Page 25: of Marine Technology Magazine (June 2015)

Hydrographic Survey

Read this page in Pdf, Flash or Html5 edition of June 2015 Marine Technology Magazine

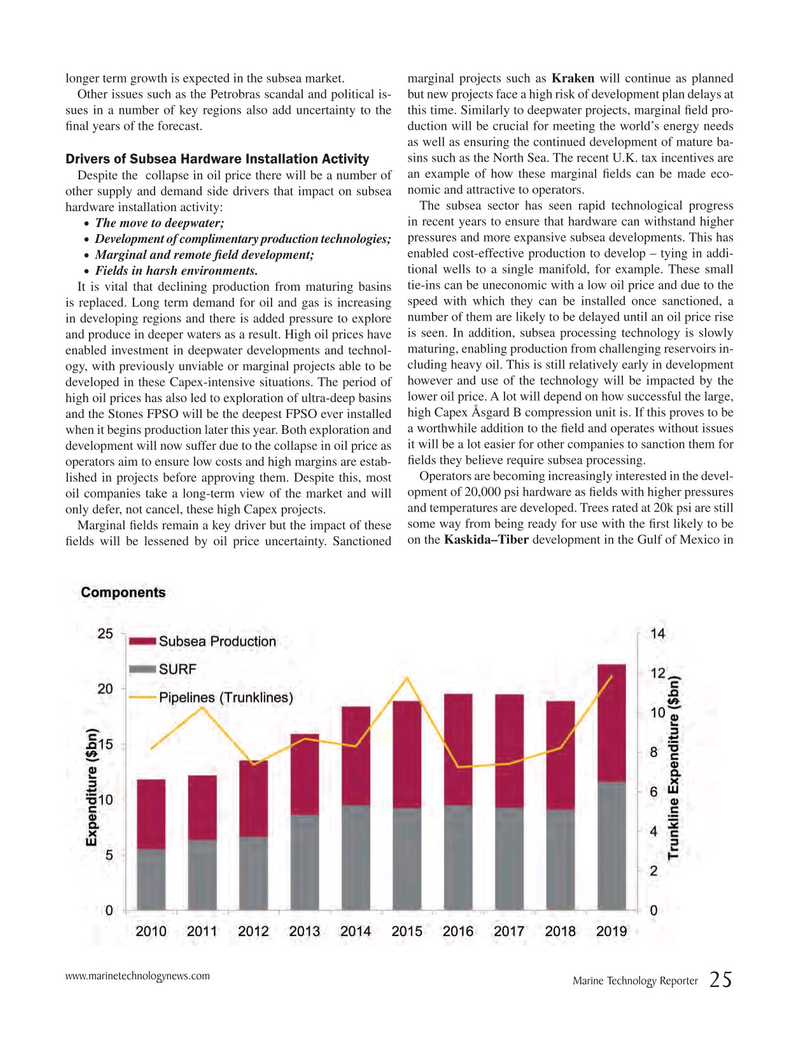

longer term growth is expected in the subsea market. marginal projects such as Kraken will continue as planned

Other issues such as the Petrobras scandal and political is- but new projects face a high risk of development plan delays at sues in a number of key regions also add uncertainty to the this time. Similarly to deepwater projects, marginal ? eld pro- ? nal years of the forecast. duction will be crucial for meeting the world’s energy needs as well as ensuring the continued development of mature ba- sins such as the North Sea. The recent U.K. tax incentives are

Drivers of Subsea Hardware Installation Activity

Despite the collapse in oil price there will be a number of an example of how these marginal ? elds can be made eco- other supply and demand side drivers that impact on subsea nomic and attractive to operators.

The subsea sector has seen rapid technological progress hardware installation activity: in recent years to ensure that hardware can withstand higher

The move to deepwater; • pressures and more expansive subsea developments. This has • Development of complimentary production technologies; enabled cost-effective production to develop – tying in addi-

Marginal and remote ? eld development;• tional wells to a single manifold, for example. These small

Fields in harsh environments.

•

It is vital that declining production from maturing basins tie-ins can be uneconomic with a low oil price and due to the is replaced. Long term demand for oil and gas is increasing speed with which they can be installed once sanctioned, a in developing regions and there is added pressure to explore number of them are likely to be delayed until an oil price rise and produce in deeper waters as a result. High oil prices have is seen. In addition, subsea processing technology is slowly maturing, enabling production from challenging reservoirs in- enabled investment in deepwater developments and technol- ogy, with previously unviable or marginal projects able to be cluding heavy oil. This is still relatively early in development developed in these Capex-intensive situations. The period of however and use of the technology will be impacted by the high oil prices has also led to exploration of ultra-deep basins lower oil price. A lot will depend on how successful the large, and the Stones FPSO will be the deepest FPSO ever installed high Capex Åsgard B compression unit is. If this proves to be when it begins production later this year. Both exploration and a worthwhile addition to the ? eld and operates without issues development will now suffer due to the collapse in oil price as it will be a lot easier for other companies to sanction them for ? elds they believe require subsea processing.

operators aim to ensure low costs and high margins are estab-

Operators are becoming increasingly interested in the devel- lished in projects before approving them. Despite this, most oil companies take a long-term view of the market and will opment of 20,000 psi hardware as ? elds with higher pressures and temperatures are developed. Trees rated at 20k psi are still only defer, not cancel, these high Capex projects.

Marginal ? elds remain a key driver but the impact of these some way from being ready for use with the ? rst likely to be ? elds will be lessened by oil price uncertainty. Sanctioned on the Kaskida–Tiber development in the Gulf of Mexico in www.marinetechnologynews.com

Marine Technology Reporter 25

MTR #5 (18-33).indd 25 MTR #5 (18-33).indd 25 6/11/2015 9:57:13 AM6/11/2015 9:57:13 AM

24

24

26

26