Page 29: of Marine Technology Magazine (April 2016)

Offshore Energy Annual

Read this page in Pdf, Flash or Html5 edition of April 2016 Marine Technology Magazine

various stages of planning. Of these projects, 59% likely in- climb to the $50 to $60 range in 2017/18 and to $60 to $70 volve an FPSO, 10% another type of oil/gas production ? oat- in 2019/20. We have also assumed Petrobras’ problems will er, 24% a liquefaction/regasi? cation ? oater and 7% a storage/ continue through 2017 – limiting the company’s capability to of? oading ? oater. 44% of the projects are at stage of planning ? nance new projects. But from 2018 onward Petrobras will where a production/storage system contract is possible within be fully back in the market and/or the operating rights to some the next ? ve years – provided the underlying markets drivers pre-salt blocks offshore Brazil now managed by Petrobras will support the investment decision. be contracted to international players.

But obviously the underlying drivers need to improve before Further, we have assumed there will be signi? cant (20 to investment activity rebounds and planned projects turn into 30%) cost reductions in the deepwater supply chain as com- orders for ? oating production systems. Until there is improve- petition for available contracts tightens, local content require- ment in oil prices, ? eld operators will be reluctant to invest in ments ease and operators negotiate more favorable revenue new production equipment. In late March we examined the sharing arrangement with resource owners. The result will be projects in the planning stage to identify those likely to reach to lower the breakeven price of new deepwater projects.

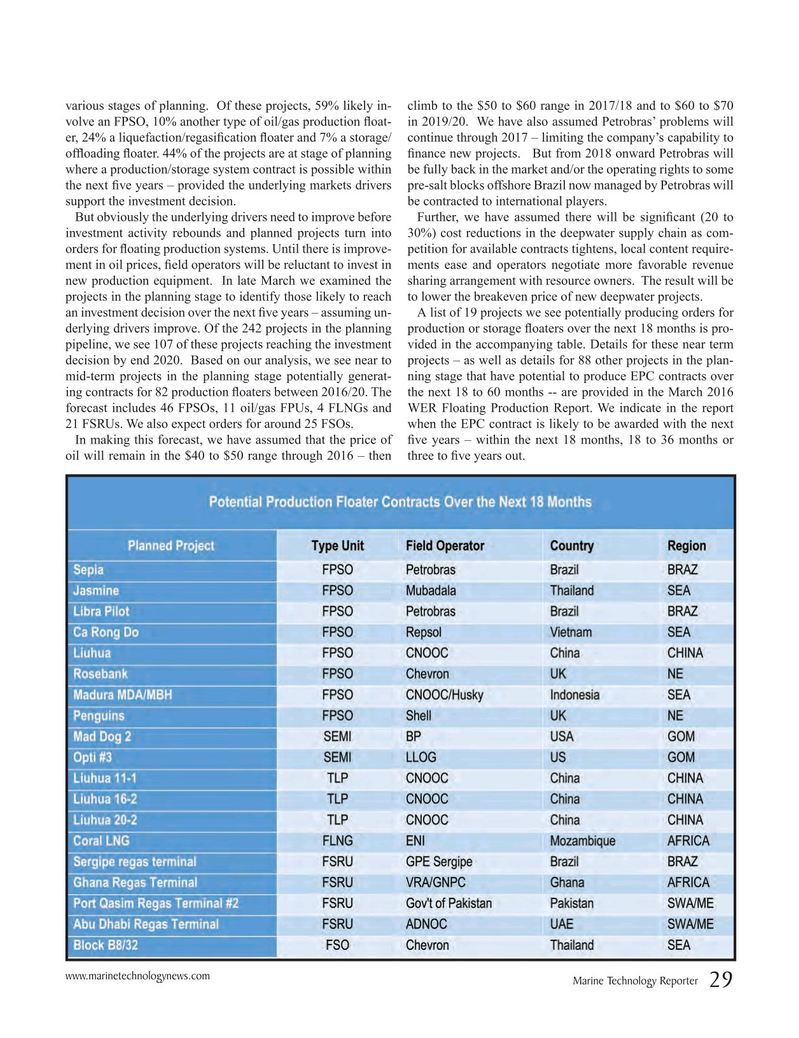

an investment decision over the next ? ve years – assuming un- A list of 19 projects we see potentially producing orders for derlying drivers improve. Of the 242 projects in the planning production or storage ? oaters over the next 18 months is pro- pipeline, we see 107 of these projects reaching the investment vided in the accompanying table. Details for these near term decision by end 2020. Based on our analysis, we see near to projects – as well as details for 88 other projects in the plan- mid-term projects in the planning stage potentially generat- ning stage that have potential to produce EPC contracts over ing contracts for 82 production ? oaters between 2016/20. The the next 18 to 60 months -- are provided in the March 2016 forecast includes 46 FPSOs, 11 oil/gas FPUs, 4 FLNGs and WER Floating Production Report. We indicate in the report 21 FSRUs. We also expect orders for around 25 FSOs. when the EPC contract is likely to be awarded with the next

In making this forecast, we have assumed that the price of ? ve years – within the next 18 months, 18 to 36 months or oil will remain in the $40 to $50 range through 2016 – then three to ? ve years out.

www.marinetechnologynews.com

Marine Technology Reporter 29

MTR #3 (18-33).indd 29 4/4/2016 9:59:49 AM

28

28

30

30