Arctic Energy Exploration Efforts Heat Up

Oil and gas—and also mining—are the drivers today propelling Arctic maritime operations and the construction of new vessels able to operate in extreme latitudes.

While the gas and oil resources can be recovered in the Arctic or far north and shipped to markets by sea or pipeline, the cost of doing must be balanced upon the global market price for those commodities.

Ships and marine structures able to operate in the harsh conditions of the extreme latitudes require special designs and construction techniques. Ships that will operate in or around ice, or could likely encounter ice, may require icebreaking ships or tugs to open channels.

The International Maritime Organization (IMO) is developing an International Code of safety for ships operating in polar waters (Polar Code).

An IMO report on the Polar Code explains some of the challenges. “Ships operating in the Arctic and Antarctic environments are exposed to a number of unique risks. Poor weather conditions and the relative lack of good charts, communication systems and other navigational aids pose challenges for mariners. The remoteness of the areas makes rescue or clean-up operations difficult and costly. Cold temperatures may reduce the effectiveness of numerous components of the ship, ranging from deck machinery and emergency equipment to sea suctions. When ice is present, it can impose additional loads on the hull, propulsion system and appendages.”

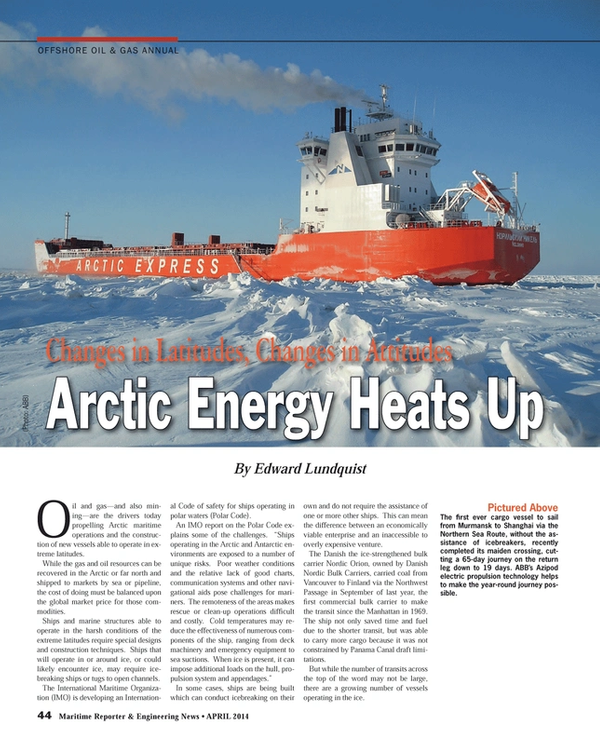

In some cases, ships are being built which can conduct icebreaking on their own and do not require the assistance of one or more other ships. This can mean the difference between an economically viable enterprise and an inaccessible to overly expensive venture.

The Danish the ice-strengthened bulk carrier Nordic Orion, owned by Danish Nordic Bulk Carriers, carried coal from Vancouver to Finland via the Northwest Passage in September of last year, the first commercial bulk carrier to make the transit since the Manhattan in 1969. The ship not only saved time and fuel due to the shorter transit, but was able to carry more cargo because it was not constrained by Panama Canal draft limitations.

But while the number of transits across the top of the word may not be large, there are a growing number of vessels operating in the ice.

“Major oil companies continue to make major commitments to oil and gas exploration operations in the Arctic region,” said Mikko Niini, until recently the managing director at Aker Arctic in Helsinki, and now a senior management advisor.

“We’re developing more independent cargo vessel solutions,” said Niini.

Some of Aker Arctic’s more unusual designs include the double-acting ship (DAS) and the oblique icebreaker.

The first DAS, Finnish tanker Tempera, was delivered to Neste Oil Corporation in 2002. The development of the steerable electric podded-propulsion system, known as Azipods, has revolutionized marine propulsion for cruise ships and other platforms, but nowhere more dramatically than for icebreakers.

Niini says the Tempera design looks like a standard tanker with a bulbous bow, bBut with a stern that’s designed for icebreaking. “In winter it goes backwards,” said Niini.

The prop wash keeps the ice from freezing and adhering to the steel hull, thus reducing friction. “This has been proven to save up to 50% of energy and fuel.”

“It has been operating for 10 years in the Baltic Sea and has never needed any icebreaker assistance” said Niini.

