Maersk

-

- Maersk & New Containership Economics 101 Maritime Reporter, Oct 2013 #34

Capacity management is firmly on the minds of Maersk executives as the largest container ships in the world steam into service.

Photographs of Maersk Line’s 18,000 TEU ships are flooding in from ports around the world as the carrier phases its giant new vessels phase into the AE10 string between Asia and North Europe.

It’s a “Where’s Waldo” with maritime characteristics. Shanghai, Ningbo, Yantian, Hong Kong, Tanjung Pelepas, Rotterdam, Aarhus, Gdansk – the giant Triple-E Class ships are making history with each port call and tugboats with water cannons firing have been rolling out the aquatic red carpet.

Maersk Mc-Kinney Moller was the first of 20 Triple-Es ordered by the carrier and it sailed into service with plenty of fanfare on June 28. In August she was followed by Majestic Maersk, and Mary Maersk was scheduled to join the fleet in mid-September.

Five of the giant vessels will be in service before New Year celebrations begin and by 2015 all 20 will be in business, an incredible 360,000 TEU of capacity shuttling between Asia and North Europe.

It is this enormous amount of container space that has alarmed the industry. The Asia-Europe trade is already reeling under a glut of capacity and weak freight rates with few expecting a European economic recovery anytime soon.

Market watcher Drewry believes that even when the industry’s most recently ordered ships are delivered in 2016, Europe and the U.S. are still likely to be climbing out of recession, which means that capacity in the east-west trades will continue to outstrip demand.

Maersk Line, however, insists that the introduction of the Triple-Es will be managed carefully to avoid flooding the market with capacity.

“In the volatile global economy and shipping environment, it is very important that we find a balanced way of introducing new and efficient tonnage without increasing the total capacity of the market unnecessarily,” said David Skov, head of South China for Maersk Line.

“We took out the AE9 string on the Asia-Europe, and even with the five Triple Es by the end of the year the total capacity will not have grown. It is a responsible way of introducing new capacity while not making a difficult situation in the trade even worse.”

Since the global financial crisis in 2008, the trade has struggled to balance demand and supply. The European recession and falling exports from China have put the brakes on container trade and, when combined with a trend towards ordering smaller volumes more frequently, has reduced peak season spikes and flattened out exports.

The impact of the excess capacity on Asia-Europe freight rates has been brutal, with rates falling to their lowest level ever earlier this year and shippers resisting general rate increases. As it phases in the Triple-Es, Maersk Line is working hard to avoid placing any additional downward pressure on rates.

“Until we have a full string of Triple-Es we will only load the new ships to 14,200 TEUs, which is the capacity of the Emma Class vessels, the next biggest we have employed on the string,” Skov said.

But surely the lower unit costs will be lost if the vessels are sailing with a utilization of 78%?

Not so, said Skov. It turns out that the Triple-Es breakeven point is below even 70% utilization before the unit costs reach uncompetitive levels.

“We have reduced the capacity by almost 10% compared to last year and are running with a much higher utilization, up in the 90s, on average. That is very high and will have to fall to unrealistically low levels before it will become a problem.”

Maersk Line may be managing its capacity, but the Danish carrier is not the only line introducing ultra large container ships. In fact, by the end of next year Maersk won’t even have the biggest box carriers in service. China Shipping Container Line has ordered five 18,400 TEU vessels, the first of which will be delivered in the fourth quarter of 2014.

This trend towards bigger ships will continue to grow, predicted analysts. Alphaliner expected 18% of the global fleet to comprise ships capable of carrying 10,000 TEU and more by 2015, and Drewry warned that China Shipping’s decision to “follow Maersk Line down the 18,000 TEU road” was likely to be followed by most of the other carriers.

Mediterranean Shipping Co. is leading the way, but has decided to take the charter route. The world’s number two carrier will charter three 18,400 TEU ships ordered by Hong Kong Asset Management for delivery from early 2015, and it will take another three 18,400-box boats on long-term bareboat charter from the Bank of China Financial Leasing, also from 2015.

United Arab Shipping Co. has five 18,000 TEU vessels that will be delivered from late 2014. China Shipping and UASC will use their vessels in a joint service.

But biggest and best comes at a price, and the first 10 ships cost Maersk Line $190 million each. The carrier expects optimization and energy improvements to the second 10 should see the price dropping to an average of $185 million per ship. Raw materials comprise most of the cost with each vessel requiring 55,000 tons of steel.

