Page 26: of Marine News Magazine (March 2015)

Fleet Optimization

Read this page in Pdf, Flash or Html5 edition of March 2015 Marine News Magazine

RISK price changes and passing them on to the end user. Trans- Should you ? x the price (no participation if prices fall) parency, the ability for all the parties to view a universal or cap the price (ability to procure cheaper fuel if prices benchmark for prices, is fundamental and essential to pre- fall)? How far into the future do you want to secure pric- serving con? dence in the system. And it is the integrity of ing? Seasonally, annually, or longer? Who will administer the exchanges that allow us to structure a hedge with the the program? How will you structure the hedges? Will highest certainty that it will do the job intended. your supplier provide you with options for hedging, allow- ing you to purchase ? xed price contracts or even options

The D.E.A.D. Rule on those contracts? What does the structure of your RFP

There are critical steps – the DEAD Rule – that should contract look like? How much of your fuel needs will you be followed when engaging in any hedge program. The hedge? All of it or some percentage of it? What will be the

D.E.A.D. rule (Development, Execution, Assessment, Dis- timing of purchases and executing hedges? Do you ‘cost cipline) is critical because if you don’t adhere to these im- average’ over multiple purchases or do you execute all at portant principles and actions, your program is likely to fail. once based on a certain price level?

Development: First you’ll want to assemble the team The Assessment component involves setting the objec- that will be making the decisions on execution, providing tives, establishing best practices, and providing clarity go- and reporting on assessment, and maintaining discipline ing forward. Execution and Discipline is a bilateral proto- to the adherence of the plan. It is here where vital ques- col: the signi? cance of these two steps in the D.E.A.D. rule tions and issues should be answered and de? ned. What cannot be overstated. The volatile nature of prices chang- are your objectives? Budget certainty, removing volatility, ing every day and moving signi? cantly up and down will eliminating the need for fuel surcharging, are typical fac- inject an emotional component that you will want to elim- tors, but there are many variables involved. And, myriad inate. The only way to do this is to have a blue print, the questions to be asked and answered. plan you set in the development phase. This will allow you

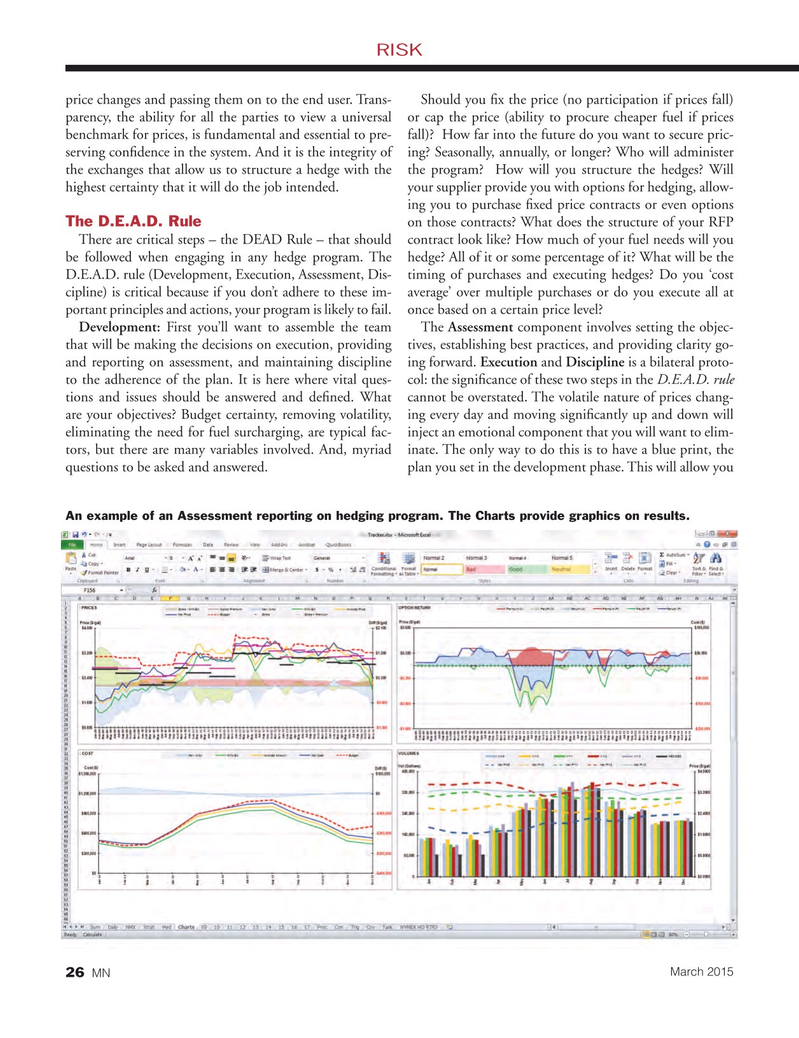

An example of an Assessment reporting on hedging program. The Charts provide graphics on results.

March 2015

MN 26

25

25

27

27