'80s Brain Drain Haunts Today’s Offshore Layoffs

Companies struggle to balance cost-cutting with skills retention.

If you can’t accept the rollercoaster of employment that is the offshore industry, adding and shedding jobs like clockwork through its cyclical ups and downs, don’t get on for the ride.

That cold bucket of reality is repeated like a mantra across the industry. Job security and highly paid offshore employment are like mixing oil and water. The emulsion will keep hold for a while until it eventually falls apart when oil prices disintegrate. It’s a pattern industry veterans know well. But it’s also a cycle that many agree needs to be approached more strategically today, with a greater eye toward future staffing needs. For some companies, their future success will depend upon it.

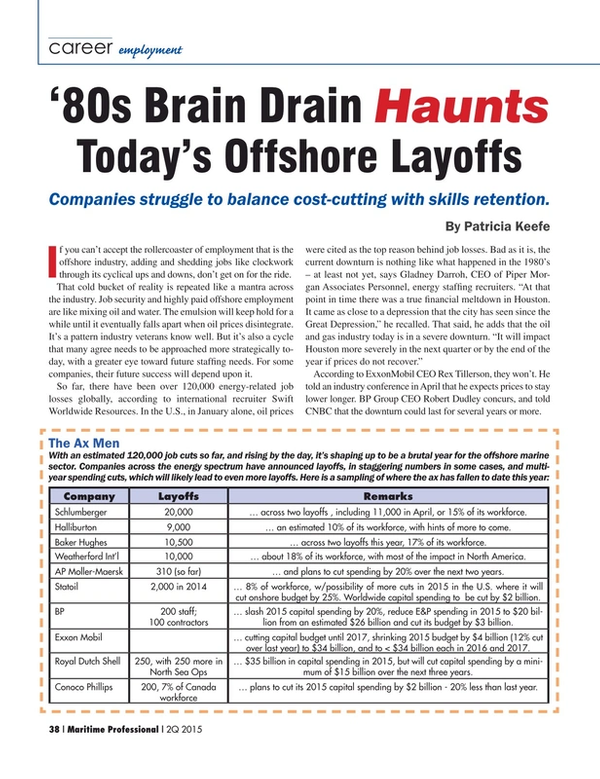

So far, there have been over 120,000 energy-related job losses globally, according to international recruiter Swift Worldwide Resources. In the U.S., in January alone, oil prices were cited as the top reason behind job losses. Bad as it is, the current downturn is nothing like what happened in the 1980s – at least not yet, says Gladney Darroh, CEO of Piper Morgan Associates Personnel, energy staffing recruiters. “At that point in time there was a true financial meltdown in Houston. It came as close to a depression that the city has seen since the Great Depression,” he recalled. That said, he adds that the oil and gas industry today is in a severe downturn. “It will impact Houston more severely in the next quarter or by the end of the year if prices do not recover.”

According to ExxonMobil CEO Rex Tillerson, they won’t. He told an industry conference in April that he expects prices to stay lower longer. BP Group CEO Robert Dudley concurs, and told CNBC that the downturn could last for several years or more.

The Industry Retrenches

As the steady drumbeat of layoffs continues, some analysts are predicting one or two more waves of layoffs by yearend. Cuts to date have ranged from huge, brutal chops to more selective, smaller cuts.

Schlumberger, for example, in mid-April axed in one fell swoop 11,000, bringing the world’s largest oil field services provider’s total cuts this year to about 20,000, or 15% of its workforce. Halliburton has jettisoned 9,000 workers over the last six months – an estimated 10% of its workforce – and is hinting there may be more. Merger partner Baker Hughes has so far cut its workforce by 10,500 (17%).

All of the major oil companies have announced their intent to implement massive spending cuts and billions in cost reduction over the next several years, also demanding at least 30% reductions from their business partners, many of whom are struggling themselves.

Shell’s $70 billion bid to purchase BG Group is expected to start the ball rolling on industry consolidation, which in turn should trigger more layoffs. In an April interview with Reuters, Claus Hemmingsen, CEO of Maersk Drilling, predicted the industry will face a wave of takeovers in the next two years as crude prices are expected to remain under $85 per barrel. The downturn has so far mostly affected upstream jobs, with the Gulf of Mexico and the North Seas bearing the brunt. For example, last month it was reported that there were at least 30 platform supply vessels in the North Sea without contracts.

“The midstream and downstream areas are still busy; they have been impacted to a lesser degree,” says Darroh, noting product still needs to be transported, and people still have to get out to the rigs.

But there is no question that the offshore sector is under enormous financial pressure as each level in the supply chain pushes their pain down to the next. “New orders have been reduced tremendously, contracts canceled and hiring frozen, in addition to outright cuts, budget caps and new projects being pared back significantly. At these prices, it is exceptionally difficult to make money in the offshore industry,” says Darroh. Add in new regulations as a result of Macondo, and the Gulf of Mexico has become a very difficult environment in which to make money, he says.