China Shipping paid $136.5 million for its 18,400 TEU ships, although the single engine design has been described as “fairly basic.” Hong Kong Asset Management is believed to have paid $140 million per ship, Bank of China $140.5 million and UASC is understood to have paid $150 million each.

The ripple effects of these mega vessels will be felt throughout the shipping business. Introducing large new tonnage to a trade without increasing total capacity means smaller ships have to essentially ship out. The preferred option is to cascade the excess vessels down to other trades, which often means merely transferring an overcapacity situation from one trade to another.

The transpacific and north-south trades have borne the brunt of cascading, as mega ships were inserted into Asia-North Europe services, the world’s busiest container route. To absorb as much capacity as possible, lines have employed super slow steaming, accelerated scrapping, handed back chartered tonnage and pulled in orderbooks.

Despite initial resistance to slow steaming, shippers have grown accustomed to longer voyage times and have adapted their supply chains accordingly. Guaranteed times have replaced speed, even though it now takes six days longer than in 2008 to ship containers from Shanghai to North Europe.

The two-propeller engine that can push the Triple-Es to 23 knots while operating at slower speeds gives the ship an operational sweet spot lower than the Emma Maersk. Design improvements see the engines in the second batch of 10 vessels reduced from eight cylinders to seven cylinders.

The more efficient engines make low fuel consumption one of the Triple-Es greatest advantages. Compared to the 13,000 TEU ships of competitors, vessels of 18,000 TEU are believed to burn around 35% less fuel per container. In fact, Maersk said the vessels will burn 30,000-35,000 tons of fuel a year, which over their lifetime will be close to three times the price of the ship. As fuel accounts for well over half of all voyage costs, this kind of fuel economy is a powerful incentive for ordering the new generation of container ships.

Then there are the much vaunted per slot costs, which on an 18,000 TEU ship are $10.96 per TEU per day at sea, almost the same cost as a vessel half its size.

The main drivers behind building the Triple-E in the first place were to achieve greater container capacity and better fuel efficiency. Its “Triple-E” moniker refers to economy of scale, energy efficiency and environmental improvements made possible through advances in ship design and technology.

At 400 m, the ships are just four m longer than E-class vessels (Emma Maersk) yet can carry 2,500 more containers. An expanded inside cavity in a wider hull with a more bulbous bow allows the additional 16% of boxes to be piled in without significantly increasing the draft. Moving the navigation bridge and accommodation five bays forward and the engine room and chimney six rows back created more space.

“There is incremental change going on all the time during the building of the Triple-Es,” said Skov.

Change is also being driven at ports around the world that will handle the giant vessels. Ports are under pressure to improve gate and yard efficiency, beef up feeder and barge services and intermodal connections. Skov, however, did not believe the ports would have problems with the larger vessels.

“Compared to the Emma Class ships, the Triple-Es bring a big jump in total numbers but percentage-wise it is not that big and nothing our terminal partners can’t handle,” he said.

“In Asia and Europe ports they are already very efficient and ships of this size will not stretch terminals beyond what they can handle.”

Despite the increase in container capacity, the Triple-Es will only be one row wider than the E-class ships, 23 rows as opposed to 22. This means the ships can be handled with cranes currently in use in the hub ports.

Skov also pointed out that Asia-Europe trade has been flat for a few years and will be flat again this year.

“So it is not like in the old days with double-digit growth that led to bottlenecks at terminals. In South China there is decent spare capacity at the major terminals. Berth and yard utilization is good but nowhere close to maximum operating levels.”

Maersk believes its 20 Triple-Es will be enough new capacity for the next few years and has long since declined to exercise an option for a third round of 10 Triple-Es.

Still, the trend towards deploying bigger ships will continue and all other areas of the container shipping business will simply have to fall in line. So far China Shipping has had the last word with its 18,400 box ships, but as soon as a recovery in global trade brings improved profitability, liner executives will reach for their orderbooks and before long, the industry will tumble into a new cycle of over supply.

Why Size Matters

Container Ship Economies of Scale

Maersk Line’s first 18,000 teu vessel has prompted much speculation on her economies of scale, particularly as HHI has just confirmed that it is negotiating an order for five slightly larger ships with UASC, said Drewry Maritime Research in a recent paper. The economies of scale offered by Maersk Line’s 18,000 teu vessels are so great that few can ignore them. Assuming the Triple E’s consume 164 tons of fuel a day (excluding diesel), the estimated IFO bunker cost of the Maersk Mc-Kinney Moller (18,270 teu) would already be 35% lower than a typical 13,100 teu vessel on a per teu carried basis – $218/teu versus $333/teu. Apart from the fact that the ships are bigger, their hulls are reported to be designed around an average ship speed of only 23 knots, compared to over 24 knots for the first 13,000 teu vessels, enabling them to glide through the water more efficiently.

