LNG Capital Expenditure

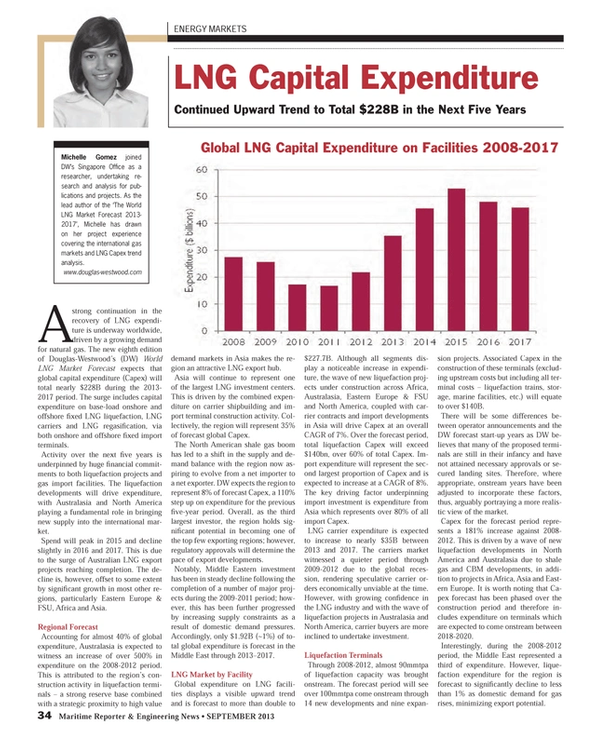

Continued Upward Trend to Total $228B in the Next Five Years

A strong continuation in the recovery of LNG expenditure is underway worldwide, driven by a growing demand for natural gas. The new eighth edition of Douglas-Westwood’s (DW) World LNG Market Forecast expects that global capital expenditure (Capex) will total nearly $228B during the 2013-2017 period. The surge includes capital expenditure on base-load onshore and offshore fixed LNG liquefaction, LNG carriers and LNG regasification, via both onshore and offshore fixed import terminals.

Activity over the next five years is underpinned by huge financial commitments to both liquefaction projects and gas import facilities. The liquefaction developments will drive expenditure, with Australasia and North America playing a fundamental role in bringing new supply into the international market.

Spend will peak in 2015 and decline slightly in 2016 and 2017. This is due to the surge of Australian LNG export projects reaching completion. The decline is, however, offset to some extent by significant growth in most other regions, particularly Eastern Europe & FSU, Africa and Asia.

Regional Forecast

Accounting for almost 40% of global expenditure, Australasia is expected to witness an increase of over 500% in expenditure on the 2008-2012 period. This is attributed to the region’s construction activity in liquefaction terminals – a strong reserve base combined with a strategic proximity to high value demand markets in Asia makes the region an attractive LNG export hub.

Asia will continue to represent one of the largest LNG investment centers. This is driven by the combined expenditure on carrier shipbuilding and import terminal construction activity. Collectively, the region will represent 35% of forecast global Capex.

The North American shale gas boom has led to a shift in the supply and demand balance with the region now aspiring to evolve from a net importer to a net exporter. DW expects the region to represent 8% of forecast Capex, a 110% step up on expenditure for the previous five-year period. Overall, as the third largest investor, the region holds significant potential in becoming one of the top few exporting regions; however, regulatory approvals will determine the pace of export developments.

Notably, Middle Eastern investment has been in steady decline following the completion of a number of major projects during the 2009-2011 period; however, this has been further progressed by increasing supply constraints as a result of domestic demand pressures. Accordingly, only $1.92B (~1%) of total global expenditure is forecast in the Middle East through 2013–2017.

LNG Market by Facility

Global expenditure on LNG facilities displays a visible upward trend and is forecast to more than double to $227.7B. Although all segments display a noticeable increase in expenditure, the wave of new liquefaction projects under construction across Africa, Australasia, Eastern Europe & FSU and North America, coupled with carrier contracts and import developments in Asia will drive Capex at an overall CAGR of 7%. Over the forecast period, total liquefaction Capex will exceed $140bn, over 60% of total Capex. Import expenditure will represent the second largest proportion of Capex and is expected to increase at a CAGR of 8%. The key driving factor underpinning import investment is expenditure from Asia which represents over 80% of all import Capex.

LNG carrier expenditure is expected to increase to nearly $35B between 2013 and 2017. The carriers market witnessed a quieter period through 2009-2012 due to the global recession, rendering speculative carrier orders economically unviable at the time. However, with growing confidence in the LNG industry and with the wave of liquefaction projects in Australasia and North America, carrier buyers are more inclined to undertake investment.

Liquefaction Terminals

Through 2008-2012, almost 90mmtpa of liquefaction capacity was brought onstream. The forecast period will see over 100mmtpa come onstream through 14 new developments and nine expansion projects. Associated Capex in the construction of these terminals (excluding upstream costs but including all terminal costs – liquefaction trains, storage, marine facilities, etc.) will equate to over $140B.

