Page 8: of Marine News Magazine (April 2017)

Boatbuilding: Construction & Repair

Read this page in Pdf, Flash or Html5 edition of April 2017 Marine News Magazine

BY THE NUMBERS

U.S. Shipbuilding: how are we doing? It depends on who you ask …

The past ? ve years for U.S. boatbuilders have been a bit draft deliveries of blue water hulls are being punched out at of a roller coaster. Alternately feast or famine, some yards a rate of almost 2X the seven year average. Sure, that’s a ? nite have nevertheless done remarkably well. Those yards that market that will cap out, but, self-propelled hull deliveries diversi? ed their portfolio, balancing commercial and gov- of all types are slightly ahead of that same running average.

ernment contracts and/or via domestic and export produc- With all that happiness, the boatbuilding industry still tion, fared the best. Some sectors have been red hot, while says it is feeling some pain. There is hope around the cor- others peaked and ? zzled, predictably because of current ner. According to shipbuildinghistory.com, U.S. yards events, the price of oil and/or regulatory issues. And, the delivered almost 1,200 hulls in 2016, a number close to numbers vary (sometimes widely) depending on who is do- the six year average of about 1,250. Inexplicably, the U.S. ing the counting. For example, over a ? ve year span of com- ? eet continues to get older. For example, although almost parative data (2010-2014), the USACE and a widely used, 1,200 hulls entered service, the number of vessels older well respected industry web site, shipbuildinghistory.com than ? ve years actually increased and the ? eet size only differ in their tallies of an average annual vessel delivery vol- grew by 500 vessels. The number of hulls older than 25 ume (1,227 versus 1,082, respectively). Nevertheless, the years – now 13,011 (one-third of the existing ? eet) at last numbers tell a story, no matter who is doing the counting. count – continues to grow. This means that there are plenty

Tank barge construction increased steadily in the last of candidates for replacement in the coming years. Beyond few years before ? nally ? zzling out. Why? The OPA-90 this, ? eet numbers have been static for the last 15 years, double hull regulations ? nally came to roost, and opera- and operators have been replacing older hulls regularly in tors ? nally had to do away with single skin units. Like- a one-for-one building scheme. Moreover, even if the tank wise, the miserable price of oil has drastically impacted barge building boom has cooled, yards can take solace in the production of OSV tonnage, down last year to just 21 the knowledge that almost 1,000 of these units are more from the high water mark (52) of 2014. Many of those than 25 years old; that’s 25 percent of existing tank barges.

hulls head straight to layup upon delivery and no doubt There is more good news. The advent of the subchap- some owners regret the day they signed the contract. ter M towboat rules means re? ts for some vessels, and for

Separately, the recapitalization of the domestic commer- many more, retirement and replacement. It is inconceiv- cial ? shing ? eet is coming along nicely, with deliveries able that the 5,000 hulls now under this inspection regime in that sector mirroring the seven year average. Likewise, were all in compliance after spending their entire lifespan shipyards are pumping out pushboats and tugs at a rate in a non-compulsory scheme. For bigger vessels – OSV’s, that exceeds the seven year running average. Why? Could and offshore ATB’s, etc. – the promise of the ballast water these be subchapter M renewals? That’s my bet. treatment (BWT) convention is ? nally here, the Coast

Then, there’s the red hot passenger vessel market, Guard has approved multiple OEM entries and the race which is outstripping its seven year average by almost to comply (should be) on. That said; most U.S. operators 20 percent. Unless you’ve been sleeping for the last 12 will ? ee to Asia for a bargain basement installation, rather months, then you also know that the number of ferry than use a U.S. yard. And, of course, the U.S. EPA Tier contracts signed and in production for the next two years IV emissions situation is no longer just knocking at the is staggering. Several major ‘series-build’ contracts are un- door – it is here, and barging right in. Operators have de- derway, with other set to kick off. You won’t see those in cisions to make: will they repower, replace, use a so-called the totals within this accounting. ‘tier beater’ arrangement of multiple, smaller engines, or

Finally, the rebirth of the Jones Act deep draft rebuild and take the leap to hybrid or LNG? Whatever the answer, recapitalization program isn’t doing too badly either. Deep shipyards are waiting for the opportunity.

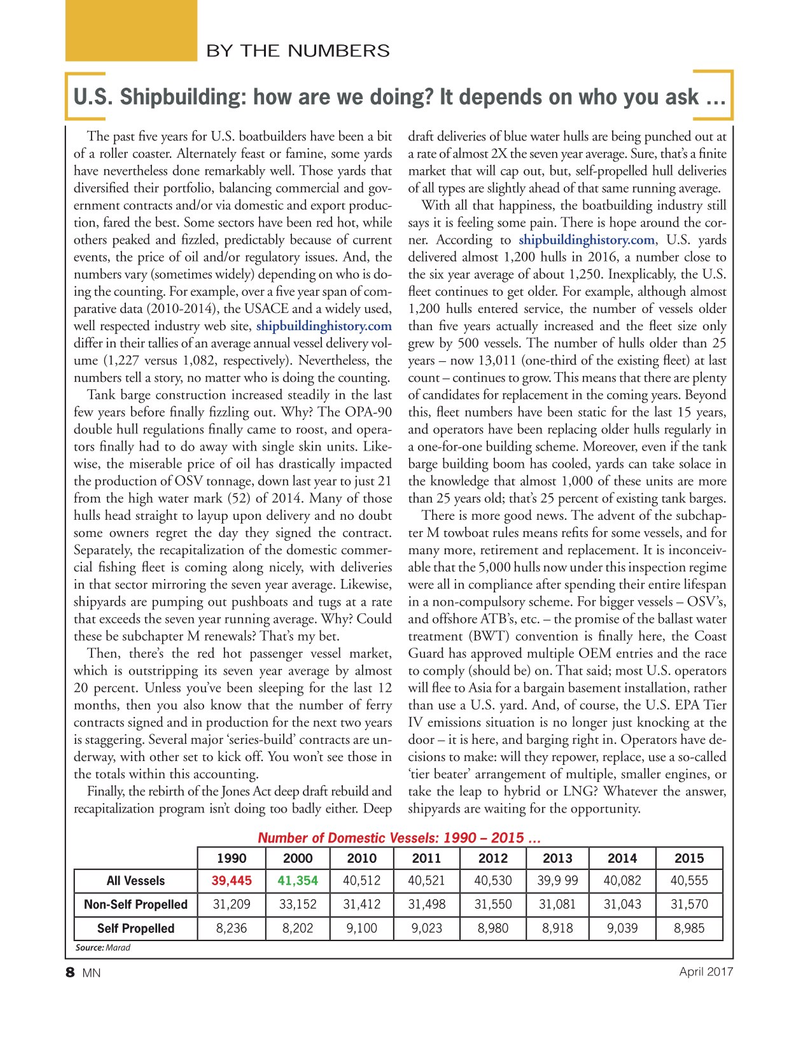

Number of Domestic Vessels: 1990 – 2015 … 19902000201020112012201320142015

All Vessels 39,445 41,354 40,51240,52140,53039,9 9940,08240,555

Non-Self Propelled 31,20933,15231,41231,49831,55031,08131,04331,570

Self Propelled 8,2368,2029,1009,0238,9808,9189,0398,985

Source: Marad

April 2017 8

MN

7

7

9

9