The unit cost comparison is based on an average westbound ship speed of 20 knots for both sizes of vessel, and an eastbound ship speed of 14.6 knots which is the average of Maersk’s services between Asia and Europe according to Drewry’s Carrier Performance Insight. The ships are also assumed to be 85% full westbound, and 55% full eastbound, which may only be achieved in steady state conditions, when all of the vessels deployed in the AE10 service are Triple Es.

As bunker consumption tables for 18,000 teu vessels are not readily available, and Maersk does not disclose such information, the daily consumption has had to be extrapolated from those of vessels ranging between 10,000 teu and 16,000 teu, but they do more-or-less tie in with public announcements from Maersk and national press reports. Maersk claims the vessels to be 35% more fuel efficient per container carried than the first 13,100 teu ships, and the Daily Telegraph has reported that their westbound fuel consumption is approximately 150 tons/day, compared to normal consumption of over 214 tons/day.

Ship operating costs, including manning, insurance, stores/lubes, R&M and

Admin, are also an impressive 11% cheaper – $76/teu carried versus $85/teu carried, although here again, the result has had to be extrapolated from Drewry’s analysis of vessel sizes ranging between 3,000 teu and 12,000 teu in its report entitled ‘Ship Operating Costs 2012-2013 ’. It is based on 2011 costs, which are currently being updated.

The Maersk McKinney Moller is manned with a crew of just 21, which is not unusual these days, but it is possible to run her with just 13.

Putting both IFO bunker and ship operating cost savings together reveals that Maerk’s 18,000 teu ships are a massive 30% cheaper than 13,100 teu ships on a round voyage basis – $294/teu carried versus $418/teu carried. This does not include Suez Canal and port costs, however, so is not a total slot cost, but the differential in ship operating cost is clear.

Other savings include faster cargo handling. According to APM Terminals, berth and crane productivity of the Maersk Mc-Kinney Moller (18,270 teu) last week already reached a record 215 and 37.1 gross moves per hour respectively in Rotterdam. This compares with a ‘normal’ berth productivity average of between 140 and 150 moves per hour and a crane productivity average of between 32 and 33 moves per hour for a well stowed 14,000 teu vessel. Because of its greater size, an average of seven cranes could be worked on the Maersk Mc-Kinney Moller, with the maximum going up to eight, whereas only six can usually be worked on a 14,000 teu size vessel.

Source: Drewry Maritime Research(As published in the October 2013 edition of Maritime Reporter & Engineering News - www.marinelink.com)

-

- A.P. Meller-Maersk Creates Dedicated Tech Group Maritime Reporter, Nov 2004 #64

Denmark's A.P. M0ller-Maersk Group, one of the largest shipowning groups in the world, has established a dedicated company to handle all of the technical purchasing requirements of its extensive fleet. Maersk Procurement, the new company, is now responsible for all coordinated purchasing for the

-

- Keppel to Deliver Maersk Rig Early Maritime Reporter, Aug 2003 #23

Keppel Offshore & Marine Limited (Keppel O&M) will deliver a new generation semi-submersible rig to Maersk Contractors in mid August 2003 - two weeks ahead of schedule. The rig was named Lider in a ceremony that was held at Caspian Shipyard Company (CSC) in Baku, Azerbaijan. Lider will be contracted to

-

- Maersk Durban: Innovative Panamax Containership Maritime Reporter, Dec 2004 #27

Maersk Durban (Jennifer Rickmers) is the series vessel adopting a new panamax length design of 964.7 ft. (294 m). Hanjin has developed and designed the vessel themselves, and have attracted orders 32 units, making it one of the most popular design in its class. The ship has been designed to move flexi

-

- Maersk’s Mammoth Containerships Making History Maritime Reporter, Dec 2013 #40

Photographs of Maersk Line’s 18,000 TEU ships are flooding in from ports around the world as the carrier phases its giant new vessels phase into the AE10 string between Asia and North Europe. It’s a “Where’s Waldo” with maritime characteristics. Shanghai, Ningbo, Yantian, Hong Kong, Tanjung Pelepas,

