Public-Private Project Promises to Revive America’s Marine Highway

By Tom Ewing

Plaquemines and American Patriot Holdings plan new container port-vessel system.

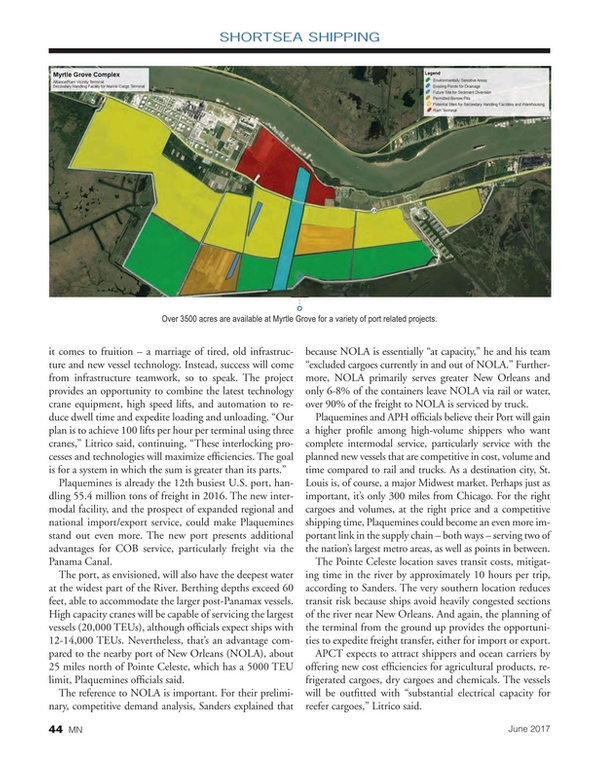

Plans are underway for a new 4,200-acre intermodal container terminal within the Port of Plaquemines Harbor and Terminal District. The project, a partnership (Exclusivity Agreement) between the Port and American Patriot Holdings (APH) calls for the development of a logistics system for “vessel operations comprised of deep-water docking at the Pointe Celeste Container Terminal and multiple upriver terminals.” That’s the Mississippi River, of course, and initial upriver terminals could be sited in Memphis and St. Louis.

The new facility would be the southern-most full service port complex on the Mississippi, located between river-miles 50 and 55. The fledgling project presents a fundamental change for inland waterways shipping. “We’re building a new, modern technology port from the ground up,” said Sandy Sanders, Executive Director of the Port. He added, “The new, central factor at Plaquemines is the specific focus on intermodal planning, getting the system right, not just the moving parts. This is not a retrofit, trying to force modern equipment – and ideas – into old worksites and infrastructure. It’s a project out of Jeff Bezos’ playbook.”

Nuts & Bolts

The proposal has two major, complementary parts. One is the new land-side infrastructure. The second is for the facility to be the operational base for a new type of container vessel being developed by American Patriot Container Transport, LLC (APCT); an APH subsidiary. When constructed, these planned vessels could really scale up inland river freight transport – both in terms of size and speed. They will be big, approximately 772 feet LOA, with a 100 foot beam and a truck equivalent capacity up to 2400 TEUs. Draft: 10 feet. Top speed: 13 mph, with no wake. And they will be facile – assist tugs will not be needed because of azimuthing thrusters and bow pumps. [Just for comparison, a 35-barge tow (five barges wide and seven barges long) typically has an overall length of 1,365 feet and a beam of 175 feet. Conventional hopper barges hold approximately 30 containers per barge, according to APCT.]

As envisioned, initial service will be to St. Louis, a roundtrip of 11 days and to Memphis, a seven day roundtrip. APH projects actual underway times to and from Memphis at 4.5 days per round trip and 8.7 days to St Louis. In comparison, say the project’s organizers, a conventional tow would be underway 9.9 days to and from Memphis and 15.9 days to St. Louis, at a maximum speed of 10 MPH (southbound). Northbound, the tow’s average speed would be closer to just 5 mph.

These days and times do not include the time needed to load and unload containers, or factor into the economics, the container count (payload) carried aboard. If a conventional hopper barge will hold about 30 TEUs, then a 10-barge tow would be about 300 TEU. The APH vessel can carry 2,400 TEU.

The Port and APH predict that “landed costs” for the new port will be “significantly better” than today’s comparable costs to or from mid-west markets and, for example, Shanghai and Rotterdam, using West, East and Gulf coast ports. Moreover, the APH proposal calls for staying below the locks, or in other words, operating entirely below the southernmost locks on the upper river systems so that they can provide a ratable and dedicated liner service.

Importantly, those are still preliminary assessments and numbers, determined through a “pre-feasibility” study by the Port and APH. Actual rate comparisons and costs for likely services are not included in the Port’s project briefings. When asked for details, Sanders said that “terminaling and transportation rates are proprietary and will be disclosed to shippers directly.”

Nevertheless, officials are confident that the benefits from this big-picture analysis are valid and deserve a closer look. Sanders said they now want to start a “bankable feasibility study to have third party verification of our business case and value proposition.” They want the study to help develop a financing plan. Sanders and his team are meeting with terminal operators, carriers, and related freight businesses to shop the idea and seek project investors.

Big Ideas

These are big ideas – incremental change need not apply. Case in point: the new container-on-barge (COB) transport vessels. More fundamental is the hard-headed thinking about why new vessels are needed. Sal Litrico is CEO of APCT, which is working in conjunction with Naviform Consulting & Research. Litrico said this team set out to design a vessel that will be “radically innovative and technologically advanced,” that would “revolutionize how containers are moved on inland waterways.” Litrico notes the “failure of previous COB projects” (emphasis added) and, importantly, the need to learn from that history.

