United States

-

- What Does the Jones Act Mean for Offshore Wind? Marine News, Feb 2018 #20

Offshore wind power continues to gain momentum in the United States. How will the Jones Act affect the development, operation and maintenance of offshore wind farms?

After years of planning and some unsuccessful attempts, offshore wind power developers finally have their first success in the United States. The Block Island Wind Farm, a 30-megawatt wind farm located just off the coast of Rhode Island, began operations in December 2016, fulfilling the goal of the project’s developer, Deepwater Wind LLC, to build America’s first offshore wind farm. The Block Island Wind Farm consists of only five wind turbines and is tiny in comparison to the large offshore wind farms operating off the coasts of Europe, but Deepwater Wind is planning larger wind farms off the coasts of New York, Massachusetts, Rhode Island, Maryland and New Jersey. Other developers are doing the same with other projects up and down the East Coast of the United States.The Jones Act and the Passenger Vessel Services ActAffecting how these wind farms are being planned and built is a little-known but controversial law: The Jones Act, originally enacted as part of the Merchant Marine Act of 1920, regulates the carriage of merchandise between points in the United States, commonly called “coastwise trade,” and generally requires that a vessel may not provide any part of the transportation of merchandise by water, or by land and water, between points in the United States to which the coastwise laws apply, either directly or via a foreign port, unless the vessel is wholly owned by citizens of the United States and has been issued a certificate of documentation with a coastwise endorsement by the United States Coast Guard (USCG) or is exempt but would otherwise qualify for such a certificate and endorsement. A coastwise endorsement may only be issued to a United States flagged vessel that, with limited exceptions, was built in the United States. The Passenger Vessel Services Act similarly restricts the transportation of passengers between points or places in the United States to vessels built in and owned by citizens of the United States.The penalties for violating the Jones Act can be severe, including forfeiture of the merchandise transported or a monetary amount equal to the greater of the value of that merchandise or the cost of the transportation. The penalty for violating the Passenger Vessel Services Act is a fine of $300 per passenger transported and landed. The laws are otherwise similar enough that, for the purposes of the remainder of this article, they are collectively referred to as the Jones Act. United States Customs and Border Protection (USCBP) enforces the Jones Act, but relies on the USCG to determine vessel eligibility for United States coastwise trade, including whether vessels are built in and owned by citizens of the United States.So how does the Jones Act affect the development of offshore wind farms in the United States? Offshore wind farms are just that, offshore, and nothing in the Jones Act appears to restrict the transportation of merchandise or passengers between United States ports and offshore wind farms.The Territorial Sea and the Outer Continental Shelf Lands ActUSCBP has repeatedly ruled that points in United States territorial sea are points in the United States for the purposes of the Jones Act. The territorial sea is defined as a belt, three nautical miles wide, seaward of the territorial baseline (typically the coastline) and to points located in internal waters, landward of the territorial sea baseline. Documents filed with USCBP suggest that the Block Island Wind Farm is located in the territorial sea.But developers are planning bigger projects even further offshore, on the outer Continental Shelf of the United States (the OCS), where the winds are stronger and more constant. The Outer Continental Shelf Lands Act provides that the laws of the United States, including the Jones Act, extend to the subsoil and seabed of the OCS, and all installations and other devices permanently or temporarily attached to the