-

- Maersk Computer Game to Spark Students' Interest in Science Marine Technology, Jun 2014 #14

The Maersk Group launched a computer game and teaching materials, available for free, to help teach students about oil exploration and oil production for Danish secondary schools, technical colleges and higher preparatory examination courses. The oil exploration game, which provides an insight into the

-

- Maersk Rate Hikes Hitting the High Notes Maritime Reporter, Jun 2013 #8

Do we sense a touch of desperation from the executive corridors of Maersk Line as the Triple-E delivery dates approach? Maersk Line boss Nils Smedegaard Andersen was in a confident mood after his carrier posted a decent $204 million profit in the first quarter. Making a profit when Asia-Europe is a

-

- $61,4-Million Contract Awarded Maersk Line By Military Sealift Command Maritime Reporter, Oct 1989 #33

Maersk Line, Limited of Madison, N.J., has been awarded a $61.4- million contract for the operation and maintenance of 12 ocean surveillance ships (T-AGOS). The contract performance period is three years with the first ship being turned over approximately October 1, 1989, and the last in September 19

-

- CE&MCO Receives Order For Three Portainers From Maersk Container Maritime Reporter, May 1989 #8

Engineering & Manufacturing Company (CE&MCO), formerly PACECO, Inc., recently received an order for three 50-longton- capacity PACECO Portainers from Maersk Container Service Co., Inc. The post-Panamax cranes will be designed and manufactured at the company's 100-acre facility in Gulfport, Miss., and

-

- Sparrows Point Yard Delivers Third Maersk MPS Conversion Maritime Reporter, Oct 15, 1985 #10

the Pvt. Harry Fisher by Congresswoman Helen D. Bentley (R-Md.), guest of honor and sponsor at the christening ceremonies. Formerly named the Evelyn Maersk and and a part of the Maersk Line fleet until she entered the yard in February 1984, the ship is named to honor a U.S. Marine Corps hero of the

-

- Wynholds Company Will Provide Computer Systems For Maersk Line Ships Maritime Reporter, Apr 1984 #32

The Hans W. Wynholds Company (HWW) of Cupertino, Calif., recently signed its third major maritime contract—a multi-year project with Maersk Line, Ltd. of New York—to provide computer hardware, software, documentation, training, and support for both shipboard and shoreside applications. The hardware

-

- Bethlehem Steel Lays Keel For Second T-AKX Reconstruction Maritime Reporter, Jun 1983 #129

Prepositioning Ship Program, it was announced recently by David Watson, yard general manager. "The keel is for the mid-body section of the Emma Maersk, which is due to arrive at the yard in November," Mr. Watson said. The ship is now operating on trade routes between the Persian Gulf and Japan

-

)

August 2025 - Maritime Reporter and Engineering News page: 51

)

August 2025 - Maritime Reporter and Engineering News page: 51shipping companies are already investing in meth- set by its easier storage and retro? tting potential. For contain- anol-capable ? eets. A.P. Moller–Maersk has ordered over er, short-sea, and roll-on, roll-off (RoRo) shipping segments, 25 dual-fuel methanol vessels and began taking deliveries where

-

)

March 2025 - Marine News page: 27

)

March 2025 - Marine News page: 27(SVITZR) as a result of the pre- at different future viously announced separation from its former fuel solutions and O parent company, A.P. Møller - Mærsk A/S. also electri? cation. Danish national Kasper Karlsen has been Global Chief We’ve deselected Operating Of? cer of the Svitzer Group since

-

)

December 2024 - Maritime Reporter and Engineering News page: 31

)

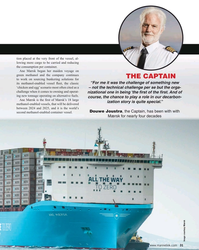

December 2024 - Maritime Reporter and Engineering News page: 31tion placed at the very front of the vessel, al- lowing more cargo to be carried and reducing the consumption per container. Ane Mærsk began her maiden voyage on green methanol and the company continues THE CAPTAIN to work on sourcing bunkering solutions for “For me it was the challenge of something

-

)

December 2024 - Maritime Reporter and Engineering News page: 30

)

December 2024 - Maritime Reporter and Engineering News page: 30ANE MÆRSK WORLD’S FIRST LARGE METHANOL-FUELED CONTAINERSHIP hen talk turns to fuel transition in the maritime Holding. Ane’s eldest granddaughter served as godmother and sector, the conversation usually starts with: christened the vessel. ‘yes, change is happening, but the majority of Ane Mærsk is

