Supply Chain Shocks: Ocean Shipping Challenges Abound

Supply chain issues tied to liner shipping have been front page news throughout 2021; just about everyone agrees that there’s a problem. The underlying cause is right out of Economics 101: a surge in demand for moving containerized cargo, in the face of “inelastic” throughput capacity (which includes vessels and their landside interfaces to surface transportation, trucks and rail) that could not handle the swell, attributable to re-stocking of containerized cargo as economic activity recovered from the pandemic induced jolts.

Gordon Downes, the Chief Executive Officer of New York Shipping Exchange (NYSHEX), told Maritime Reporter & Engineering News “Like most markets, the price of container shipping is determined by supply and demand. Container shipping has long been characterized by notoriously volatile prices primarily due to significant variations in demand, with supply being relatively stable. But the extreme volatility we have seen in the container market recently is completely unprecedented, and it is being driven by supply constraints coinciding with a surge in demand. This is a normal free-market response to external ‘shocks’…”

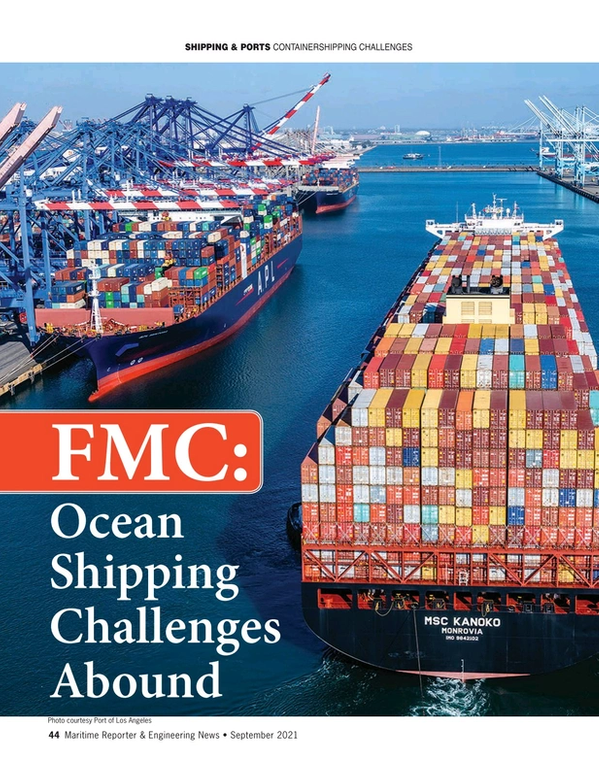

Gene Seroka, Executive Director at the Port of Los Angeles, a frequent and highly quotable spokesperson on the ongoing crunch, analogized the situation at his port in a mid-August press briefing as: “…squeezing 10 lanes of freeway traffic into five lanes.”

At the time of Mr. Seroka’s remarks, dwell times for boxes at the port (in warehouses, or on trucks or at rail sidings) were increasing, and the numbers of vessels anchored and waiting for berths in the port were climbing towards levels not seen since late winter. In late Spring and early Summer, 2021, port officials at Los Angeles and at neighboring Long Beach had been touting reduced waiting times at anchorage, and for boxes on the landside. By later Summer, disruptions at Asian ports- notably Yantian and Ningbo, and the seasonal volume build, had reversed these improvements.

Congestion on the West Coast has motivated cargo interests to shift their Asian-origin imports to the East Coast. John McCown, a long-time container industry executive (who once worked alongside the legendary Malcom McLean), noted in his August 2021 edition of the McCown Container Report, that “Inbound volume growth rates have peaked … July saw a dichotomy between the West Coast [up 3.9% year on year] and East/Gulf Coast port ranges [up 27.7% … I suspect that routing choices by shippers are the key driver in recent East/Gulf Coast over performance.”

After noting the disparaging reports of West Coast congestion, he said that: “These decisions are made easier by the fact that linehaul transportation costs of moving containers to most eastern points are irrefutably lower with all or more water vessel service to the East Coast compared to rail intermodal service via the West Coast.” These observations are borne out by a look at the maps on MarineTraffic.com and similar online platforms; in late August, more than a dozen liners were waiting outside Savannah, Georgia.

“Data is always important and there are still many further efficiencies to be gained in coming up with even better digital twins of the still too paper intensive worldwide container system. That being said, that system is moving 1.2 trillion TEU-miles of freight annually and that requires hard assets. The actual heavy lifting can't be done on the internet.” John McCown, Shipping executive, author of "Giants of the Sea"

“Data is always important and there are still many further efficiencies to be gained in coming up with even better digital twins of the still too paper intensive worldwide container system. That being said, that system is moving 1.2 trillion TEU-miles of freight annually and that requires hard assets. The actual heavy lifting can't be done on the internet.” John McCown, Shipping executive, author of "Giants of the Sea"

The Politicians Get Involved

Though cargo interests and carriers have created “hands on” fixes to difficulties in moving goods, for example Home Depot and Walmart chartering vessels, or CMA-CGM running freighters in the skies, the search for solutions has attracted the attention of politicians, and has devolved into finger-pointing, as well.