seabed, which may be erected thereon for the purpose of exploring for, developing or producing resources therefrom. As a result, the Jones Act extends to drilling rigs and platforms sitting on or attached to the seabed of the OCS for the purpose of exploring for, developing or producing oil or natural gas. It is less clear whether the Jones Act extends to a wind turbine on a tower attached to the seabed of the OCS because it is unclear whether the turbine is developing or producing natural resources from the seabed, but many developers are taking a cautious approach and assuming that it does.The Effect of the Jones Act on Offshore Wind Farms in the United StatesThe Jones Act complicates the construction, operation and maintenance of offshore wind farms in the United States because it generally requires merchandise and passengers to be moved between a port in the United States and towers attached to the seabed of the territorial sea or possibly the OCS, or between these towers, using vessels built in and owned by citizens of the United States. The wind power industry in Europe has used purpose-built wind turbine installation vessels (WTIV) to build offshore wind farms for years, but few, and most likely none, of these vessels were built in the United States.Offshore wind farms can also be built using Jones Act qualified vessels built for other purposes, but these vessels may not be as efficient or reliable as purpose-built WTIVs, especially in rougher or deeper waters. A study concluded in October 2017 found that offshore wind farm development in the United States could eventually support the construction of multiple WTIVs in the United States, and plans were announced earlier in 2017 for the construction of a WTIV in the United States, but it remains uncertain whether the number of offshore wind farms needed to support a Jones Act qualified WTIV will actually be built.A Jones Act qualified WTIV could also be used in other applications, including the construction of wind farms in Europe and the decommissioning of oil and gas installations on the OCS, but the higher cost of building WTIVs in the United States may make it too expensive for use outside of the United States and it may not be as efficient in other applications as vessels built for those applications. Until a sufficient number of Jones Act qualified WTIVs are actually built and enter service, offshore wind farm developers may need to look to other possible solutions.So how can developers work around these problems? Most proposed solutions employ a combination of Jones Act qualified and non-Jones Act qualified vessels. Turbines located at a United States port could be transported to a tower on a Jones Act qualified vessel and installed by a non-Jones Act qualified specialized WTIV. This process, or something like it, may have been used at the Block Island Wind Farm.Alternatively, turbines could be shipped from outside the United States on foreign-flagged vessels scheduled to arrive directly at the wind farm just in time to be installed by a non-Jones Act qualified WTIV. In each case the process works as long as the operators of the WTIV and any foreign-flagged vessels are careful not to transport merchandise or passengers between towers, between a tower and a port or other point in the United States, or between any such ports or points. Other solutions may also be possible, but whether any solution, including any of those described above, complies with the Jones Act always depends on the facts of the situation.Until a sufficient number of Jones Act qualifying WTIVs can be built in the United States, offshore wind farm developers and operators may need to be resourceful in how they comply with the Jones Act.The AuthorJohn F. Imhof Jr. is a Partner in the New York office of Seward & Kissel LLP focusing on maritime, transportation and energy finance. John’s experience includes advising lenders to and investors in the owners of Jones Act qualified vessels and offshore wind power projects. Kristy Choi, a Law Clerk in the New York office of Seward & Kissel LLP, contributed to this article.(As published in the February 2018 edition of Marine News) -