There will be some differences between operator announcements and the DW forecast start-up years as DW believes that many of the proposed terminals are still in their infancy and have not attained necessary approvals or secured landing sites. Therefore, where appropriate, onstream years have been adjusted to incorporate these factors, thus, arguably portraying a more realistic view of the market.

Capex for the forecast period represents a 181% increase against 2008-2012. This is driven by a wave of new liquefaction developments in North America and Australasia due to shale gas and CBM developments, in addition to projects in Africa, Asia and Eastern Europe. It is worth noting that Capex forecast has been phased over the construction period and therefore includes expenditure on terminals which are expected to come onstream between 2018-2020.

Interestingly, during the 2008-2012 period, the Middle East represented a third of expenditure. However, liquefaction expenditure for the region is forecast to significantly decline to less than 1% as domestic demand for gas rises, minimizing export potential.

Due to significant cost escalations in Australasia, the region alone will account for approximately almost $90bn of expenditure. The continued trend in cost escalation could bring into doubt the viability and future of some Australasian projects, raising the question – could we see a significant slowdown in Australasian investment?

Due to developments in shale gas drilling technology and the associated rise in production, significant investments extending capabilities of existing infrastructure in North America will be made throughout the entire forecast period and beyond. However, the pace of development will be determined by the rate of regulatory approval. Its first export facility Sabine Pass, after Kenai terminal (recently decommissioned), will only be due onstream in 2016.

Eastern Europe will see increased investment in liquefaction with Russia building up its export capacity. Africa will also grow in importance as an exporting region given developments in Mozambique and Tanzania.

LNG Carrier Market

Over the forecast period, all shipbuilding activity will take place in Asia where the major yards are located. The carrier market will display heavy expenditure throughout the forecast period, increasing by almost 40% over 2008-2012’s spending. This is expected to peak in 2016 at approximately $8bn.

During 2008-2012, 121 vessels were delivered, peaking in 2008 at 54 units. Carriers delivered were predominantly Q-max and Q-flex sized vessels, as per the direct requirements of the Qatari fleet.

However, the effects of the economic recession were reflected in the shipbuilding industry, negatively impacting the order book and associated expenditure levels from 2009 to 2012.

A large surge in deliveries is anticipated due to the onset of liquefaction facilities expected during and beyond the forecast period. Increased confidence in the LNG market as a whole will give the LNG carrier building industry an additional boost.

Pre-2008, some carriers were constructed in Western Europe. However, there has been a transition towards Asian shipbuilding because of increased familiarity with Asian-built vessels coupled with its lower cost offering. South Korean shipyards will account for the majority of new builds, while Chinese group Hudong-Zhonghua Shipbuilding will increase its market share through 2013-2017.

However, given the large number of deliveries anticipated from 2014 onwards, yard capacity constraints in Asia may become an issue. Western European shipbuilders may be well placed to take advantage during periods of exceptionally high demand.

LNG Import Terminals

Approximately 250mmtpa was brought onstream 2008-2012, with associated Capex totalling $32B. The next five years will see Capex increase reaching almost $50B, as similar import capacity levels to the 2008-2012 period is again brought onstream.

The previous five years saw significant investments in Asia, North America and Western Europe. However, 2011 and 2012 experienced a drastic reduction in import investment by North America, due to the possibility of monetising shale gas reserves at home, reducing their requirement for LNG imports and associated expenditure. Since then, North America has been moving towards LNG import independence.

Increased Capex for import infrastructure in Asia during 2013-2017, will represent a 180% rise in expenditure on the previous five-year period.

Comparing the two periods, 2008-2012 and 2013-2017, the demand side of the equation has evolved. As with the previous five-year period, developing economies in Asia will continue to be the dominant importing region, accounting for over 80% of import facility expenditure. In addition to established LNG importers, Japan and South Korea, top exporters Malaysia and Indonesia will drive further LNG imports as domestic demand dictates a reverse in trade.

Accounting for almost $30bn of forecast import Capex, key emerging economies China and India will contribute significantly to import expenditure due to growing domestic gas demand. Likewise, the Philippines, Singapore and Vietnam are anticipated to substantially increase their investments in import infrastructure during the forecast period.

Latin America’s Capex will rise gradually throughout the forecast period is attributed to projects in Brazil, Chile, Cuba, Dominican Republic and Mexico. A poor gas demand climate has seen in Western Europe as it experience a $0.4B drop in forecast import spend. In the long term however, the European gas market should recover as gas-fired power demand returns to pre-recession levels.

A forecast of strong growth in global natural gas demand as a fuel for power generation and increasingly as a substitute for oil as a transportation fuel will drive increased expenditure on natural gas facilities worldwide. The discoveries of large reserves are, however, remote from the end users.

