waters,? Franques said. The federal decommissioning bureaucracy has become much more complicated and confusing in recent years because regulations were tightened after the 2010 Macondo spill. Federal rules and regulations are a moving target that keeps changing, making offshore oil and gas operators very cau- tious about how they invest. Today, they might be more willing to invest in less-regulated state waters.? In the last 15 years, D&L has salvaged abandoned state-water pipe- lines, oil platform steel and other metals from old pipelines and equipment, and collected them for its scrap division.BSEES REVISIONS COULD GIVE STATES MORE FLEXIBILITY Sixteen states have rigs-to-reefs programs now. Louisi- ana reefs about 25 structures a year through its Arti? cial Reef Development Fund or ARDF. The states oil-and-gas operators pay into the fund, expecting the money to be used on reef building and ? sheries enhancement. For oil companies operating in Louisiana, the average cost of decommissioning a Gulf platform outside of the ARDF program is about $3.8 million, Randy Pausina, As- sistant Secretary of the Louisiana Dept. of Wildlife and Fisheries, said last month. Companies enrolling structures in the ARDF donate half of their realized savings to the fund. It takes six months to a year before old platforms are deployed as reef. LDWF pays any costs associated with maintaining arti? cial reefs. BSEEs initiatives in June were a revision in internal policy, not a change in regulations, but they seem to be in a positive direction, allowing for more ? exibility at the August 201336 MNMN August2013 Layout 32-49.indd 367/23/2013 7:25:18 PM

35

35

37

37