- History and Overview of U.S. Cabotage Laws Maritime Reporter, Sep 2020 #14

The United States domestic maritime sector recently celebrated the 100th anniversary of the passage by Congress of the Jones Act. It is considered the most significant of various US cabotage laws. Few mariners though appreciate the long history of cabotage laws in this country.Cabotage laws here are older

-

- SS United States: Leading Lady to Damsel in Distress Maritime Reporter, Feb 2014 #32

Once queen of the express liners, and the fastest, safest and biggest passenger liner in history, the SS United States today quietly awaits rescue from a pending cruise to the scrapyard. The Big Ship the Big U, the one that didn’t sink. The S.S. United States, still the fastest passenger liner ever and

-

- The Treatment of Foreign Seafarers Maritime Reporter, May 2014 #16

The United States effectively treats foreign seafarers more harshly than any other group that enters the country without breaking the law. The general rule is that all persons who are not U.S. nationals or permanent residents must have a visa to enter the United States. Persons desiring to become U.S.

-

- America's Super Liner to Set Sail Once Again? Maritime Reporter, Jun 2003 #34

it was the greatest ship ever built ... the greatest achievement of our greatest naval architect" Robert Hudson Westover. chairman of the S.S. United States Foundation As a child, I often noticed a framed postcard that hung in the living room of my parents' home in Long Island. It was a simple silver

-

- United States Cruises Acquires Title To SS 'United States' Maritime Reporter, Apr 15, 1981 #4

United States Cruises, Inc. (USCI), Seattle, Wash., has made the final $3-million payment for the purchase of the passenger ship United States, and received title to the vessel from the Commerce Department's Maritime Administration (MarAd). USCI presented MarAd with an irrevocable letter of credit

-

- Proposed Regulations Regarding Source of Income From Activities In Intl. Waters Maritime Reporter, Apr 2001 #14

on both U.S. persons engaged in shipping activities through a foreign corporation and foreign shipping companies currently doing business in the United States. The IRS is accepting written comments on the proposed regulations and there will be a public hearing that is currently scheduled for March

-

- United Defense to Acquire United States Marine Repair Maritime Reporter, Jun 2002 #10

United Defense Industries has agreed to acquire closeiy held United States Marine Repair, Inc., a provider of non-nuclear ship repair, modernization, overhaul and conversion services to the United States Navy, for $316 million. Based in Norfolk, Va., United States Marine Repair serves defense and commercia

-

- Old Cruise Ships: Save 'em or Scrap 'em? Maritime Reporter, Jul 2003 #33

to predict any tangible changes. By Regina P. Ciardiello, managing editor Basking in the limelight of its highly-publicized purchase of the S.S. United States (as seen in MR's June 2003 Yearbook edition), Norwegian Cruise Lines' (NCL's) moment was short-lived when the Norway incident occurred on May

-

- How The Oil Industry Did Financially In 1991 Maritime Reporter, Apr 1992 #83

. 1). However, the worldwide profitability of U.S. oil companies masks the extremely low earnings they've been able to achieve here in the United States. The low rate of return in the United States is largely due to a poor investment climate for exploration and development: • Political and

-

- Maritime Industry Gets A New Act Maritime Reporter, Dec 2002 #13

After two years of machinations within Congress, involving various federal agencies and with some input from the private sector, the United States finally has a Maritime Transportation Security Act. This measure, when fully implemented, will impose broad security requirements on the maritime industry.

-

- The Irony Of Maritime Security Maritime Reporter, Nov 2002 #18

been noticeably slow in enacting new legislation intended specifically to provide new legal tools to reduce the risk of maritime terrorism in the United States. As the world saw on October 6, 2002 with the terrorist attack on the French supertanker Limburg in Yemen, the maritime security threats are very

-

)

March 2024 - Marine Technology Reporter page: 35

)

March 2024 - Marine Technology Reporter page: 35Figure 1 A self-righting vehicle design with buoyancy high and weight low, WHOI’s SeaBED AUV captures the attention of a pair of curious Antarctic penguins as it is deployed from the British research vessel James Clark Ross. Vehicle designers allowed for temperature reduction of battery capacity. Recharge

-

)

March 2024 - Marine Technology Reporter page: 33

)

March 2024 - Marine Technology Reporter page: 33regulated industry in the world.” How- ever, commercial success depends on many factors, not least a predictable OPEX. Over the past four years, SMD has worked with Oil States Industries to calculate cost per tonne ? gures for prospective customers. Patania II uses jet water pumps to Oil States’

-

)

April 2024 - Maritime Reporter and Engineering News page: 48

)

April 2024 - Maritime Reporter and Engineering News page: 48Silicon Sensing Systems Ltd, Clittaford Road Southway, Massa Products Corporation, 280 Lincoln Street, UNDERWATER SONAR SENSORS Plymouth, Devon PL6 6DE United Kingdom , UK , Hingham, MA 02043-1796 , tel:(781) 749-4800, tel:+44 (0) 1752 723330, [email protected] [email protected] contact: Nick Landis

-

)

April 2024 - Maritime Reporter and Engineering News page: 39

)

April 2024 - Maritime Reporter and Engineering News page: 39Tech Files Latest Products, Systems and Ship Designs “Wall Climbing Robot” Danish Pilot calls gets ClassNK Nod LEGO Model "A tribute build to a work life at sea" Image courtesy MOL, Sumitomo Heavy Industries lassNK granted its Innovation Endorse- Image courtesy Espen Andersen/DanPilot ment for

