Page 48: of Marine News Magazine (November 2020)

Workboat Annual

Read this page in Pdf, Flash or Html5 edition of November 2020 Marine News Magazine

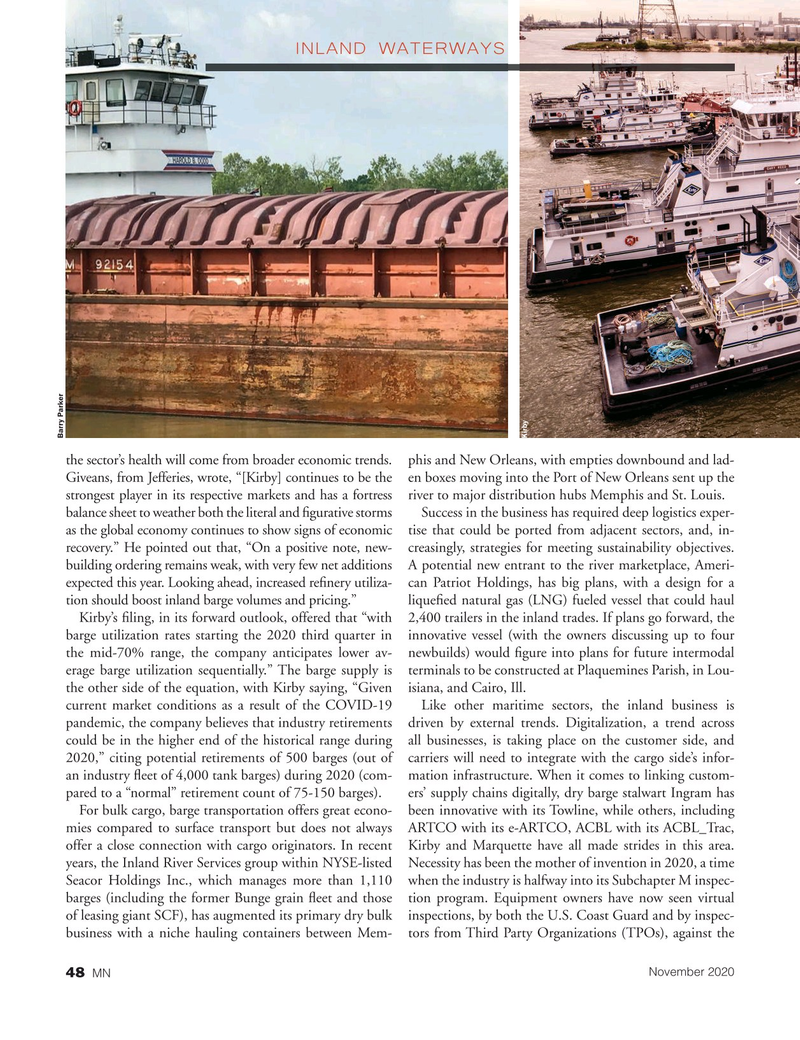

INLAND WATERWAYS

Barry Parker

Kirby the sector’s health will come from broader economic trends. phis and New Orleans, with empties downbound and lad-

Giveans, from Jefferies, wrote, “[Kirby] continues to be the en boxes moving into the Port of New Orleans sent up the strongest player in its respective markets and has a fortress river to major distribution hubs Memphis and St. Louis. balance sheet to weather both the literal and ? gurative storms Success in the business has required deep logistics exper- as the global economy continues to show signs of economic tise that could be ported from adjacent sectors, and, in- recovery.” He pointed out that, “On a positive note, new- creasingly, strategies for meeting sustainability objectives. building ordering remains weak, with very few net additions A potential new entrant to the river marketplace, Ameri- expected this year. Looking ahead, increased re? nery utiliza- can Patriot Holdings, has big plans, with a design for a tion should boost inland barge volumes and pricing.” lique? ed natural gas (LNG) fueled vessel that could haul

Kirby’s ? ling, in its forward outlook, offered that “with 2,400 trailers in the inland trades. If plans go forward, the barge utilization rates starting the 2020 third quarter in innovative vessel (with the owners discussing up to four the mid-70% range, the company anticipates lower av- newbuilds) would ? gure into plans for future intermodal erage barge utilization sequentially.” The barge supply is terminals to be constructed at Plaquemines Parish, in Lou- the other side of the equation, with Kirby saying, “Given isiana, and Cairo, Ill. current market conditions as a result of the COVID-19 Like other maritime sectors, the inland business is pandemic, the company believes that industry retirements driven by external trends. Digitalization, a trend across could be in the higher end of the historical range during all businesses, is taking place on the customer side, and 2020,” citing potential retirements of 500 barges (out of carriers will need to integrate with the cargo side’s infor- an industry ? eet of 4,000 tank barges) during 2020 (com- mation infrastructure. When it comes to linking custom- pared to a “normal” retirement count of 75-150 barges). ers’ supply chains digitally, dry barge stalwart Ingram has

For bulk cargo, barge transportation offers great econo- been innovative with its Towline, while others, including mies compared to surface transport but does not always ARTCO with its e-ARTCO, ACBL with its ACBL_Trac, offer a close connection with cargo originators. In recent Kirby and Marquette have all made strides in this area. years, the Inland River Services group within NYSE-listed Necessity has been the mother of invention in 2020, a time

Seacor Holdings Inc., which manages more than 1,110 when the industry is halfway into its Subchapter M inspec- barges (including the former Bunge grain ? eet and those tion program. Equipment owners have now seen virtual of leasing giant SCF), has augmented its primary dry bulk inspections, by both the U.S. Coast Guard and by inspec- business with a niche hauling containers between Mem- tors from Third Party Organizations (TPOs), against the

November 2020 48 MN

47

47

49

49