“Our crude oil fleet was designed for independent operation in ice conditions encountered in Gulf of Finland, mainly between our two refineries in Porvoo and Naantali and Primorsk Oil Terminal in Russia. In practice these vessels are as pipeline extension from Russia to our refineries in Finland,” said Captain Ari Inkinen, fleet manager for Neste Oil Corporation in Espoo, Finland.

“Our product fleet was designed for icebreaker assisted operation to ports in Gulf of Finland, Sea of Bothnia and Bay of Bothnia, carrying cold product cargoes at temperatures as low as-20 degrees C,” said Inkinen. “All of our vessels have extra ice reinforcement above the rule requirement in bow area and winterized according to our experience.”

“Ice navigation was taken into consideration in bridge design. The helmsman is located in front of the main conning position with an unobstructed view and bow searchlight control. All searchlights can be controlled from main conning positions and bridge wings,” Inkinen said. “We adopted paperless ECDIS Navigation in 2002. We wanted to increase the bridge team’s situational awareness in ice infested waters.”

Aker Arctic’s DAS design was employed for the design of five ice-capable containerships and one tanker for Russian mining company Norilsk Nickel, the world’s largest producer of nickel and palladium. The ships are capable of operating without icebreaker support to conduct year-round shuttle operations between Murmansk and Dudinka on the Arctic coast. The first vessel, Norilsky Nikel, was delivered in 2006, followed by Monchegorsk, Zapolyarny, Talnakh, Nadezhda and Enisey.

Aker Arctic has also designed a fleet of DAS icebreaking LNG tankers for the joint Novatek/Total Yamal LNG project in Northern Russia on the Ob River where the river meets the Arctic Ocean. When all 16 ships are complete, the company says a ship will arrive to take on cargo every 38 hours and carry the product to Asian markets.

According to Yamal LNG, the Sabetta seaport— which is ice-bound nine months of the year—will be protected by a pair of anti-ice barriers to manage ice jams and drifting ice blocks. The Sabetta seaport will also have six icebreakers to keep the port navigable in ice conditions.

Glencore Xstrata Nickel’s Raglan Mine is located on the Ungava Peninsula in the Nunavik region of northern Quebec. Milled ore is trucked north to Deception Bay for shipment by sea to a railhead in Quebec City for further transportation to smelting facilities in Ontario. Ice capable bulk carriers can transport large bags of nickel ore to market, such as those operated by the Netherlands-based Wagenborg and its fleet of 180 ice-classed vessels. Fednav recently took delivery of the 25,000-ton icebreaking bulk carrier, Nunavik, to transport nickel concentrate from the Nunavik nickel mine in northern Quebec to Europe.

The 70,000-ton DAS shuttle tanker Mikhail Ulyanov was designed by Aker Arctic and built in Russia for OAO Sovcomflot and delivered in 2010. Along with sister ship Kirill Lavrov, it takes on crude oil from the Aker Arctic-designed floating storage and offloading (FSO) unit moored off Murmansk in the Prirazlomnoye oil field development in the Pechora Sea.

Double Wide

For many icebreaking operations, a single icebreaker isn’t able to create a channel wide enough for ships to navigate. This is especially true for Russian crude oil shipments in the Baltic during the winter months. A novel design from Aker Arctic has designed has resulted in a ship that can break ice sideways. The oblique icebreaker is an asymmetrical design. Using podded propulsion—one pod in the bow, one aft and one on the port side in the aft part of the vessel—the ship can move forwards, backwards and obliquely in ice. The first oblique icebreaker, Baltika, is now undergoing sea trials and will be delivered by Arctech Helsinki Shipyard to the Russian Federal Agency of Sea and River Transport this spring. Baltika will be used in icebreaking, rescue and oil combatting operations in the Gulf of Finland.

When moving obliquely, the design also allows the ship to respond to an oil spill by creating a wider area for collecting oil. “The vessel’s hull is being used as a boom to guide the oily water into the collecting tank via a hatch. The oil is separated from the water by using a skimmer,” said Arctech Helsinki Shipyard’s Baltika Project Manager Mika Willberg.

Aker Arctic is working with Finnish naval architects Mobimar on a trimaran icebreaker, which is actually a single hull ship with two side hulls. “It creates a channel twice as wide without increasing the power requirement,” Niini said.

Hannu Tiainen of Mobimar said the trimaran design is particularly suitable for ice operations and icebreaking. ”Our solution is to make the middle hull slim and simultaneously shaped so to break ice effectively. A slim hull means less breaking energy. The middle hull can be shaped so that the propeller can be placed quite deep without a risk of stability problems because the side hulls provide the needed stability.”

