Louisiana Dredging Outlook

By Susan Buchanan

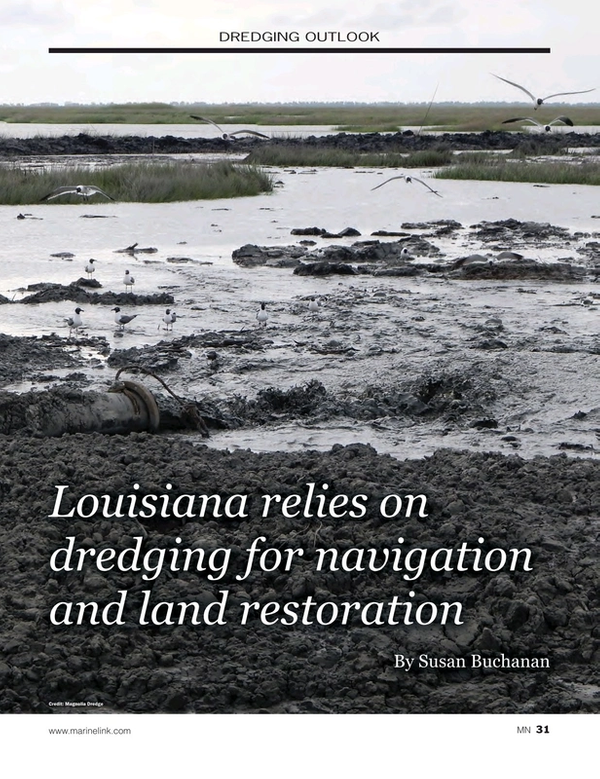

Louisiana relies on dredging for navigation and land restoration

When maritime stakeholders think about dredging, they typically first conjure up visions of harbor deepening projects to accommodate those giant, post-Panamax boxships. Conversely, inland players hope for maintenance dredging in the heartland to keep the nation’s 31,000 cargo barges afloat as they head for the coast. But, there is much more to it than that.

In Louisiana, dredging, of course, keeps Louisiana's waterways open for navigation, provides material for coastal restoration and helps industrial plants with drainage. The biggest projects are sponsored by the U.S. Army Corps of Engineers (USACE) in New Orleans and the state's Coastal Protection and Restoration Authority (CPRA). The state's newest and largest restoration projects will span several decades and could cost $1 billion or more each. In this case, they are badly needed as the shoreline shrinks.

In the last 50 years, Louisiana lost about 34 square miles of marsh and other land annually to the sea. The state has relinquished 2,000 square miles since 1932. Louisiana's dredging industry welcomes, albeit with some reservations, the Water Infrastructure Improvements for the Nation Act, or WIIN, approved by Congress in December, along with a U.S. Army Corps of Engineers' plan, announced in December, to deepen waterways.

WIIN, (Win?)

WIIN, signed into law by President Obama on December 16, facilitates harbor and channel deepening, and expands the fed-state, cost-sharing for navigation-construction projects from 45 to 50 feet deep. That means waterways will be able to accommodate larger vessels. WIIN allows the Army Corps to make improvements to ports, waterways, dams and flood protection. It authorizes 30 new infrastructure projects across the nation. Congress will still have to appropriate funding for most of these projects, however. WIIN also establishes a pilot program for activities that use dredged material. It calls for Harbor Maintenance Tax funding targets to grow by 3 percent annually over each previous year, with a goal of providing all collected HMT revenues for use by the nation's ports and harbors by fiscal 2025.

Sean Duffy, executive director of the Big River Coalition in Metairie, La., said WIIN's navigation and construction provisions will increase opportunities for Louisiana's dredging industry. The Coalition's 100 maritime members rely on the Mississippi River. Separately, a plan released by the Army Corps in December would deepen portions of the Mississippi River navigation channel, including stretches between New Orleans and Baton Rouge, to 50 feet. The channel measures 45 to 47 feet deep now. More dredging would allow Mississippi River ports like New Orleans, Plaquemines and South Louisiana to handle large post-panamax vessels traveling through the expanded Panama Canal.

Coastal Master Plan Projects

Released in January, Louisiana's $50 billion, 50-year 2017 draft Coastal Master Plan includes large-scale marsh creation projects that depend on dredging. The plan is an update of earlier versions in 2012 and 2007.

“These marsh creation projects will be implemented over several decades and in multiple phases,” Rudy Simoneaux, manager of CPRA’s engineering division, said last month. The projects include $1.8 billion for Belle Pass to Golden Meadow Marsh Creation on 24,800 acres; $680 million for Large Scale Barataria Marsh Creation on over 12,400 acres; and $1 billion for New Orleans East Landbridge Restoration on 21,400 acres.

