Page 12: of Marine News Magazine (June 2018)

Combat & Patrol Craft Annual

Read this page in Pdf, Flash or Html5 edition of June 2018 Marine News Magazine

BY THE NUMBERS

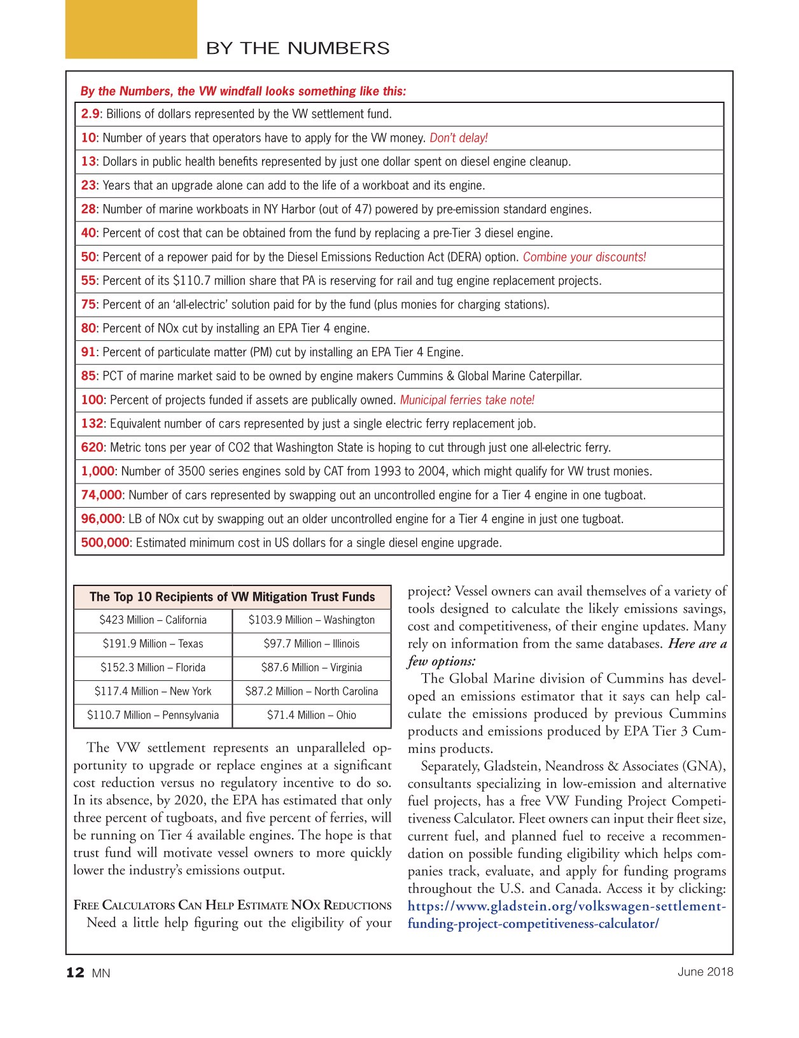

By the Numbers, the VW windfall looks something like this: 2.9: Billions of dollars represented by the VW settlement fund.

10: Number of years that operators have to apply for the VW money. Don’t delay!

13: Dollars in public health bene? ts represented by just one dollar spent on diesel engine cleanup.

23: Years that an upgrade alone can add to the life of a workboat and its engine.

28: Number of marine workboats in NY Harbor (out of 47) powered by pre-emission standard engines.

40: Percent of cost that can be obtained from the fund by replacing a pre-Tier 3 diesel engine.

50: Percent of a repower paid for by the Diesel Emissions Reduction Act (DERA) option. Combine your discounts!

55: Percent of its $110.7 million share that PA is reserving for rail and tug engine replacement projects. 75: Percent of an ‘all-electric’ solution paid for by the fund (plus monies for charging stations).

80: Percent of NOx cut by installing an EPA Tier 4 engine.

91: Percent of particulate matter (PM) cut by installing an EPA Tier 4 Engine.

85: PCT of marine market said to be owned by engine makers Cummins & Global Marine Caterpillar.

100: Percent of projects funded if assets are publically owned. Municipal ferries take note!

132: Equivalent number of cars represented by just a single electric ferry replacement job.

620: Metric tons per year of CO2 that Washington State is hoping to cut through just one all-electric ferry.

1,000: Number of 3500 series engines sold by CAT from 1993 to 2004, which might qualify for VW trust monies. 74,000: Number of cars represented by swapping out an uncontrolled engine for a Tier 4 engine in one tugboat.

96,000: LB of NOx cut by swapping out an older uncontrolled engine for a Tier 4 engine in just one tugboat.

500,000: Estimated minimum cost in US dollars for a single diesel engine upgrade.

project? Vessel owners can avail themselves of a variety of

The Top 10 Recipients of VW Mitigation Trust Funds tools designed to calculate the likely emissions savings, $423 Million – California$103.9 Million – Washington cost and competitiveness, of their engine updates. Many $191.9 Million – Texas$97.7 Million – Illinois rely on information from the same databases. Here are a few options: $152.3 Million – Florida $87.6 Million – Virginia

The Global Marine division of Cummins has devel- $117.4 Million – New York$87.2 Million – North Carolina oped an emissions estimator that it says can help cal- culate the emissions produced by previous Cummins $110.7 Million – Pennsylvania$71.4 Million – Ohio products and emissions produced by EPA Tier 3 Cum-

The VW settlement represents an unparalleled op- mins products. portunity to upgrade or replace engines at a signi? cant Separately, Gladstein, Neandross & Associates (GNA), cost reduction versus no regulatory incentive to do so. consultants specializing in low-emission and alternative

In its absence, by 2020, the EPA has estimated that only fuel projects, has a free VW Funding Project Competi- three percent of tugboats, and ? ve percent of ferries, will tiveness Calculator. Fleet owners can input their ? eet size, be running on Tier 4 available engines. The hope is that current fuel, and planned fuel to receive a recommen- trust fund will motivate vessel owners to more quickly dation on possible funding eligibility which helps com- lower the industry’s emissions output. panies track, evaluate, and apply for funding programs throughout the U.S. and Canada. Access it by clicking:

F C C H E NO R https://www.gladstein.org/volkswagen-settlement-

REE ALCULATORS AN ELP STIMATE X EDUCTIONS

Need a little help ? guring out the eligibility of your funding-project-competitiveness-calculator/

June 2018 12

MN

MN June18 Layout 1-17.indd 12 MN June18 Layout 1-17.indd 12 5/24/2018 11:47:39 AM5/24/2018 11:47:39 AM

11

11

13

13