Page 26: of Marine Technology Magazine (June 2015)

Hydrographic Survey

Read this page in Pdf, Flash or Html5 edition of June 2015 Marine Technology Magazine

Subsea Hardware the early 2020s. FMC is still expected to continue develop- as the deepwater 718km Ichthys pipeline that is due to be ment of this technology but the uptake from operators will installed by Saipem this year. be constrained until a high sustained high oil price convinces Analysis of the top ? ve subsea equipment vendors indicates them that 20,000 psi projects are worth the high capital costs. that backlogs are at near record levels of over $17bn. Howev- er, the industry-wide backlog was 6% lower than in Q2 2014, but 1% higher than a year ago.

Components

The high level of backlogs will ensure that the next few

Subsea production hardware will attract $50bn of expendi- years will feel busy for industry players, as they work through ture 2015-2019, driven by a number of large projects in deep- water such as the 65 tree Kaombo project that was sanctioned their current order books and this is re? ected in their share early last year. Projects like this will still go ahead, having prices. Since the oil price collapse subsea hardware manufac- already been commissioned and demonstrate why the market turers indexed share price has declined 34%, signi? cantly less than others such as drilling companies. will remain steady in 2016-2017 despite the low oil price.

Over the next two years a decline in backlogs is expected, as

The SURF market will approach $48bn Capex and this is boosted by a revision of development plans that mean that new orders for equipment dry up in the low oil price environ- projects are developed as tiebacks rather than with their own ment. Major subsea players such as FMC and Aker are likely ? xed or ? oating platform, increasing the length of required to be affected by this and as the number of orders shrinks they

SURF units. This is often a cheaper solution and in a time will likely have to lower prices to ensure they win orders. It is when companies are under pressure to cut costs, will be an not a simple issue though and lower costs will have to be bal- attractive option. As well as this the development of remote anced with maintaining high safety standards. This expected increase in price competition is going to be important in an ? elds and the addition of new project phases will drive expen- area where equipment costs continued to grow even as the oil diture in this category. price peaked.

Other factors such as the use of certain production facil-

It is important to highlight however that this is only expect- ity designs drive higher installation Capex of particular pieces of hardware. For example subsea completion of wells with a ed to be short term and the growth in Capex spend after 2018 ? oating production unit, which is seen to be more common in demonstrates that orders will grow again after a few lean years. regions such as African and Latin American deepwater devel- opments, directly drive more installations of larger riser bun-

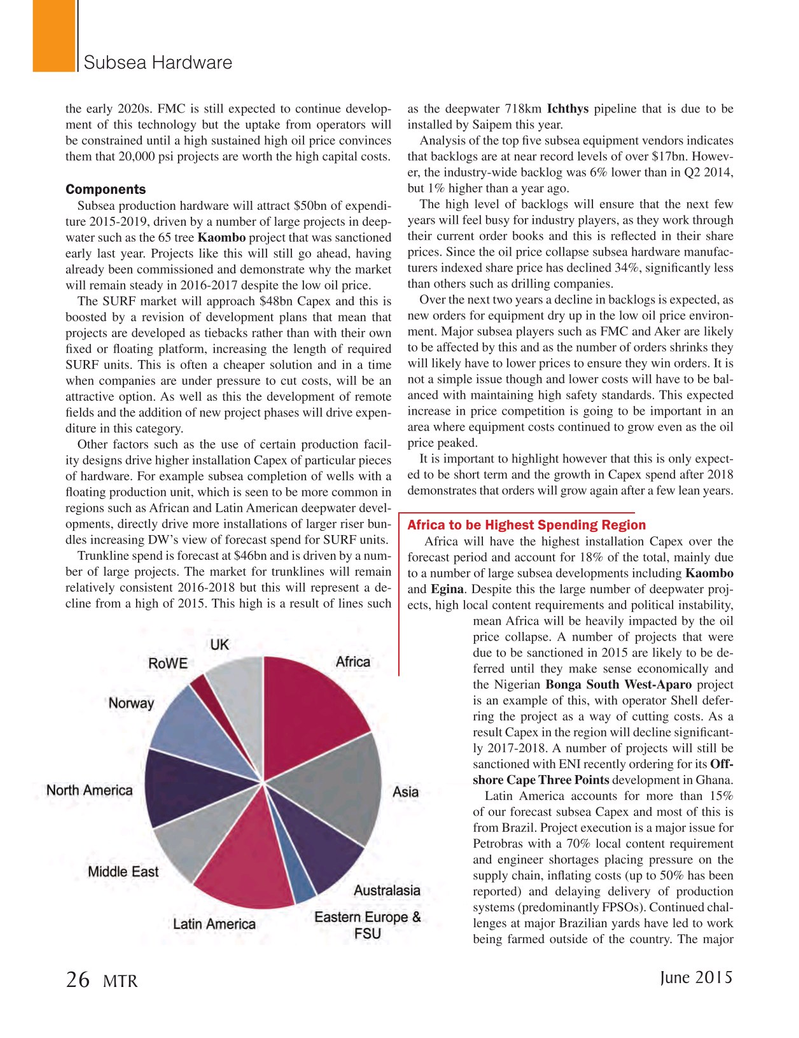

Africa to be Highest Spending Region dles increasing DW’s view of forecast spend for SURF units.

Africa will have the highest installation Capex over the

Trunkline spend is forecast at $46bn and is driven by a num- forecast period and account for 18% of the total, mainly due ber of large projects. The market for trunklines will remain to a number of large subsea developments including Kaombo relatively consistent 2016-2018 but this will represent a de- and Egina. Despite this the large number of deepwater proj- cline from a high of 2015. This high is a result of lines such ects, high local content requirements and political instability, mean Africa will be heavily impacted by the oil price collapse. A number of projects that were due to be sanctioned in 2015 are likely to be de- ferred until they make sense economically and the Nigerian Bonga South West-Aparo project is an example of this, with operator Shell defer- ring the project as a way of cutting costs. As a result Capex in the region will decline signi? cant- ly 2017-2018. A number of projects will still be sanctioned with ENI recently ordering for its Off- shore Cape Three Points development in Ghana.

Latin America accounts for more than 15% of our forecast subsea Capex and most of this is from Brazil. Project execution is a major issue for

Petrobras with a 70% local content requirement and engineer shortages placing pressure on the supply chain, in? ating costs (up to 50% has been reported) and delaying delivery of production systems (predominantly FPSOs). Continued chal- lenges at major Brazilian yards have led to work being farmed outside of the country. The major

June 2015 26

MTR

MTR #5 (18-33).indd 26 MTR #5 (18-33).indd 26 6/11/2015 9:57:56 AM6/11/2015 9:57:56 AM

25

25

27

27