Page 31: of Offshore Engineer Magazine (Apr/May 2014)

Read this page in Pdf, Flash or Html5 edition of Apr/May 2014 Offshore Engineer Magazine

and jackup sectors, the semi sector has soften. Rig supply is somewhat outpacing outpace new orders, leveling off at about not seen a sustained newbuilding program demand. And the large number of drill- the same level seen by the industry in over the last 10 years. Today, there are only ing rigs due to come out of the yard by mid-2011. High-speci? cation jackups will about 25 newbuilds under way, and the the end of this year is compounding that make up the lion’s share of exploration majority of those are being built speci? - problem. A slowdown in the market is unit activity. cally to work offshore Brazil and Norway.

shaping up, and with stagnant oil prices, The correction in the market is likely to

There certainly still is a place for it could last a few years. take a year or more, but the industry will

Drilling rig market semisubmersibles, but the newbuilds will

ABS has framed its forecast based on emerge on the other side of the decline be constructed for focused mission type macro industry demand drivers, and with a much more capable drilling ? eet to operations, where they can compete with using a supply vs. demand approach to meet the more demanding operating envi-

The drillships. Fleet replacement will happen, project future supply needs. Oil price ronments that operators are targeting. set to change upgraded ? eet will be much better placed and the semi will reinvent itself to compete and oil demand are closely correlated these units will continue to grow, with to offshore industry activity on a longer to meet their exploration needs. in a bifurcated ? oater market. steady ordering at a somewhat lesser term trend basis, and consequently rep-

Forecast is the level than currently seen for the remain- resent a primary base demand indicator Ian Simpson

Director of Offshore der of the decade. Over all, the market appears to be taking used for longer-term activity projections.

Drilling contractors are well aware of Technology and a breather from the surge the past few Barring any major geopolitical event or the bifurcation of the market. Asset owners Business Development years. There are 31 drillships and semi- natural disaster, oil prices should remain realize that to maintain a healthy balance for ABS Americas. He submersibles slated to leave the yards by relatively ? at for the next few years; in between utilization and day rates, they is responsible for year-end, and nearly half are not con- part dampened by weak oil demand will have to scrap or ? nd alternative uses coordinating survey, tracted. Demand has begun to drop off, growth, the growing shale oil contribu- (other than drilling) for at least 200 of the engineering and R&D in part as a result of a number of interna- tion, and the growing demand for natural aging units in the ? eet as higher-spec new- efforts to meet offshore industry clients tional operating companies cutting back gas. Oil demand is projected to grow at builds come in and displace older units. needs. Ian has over 40 years of offshore on their exploration programs. only a modest 1-2% per year over the

Those watching the international mar- next four years. As a result of a series experience covering marine and drilling

Drillships ket began to recognize toward the middle of factors – which includes dampened operations, technical and regulatory

The drillship ? eet has grown from less of 2013 that the market was beginning to demand, stagnant oil prices, recent large support and new construction projects and than 40 units in 2005 to more than 100 in? ow of new supply, large current order- existing unit maintenance and repair.

