Brazil is still attracting cruise lines, such as Norwegian Cruise Line, which is bringing a ship to Brazil for the first time in the 2016/2017 season. However, hard numbers do not bode well for the industry as the number of cruises dropped by more than half in four years, with a staggering 54 percent decrease in the number of regular cruise ships on the Brazilian coast. In 2012, the season had 15 regular ships, while this year there will be only seven, and the number of passengers boarding at Santos port will be 42 percent lower.

The 2010/2011 season of cruises hit the record for ships on the Brazilian coast: 20. Since then, this number has fallen year on year, and this season, which started on November 21, will be the worst since the 2004/2005 season, when only six cruise ships came to the country. In the face of the economic crisis, port infrastructure problems and the high cost associated with operating in Brazil, cruise lines end up directing their vessels to other more competitive countries. Of the ships Brazil lost from last season, two went to Cuba, the newest and much awaited destination for cruises, and one to China, a market that has grown considerably. However, even with these setbacks, optimism for the upcoming season still prevails among local operators and foreign cruise lines, but the sector understands the hurdles it faces in Brazilian waters. In addition to the high tax burden and port charges (about 40 percent more expensive than anywhere else in the world), one of the main complaints is the low quality of port infrastructure at destinations which would be attractive to cruise lines. As an example of the costs involved in cruise ship operations in Brazil, in the 2014/2015 season, the total economic movement (direct and indirect) totaled $641,054 million. Of this total, $339,049 million was generated by the expenses of companies with bunker fuel, port taxes and other taxes, purchases of supplies, commissioning of travel agencies and tour operators, water embarkation and garbage disposal, salaries paid, in addition to marketing and office expenses, among others. The total expenses of cruise ships and crew members in the cities and ports of embarkation/debarkation and transit were $302,101 million.

Fifteen ships that will pass through the Port of Santos passenger terminal (Concais). Of these, four cruises are regular, these being MSC Preziosa, MSC Musica, Costa Fascinosa, Costa Sovereign, CVC and another 11 ships will only transit, one more than the last two seasons. Concais will receive four transit ships for the first time: Norwegian Sun (NCL), Crystal Serenity, Amadea and Fram (Hurtigruten). In total, there will be 92 stops. Last season, the total number of ships in transit had already been higher than those on regular stopovers. During that period, there were 10 vessels in transit and seven regular vessels in Santos. This year, there will be 15 ships, 11 in transit and only four regular. The forecast is for 455,741 passengers to travel through the Maritime Passenger Terminal (between boarding, debarkation and transit) in Santos. However, there will be a 42 percent drop in the number of passengers that will board and debark at the Santos quay, when compared to the previous season. In the 2015/2016 season, there were 700,408 passengers. This season, the forecast is for 409,796 passengers to board and debark in Santos.

The vessels will sail through 13 destinations in Brazil, and 13 other locations in South American countries, including Argentina, Chile, Uruguay and Port Stanley (in the Falkland Islands, which is a British overseas possession). The itineraries will have a minimum duration of three nights and a maximum of 20 nights. Abremar (Brazilian Associations of Maritime Cruises) points out to the high costs charged by Brazilian ports as one of the reasons for this drop in the number of cruise ships in Brazil. The search for increased competitiveness for Brazil to attract more ship owners, is one of the fronts of the Association’s work. Abremar is debating with the Federal Government, the Legislative and Judiciary powers, and suppliers in the search for an environment with legal certainty, costs and taxes similar to those found in other cruise friendly countries. Italian cruise line MSC, one of the traditional players in the Brazilian cruise ship market has reduced its stake, from five ships last year, to only three ships this year. MSCs commercial manager in Brazil, Bruno Cordaro, says that this retraction was only “momentary,” as a new MSC expansion plan will add 11 new ships to the fleet next year. “Increasing the fleet, Brazil will certainly have more ships,” he says.

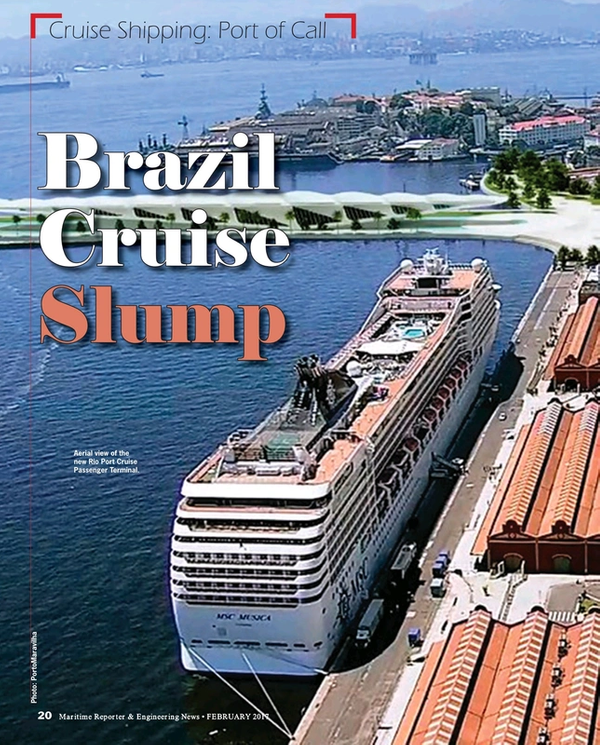

Cruise passenger terminals have also received various complaints from passengers, these complaints range from cleanliness to transportation problems, with some docks being so remote as to need buses to take guests from the ships to the terminal proper. The terminals in Santos and Rio de Janeiro are usually considered the best and the Rio terminal was very recently refitted for the Olympic Games, when a chartered cruise ship hosted the U.S. Olympic Basketball team and other VIP’s. As previous studies have shown, the Port of Santos continues to be the main port for boarding and debarking in Brazil, followed by Rio de Janeiro. Other important destinations were highlighted by ship owners as having high demand for cruises, these were locations such as Salvador (Bahia), Búzios (Rio de Janeiro) and Ilhabela (São Paulo). Destinations are benefited in different aspects by the cruise ships, with increase in the flow of tourists to the destination cities, which moves the local economy, generates jobs, and stimulates the entry of foreign capital. Cruise lines flagged the following factors as hindrances to growth in the sector, in order of importance: High operating costs (ports and pilotage), lack of adequate infrastructure at the ports (piers, bathymetry and others), tax burdens (labor, visas, trade unions, environmental taxes, etc.), bureaucracy, lack of new destinations, and an unfavorable economic and political moment.