The cargo interests and carriers staked out their opposing positions in early August. Responding to the concerns of U.S. exporters in the agricultural trades who had experienced difficulties in securing container capacity during the ongoing supply chain disruptions, Republican Congressman Dusty Johnson (South Dakota) and Democrat John Garamendi (California) introduced the Ocean Shipping Reform Act of 2021 (OSRA 2021), into the House of Representatives. On a call just prior to the bill’s introduction, Garamendi explained the bill’s main objectives; these include minimum requirements for service contracts and anti-retaliation provisions in the event of complaints by a cargo shipper.The bill would beef up the enforcement powers of the Federal Maritime Commission (FMC) to initiate investigations into demurrage and detention issues (frequent subjects of complaints from shippers) but also anti-competitive practices. Paradoxically, the successes of the carriers in managing capacity as demand plummeted during Spring, 2020, have put them in the regulatory cross-hairs. Through the ability to cancel scheduled sailings (known as “blanking”) and slow steaming, the lines were able to maintain their pricing and avoid the historical racing to the bottom in efforts to fill up ships. In explaining the rationale for OSRA 2021, Congressman Johnson (who was involved in regulation of utilities prior to serving in Congress) was quick to point to the increased market concentration in the liner business, with the top 10 carriers controlling more than 80% of capacity.

As drafts of the OSRA 2021 legislation were being circulated in early August, the Washington, D.C. based World Shipping Council (WSC), providing a voice on Capitol Hill for the top international liner carriers serving the United States, quickly responded. In its brief, WSC offered three major objections to OSRA 2021; refuting the inference that “… ocean carriers are solely responsible for the current supply chain congestion”, disputing the suggestion “ that existing legislation is infused with fundamental unfairness”, and asserting that “ the bill ignores the fact that all supply chain participants are working collaboratively to find solutions to today’s problems.” It went on to stress that: “Supply chain participants including ports, carriers, labor, marine terminal operators, rail, truckers, chassis providers and shippers are collaboratively working to find operational solutions to increase efficiency and cargo velocity.”

Containerized cargo was already on the radar in Washington, D.C. even prior to the introduction of OSRA 2021. The Biden administration had included liner shipping in an early July Executive Order (EO) titled “Promoting Competition in the American Economy”, imploring the FMC to take a hard look at the ongoing sources of complaints from the cargo side. The FMC was also encouraged to work closely with the Department of Justice (DOJ) in reviewing potential antitrust issues. Around the same time, President Joe Biden launched a Supply Chain Task Force (the result of a review initiated a month after his inauguration) headed up by the Secretaries of Commerce, Transportation, and Agriculture. While shipping is not mentioned specifically, the White House states that: “The U.S. government must implement a comprehensive strategy to push back on unfair foreign competition that erodes the resilience of U.S. critical supply chains and industries.”

OSRA 2021 was driven by difficulties in securing “empties” for export cargo back to Asia, seemingly one aspect of a far broader set of issues, albeit a great source of inefficiencies. Indeed, Los Angeles’s Gene Seroka, in his recent remarks, noted that: “Our largest export commodity continues to be air as we reposition empty containers back to Asia.” While there have been loud complaints from the cargo side, the carriers also face uncertainties in planning for future loads as cargo customers adjust their programs. Gordon Downes, from NYSHEX, tells Maritime Reporter: “What carriers and shippers really need is the ability to make enforceable contracts, where both parties are committed to the terms of the contract. Of course, carriers and shippers should always have a choice, either to lock in a price and service level to “hedge” against the volatility, or to ‘ride’ the market. NYSHEX provides a digital mechanism that enables carriers and shippers to lock in through 2-way committed contracts that are always fair to both parties.”

All of the dialogue has occurred at a time of bigger vessels. In discussing broad solutions to the supply chain crises, John McCown stressed that the vessels themselves, which now top out around 24,000 TEU with recent newbuilds (such as HMM’s HMM Algeciras, Evergreen’s Ever Ace, MSC’s Gülsün class vessels and the 23,000 TEU LNG-fueled vessels being deployed by CMA-CGM) “… deliver extraordinary efficiencies and can access many ports directly…” (unlike the dinosaur-like ULCCs which failed in the tanker trades). McCown, author of the book Giants of the Sea, told Maritime Reporter, “Recent events demonstrate that bottlenecks have occurred … but these efficient vessels are not the problem and our gaze should be focused elsewhere.” Commenting on regulatory issues, including OSRA 2021, he said: “Shipping is a cyclical business and things should be looked at in terms of impact over the entire cycle. While any abuses need to be checked, circumspection is in order for changes directed at temporary issues that the market will correct.”