-

)

April 2024 - Maritime Reporter and Engineering News page: 29

)

April 2024 - Maritime Reporter and Engineering News page: 29RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND U.S. Navy photo by Bill Mesta/released U.S. Navy photo by Ryan Carter Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command, visits USNS Patuxent (T-AO 201) for a tour of the ship at Naval Station Norfolk, Va., November 20, 2023. ENDLESS

-

)

April 2024 - Maritime Reporter and Engineering News page: 27

)

April 2024 - Maritime Reporter and Engineering News page: 27RADM PHILIP SOBECK, MILITARY SEALIFT COMMAND With COVID, we had to make some hard choices for our Do your CIVMARs have upward mobility? mariners because we couldn’t rotate. Many of our mariners The Navy has Sailors who become “Mustangs,” and work found other employment, and were able to use their skills

-

)

April 2024 - Maritime Reporter and Engineering News page: 26

)

April 2024 - Maritime Reporter and Engineering News page: 26emergency medical ships. A large percentage of our ships are 40 years old or older and need to be replaced.” Rear Adm. Philip Sobeck, Commander, United States Navy’s Military Sealift Command Military Sealift Command’s expeditionary fast transport ship USNS Burlington (T-EPF 10) pulls into Joint Expeditionary

-

)

April 2024 - Maritime Reporter and Engineering News page: 12

)

April 2024 - Maritime Reporter and Engineering News page: 12about methanol This study concluded that the Toyota Prius Prime is the green- where we concluded that methanol is a prom- est car you can buy in the United States. ising sustainable liquid fuel for transportation The Council assesses vehicle “green scores” not only by Mdevices when batteries cannot do

-

)

April 2024 - Maritime Reporter and Engineering News page: 7

)

April 2024 - Maritime Reporter and Engineering News page: 7- EWIGXSVWTIGMjGIZIRXJSVJEWXZIWWIPW 11 operating at high speed forsecurity Southampton JUNE in partnership with TO interventions and Search & Rescue. United Kingdom ???? 13 Celebrate innovation and excellence in the commercial marine industry at The European For more information (SQQIVGMEP2EVMRI&[EVHW *(2&W

-

)

April 2024 - Marine News page: 42

)

April 2024 - Marine News page: 42People & Companies Nevey to Head TAI Hires Kalla Washington State Ferries TAI Engineers appointed Amer Steve Nevey has been selected to Kalla as director of production design. serve as assistant secretary for the FMC Names Usman CIO Washington State Ferries Division, Nevey Schwandt succeeding Patty

-

)

April 2024 - Marine News page: 40

)

April 2024 - Marine News page: 40Vessels General Arnold Chasse, La. The 32-inch CSD will immediately begin work on Phase Four of the Corpus Christi Ship Channel Improvement Project. The project will bene? cially reuse 100% of the dredged material removed from the channel deepening and widening. The General Arnold is the newest,

-

)

April 2024 - Marine News page: 38

)

April 2024 - Marine News page: 38collaboration Imagine a shipyard as a football team, where the dis- parate execution of roles, along with precise timing and placement are paramount for a united victory. Just as dif- ferent football teams leverage their unique strengths to create an advantage to win games, shipyards must em- ploy unique strategies

-

)

April 2024 - Marine News page: 32

)

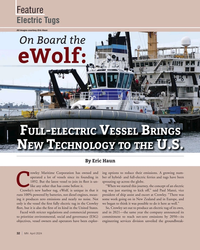

April 2024 - Marine News page: 32? rst fully electric tug in the Crowley we began to think it was possible to do it here as well.” ? eet, but it is also the ? rst of its kind in the United States. So, Crowley set out to produce an electric tug of its own, Faced with stricter regulations and commercial pressure and in 2021—the same year

-

)

