Page 31: of Offshore Engineer Magazine (May/Jun 2020)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2020 Offshore Engineer Magazine

THERE ARE FEW LONG-TERM CONTRACTS AVAILABLE IN THIS

MARKET, WITH ONLY PETROBRAS AND EQUINOR OFFERING

THE SECURITY OF A LONG-TERM CHARTER. HENCE, THE MARKET

IS RELIANT UPON SECURING SEASONAL SHORTER-TERM WORK

AND TENDS TO BE ONE OF THE FIRST TO BE AFFECTED IN TERMS

OF RATES AND UTILIZATION. DATA SHOWS THAT ONLY SIX LWI

VESSELS ARE ON OR ABOUT TO START LONG-TERM CONTRACTS.

seasonal shorter-term work and tends to be one of the frst to new entrants, with only a limited market, clients, and regions, be affected in terms of rates and utilization. Data from Con- and there have been casualties along the way. The aforemen- structionVesselBase shows that only six LWI vessels are on or tioned Etesco Interventor remains at the Dalian yard. At the about to start long-term contracts. same time, the PaxOcean yard also ended up with newbuild semisubmersible Derwent in 2014, following the termination • AKOFS Seafarer/Equinor about to start of a shipbuilding contract with Hallin Marine. To date, the • Siem Helix 1/Petrobras vessel is yet to fnd a buyer, or work. Meanwhile, the Skandi • Siem Helix 2/Petrobras Constructor, which started out life as Marine Subsea’s Sarah, • Skandi Santos/Petrobras and is now owned by DOF Subsea, has spent most of its re- • Island Wellserver/Equinor cent working life as a walk-to-work vessel in the wind market, • Aker W ayfarer/Petrobras despite still being equipped with a tower on board.

Helix’s semisubmersible Q7000, originally scheduled for

While some of the ship-shaped units are able to compete in delivery in 2017, was fnally delivered from the yard in No- the subsea construction or diving market during lean times, vember 2019, after securing its frst scope of work in Nigeria, some of the larger semisubmersible units are too niche to fnd West Africa, which it started in January 2020. 3 employment elsewhere. The semisubmersible units also face However, the unit is now another maritime victim of Co- stiff competition from a struggling rigs market. Prior to the vid-19 and (at the time of writing) was warm stacked while

Covid-19 pandemic, 2020 fnally promised some very mod- discussions with clients about future work for later this year est rate increases and a stabilizing market, after a protracted remain ongoing.

recovery period. The outlook for the LWI vessel market will mainly rest on

The LWI market has been a notoriously diffcult market for the oil price and the subsequent decisions made by operators.

Unlike subsea construction vessels, there are few other mar- kets for these vessels to seek refuge in, and the semisubmers-

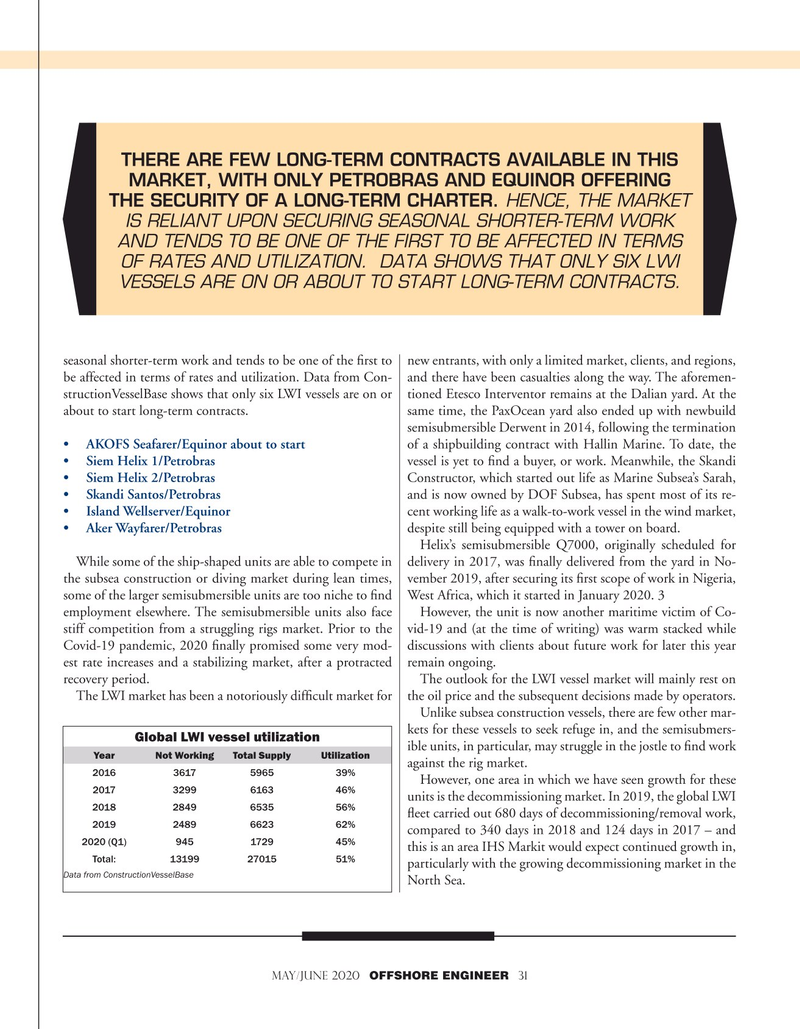

Global LWI vessel utilization ible units, in particular, may struggle in the jostle to fnd work

Year Not Working Total Supply Utilization against the rig market. 2016 3617 5965 39%

However, one area in which we have seen growth for these 2017 3299 6163 46% units is the decommissioning market. In 2019, the global LWI 2018 2849 6535 56% feet carried out 680 days of decommissioning/removal work, 2019 2489 6623 62% compared to 340 days in 2018 and 124 days in 2017 – and 2020 (Q1) 945 1729 45% this is an area IHS Markit would expect continued growth in,

Total: 13199 27015 51% particularly with the growing decommissioning market in the

Data from ConstructionVesselBase

North Sea.

MAY/JUNE 2020 OFFSHORE ENGINEER 31

30

30

32

32