This geographic disconnect results in major regional gas price differences and considerable potential for arbitrage. One specific example is the U.S. with gas at some $3 compared with $9 in Europe and >$16 in Japan. Liquefaction enables these reserves to be brought to market.

Many areas in Asia, Latin America and the Middle East are seeing growing gas demand and LNG is also seen as a good solution to seasonal demand spikes. Other areas such as the UK are seeing a severe fall in gas production and are importing increasing amounts of LNG.

Growing environmental awareness is also an important factor – with natural gas only emitting half of the greenhouse gases of coal it provides a mechanism for rapidly reducing emissions.

The EU’s emissions act in 2015 may incentivize shipowners to use LNG as an alternative fuel in addition to the price arbitrage effect. LNG is also being increasingly adopted in many countries in road applications for buses and trucks.

Unconventional gas reserves such as shale gas and coalbed methane will be both a feedstock and a competing source of natural gas. However, some of this may also, as a function of location, also be a candidate for liquefaction.

Successful production of unconventional gas may enable the U.S. to become a net exporter within the forecast period. However, regulatory approvals have been hard to obtain, to date impeding the development process.

We expect U.S. natural gas prices to increase as the full cycle costs of shale gas production are at least $7-8/mmbtu. Elsewhere in the world they are yet to be understood but are likely to be higher than the U.S. LNG from conventional gas plays can, therefore, be cost-competitive with shale gas.

In most regions natural gas prices are strongly discounted, compared to oil on a btu-parity basis. This suggests potential for increases in natural gas prices over time as the ease of trade and arbitrage increases.

DW expect continued change in the focus areas for LNG export projects. While the Middle East remains one of the top exporters, the region will see very little expenditure within the forecast period. Australian spend however, will surge, peak and start to decline somewhat. As in many other sectors of the oil & gas industry, reducing the costs of LNG projects remains a major challenge. However, beyond 2017, significant potential for major growth in LNG capital expenditure can be seen, due to the large discoveries in East Africa and Eastern Mediterranean, together with increased focus on exports of US shale gas. Furthermore, the considerable prospective reserves of the arctic offer a longer-term potential.

Get the Report

World LNG Market Forecast 2013-2017: The report covers capital expenditure on base-load onshore and offshore fixed LNG liquefaction, LNG transport by LNG carriers and LNG regasification via onshore and offshore fixed import terminals. The report details LNG trends by region and facility type, supported by analysis and insight for strategy teams within shipping companies, contractors, shipbuilders, oil & gas operators, gas utilities and financial institutions. Essential reading for companies associated with the LNG industry and potential entrants.

www.douglas-westwood.com/shop/shop-infopage.php?longref=1175

Michelle Gomez joined DW’s Singapore Office as a researcher, undertaking research and analysis for publications and projects. As the lead author of the ‘The World LNG Market Forecast 2013-2017’, Michelle has drawn on her project experience covering the international gas markets and LNG Capex trend analysis.

www.douglas-westwood.com

(As published in the September 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

Read LNG Capital Expenditure in Pdf, Flash or Html5 edition of September 2013 Maritime Reporter

Other stories from September 2013 issue

Content

- Shale Oil Is it a Threat to Future Deepwater Development? page: 12

- ZF Marine Propulsion Systems page: 14

- Interview: MAN Diesel & Turbo Head of R&D, Søren H. Jensen, page: 18

- Efforts continue to improve the Modeling of Thrusters page: 24

- GPS Spoofing and the Potential Perils to Ships at Sea page: 26

- Mitigation of Shock & Vibration on Fast Boats page: 30

- LNG Capital Expenditure page: 34

- Safety in Numbers page: 38

- Poland’s Maritime U. page: 40

- Back to School page: 48

- Pick Me Up page: 52

- Liebherr Wins Significant Ship Crane Order page: 54

- BAE Yards Busy with PSV Newbuilds, Ship Repairs page: 58

- The Ties that Bind page: 60

- Floating Production Systems: A Big Opportunity for Shipyards page: 62

- Kirby Corp. CEO Joe Pyne is "No Ordinary Joe" page: 68

- Bollinger Builds page: 78

- Conrad Shipyard: Strength in Diversity page: 82

- SCANIA Powers Ahead in Workboat Market page: 84

- MAN Diesel & Turbo and the Tier-III Age page: 86

- Offshore Service Vessels page: 94

- W&O Expands Repertoire page: 98

- Tech Profile: Colfax CM-1000 page: 102

- A “Look Under the Hood” page: 106

- Beier Radio page: 108

- Carnival to Develop New Emission Reduction Tech page: 110

- Fire Protection for LNG-fueled Ships page: 118

- A Shipyard First Bug-O System’s Heavy-Duty MDS and Hardcoat Anodized Rail page: 120