Page 30: of Offshore Engineer Magazine (Apr/May 2014)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2014 Offshore Engineer Magazine

Rig Market Review

Drilling rig market set to change

Market drivers point to a capability, but over all, these units are these units will continue to grow, with averaging approximately $90,000/day. steady ordering at a somewhat lesser slowdown in new project activity,

At present, the Middle East has the most level than currently seen for the remain-

Ian Simpson and James Graf rigs working offshore, followed by the der of the decade.

Asia-Paci? c region and Europe. And while Drilling contractors are well aware of of ABS report.

the distribution of working rigs is likely to the bifurcation of the market. Asset owners hanges in the drilling rig market remain more or less the same, the number realize that to maintain a healthy balance are indicators of industry ups of rigs working most likely will not. between utilization and day rates, they

C and downs. A look at today’s The utilization numbers are high, but it will have to scrap or ? nd alternative uses numbers indicates that the most recent is worth noting that they have all dropped (other than drilling) for at least 200 of the upswing is about to change direction. slightly from January, when 91% of the aging units in the ? eet as higher-spec new-

There is fairly good agreement among drillships, 87% of the jackups, and 90% builds come in and displace older units.

the organizations that track drilling of the semis were on contract.

Drillships rig day rates and utilization numbers. Because ABS classes jackups, semisub-

Rigzone’s RigLogix numbers provide a mersibles, and drillships, the organization The drillship ? eet has grown from less snapshot of the market, offering a good follows activity in these sectors closely. than 40 units in 2005 to more than 100 starting point from which to begin drill- Globally, 84% of jackups, 57% of semis, units at the beginning of 2014. The pro- ing rig sector analysis. and 55% of drillships are ABS classed. ? le of the ? eet is young, with approxi-

In February 2014, Rigzone reported mately 75% of the vessels less than 15

Jackups drillship utilization at 86.7%, with 85 of years old. A further 76 or so units are on 98 vessels working. Jackups were at 85% The jackup market currently stands at order, and steady ordering is expected for utilization, with 367 of 431 on contract. around 530 units. There are 120 addi- the remainder of the decade. A ? eet of

And the semisubmersible sector was tional units contacted or under negotia- 200 units would appear to be sustainable even higher, with 89% of the units – 168 tion, not including options. About 470 with some removals from the older end of 189 – on contract. units make up the operational ? eet, but of the ? eet. Drillships will continue to be

While day rates have ? uctuated nearly 300 of these units are more than the asset of choice for extending industry somewhat, they have remained relatively 30 years old. Some have passed middle frontiers – deeper targets in deeper water strong. Drillships capable of working age, with 45 years or more under their and further from logistic base support. in more than 4000ft water depth are belts since originally being delivered.

Semisubmersibles averaging US$500,000/day, while high- Worldwide demand appears to be

Drillships 80.6% (79/98)

The semisubmersible ? eet of around 240 spec semis are bringing in more than somewhere between 450 and 480 units.

Jackups 79.8% (343/430) units is one where 65% of the rigs are more $400,000/day. Jackups vary broadly, of Not surprisingly, the preference is toward

Semisubmersibles 84.1% (159/189)

Source: RigLogix, www.Rigzone.com than 20 years old. But unlike the drillship course, based on water depth and drilling higher-spec units; so the demand for