With the current design variations under consideration, Tiainen said the displacement of the side hulls is quite small compared to middle hull. “With the propulsion being in the middle hull, the side hulls can be quite simple and shaped to give the required stability as well as bending the already broken ice edge down.”

Aker Arctic’s model basin was used to experiment with multiple designs and configurations in its unique ice testing facility located in Helsinki.

“Aker Arctic has additionally studied a case where the side hulls have turning thruster bodies to give better steering ability as well as forcing the ice blocks to both sides for a wide ice-free channel,” said Tiainen.

A new icebreaker is being constructed at Arctech Helsinki Shipyard for the Finnish Transport Agency that will use both diesel and LNG as its fuel, which is cleaner and more efficient. The vessel will also be equipped for oil spill response operations and emergency towing missions.

Ice conditions also require specialized research vessels, offshore support vessels and anchor handling tugs.

The 360-ft. icebreaking anchor handling tug supply vessel (AHTS) Alviq was constructed by North American Shipbuilding in Larose, Louisiana and LaShip in Houma, Louisiana, and owned by Edison Chouest Offshore (ECO). She was chartered by Royal Dutch Shell for towing and laying anchors for drilling rigs in support of Shell’s now-postponed oil exploration and drilling in the Chukchi Sea off Alaska. The $200 million vessel is also equipped for oil spill response. Two more are under construction, but, Niini said, is fitted with azimuthing thrusters instead of shaftlines as in Aiviq.

Aiviq was towing the mobile offshore drilling unit Kulluk off the coast of Kodiak Island, Alaska, in December, 2012, when the tow line parted. Kulluk subsequently went aground.

Because the anchors touch the bottom within the U.S. EEZ, the anchor handling tugs must comply with the Jones Act and be U.S. flagged.

As the U.S. market grows, other ice-capable ships can be expected to serve in Jones Act business. For example, Seattle-based Foss Maritime Company is building three 132-ft. Ice Class ocean-going tugs at its Rainier Shipyard in Rainier, Oregon on the Columbia River to support Foss work in Alaska and the Arctic servicing the oil and gas industry, mining and other sectors.

Business Model

Niini said the Aker Arctic business model has changed as there are fewer shipyards in Finland. Today Aker Arctic’s designs and concepts are built in the U.S., Russia, Rumania, Japan and Korea. “Instead of supporting the group’s own shipyards, which was the original idea, now we follow the concepts to wherever the clients want to build them.”

The test facility is a big freezer with a 229 ft. long and 24.4 ft. wide test basin, with a water depth of 6.4 feet. Mist can be sprayed into the minus 25 centigrade cold air to generate snow to simulate real conditions on the ice.

All types of ice conditions can be made for testing different hull designs and structures in the operational and environmental conditions expected to be encountered. “We know the performance criteria, that information is taken into scale, and we know how thick the ice needs to be,” Niini said.

A glass bottom allows the Aker Arctic team and its customers to how a ship design responds from underneath.

Steerprop of Finland is offering Steerprop CRP (Contra-Rotating Propellers) propulsors with forward and aft dual-end counterrotating props. The company has tested the system extensively at the Aker Arctic facility. Fincantieri in Italy is building a passenger ferry for Société des Traversiers du Québec (STQ) with its Steerprop pods.

Azimuth propulsion systems can project a slipstream in any desired direction. SteerProp’s Hannu Jukola, said they are a “most potent tool for ice-management.”

“The power is divided to two relatively short propeller shafts pointing in opposite directions. Both propeller shafts have their own gear wheels, bearings and seals which, thanks to the reduced velocities from lower propeller RPM, have longer lifetimes than the bearings and seals that have higher operational velocities.,” Jukola said.

“We used the ice basin at the Aker Arctic test facility to evaluate different propulsion configurations and propulsor installation angles in varying ice conditions to discover the best propulsive efficiencies. Another equally important aspect of the tests was to discover the best ice-management configurations for both dedicated ice-management vessels and other ice-going vessels,” Jukola said. “As a result of the tests, the CRP propulsors were discovered to have particular advantages in ice-management and ice-going applications due to the unique nature of the CRP slipstream.”

“The propulsors themselves can be used to widen fairways as the vessel moves along the fairway, blow away or break up ice ridges, or relieve ice-pressure from Arctic offshore installations. In addition to these slipstream based ice management abilities, an icebreaking vessel with azimuth propulsors is also capable of more ‘traditional’ icebreaking methods, including such as ice-milling. The propulsors’ maneuverability has also enabled new types of vessels, such as tankers or cargo vessels capable of stern-first icebreaking,” Jukola said.

