Page 12: of Marine News Magazine (September 2018)

Offshore Annual

Read this page in Pdf, Flash or Html5 edition of September 2018 Marine News Magazine

BY THE NUMBERS ing. The more niche areas within the sector such as Pipe in a competing deal to merge with GulfMark. Now, says layers and Cable layers ? nd their values varying heavily. VesselsValue, GulfMark is left to weigh its options. “With

This is due to the project based nature of the industry. a combined ? eet size of 274 vessels, a merger between

GulfMark and Tidewater would lead to one of the largest

Tidewater & GulfMark – and HGIM, too OSV ? eets in terms of overall size with an average age 10.7

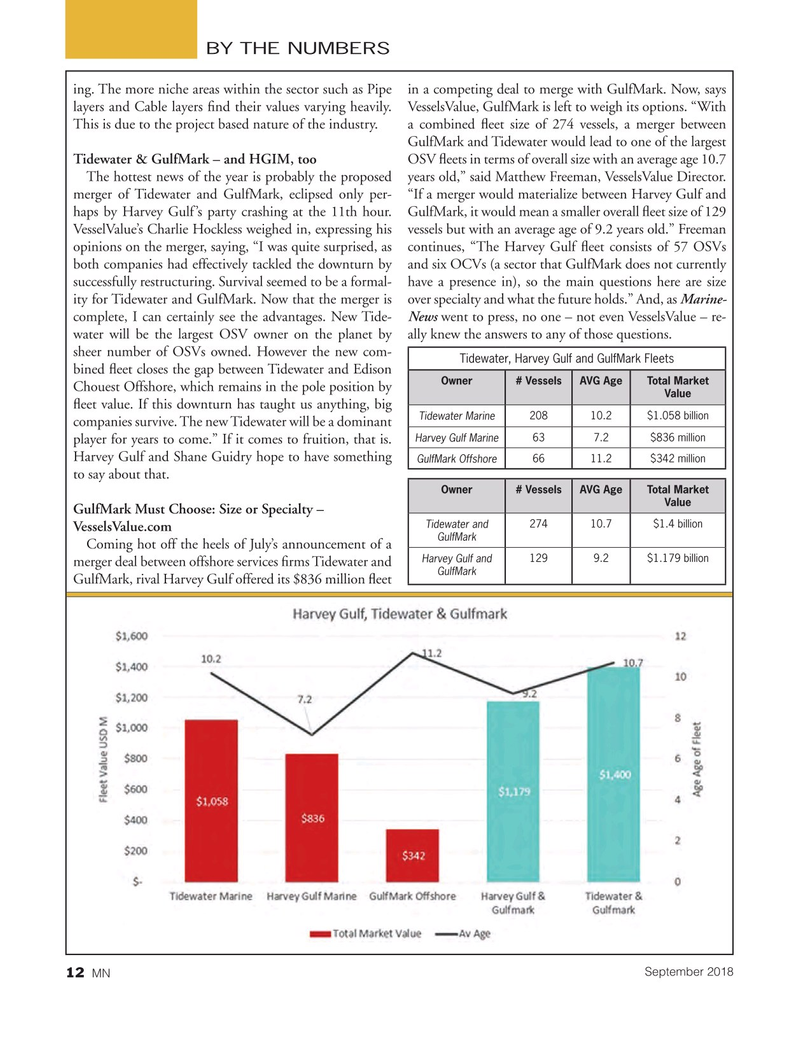

The hottest news of the year is probably the proposed years old,” said Matthew Freeman, VesselsValue Director. merger of Tidewater and GulfMark, eclipsed only per- “If a merger would materialize between Harvey Gulf and haps by Harvey Gulf’s party crashing at the 11th hour. GulfMark, it would mean a smaller overall ? eet size of 129

VesselValue’s Charlie Hockless weighed in, expressing his vessels but with an average age of 9.2 years old.” Freeman opinions on the merger, saying, “I was quite surprised, as continues, “The Harvey Gulf ? eet consists of 57 OSVs both companies had effectively tackled the downturn by and six OCVs (a sector that GulfMark does not currently successfully restructuring. Survival seemed to be a formal- have a presence in), so the main questions here are size ity for Tidewater and GulfMark. Now that the merger is over specialty and what the future holds.” And, as Marine- complete, I can certainly see the advantages. New Tide- News went to press, no one – not even VesselsValue – re- water will be the largest OSV owner on the planet by ally knew the answers to any of those questions.

sheer number of OSVs owned. However the new com-

Tidewater, Harvey Gulf and GulfMark Fleets bined ? eet closes the gap between Tidewater and Edison

Owner# VesselsAVG AgeTotal Market

Chouest Offshore, which remains in the pole position by

Value ? eet value. If this downturn has taught us anything, big

Tidewater Marine 20810.2$1.058 billion companies survive. The new Tidewater will be a dominant

Harvey Gulf Marine 637.2$836 million player for years to come.” If it comes to fruition, that is.

Harvey Gulf and Shane Guidry hope to have something

GulfMark Offshore 6611.2$342 million to say about that.

Owner# VesselsAVG AgeTotal Market

Value

GulfMark Must Choose: Size or Specialty –

Tidewater and 27410.7$1.4 billion

VesselsValue.com

GulfMark

Coming hot off the heels of July’s announcement of a

Harvey Gulf and 1299.2$1.179 billion merger deal between offshore services ? rms Tidewater and

GulfMark

GulfMark, rival Harvey Gulf offered its $836 million ? eet

September 2018

MN 12

MN Sept18 Layout 1-17.indd 12 MN Sept18 Layout 1-17.indd 12 8/27/2018 4:31:11 PM8/27/2018 4:31:11 PM

11

11

13

13