Page 17: of Offshore Engineer Magazine (Mar/Apr 2014)

Read this page in Pdf, Flash or Html5 edition of Mar/Apr 2014 Offshore Engineer Magazine

Analysis

Improving UK North Sea production through targeted maintenance

Targeted maintenance could boost

UK North Sea production by 10%, equating to US$18 billion in annual revenue, suggests Alan D’Ambrogio,

ABB Consulting’s vice president, oil and gas. reports. Meg Chesshyre Fig. 1: UKCS oil and gas n 2013, the industry cautious and conservative production decline invested £13.5 billion approach to the operations 4.5

I (US$22.4 billion) in the and maintenance of the assets.

UK Continental Shelf (UKCS) Most notably, the Deepwater 4 4 -8.7% -8.7% facilities. This ? gure is Horizon disaster saw BP 3.5 -10.1% -10.1% unprecedented, even during spend $42 billion.

3 -4.6% -5.1% -4.6% -5.1% • There has been unprece- the boom years of the 1970s. dented expenditure on asset

Majors ConocoPhillips (the -9.6% -9.6% -9.6% 2.5 integrity and interventions

Jasmine project), BP (Clair -6.5% -6.5% -6.5% -9.4% -9.4% 2 over the last ? ve years. It is and Sullom Voe), Total -14.5% -14.5% estimated that US$1.7 bil- (Laggan-Tormore), Statoil 1.5 -19.2% -19.2% lion was spent in 2012 and (Mariner) are some of the 1 2013 on asset integrity. This companies pumping big 0.5 spending requires downtime money into their projects.

Oil and gas production (million boe/d) in assets to be implemented,

With such a staggering 0 which impacted 2013 level of investment, compa- 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013* performance.

nies expect stellar production

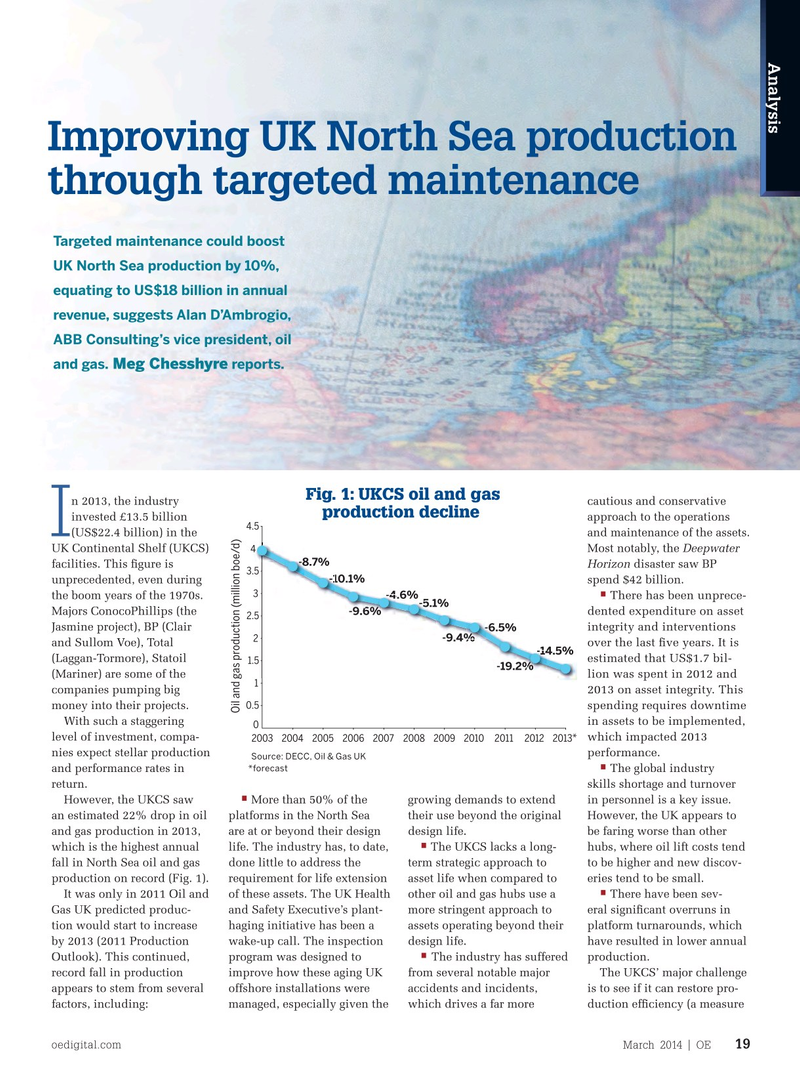

Source: DECC, Oil & Gas UK *forecast • and performance rates in The global industry return. skills shortage and turnover • More than 50% of the However, the UKCS saw growing demands to extend in personnel is a key issue. platforms in the North Sea an estimated 22% drop in oil their use beyond the original However, the UK appears to are at or beyond their design and gas production in 2013, design life. be faring worse than other • life. The industry has, to date, which is the highest annual The UKCS lacks a long- hubs, where oil lift costs tend done little to address the fall in North Sea oil and gas term strategic approach to to be higher and new discov- requirement for life extension production on record (Fig. 1). asset life when compared to eries tend to be small.

• of these assets. The UK Health It was only in 2011 Oil and other oil and gas hubs use a There have been sev- and Safety Executive’s plant- Gas UK predicted produc- more stringent approach to eral signi? cant overruns in haging initiative has been a tion would start to increase assets operating beyond their platform turnarounds, which wake-up call. The inspection by 2013 (2011 Production design life. have resulted in lower annual • program was designed to Outlook). This continued, The industry has suffered production.

improve how these aging UK record fall in production from several notable major The UKCS’ major challenge offshore installations were appears to stem from several accidents and incidents, is to see if it can restore pro- managed, especially given the factors, including: which drives a far more duction ef? ciency (a measure oedigital.com March 2014 | OE 19 000_OE0314_ Analysis.indd 19 2/21/14 6:18 PM

16

16

18

18