-

)

December 2024 - Maritime Reporter and Engineering News page: 6

)

December 2024 - Maritime Reporter and Engineering News page: 6Justin Zurre [email protected] Wthe micro and personal Editor - MarineNews level, I’ve owned several boats in my question begs ... will Ane Mærsk be con- Eric Haun lifetime, and when I ? rst make the purchase I sidered ‘Great’ once she is retired in 20-30 [email protected] can assure you

-

)

December 2024 - Maritime Reporter and Engineering News page: 2

)

December 2024 - Maritime Reporter and Engineering News page: 2Navy and US Coast Guard. 24 Interview By Greg Trauthwein Sameer Kalra, Alfa Laval 43 Pro? le Great Ships & Boats of 2024 100-Year-Old Webbie, 30 Ane Mærsk Containership AP Moeller Maersk Hyundai Heavy Ind. Niel Spillane, on a Life Well Lived 32 Oceanus Aurora LPG/Ammonia IINO Lines Hanwha Ocean Co.

-

)

December 2024 - Maritime Reporter and Engineering News page: Cover

)

December 2024 - Maritime Reporter and Engineering News page: CoverDecember 2024 MARITIME REPORTER AND ENGINEERING NEWS marinelink.com ANE MÆRSK World’s First Large Methanol-enabled Container Vessel 2024 SHIP OF THE YEAR Since 1939 | Number 12 | Volume 86 FMD’s George Whit ier Building a Defense Juggernaut O? shore Floating Wind Vessel Demand to 2035 100-Year-Old

-

)

November 2024 - Maritime Reporter and Engineering News page: 50

)

November 2024 - Maritime Reporter and Engineering News page: 50are going Step one for ABS is to inform, educate and illustrate that to be implemented are poor as well.” yes, the threat is real. Just ask A.P. Moller-Maersk Group, one of the world’s largest shipping companies which in 2017 was NEW COAST GUARD RULES hit with the NotPetya attack, disrupting operations

-

)

October 2024 - Marine News page: 31

)

October 2024 - Marine News page: 31Maersk’s new Sturgeon WTIV concept promises ef? ciency gains. Maersk www.marinelink.com MN 31|

-

)

October 2024 - Marine News page: 29

)

October 2024 - Marine News page: 29purpose- built barges to connect into a specially designed jackup WTIV via a locking mechanism that stabilizes the barge. Leveraging this innovation, the Maersk Sturgeon WTIV will be built by Seatrium in Singapore and used in turbine installation in the U.S. Northeast. According to Maersk, the solution can

-

)

May 2024 - Maritime Reporter and Engineering News page: 40

)

May 2024 - Maritime Reporter and Engineering News page: 40for the container shipping route between the Ports of Los Ange- les, Long Beach and Shanghai. Carrier partners include CMA CGM, COSCO Shipping Lines, Maersk, and ONE, and they will begin deploying reduced or zero lifecycle carbon capable ships on the corridor by 2025. RINA is partnering on the development

-

)

May 2024 - Maritime Reporter and Engineering News page: 25

)

May 2024 - Maritime Reporter and Engineering News page: 25studies and consortiums to study the operations of methanol bunkering and ammonia bunkering. For example: in July 2023, Hong Lam Marine, together with Maersk and Maritime and Port Authority of Sin- gapore, conducted the ? rst in the world ship to containership methanol bunkering of 300 All photos courtesy

-

)

April 2024 - Maritime Reporter and Engineering News page: 22

)

April 2024 - Maritime Reporter and Engineering News page: 22at Seatrium Amfels for Dominion Energy Coast Virginia projects and lease areas. Virginia Offshore Wind and Revolu- offshore wind; and the foreign fag Maersk supply WTIV at tion is in construction; Southfork is into installation, “so Or- Seatrium Singapore, together with U.S. fag feeder ATBs for 22 Maritime

-

)

February 2024 - Maritime Reporter and Engineering News page: 38

)

February 2024 - Maritime Reporter and Engineering News page: 38TECH FEATURE Ammonia and the 15,00 A project initiated by Seaspan Corporation and the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMMCZCS) has set out to develop a design for a large 15,000-TEU ammonia-fueled container vessel. Image Seaspan Corporation/Foreship By Greg Trauthwein orking with

-

)

February 2024 - Maritime Reporter and Engineering News page: 6

)