April 2024 - Marine News page: 31

)

April 2024 - Marine News page: 31AmFELS), in Brownsville, Texas on Charybdis, the sole Jones Act compliant wind tur- bine installation vessel (WTIV) un- der construction in the United States. The most recent announcements have put the WTIV’s cost at $625 mil- lion, with delivery pushed back to late 2024/early 2025. www.marinelink

-

)

April 2024 - Marine News page: 28

)

April 2024 - Marine News page: 28Feature Shipbuilding WindServe Marine you don’t have the sustained backlog.” Previous editions of Marine News’ U.S. Shipbuilding re- port have noted the increasing concern about what ABS’s Bleiberg (moderating the Marine Money panel) called “the big push for sustainable” shipping”, adding that: “What we

-

)

April 2024 - Marine News page: 18

)

April 2024 - Marine News page: 18Column Cybersecurity The Maritime Industry Has Unique Cybersecurity Challenges By Joe Nicastro, Field CTO, Legit Security With supply chain attacks on the rise, works, while foundational, have not evolved in tandem and nation-state attackers constantly looking for new ways with these digital threats

-

)

April 2024 - Marine News page: 17

)

April 2024 - Marine News page: 17OpEd Shipbuilding can industrial base. building, repairing, repowering and local communities at a time in which Second, the Congress must pri- maintaining ships, not to mention our maritime strength is needed more oritize stable and predictable budgets the massive supply chain that sup- than ever

-

)

April 2024 - Marine News page: 16

)

April 2024 - Marine News page: 16readiness. In fact, on March 12, Wisconsin Senator Tammy the importance of strengthening the Jones Act. Baldwin, Pennsylvania Senator Bob Casey and the United First, the U.S. must create a de? nable national maritime Steelworkers, among others, joined together to call for the strategy that bolsters the

-

)

April 2024 - Marine News page: 15

)

April 2024 - Marine News page: 15Q&A time, sometimes we win in game seven, but it really takes now to make sure that folks understand that tug and barge a united industry, and so I just really appreciate the great transportation is the most sustainable mode of freight work of AWO members, of coalition partners, shippers, transportation?

-

)

April 2024 - Marine News page: 14

)

April 2024 - Marine News page: 14like to see both We’re trying to do hard things, and so it’s really impor- agencies move forward quickly. They’re already really late. tant that we are a united industry, that we’re ? elding a full They’ve blown past their statutory deadlines. They need to team and that we are pushing hard together to tackle

-

)

April 2024 - Marine News page: 12

)

April 2024 - Marine News page: 12clearer guidance on when ATB support our industry. barges can be authorized to be conditionally occupied, that As we try to serve as the industry’s united voice, we are is, when somebody can go from the tug onto the barge and partnering with other organizations to spread the good work there for a period

-

)

April 2024 - Marine News page: 10

)

April 2024 - Marine News page: 10shy away from making improve- dustry’s advocate, as a resource for the industry, as the ments, making upgrades to support safety and environ- industry’s united voice. But what are the issues? What mental sustainability. You’ve seen that many times over are the challenges? What are the things that could really

-

)

April 2024 - Marine News page: 8

)

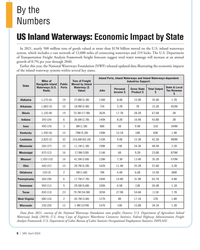

April 2024 - Marine News page: 8By the Numbers US Inland Waterways: Economic Impact by State In 2021, nearly 500 million tons of goods valued at more than $158 billion moved on the U.S. inland waterways system, which includes a vast network of 12,000 miles of connecting waterways and 219 locks. The U.S. Department of Transportation

-

)

April 2024 - Marine News page: 6

)

April 2024 - Marine News page: 6in Cozen O’Connor’s Transportation Wave Media titles. & Trade Group. He focuses his practice on strategic and operational matters affecting the United States 4 Joe Nicastro maritime industry and on government contracts is a former cybersecurity analyst for the Coast Guard across all industries