Containership assist docking at Port of Los Angeles. Photo courtesy Port of Los Angeles

Containership assist docking at Port of Los Angeles. Photo courtesy Port of Los Angeles

Punch and counterpunch

In the week just prior to the introduction of OSRA 2021, the carriers and shippers were already jousting. Shortly after a late July announcement from the FMC that it would be examining the actions of nine large carriers serving U.S. markets concerning detention and demurrage charges, a Pennsylvania- based furniture importer filed a complaint with the agency claiming market manipulation by two carriers (MSC and Cosco), seeking some $600,000 in damages. At issue was the furniture shipper’s inability to source freight under service contracts it had signed with the carrier. After the complaint was revealed in early August, MSC fired back, expressing “shock” at the accusations on allocating space under contracts, as well as further accusations of collusion among the liner carriers (with the complaint referencing the policy of blanking sailings during the tough days in Spring, 2020).

Readers can decide for themselves:

https://www2.fmc.gov/readingroom/proceeding/21-05/

(first document is the actual complaint)

https://www.msc.com/bwa/press/press-releases/2021-august/mcs-industries-shipper-complaint

Technology on the Horizon

Technologies are a handmaiden of logistics- in recent years, as digitalization has impacted both the operational side of shipping but also the commercial side: booking freight, handling payments and documentation. Importantly, the largest ports have recognized the need to handle information, as well as cargo. Rotterdam, with 14.8 million TEU throughput in 2019, has been at the forefront of efforts to bring artificial intelligence to the management of port operations. Los Angeles- on track to move a record nearly 11 million TEU in 2021, has announced that it will be sharing data from its Port Optimizer data management platform with the FMC, as the agency looks at removing supply chain bottlenecks. The port’s Executive Director, Gene Seroka, has long championed the idea of a nationwide port information system. Across San Pedro Bay, the Long Beach Container Terminal (a one time OOCL facility) has now been completed after a multi-year construction project. With low emission electric equipment, the partially automated facility has been described as “… a state-of-the-art terminal, one of the wonders of the maritime industry,” according to Mario Cordero, the port’s Executive Director- who served as Chairman of the FMC during 2013 to 2017.

NYSHEX’s Gordon Downes noted that: “There are many examples where technology can improve efficiencies and help both carriers and shippers perform better. One example is where both shippers and carriers leverage technology and data to more accurately forecast future supply and future demand, then it is possible for carriers adjust their service networks to better meet the demand, and potentially for shippers to adjust their supply chains to avoid bottle necks and constraints etc. At NYSHEX we are developing technology that helps our shipper and carrier members to better anticipate changes in future supply and demand.”

John McCown reminded Maritime Reporter about the nuts and bolts of moving cargo, saying: “Data is always important and there are still many further efficiencies to be gained in coming up with even better digital twins of the still too paper intensive worldwide container system. That being said, that system is moving 1.2 trillion TEU-miles of freight annually and that requires hard assets. The actual heavy lifting can’t be done on the internet.”

Carrier and tonnage provider stocks

Through share purchases in listed carriers, or tonnage providers (shipowners who charter their vessels to the carriers), investors who climbed aboard in late 2020, and into early 2021, have been able to reap large gains as these shares out-paced the broader market. Stocks that U.S. investors can trade include: ZIM (“ZIM”, carrier), Danaos (“DAC”, tonnage provider), Atlas Corporation (“ATCO”, parent of tonnage provider Seaspan Corp.) and Costamare (“CMRE”, tonnage provider). In a mid August research report covering ZIM, Jefferies and Co. shipping equities analyst Randy Giveans wrote: “Container freight rates and containership charter rates have climbed higher throughout the year as demand for containerized goods, especially in the US and Europe, remains robust, availability of spot vessels remains constrained, and persistent congestion is removing effective supply from the market. The Shanghai Containerized Freight Index is up over 50% year to date to an all-time high of $4,282/TEU last week ... We expect rates to remain very robust through 2021 and well into 2022.” In an early August report on DAC, Mr. Giveans highlighted the dynamic of carriers chartering in vessels from tonnage providers, saying: “… charterers are currently booking vessels further in advance and for longer durations of 3-4 years.” John McCown, in his report estimates that in Q1 2021, the carriers earned a record setting aggregate $19.1 billion, a mark likely to be exceeded once all the Q2 results are available.

Read Supply Chain Shocks: Ocean Shipping Challenges Abound in Pdf, Flash or Html5 edition of September 2021 Maritime Reporter

Other stories from September 2021 issue

Content

- A BC Ferries Case Study: Lessons Learned in Setting Underwater Radiated Noise Targets page: 22

- Marine Design: Multi-Physics Simulation (MPS) & Decarbonization Walk Hand-in-Hand page: 26

- PROFILE: Glosten is Meeting the Decarbonization Challenge, by Design page: 36

- Supply Chain Shocks: Ocean Shipping Challenges Abound page: 44

- Marine Biofouling in Ports: Wet Docks Acting as ‘Hot Spot’ Biofouling Transfer Stations page: 50