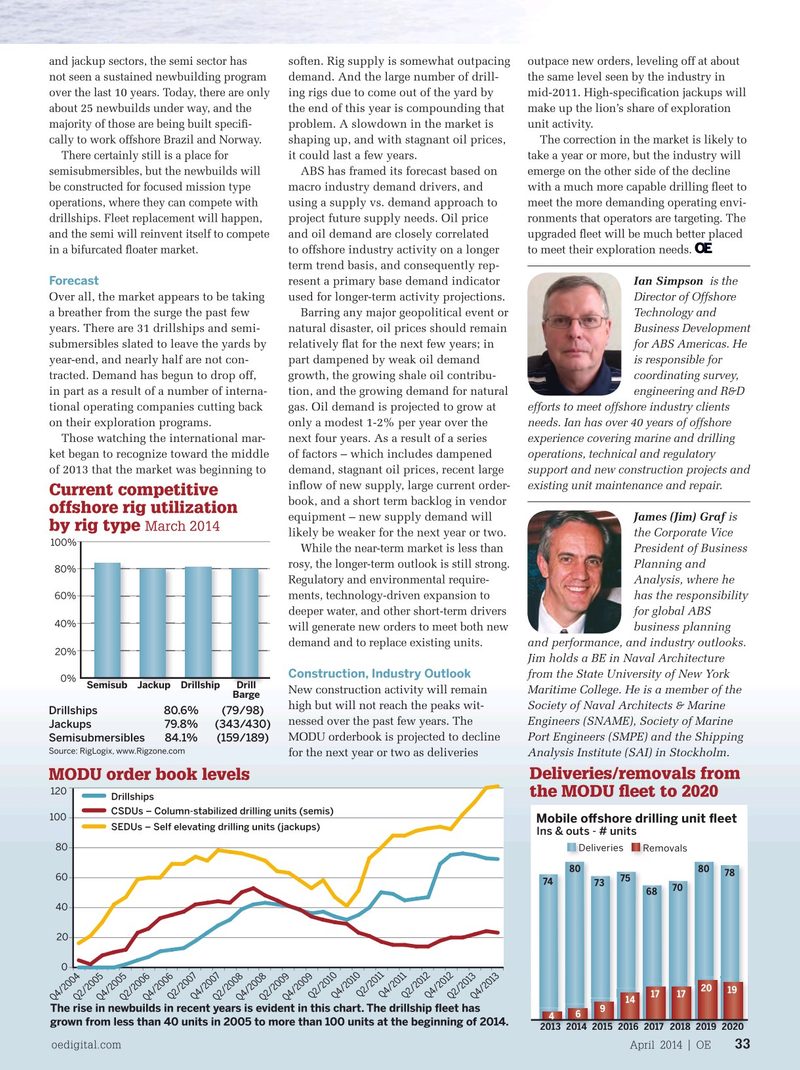

Current competitive units at the beginning of 2014. The pro- book, and a short term backlog in vendor offshore rig utilization

James (Jim ? le of the ? eet is young, with approxi- equipment – new supply demand will ) Graf is by rig type

March 2014 mately 75% of the vessels less than 15 likely be weaker for the next year or two. the Corporate Vice 100%

While the near-term market is less than years old. A further 76 or so units are on President of Business rosy, the longer-term outlook is still strong. order, and steady ordering is expected for Planning and 80%

Regulatory and environmental require- the remainder of the decade. A ? eet of Analysis, where he 60% ments, technology-driven expansion to 200 units would appear to be sustainable has the responsibility deeper water, and other short-term drivers with some removals from the older end for global ABS 40% will generate new orders to meet both new of the ? eet. Drillships will continue to be business planning demand and to replace existing units.

the asset of choice for extending industry and performance, and industry outlooks. 20% frontiers – deeper targets in deeper water Jim holds a BE in Naval Architecture

Construction, Industry Outlook and further from logistic base support. from the State University of New York 0%

SemisubJackupDrillshipDrill

New construction activity will remain Maritime College. He is a member of the

Barge

Semisubmersibles high but will not reach the peaks wit- Society of Naval Architects & Marine

Drillships 80.6% (79/98)

The semisubmersible ? eet of around 240 nessed over the past few years. The Engineers (SNAME), Society of Marine

Jackups 79.8% (343/430) units is one where 65% of the rigs are more

MODU orderbook is projected to decline Port Engineers (SMPE) and the Shipping

Semisubmersibles 84.1% (159/189)

Source: RigLogix, www.Rigzone.com than 20 years old. But unlike the drillship for the next year or two as deliveries Analysis Institute (SAI) in Stockholm.

MODU order book levels Deliveries/removals from 120 the MODU ? eet to 2020

Drillships

CSDUs – Column-stabilized drilling units (semis) 100

Mobile o

30

30

32

32