The result is the “exoskeleton hull structure” self-propelled container vessel. The new vessel seeks to maximize payload, provide high transit speed and optimal loading and unloading speeds. The new vessels will not need time for fleeting, shifting and making up tows. Reliability, safety and cargo flexibility are core performance criteria.

Importantly, the design of the new port itself will match and augment the advantages designed into the vessels (and vice versa). This will not – if it comes to fruition – a marriage of tired, old infrastructure and new vessel technology. Instead, success will come from infrastructure teamwork, so to speak. The project provides an opportunity to combine the latest technology crane equipment, high speed lifts, and automation to reduce dwell time and expedite loading and unloading. “Our plan is to achieve 100 lifts per hour per terminal using three cranes,” Litrico said, continuing, “These interlocking processes and technologies will maximize efficiencies. The goal is for a system in which the sum is greater than its parts.”

Plaquemines is already the 12th busiest U.S. port, handling 55.4 million tons of freight in 2016. The new intermodal facility, and the prospect of expanded regional and national import/export service, could make Plaquemines stand out even more. The new port presents additional advantages for COB service, particularly freight via the Panama Canal.

The port, as envisioned, will also have the deepest water at the widest part of the River. Berthing depths exceed 60 feet, able to accommodate the larger post-Panamax vessels. High capacity cranes will be capable of servicing the largest vessels (20,000 TEUs), although officials expect ships with 12-14,000 TEUs. Nevertheless, that’s an advantage compared to the nearby port of New Orleans (NOLA), about 25 miles north of Pointe Celeste, which has a 5,000 TEU limit, Plaquemines officials said.

The reference to NOLA is important. For their preliminary, competitive demand analysis, Sanders explained that because NOLA is essentially “at capacity,” he and his team “excluded cargoes currently in and out of NOLA.” Furthermore, NOLA primarily serves greater New Orleans and only 6-8 percent of the containers leave NOLA via rail or water, over 90 percent of the freight to NOLA is serviced by truck.

Plaquemines and APH officials believe their port will gain a higher profile among high-volume shippers who want complete intermodal service, particularly service with the planned new vessels that are competitive in cost, volume and time compared to rail and trucks. As a destination city, St. Louis is, of course, a major Midwest market. Perhaps just as important, it’s only 300 miles from Chicago. For the right cargoes and volumes, at the right price and a competitive shipping time, Plaquemines could become an even more important link in the supply chain – both ways – serving two of the nation’s largest metro areas, as well as points in between.

The Pointe Celeste location saves transit costs, mitigating time in the river by approximately 10 hours per trip, according to Sanders. The very southern location reduces transit risk because ships avoid heavily congested sections of the river near New Orleans. And again, the planning of the terminal from the ground up provides the opportunities to expedite freight transfer, either for import or export.

APCT expects to attract shippers and ocean carriers by offering new cost efficiencies for agricultural products, refrigerated cargoes, dry cargoes and chemicals. The vessels will be outfitted with “substantial electrical capacity for reefer cargoes,” Litrico said.

Around the Bend

Port officials expect the project to be built in phases, involving land assembly as well as greenfield development. An initial phase will include a recently announced $8.5 billion LNG re-liquefaction facility, a break bulk terminal and a state-of-the-art container terminal expected to comprise approximately 1000 acres. “The project will be done in phases,” Sanders said, “depending on investment and market conditions. The project could begin in as little as 90 days on a mid-streaming basis.”

Plaquemines officials are thinking about all of this. They said that possible upriver sites “may be existing facilities or developed from greenfields and that existing terminals may need to be updated with more modern cranes to expedite loading and unloading of containers from our vessels.” Paired cities will also need intermodal connectivity. Obviously, this will take cooperation – and investments – in markets and territories well beyond the control of Plaquemines officials. A vessel with 2,400 TEUs, priced for speed and timeliness, can’t go to a port facility with a crane working at 10 lifts per hour.

“It is critical that the system is optimized in all locations,” Sanders said, adding that “we have tentative meeting dates with upriver port management teams to discuss locations and facility amenities that could be available in these locations.”

Still very much a work in progress, the partnership and proposed infrastructure investments also represent possibly the most ambitious shortsea gamble in decades. It promises shorter transit times for cargoes, cleaner air though the removal of trucks from the Interstate Highways, less wear and tear on the roads, reduced congestion for commuters and a competitively priced alternative to current freight options. There is, therefore, little to lose and everything to gain by trying.

(As published in the June 2017 edition of Marine News)

Read Public-Private Project Promises to Revive America’s Marine Highway in Pdf, Flash or Html5 edition of June 2017 Marine News

Other stories from June 2017 issue

Content

- Op/Ed: The Spill Response Industry's Greatest Challenges page: 18

- Anatomy of a Commercial Marine Lender page: 20

- A Legal Approach to Marine Casualty Response page: 22

- Regulatory Growth Drives Search for Durable Lubricants page: 26

- It All Flows Downstream page: 30

- North River Boats: Delivering Flexibility & Customized Output page: 34

- The Right Boat, Right Away page: 38

- Public-Private Project Promises to Revive America’s Marine Highway page: 44

- Autonomous Workboats: The Future is Now page: 46

- Advanced Greases Can Handle Today’s Deck Equipment Challenges page: 50

- Marine News Boat of the Month: June 2017 page: 51