“All the major drilling companies have lost 50% of their value – Ensco, Transocean, Seadrill – banks absolutely don’t want to lend them money,” says Jason Waldie, energy analyst for Douglas-Westwood Pte, Ltd. “Exploration and seismic spending is down 15% to 20% globally; in the U.S. it’s [down] 30%.”

Amid the turmoil, mounting layoffs are calling up the ghost of the mid-1980’s market collapse that drove thousands from the industry, and have ignited fears of a second ‘lost generation.’ “The industry is traditionally wary of a drop in unemployment,” says Mike Haney, director, Houston office, Douglas Westwood.

Mind the Gap

The impact of the crash in oil prices on employment in the offshore marine sector is not without a sense of deja vu. It calls up the old adage that those who fail to learn from history are doomed to repeat it. One of the major ironies of the current round of layoffs is that the industry has been bemoaning the lack of skilled crew and officers for years now, stretching back to the mass exodus of labor during the mid-1980’s implosion.

The energy industry and its offshore sector have suffered through several downturns since the mid-‘80s, but the last big shutdown was a “generation and a half ago,” says Waldie. “In that span between 1985 and 2005, this was not a popular industry to go into.” The stigma left its mark, so much so that the industry continues to suffer the aftereffects today both of the mass exodus of labor and of generations of students who switched career plans to safer ground.

The result is a definable generation gap that has made the availability of a solid middle tier of skilled employees ready to move up as older workers retire, a shadow of what it should be. “There aren’t many 45-year-olds in our business,’’ notes Haney. That yawning void in the middle has created a work force today that is heavily weighted at both ends of the experience meter. Which begs the question of who, then, is going to replace the crush of senior-level workers when they start to retire?

“The average age in the offshore industry is 55-65,” says Darroh, an age group the Independent Petroleum Association of America estimates to be 71% of the workforce. Over the next five to seven years, up to 50% of that demographic is expected to retire, according to a February report from the American Petroleum Institute’s American Energy Works foundation.

This is no minor issue. The last market recovery did bring more engineers and business people into the field, but few are deemed ready to pick up the mantle of senior staff. And some warn the lack of experience could translate to an uptick in workplace hazards and increased liabilities.

Industry observers say companies are cognizant of the issue. There has been a lot of talk about the “graying” of the industry, and the need to avoid another brain drain, but little has been done about it, they say, beyond standard college recruiting tours and internship programs.

Déjà vu All Over Again

Decades later, the fear is that this downturn’s cuts will be déjà vu all over again. “You’ll have this same problem, only it will get worse because there won’t be any new kids coming into the industry over the next three to five years. Not like they have in the last two to four years,” says Darroh. “These types of things will continue to haunt the industry in terms of closing the gap between retiring folk and success in [attracting] permanent employees making a career with the company.”

Where layoffs have been unavoidable, one way to fill the experience gap or plug-in a specific skill set, at least in the short term, is to bring in consultants or contract workers until a recovery has stabilized. Still, recruiters such as Faststream CEO Mark Charman and others have suggested that going forward, employers might want to consider using contract workers on a regular basis, a strategy more prevalent in Europe and other industries such as high tech, where the use of “permatemps” is widely practiced.

Even in a downturn, the industry needs to take a medium- to-long-term view in workforce planning. The need for cost reductions is a good time to reorganize, eliminate deadwood, and restructure jobs. It’s a great time to look ahead and try to figure out where hiring needs to go. “Winning” companies “that have a long-term optimistic view of the market will use this as an opportunity to go out and find those hard-to-find individuals who were previously bear-hugged by their employers,” Charman recently said.

A particularly aggressive approach involves scanning the competition to see which workers are being retained – these being presumably the best and now most overworked – and to try to recruit needed skill sets, possibly at ‘discount’ given the volatility of the job market. Once the market recovers and companies compete to fill positions, these workers will be able to demand premium pay.

A Plan of Action from Across the Pond

When hunting for talent, it helps to have a global perspective – and contacts. The mid-level gap may be unique to, or at least more prevalent in the U.S. According to “Fuelling the Next Generation,” an Ernst & Young study on employment trends done for industry association UK Oil & Gas, the UK sector has a much more balanced, younger workforce. The study, which was designed to provide insight into the skills requirements of the industry - says staff over 55 comprises just over 10% of the workforce while those 35 and younger make up 40%.

