Page 30: of Offshore Engineer Magazine (May/Jun 2020)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2020 Offshore Engineer Magazine

FEATURE WELL INTERVENTION

The Well Intervention Market:

An Overview

By Catherine MacFarlane, Subsea Analyst, Energy, IHS Markit he well intervention market is a niche one, with only Newbuild semi well intervention unit Etesco Interventor a few main players – including Helix/Well Ops, Is- is also still yet to be delivered from the Dalian yard, China, land Offshore, AKOFS Offshore, and Siem Offshore after Petrobras and Etesco reached an agreement to cancel the

T – and only three key geographical regions; Northwest charter of the unit in 2017, bringing the total potential feet

Europe, South America, and the US Gulf of Mexico. size to 22 vessels, if there are no retirements.

Unsurprisingly then, the feet operates in regions with high In recent years, the LWI feet, like so many other segments, numbers of installed subsea wells, particularly those with ag- has struggled with the downturn in oil and gas. ing installations. There are few long-term contracts available in this market,

Regions seen with potential developing well intervention with only Petrobras and Equinor offering the security of a markets include West Africa and Australia. long-term charter. Hence, the market is reliant upon securing

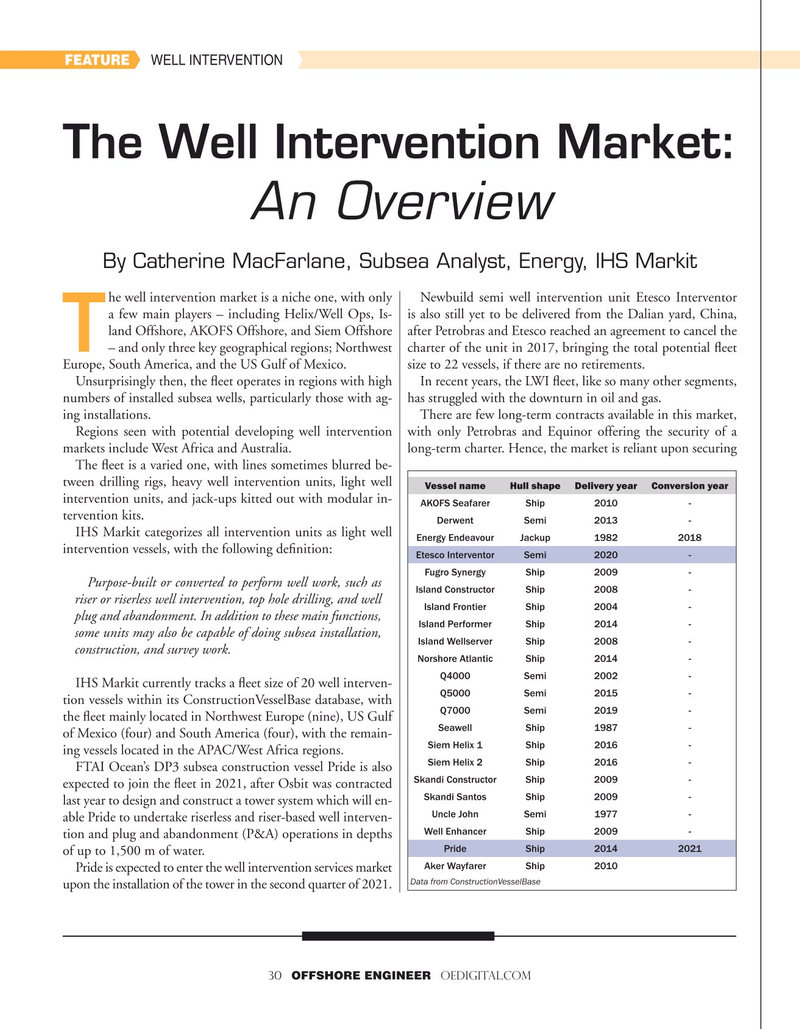

The feet is a varied one, with lines sometimes blurred be- tween drilling rigs, heavy well intervention units, light well

Vessel name Hull shape Delivery year Conversion year intervention units, and jack-ups kitted out with modular in-

AKOFS Seafarer Ship 2010 - tervention kits.

Derwent Semi 2013 -

IHS Markit categorizes all intervention units as light well

Energy Endeavour Jackup 1982 2018 intervention vessels, with the following defnition:

Etesco Interventor Semi 2020 -

Fugro Synergy Ship 2009 -

Purpose-built or converted to perform well work, such as

Island Constructor Ship 2008 - riser or riserless well intervention, top hole drilling, and well

Island Frontier Ship 2004 - plug and abandonment. In addition to these main functions,

Island Performer Ship 2014 - some units may also be capable of doing subsea installation,

Island Wellserver Ship 2008 - construction, and survey work.

Norshore Atlantic Ship 2014 -

Q4000 Semi 2002 -

IHS Markit currently tracks a feet size of 20 well interven-

Q5000 Semi 2015 - tion vessels within its ConstructionVesselBase database, with

Q7000 Semi 2019 - the feet mainly located in Northwest Europe (nine), US Gulf

Seawell Ship 1987 - of Mexico (four) and South America (four), with the remain-

Siem Helix 1 Ship 2016 - ing vessels located in the APAC/West Africa regions.

Siem Helix 2 Ship 2016 -

FTAI Ocean’s DP3 subsea construction vessel Pride is also

Skandi Constructor Ship 2009 - expected to join the feet in 2021, after Osbit was contracted

Skandi Santos Ship 2009 - last year to design and construct a tower system which will en-

Uncle John Semi 1977 - able Pride to undertake riserless and riser-based well interven-

Well Enhancer Ship 2009 - tion and plug and abandonment (P&A) operations in depths

Pride Ship 2014 2021 of up to 1,500 m of water.

Aker Wayfarer Ship 2010

Pride is expected to enter the well intervention services market Data from ConstructionVesselBase upon the installation of the tower in the second quarter of 2021. 30 OFFSHORE ENGINEER OEDIGITAL.COM

29

29

31

31