MODU order book levels

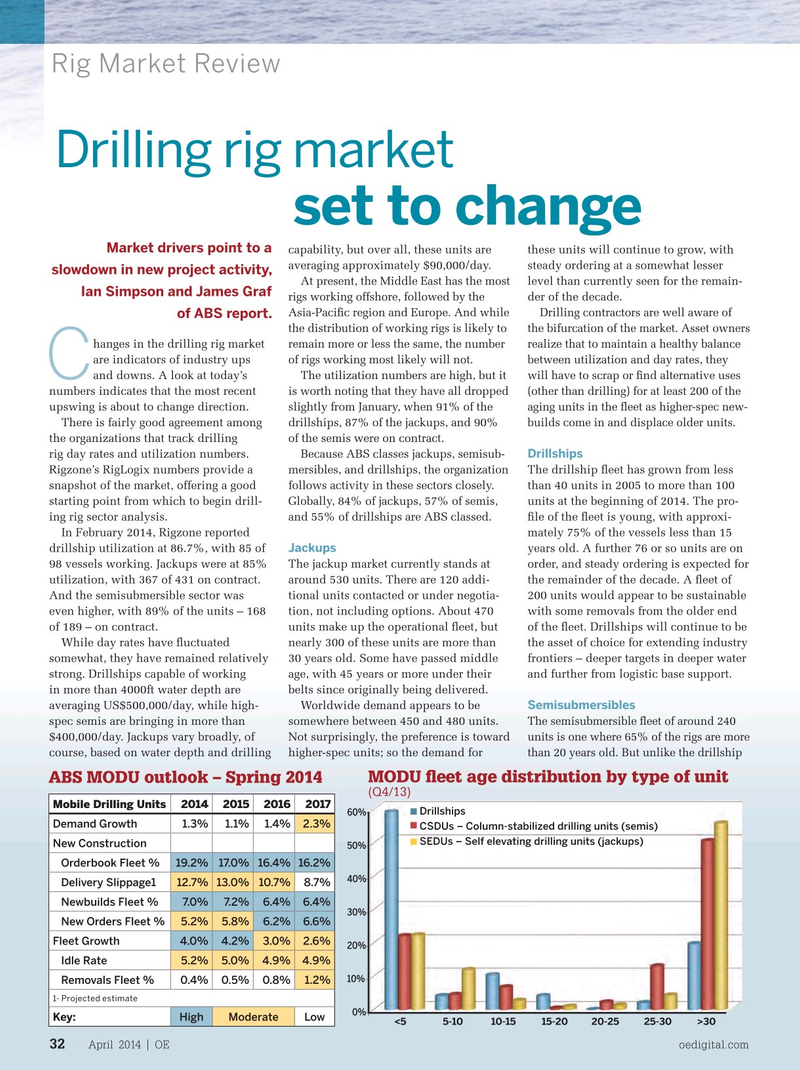

ABS MODU outlook – Spring 2014 MODU ? eet age distribution by type of unit 120 (Q4/13)

Drillships

Mobile Drilling Units20142015 2016 2017

CSDUs – Column-stabilized drilling units (semis)

Drillships 60% 100

Demand Growth1.3%1.1% 1.4% 2.3%

CSDUs – Column-stabilized drilling units (semis)

SEDUs – Self elevating drilling units (jackups)

SEDUs – Self elevating drilling units (jackups)

New Construction 50% 80 Orderbook Fleet %19.2% 17.0% 16.4%16.2% 60 40% Delivery Slippage112.7% 13.0%10.7%8.7% Newbuilds Fleet % 7.0% 7.2% 6.4%6.4% 40 30% New Orders Fleet %5.2% 5.8% 6.2% 6.6% 20

Fleet Growth 4.0% 4.2% 3.0% 2.6% 20% Idle Rate 5.2% 5.0% 4.9%4.9% 0 10% Removals Fleet % 0.4% 0.5% 0.8% 1.2%

Q2/2011

Q4/2011

Q2/2012

Q4/2012

Q2/2010

Q4/2010

Q2/2013

Q4/2013

Q2/2007

Q4/2007

Q2/2005

Q4/2005

Q2/2008

Q2/2006

Q2/2009

Q4/2008

Q4/2004

Q4/2006

Q4/2009 1- Projected estimate 0%

Key: HighModerate Low <55-1010-1515-2020-2525-30>30

April 2014 | OE oedigital.com 32 000_OE0414_Rigmarket1_ABS.indd 32 3/23/14 12:41 AM

29

29

31

31