Page 36: of Marine News Magazine (March 2019)

Pushboats, Tugs & Assist Vessels

Read this page in Pdf, Flash or Html5 edition of March 2019 Marine News Magazine

INLAND PORT PROFILE

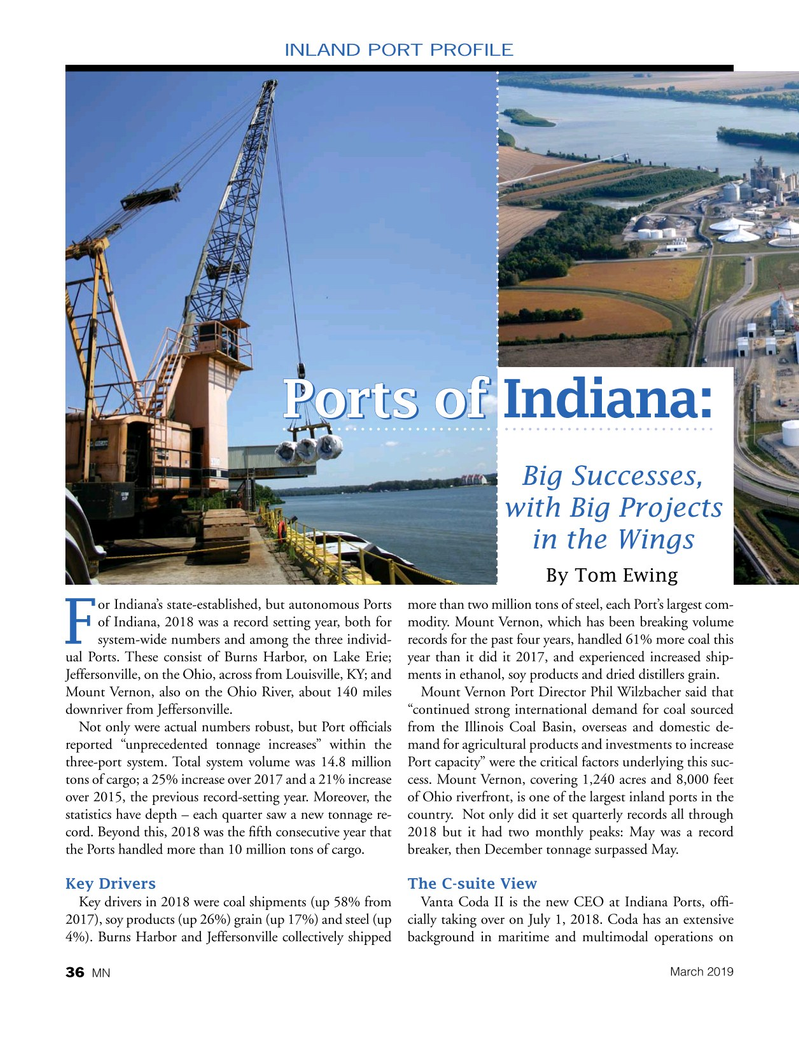

Ports of Ports of Indiana:

Big Successes, with Big Projects in the Wings

By Tom Ewing or Indiana’s state-established, but autonomous Ports more than two million tons of steel, each Port’s largest com- of Indiana, 2018 was a record setting year, both for modity. Mount Vernon, which has been breaking volume system-wide numbers and among the three individ- records for the past four years, handled 61% more coal this

F ual Ports. These consist of Burns Harbor, on Lake Erie; year than it did it 2017, and experienced increased ship-

Jeffersonville, on the Ohio, across from Louisville, KY; and ments in ethanol, soy products and dried distillers grain.

Mount Vernon, also on the Ohio River, about 140 miles Mount Vernon Port Director Phil Wilzbacher said that downriver from Jeffersonville. “continued strong international demand for coal sourced

Not only were actual numbers robust, but Port offcials from the Illinois Coal Basin, overseas and domestic de- reported “unprecedented tonnage increases” within the mand for agricultural products and investments to increase three-port system. Total system volume was 14.8 million Port capacity” were the critical factors underlying this suc- tons of cargo; a 25% increase over 2017 and a 21% increase cess. Mount Vernon, covering 1,240 acres and 8,000 feet over 2015, the previous record-setting year. Moreover, the of Ohio riverfront, is one of the largest inland ports in the statistics have depth – each quarter saw a new tonnage re- country. Not only did it set quarterly records all through cord. Beyond this, 2018 was the ffth consecutive year that 2018 but it had two monthly peaks: May was a record the Ports handled more than 10 million tons of cargo. breaker, then December tonnage surpassed May.

Key Drivers The C-suite View

Key drivers in 2018 were coal shipments (up 58% from Vanta Coda II is the new CEO at Indiana Ports, off- 2017), soy products (up 26%) grain (up 17%) and steel (up cially taking over on July 1, 2018. Coda has an extensive 4%). Burns Harbor and Jeffersonville collectively shipped background in maritime and multimodal operations on

March 2019 36 MN

35

35

37

37