Loading at Sea

As the Arctic Ocean is not exceptionally deep, one Aker Arctic solution is the Prirazlomnoye platform, a loading tower anchored to the sea bottom where bow loading tankers capable of independently operating in the ice can moor and take on crude oil.

If the U.S. doesn’t look at the Arctic strategically, Russia certainly does. Russia’s interest extending from its expansive coastline in the north has prompted establishment of a new Northern Fleet-Unified Strategic Command, as announced in February. The command reportedly will protect Russian shipping, fisheries, oil and gas and other endeavors in the region and along its northern border.

Vice Adm. Peter Neffenger, U.S. Coast Guard deputy commandant for operations observed that as diminishing sea ice is opening the region for oil, gas and mineral extraction, steadily increasing shipping traffic, commercial fishing and maritime tourism, the Coast Guard must provide a much greater presence to patrol and govern U.S. sovereign waters. Neffinger was speaking to reporters at the 5th Symposium on the Impacts of an Ice-Diminishing Arctic on Naval and Maritime Operations, held in Washington last July.

“For us, this is not an abstract, academic discussion,” Neffenger said. “All of the Coast Guard’s authorities and responsibilities apply in this new ocean that has opened up.”

And for some, the discussion is not about ships or icebreakers, it’s about people. “It’s the Arctic that puts Alaskans to work—in oil and gas, fisheries, security and aviation,” said Alaska Lt. Governor Mead Treadwell.

Arctic Issues to the Political Forefront

While commercial activities in the Arctic continue to increase at brisk pace, the Arctic and its future in terms of environment, commerce and defense has come to the forefront of both the United States and the International Maritime Organization (IMO).

In January 2014 the White House signaled its interest in Arctic matters, outlining its plan to make Arctic Shipping safer. The Implementation Plan for the National Strategy for the Arctic Region was to put flesh on the bones of the May 10, 2013 National Strategy for the Arctic Region, and assigns lead agencies and supporting agencies for each of 36 identified taskings. While safety is the headline, maritime security and defense issues are simultaneous “A-List” concerns. The U.S. Defense Department will lead an interagency effort to forecast icy conditions by launching a satellite and improving analytic methods to forecast icy conditions. The Department of Commerce, will lead coordination on surveying and charting of U.S. Arctic waters to ease shipping and improve adaptation to climate change in coastal communities. In addition, the State Department will seek agreement with Canada on the Beaufort Sea maritime boundary, and the Department of Homeland Security will work on developing an international code for ships operating in polar waters.

The lack of significant icebreaking capability in the U.S. has long been a lament U.S. shipbuilding and maritime communities, while the Russian Federation has a substantial fleet of polar icebreakers, carrying out regular activities in the region including regular trips to the geographic North Pole. On the other hand, the U.S. has the USCGC Polar Star, a polar icebreaker that has exceeded its intended 30-year service life, and the USCGC Healy, which is considered a medium icebreaker. While it has less icebreaking capability that Polar Star, Healy has extensive scientific research assets. The most important of the USCG taskings of the 36 to emerge from the plan is the requirement to sustain the federal capability to conduct maritime operations in ice-impacted waters of the Arctic. In order to ensure that the U.S. maintains icebreaking and ice-strengthened ship capability with sufficient capacity to project a sovereign U.S. maritime presence, support U.S. interests in the polar regionsp and facilitate research that advances the fundamental understanding of the Arctic, the Department of Homeland Security and the Coast Guard are directed to develop a document by the end of 2014 that lists the capabilities needed to complete the tasking. More importantly, by the end of 2017, they are directed to develop long-term plans to sustain federal ability to physically access the Arctic with sufficient capability to support U.S. interests. To many this can mean only one course of action: the construction of several new, powerful polar icebreakers.

Meanwhile, the International Maritime Organization (IMO), which is the United Nations specialized agency with responsibility for the safety and security of shipping and the prevention of marine pollution by ships, is developing a draft mandatory International Code of safety for ships operating in polar waters (Polar Code), to cover the full range of design, construction, equipment, operational, training, search and rescue and environmental protection matters relevant to ships operating in the inhospitable waters surrounding the two poles.

Its first session was held in January 2014 where a subcommittee on the matter agreed in principle to the draft text of the mandatory International Code for ships operating in polar waters (Polar Code) and also agreed in principle to proposed draft amendments to IMO’s safety and pollution prevention treaties to make it mandatory.

