Page 8: of Marine News Magazine (February 2024)

Read this page in Pdf, Flash or Html5 edition of February 2024 Marine News Magazine

By the

Numbers © Dragon Claws / Adobe Stock

Rebuilding the Foundations of

US Offshore Wind

By Philip Lewis, Director of Research, Intelatus Global Partners

As we enter a New Year, the memories of the shocks to with a potential of 3.3-6.3 GW in Delaware and Chesa- the foundations to the U.S. offshore wind segment remain peake Bays in the Central Atlantic. Along with the Central fresh. In short, supply chain in? ation and capacity/avail- Atlantic lease sales, BOEM is committed to leasing further ability, interest rate increases, and tax credit monetization sites in the Gulf of Mexico, Oregon, and the Gulf of Maine have been the key themes highlighted by developers to ex- in 2024/2025. The cumulative capacity of the leases is es- plain why many projects became commercially unviable. timated at 18.6 GW. When added to the potential capac-

Several Northeast and Mid-Atlantic states have reacted ity of those leases previously awarded, the total potential rapidly, accepting the termination of power sales & pur- leased will amount to around 80 GW, of which close to chase agreements and allowing the canceled projects to be 26 GW is at some stage in the federal permitting process.

rebid into new solicitations. The Commonwealth Wind, And it is not just federal agencies that are advancing off-

SouthCoast Wind, Pack City Wind, Empire Wind 1 and shore wind. The state of Louisiana has signed two leases in 2, Beacon Wind 1 and Sunrise Wind projects, together its waters for bottom-? xed wind farms with a combined representing more than 8.5 gigawatts (GW) of capacity, capacity of 775 MW.

have either canceled or are expected to cancel power sales While federal and states agencies (re)build the founda- agreements and then rebid the projects into current so- tions for future activity, ? rst power have been generated licitations for New York, Connecticut, Rhode Island and from both Vineyard and South Wind, and Coastal Virgin-

Massachusetts, which seek to commit as much as 9 GW of ia is building up an inventory of monopiles in Portsmouth capacity, with contracts that provide some measure of price to commence offshore construction in the Spring of 2024.

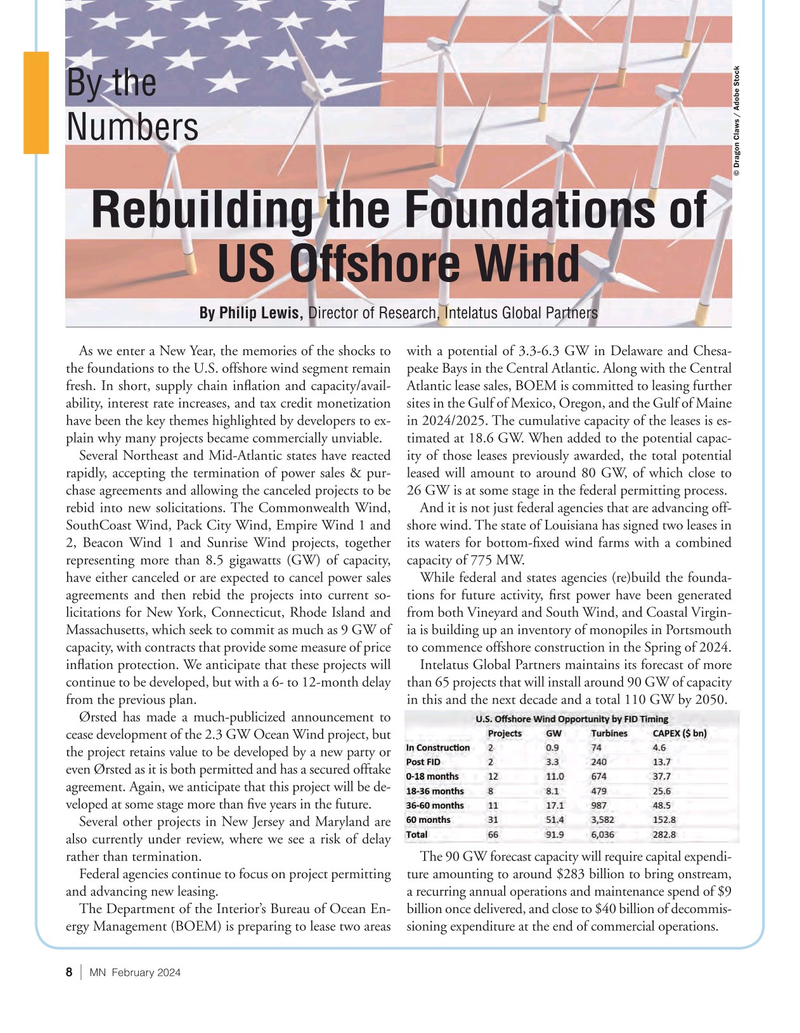

in? ation protection. We anticipate that these projects will Intelatus Global Partners maintains its forecast of more continue to be developed, but with a 6- to 12-month delay than 65 projects that will install around 90 GW of capacity from the previous plan. in this and the next decade and a total 110 GW by 2050.

Ørsted has made a much-publicized announcement to cease development of the 2.3 GW Ocean Wind project, but the project retains value to be developed by a new party or even Ørsted as it is both permitted and has a secured offtake agreement. Again, we anticipate that this project will be de- veloped at some stage more than ? ve years in the future.

Several other projects in New Jersey and Maryland are also currently under review, where we see a risk of delay rather than termination. The 90 GW forecast capacity will require capital expendi-

Federal agencies continue to focus on project permitting ture amounting to around $283 billion to bring onstream, and advancing new leasing. a recurring annual operations and maintenance spend of $9

The Department of the Interior’s Bureau of Ocean En- billion once delivered, and close to $40 billion of decommis- ergy Management (BOEM) is preparing to lease two areas sioning expenditure at the end of commercial operations.

8 | MN February 2024

7

7

9

9