The report also highlights successful efforts to seed a sustainable pool of talent for the future, noting that 86% of companies have programs targeting graduate and “apprentice” workers, with an enrollment of 19,000. U.S. industry associations might want to take note: The UK’s Offshore Petroleum Industry Training Organization (OPITO) plans to use the report as a “blueprint” to design a “skills strategy to ensure a workforce fully equipped to sustain the oil and gas industry for years to come.”

Workers don’t grow on trees. But they can be nurtured by a forward-looking plan of action supported by a coalition of industry, training and government groups. The EY study of the UK upstream oil and gas workforce was commissioned “to better understand the current workforce profile and the employment disciplines which will be in the greatest demand over the next two to five years ...,” explains Dr. Alix Thom, employment and skills issues manager, Oil & Gas UK.

By working together on the retention and development of skills, the aim is to retain as many jobs as possible and to maintain the long-term supply of quality personnel to all disciplines across the industry,Thom added.

You Don’t Know What You’ve Got ‘Til It’s Gone

Employers who can keep key personnel in the midst of a depression while others around them are willy-nilly hemorrhaging pink-slipped hot skills out the door, will have the advantage when the market comes back around, as it always does.

The ideal situation is not to lose workers at all, or to at least maintain the relationship. In a bid to stave off layoffs, companies like Tidewater, Inc., a provider of offshore supply vessels, deploy tactics such as freezing salaries, cutting benefits, changing rotations to more days off than on, job sharing, etc. To keep crew and boats working, the company also looks for spot opportunities and where possible, moves assets into other geographic sectors if that’s where the work is, according to Joseph Bennett, Tidewater Executive Vice President.

Flexibility and adaptability go a long way. So does keeping one eye on the horizon. Take a strategy that helped Tidewater shield a portion of its workforce and vessels from the market turmoil. Bennett explains that a year and half ago, the company got the sense that Gulf was in danger of vessel overcapacity. So it took 12 deep water vessels and locked them into long-term contracts at the peak of the market, the opposite of conventional wisdom at the time. Competitors who opted to play the spot market have since been more severely impacted by the downturn, while those 12 vessels and their crew will ride out the storm.

When layoffs become necessary, there’s slashing and burning, and then there is precision cutting. The rule of thumb at Tidewater, the world’s largest supplier of offshore supply vessels, is to look at corporate and onshore positions first. As Bennett says, if the boat is working, the mariners are working.

The opposite is also true. There are a lot of boats, old and new builds, stacked like frozen cod waiting for the market to return. In those cases, there are still forward-looking strategies that can be deployed.

A Little of That Human Touch

Cuts may be unavoidable, but Hornbeck Offshore Services thinks how you handle them matters. For example, says Cid Paul Arceneaux, Fleet Recruiting Manager, Hornbeck tries to personally speak to every affected worker where possible.

Darroh says smart companies are giving as much notice as they can, providing generous packages and outplacement resources. This way, when they are ready to hire again, they can say, “We had to do it at the time, but we did it with programs that lessened the consequences to employees as much as we possibly could.” “Most companies don’t do that. We care about employees, and we want them to think of Hornbeck first when hiring picks up again,” says Arceneaux. One way to make sure that happens is to literally mean “furloughed.” Hornbeck aggressively courts retention. It has eight newbuilds coming in throughout the rest of the year and it has told valued employees who had to be laid off that they will be the first called back when the new vessels are deployed. This gives the employees motivation to stay in the industry, and can help Hornbeck fill future staffing needs.

Not All Doom & Gloom

Mark Charman points out that even as companies are laying off – many are hiring. He expects the market will calm down a bit in the second half of the year, resulting in new projects and renewed hiring. Beyond this, there are a lot of new supply and drill ships being delivered, with more to come. Those ships will need to be crewed.

“I tell people that if they have the financial ability, that time and patience are their best allies. Don’t panic that the market will be this way forever. It’ll change for the better in a year or two, it always does,” says Darroh. In the meantime, he counsels people to stay plugged in, and to take stock of what is really important to them. “My message is positive. ‘You are smart, you have alternatives. Look for them and you will prosper again.’ I have seen this over 38 years in the industry. You will prosper again.”

(As published in the 2Q 2015 edition of Maritime Professional - www.maritimeprofessional.com)

Read '80s Brain Drain Haunts Today’s Offshore Layoffs in Pdf, Flash or Html5 edition of Q2 2015 Maritime Logistics Professional

Other stories from Q2 2015 issue

Content

- Energy IQ page: 8

- Statistics: The Perfect Storm page: 10

- The Other Side of the Flange page: 12

- So, You Want to be in Bunkers? page: 16

- Changing Classrooms for Changing Class Societies page: 20

- Weighing in With WISTA’s Leaders page: 28

- Ulstein: Stronger Than a City page: 32

- '80s Brain Drain Haunts Today’s Offshore Layoffs page: 38