Page 12: of Offshore Engineer Magazine (May/Jun 2025)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2025 Offshore Engineer Magazine

MARKETS RIGS

The GSP Deep Driller (cold-stacked for 2,669 days) is es between $4 - 6 million for a sixth generation interna- being marketed by Vantage Drilling for a specifc oppor- tional semi-sub, this highlights the narrow economic gap tunity under a MoU signed with GSP, but its extended between reactivation potential and retirement, especially stacking time still marks it as a recycling candidate. Noble’s for stranded rigs.

1976-built Ocean Apex, even though currently drilling,

Demand & Utilization: could still be a potential retirement case as the company

A Clear Shif Towards Drillships continues to optimize its feet following the Diamond Off- shore acquisition. Demand trends clearly refect a steady operator prefer-

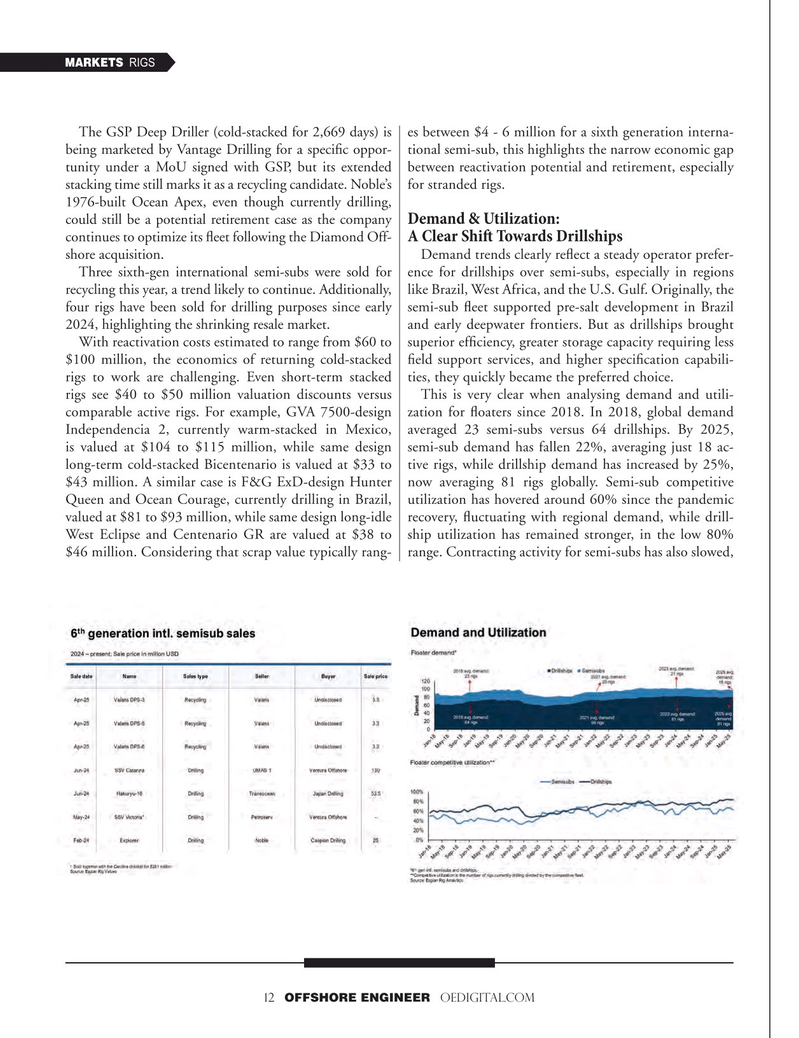

Three sixth-gen international semi-subs were sold for ence for drillships over semi-subs, especially in regions recycling this year, a trend likely to continue. Additionally, like Brazil, West Africa, and the U.S. Gulf. Originally, the four rigs have been sold for drilling purposes since early semi-sub feet supported pre-salt development in Brazil 2024, highlighting the shrinking resale market. and early deepwater frontiers. But as drillships brought

With reactivation costs estimated to range from $60 to superior effciency, greater storage capacity requiring less $100 million, the economics of returning cold-stacked feld support services, and higher specifcation capabili- rigs to work are challenging. Even short-term stacked ties, they quickly became the preferred choice.

rigs see $40 to $50 million valuation discounts versus This is very clear when analysing demand and utili- comparable active rigs. For example, GVA 7500-design zation for foaters since 2018. In 2018, global demand

Independencia 2, currently warm-stacked in Mexico, averaged 23 semi-subs versus 64 drillships. By 2025, is valued at $104 to $115 million, while same design semi-sub demand has fallen 22%, averaging just 18 ac- long-term cold-stacked Bicentenario is valued at $33 to tive rigs, while drillship demand has increased by 25%, $43 million. A similar case is F&G ExD-design Hunter now averaging 81 rigs globally. Semi-sub competitive

Queen and Ocean Courage, currently drilling in Brazil, utilization has hovered around 60% since the pandemic valued at $81 to $93 million, while same design long-idle recovery, fuctuating with regional demand, while drill-

West Eclipse and Centenario GR are valued at $38 to ship utilization has remained stronger, in the low 80% $46 million. Considering that scrap value typically rang- range. Contracting activity for semi-subs has also slowed, 12 OFFSHORE ENGINEER OEDIGITAL.COM

11

11

13

13