Page 13: of Offshore Engineer Magazine (May/Jun 2025)

Read this page in Pdf, Flash or Html5 edition of May/Jun 2025 Offshore Engineer Magazine

MARKETS RIGS particularly as operator interest concentrates in high-spec more acutely impacted in this cycle. An aging fleet, re- rigs, as mentioned. West Africa and South America are activation costs, declining demand, a narrowing buyer selectively awarding work to newer rigs, leaving older base, and competition from newer or more regionally sixth-gen international semi-subs sidelined. The result is suited designs have all combined to push values down a two-speed market: one segment approaching full utili- faster and further than for harsh-environment semi- zation, and another facing prolonged inactivity. subs and drillships.

Fleet Valuation: Looking Ahead: Forecast through 2030

Heavily Afected by Current Market Cycle

The short-term outlook remains cautious. Even

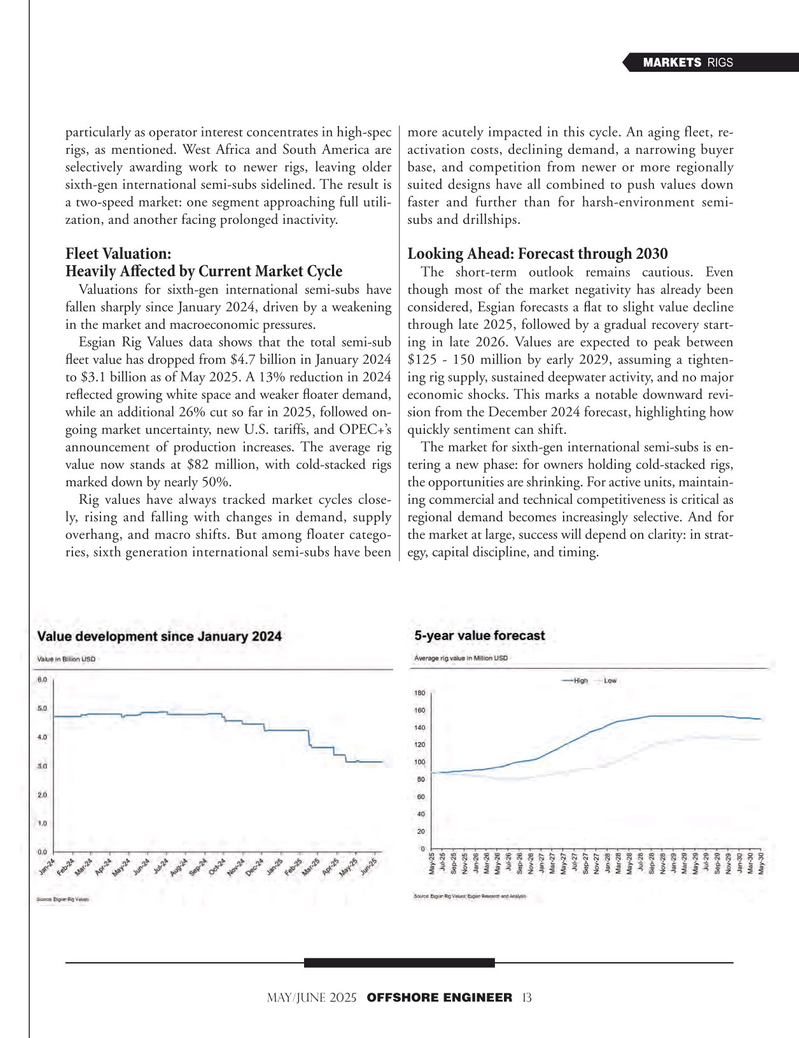

Valuations for sixth-gen international semi-subs have though most of the market negativity has already been fallen sharply since January 2024, driven by a weakening considered, Esgian forecasts a fat to slight value decline in the market and macroeconomic pressures. through late 2025, followed by a gradual recovery start-

Esgian Rig Values data shows that the total semi-sub ing in late 2026. Values are expected to peak between feet value has dropped from $4.7 billion in January 2024 $125 - 150 million by early 2029, assuming a tighten- to $3.1 billion as of May 2025. A 13% reduction in 2024 ing rig supply, sustained deepwater activity, and no major refected growing white space and weaker foater demand, economic shocks. This marks a notable downward revi- while an additional 26% cut so far in 2025, followed on- sion from the December 2024 forecast, highlighting how going market uncertainty, new U.S. tariffs, and OPEC+’s quickly sentiment can shift.

announcement of production increases. The average rig The market for sixth-gen international semi-subs is en- value now stands at $82 million, with cold-stacked rigs tering a new phase: for owners holding cold-stacked rigs, marked down by nearly 50%. the opportunities are shrinking. For active units, maintain-

Rig values have always tracked market cycles close- ing commercial and technical competitiveness is critical as ly, rising and falling with changes in demand, supply regional demand becomes increasingly selective. And for overhang, and macro shifts. But among floater catego- the market at large, success will depend on clarity: in strat- ries, sixth generation international semi-subs have been egy, capital discipline, and timing.

may/june 2025 OFFSHORE ENGINEER 13

12

12

14

14