February 2024 - Maritime Reporter and Engineering News page: 6, as in ARC you One such mover is Seaspan Corporation Corporate Staff Manager, Marketing have neatly rolled up a company that em- and its program with the Maersk McKinney Mark O’Malley momalley@marinelink bodies so many key tenets to U.S. maritime Moller Center for Zero Carbon Shipping to Accounting interest

-

)

February 2024 - Maritime Reporter and Engineering News page: 2

)

February 2024 - Maritime Reporter and Engineering News page: 2emissions. 48 Buyer’s Directory By Wendy Laursen 48 Advertisers Index 38 Ammonia & the 15K TEU Containership A project initiated by Seaspan Corp. and the Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping sets sights on a 15K TEU ammonia-fueled container vessel. By Greg Trauthwein 2 Maritime Reporter

-

)

December 2023 - Maritime Reporter and Engineering News page: 39

)

December 2023 - Maritime Reporter and Engineering News page: 39ABS-classed vessel, HMD Hull #4168 is named Lau- long-term charter to Shell Tankers (Singa- pore) Private Limited. Both AET and Eaglestar site teams ra Maersk. The Danish shipping giant has signed a deal with have been working closely together with the yard to ensure Dutch producer OCI Global on the delivery

-

)

December 2023 - Maritime Reporter and Engineering News page: 2

)

December 2023 - Maritime Reporter and Engineering News page: 2Patrol Cutter Argus 37 • Shimizu’s Blue Wind 38 • Hapag-Lloyd’s Berlin Express 38 • MISC’s Seri Damai 39 • AET’s Eagle Vellore 39 • A.P. Moller - Maersk’s Laura Maersk 2 Maritime Reporter & Engineering News • December 2023 MR #12 (1-17).indd 2 12/6/2023 10:58:33 A

-

)

November 2023 - Marine News page: 31

)

November 2023 - Marine News page: 31deepsea realm, methanol fuel- ing for conventional engines has been gaining traction, notably with orders for large containerships by giants like Maersk and CMA CGM. Methanol may soon ? gure into larger vessels in the Jones Act landscape; Overseas Shi- pholding Group (OSG) recently an- nounced the

-

)

November 2023 - Maritime Reporter and Engineering News page: 29

)

November 2023 - Maritime Reporter and Engineering News page: 29Laura Maersk is the ? rst methanol-powered vessel with 4-stroke dual fuel methanol auxiliary engines. The 2-stroke MAN B&W 6G50ME-LGIM main engine installed on Laura Maersk. The 172-meter (564-foot) 2,100 TEU Laura Maersk was ordered from Hyundai Mipo in 2021. Source Maersk Source Maersk Source

-

)

November 2023 - Maritime Reporter and Engineering News page: 28

)

November 2023 - Maritime Reporter and Engineering News page: 28FUEL TRANSITION Laura Maersk was built to ABS class and Source Maersk features a classic design. traditional investment.” For Maersk, the cost should not be an while fuel preparation spaces must be safeguarded with addi- excuse for not acting. tional ventilation and continuous monitoring in case of

-

)

November 2023 - Maritime Reporter and Engineering News page: 27

)

November 2023 - Maritime Reporter and Engineering News page: 27Of? cially named in September 2023, it is the ? rst methanol- powered vessel that doesn’t carry methanol as cargo. Source Maersk Godmother of Laura Mærsk, EU Commission President Ursula von der Leyen, in front of the vessel with Ane Maersk Mc-Kinney Uggla, Maersk Chair, Robert Uggla, Maersk CEO

-

)

November 2023 - Maritime Reporter and Engineering News page: 26

)

November 2023 - Maritime Reporter and Engineering News page: 26FUEL TRANSITION METHANOL: Source Maersk FIRST IN A LONG LINE If there’s one vessel that sparked the rapidly increasing number of methanol-fueled newbuilding orders, it’s the new container feeder, Laura Maersk. By Wendy Laursen t last count, A.P. Moller - Maersk has 24 more and therefore critical for

-

)

November 2023 - Maritime Reporter and Engineering News page: 2

)

November 2023 - Maritime Reporter and Engineering News page: 2one vessel that sparked the rapidly increasing number of methanol- 4 Authors & Contributors fueled newbuilding orders, it’s the new container feeder, Laura Maersk. 6 Editorial By Wendy Laursen 8 By the Numbers: OSVs 34 Graziuso Charts Crowley’s Digital Path 10 Training Tips for Ships: Erika Graziuso, CIO, Crowley