The subcommittee agreed in principle to a draft new chapter XIV “Safety measures for ships operating in polar waters,” of the International Convention for the Safety of Life at Sea (SOLAS), to make the Code mandatory, for forwarding to the Maritime Safety Committee (MSC), which next meets in May 2014, for consideration.

Also, proposed draft amendments to the International Convention for the Prevention of Pollution from Ships (MARPOL), to make the Polar Code mandatory under Annexes I (prevention of pollution by oil), II (noxious liquid substances), IV (sewage) and V (garbage) were also agreed, in principle, for forwarding to the Marine Environment Protection Committee (MEPC), which was to meet in early spring 2014.

The draft chapter of the Polar Code relating to training and manning will be referred to the SubCommittee on Human Element Training and Watchkeeping (HTW), which met in February 2014, for further review, while the draft chapters on fire protection/safety and life-saving appliances will be referred to the SubCommittee on Ship Systems and Equipment (SSE), which met in March. The draft chapters on Safety of navigation and Communication will be referred to the SubCommittee on Navigation, Communication and Search and Rescue (NCSR) in June/July.

(As published in the April 2014 edition of Maritime Reporter & Engineering News - http://magazines.marinelink.com/Magazines/MaritimeReporter)

Read Arctic Energy Exploration Efforts Heat Up in Pdf, Flash or Html5 edition of April 2014 Maritime Reporter

Other stories from April 2014 issue

Content

- Offshore: Seacor Raises the Bar Again page: 13

- Offshore Service Vessels Design Innovation page: 14

- U.S. Coast Guard Doing Less with Less page: 18

- New Conept Under Test: Arctic Drillship page: 20

- If You Have DPS Questions ... OSVDPA Has Answers page: 22

- How to Work with Your Insurer When Experiencing a Loss page: 24

- Calculating Settlement Value of a Case page: 26

- Strategic Planning With Aggregate Data page: 30

- Is Internal Combustion Engine Methane Slip Harmful to the Environment? page: 32

- Floating Production Growth May Face Obstacles page: 38

- Arctic Energy Exploration Efforts Heat Up page: 44

- Saipem: A Fleet Grows in Brazil page: 50

- Inside Paraguay’s Oil Boom page: 54

- The History of Offshore Energy page: 56

- Offshore Energy Timeline:1806-2014 page: 56

- C-MAR's Modern Approach to DP Training in Brazil page: 64

- CNR: Innovation Maintains US Naval Advantages page: 66

- STEM: SeaPerch Underwater Robotic Championships page: 72

- Safety the Focus as Heavy Lifting Picks Up page: 78

- Cool Runnings: R.W. Fernstrum's Engineered Solutions page: 82

- Rosie the Riveter: WWII Women Shipyard Workers Visit the White House page: 88

- Modern Solutions Power Systems Conference page: 91

- ABS Approves Design for GTTNA’s LNG Bunker Barge page: 92

- Rolls-Royce Wins Heyerdahl Award page: 94

- Damen Opens JV Yard in Vietnam page: 95

- BASS Launches New Fleet Management System page: 96

- Shipboard Pipe-joining Techniques Examined page: 98

- Luxury Yachts: Design Takes a New Track page: 100

- New Air Regulator from TDI page: 103

- DNV GL ShipManager for Entire H&P Fleet page: 103

- FARO Debuts X Series Laser Scanner page: 103

- Jinglu Chooses AVEVA Design Software page: 103

- Macro Sensors Gauge Tank Volume Changes page: 103

- Special Coupling Solution for Offshore Drives page: 103

- Conquest Offshore Buys Star Software page: 103

- Eniram Launches New Optimization Product for LNG Sector page: 104

- COSCO Selects Rolls-Royce Package page: 104

- New Tests for Ballast Water Contamination page: 104

- SSI Debuts Updated ShipConstructor page: 104

- Wärtsilä’s Launches Inline Scrubber System page: 104

- New Transas Liquid Cargo Handling Simulator page: 104

- New Hull Structure Analysis Software page: 104

- GEA Westfalia Separator Launches New Control Generation page: 105

- Omega Debuts Compact RTD Temperature Sensors page: 105

- New Heavy Duty CNC Plasma System page: 105

- Wärtsilä Introduces 46DF Dual Fuel Engine page: 105

- WSS Achieves Better Onboard Air Quality page: 105

- Trojan Marinex BWT System Earns IMO Type Approval page: 106