Page 40: of Marine News Magazine (May 2019)

Inland Waterways

Read this page in Pdf, Flash or Html5 edition of May 2019 Marine News Magazine

INLAND OPERATOR PROFILE

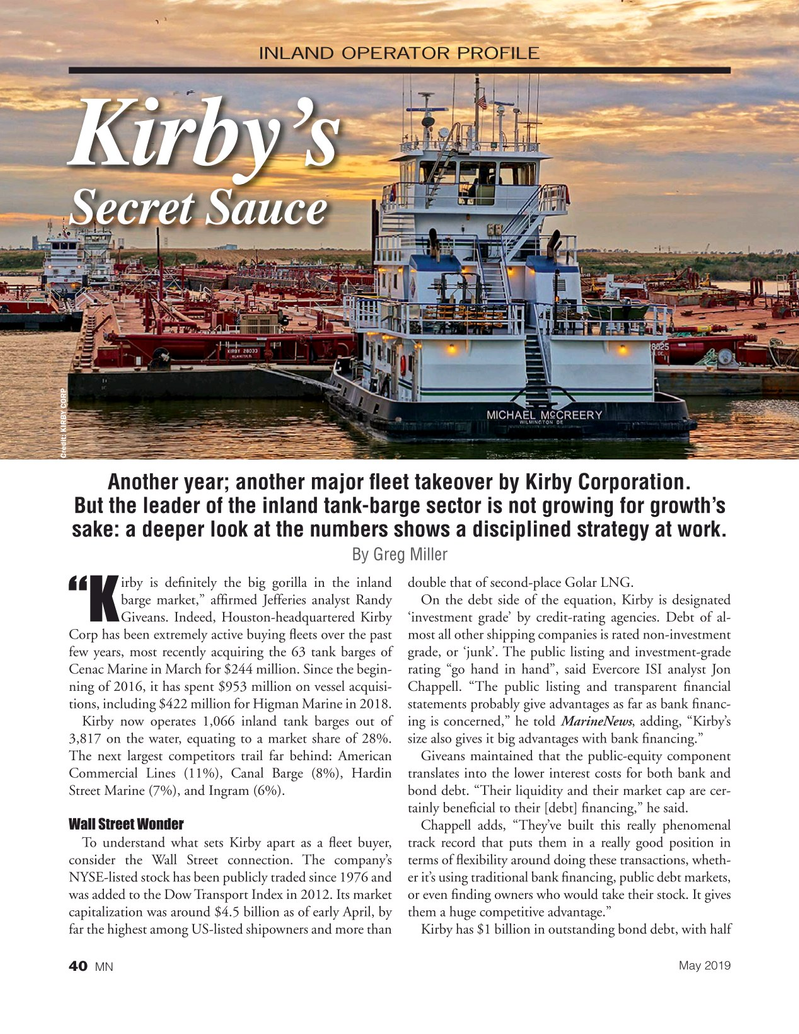

Kirby’s

Secret Sauce

Credit: KIRBY CORP

Another year; another major ? eet takeover by Kirby Corporation.

But the leader of the inland tank-barge sector is not growing for growth’s sake: a deeper look at the numbers shows a disciplined strategy at work.

By Greg Miller irby is de? nitely the big gorilla in the inland double that of second-place Golar LNG.

barge market,” af? rmed Jefferies analyst Randy On the debt side of the equation, Kirby is designated

Giveans. Indeed, Houston-headquartered Kirby ‘investment grade’ by credit-rating agencies. Debt of al- “K

Corp has been extremely active buying ? eets over the past most all other shipping companies is rated non-investment few years, most recently acquiring the 63 tank barges of grade, or ‘junk’. The public listing and investment-grade

Cenac Marine in March for $244 million. Since the begin- rating “go hand in hand”, said Evercore ISI analyst Jon ning of 2016, it has spent $953 million on vessel acquisi- Chappell. “The public listing and transparent ? nancial tions, including $422 million for Higman Marine in 2018. statements probably give advantages as far as bank ? nanc-

Kirby now operates 1,066 inland tank barges out of ing is concerned,” he told MarineNews, adding, “Kirby’s 3,817 on the water, equating to a market share of 28%. size also gives it big advantages with bank ? nancing.”

The next largest competitors trail far behind: American Giveans maintained that the public-equity component

Commercial Lines (11%), Canal Barge (8%), Hardin translates into the lower interest costs for both bank and

Street Marine (7%), and Ingram (6%). bond debt. “Their liquidity and their market cap are cer- tainly bene? cial to their [debt] ? nancing,” he said.

Wall Street Wonder Chappell adds, “They’ve built this really phenomenal

To understand what sets Kirby apart as a ? eet buyer, track record that puts them in a really good position in consider the Wall Street connection. The company’s terms of ? exibility around doing these transactions, wheth-

NYSE-listed stock has been publicly traded since 1976 and er it’s using traditional bank ? nancing, public debt markets, was added to the Dow Transport Index in 2012. Its market or even ? nding owners who would take their stock. It gives capitalization was around $4.5 billion as of early April, by them a huge competitive advantage.” far the highest among US-listed shipowners and more than Kirby has $1 billion in outstanding bond debt, with half

May 2019 40 MN

39

39

41

41