CPRA has awarded all of its recent dredging work on a low-bid basis, consistent with the state's bid laws. “To date, Illinois-based Great Lakes Dredge & Dock and New Jersey-headquartered Weeks Marine have received the most dredging contracts let by CPRA,” Simoneaux said. Mississippi River sediment diversions in the master plan are crucial to building and maintaining land, along with protecting levee investments. The agency wants to see sediment diversions constructed as soon as possible.

The state hopes to build the Mid-Barataria Sediment Diversion at mile marker 60.7 on the west side of the Mississippi River, near Myrtle Grove in Plaquemines Parish. The diversion would restore Barataria Basin habitat, including fresh, intermediate and brackish marshes, by re-introducing sediment and nutrients that maintained the area in the past. The project would include dredging of sediment mined from the Mississippi River. “As coastal conditions decline, the state must expand ways to leverage the sediment and land-building power of the river on an even greater scale in future master plans,” CPRA said in January.

Regarding the new WIIN legislation, “CPRA views its passage as a very positive thing for ports, the Army Corps and other entities involved in navigation dredging,” Simoneaux said. “But how ecosystem restoration fits or applies under this legislation hasn't been determined yet.”

As for the Army Corps' plan to deepen parts of the lower Mississippi River channel, including stretches between New Orleans and Baton Rouge, “CPRA is always in favor of innovative dredging opportunities,” Simoneaux said. “But given the location of the reaches included in this deepening proposal, along with the locations of dredging projects in our 2017 master plan, it may not be cost-feasible to use dredged material from this deepening for ecosystem restoration.” CPRA will continue to examine the possible use of that dredged material.

Army Corps sees that channels are dredged

Keeping the lower Mississippi open for navigation is the Corps' biggest dredging cost in south Louisiana. Over the last five years, dredging from Mile 10 AHP (above Head of Passes) to 22 BHP (below Head of Passes) cost an average $56 million, Army Corps spokesman Rene Poche in New Orleans said last month. “That includes Southwest Pass, which runs from Mile 0 to 22 BHP. A combination of cutterhead dredges and hopper dredges is used there.”

Annually, an average 64 percent of the material dredged from Mile 10 AHP to 22 BHP is used beneficially, Poche said. This includes marsh creation, wetlands nourishment, and restoring ridges and barrier islands. The Corps tries to use dredged material beneficially whenever it's cost-effective and meets federal laws, and utilizes it along the banks of South and Southwest Pass, in the Delta National Wildlife Refuge, the Atchafalaya Delta Wildlife Management Area and in the Sabine National Wildlife Refuge.

Besides the Mississippi River, the Corps' other big dredging projects are along the Calcasieu River and Pass in southwest Louisiana, and the Atchafalaya Basin in the south central part of the state. “The Calcasieu Project allows deep-draft, 40-foot access to the Port of Lake Charles and terminals along the Calcasieu River,” Poche said. Dredging is done at a number of spots in the Atchafalaya Basin to maintain 12-foot channels for commercial navigation, he said. These include “Three Rivers,” where the Red, Atchafalaya and Old Rivers meet in east-central Louisiana; the Old River Lock Forebay, northwest of Baton Rouge; below Bayou Sorrel lock to the south of Baton Rouge in Iberville Parish; and Berwick Bay Harbor on the Lower Atchafalaya River near Morgan City.

The Corps' Calcasieu dredging typically costs between $12 million and $20 million a year, while the Atchafalaya Basin dredge work runs from $3 million to $4 million yearly. As for the WIIN legislation, “it had nothing to do with why we're pursuing deepening of the river, nor with the depth being proposed,” Poche said. “Our effort was initiated more than two-and-a-half years ago, whereas WIIN was signed weeks ago,” he said in January.

GLDD: Keeping busy with NOAA, CPRA Contracts

At one of the big dredging companies, “we're working on two large, coastal restoration projects in Louisiana now – one for the National Oceanic and Atmospheric Administration, called Cheneire Ronquille, and the other for CPRA called Whiskey Island,” said Bill Hanson, vice president at Great Lakes Dredge & Dock. “We've been active in Louisiana since the current generation of coastal projects, including Pelican Island, Bayou Dupont, Scofield Island, Shell East and Shell West. These unique projects showcase the abilities of the nation's coastal engineering community and will serve Louisiana and the Gulf well in battling land loss. These projects have been challenging to implement and very satisfying to see to completion.”

GLDD was pleased to see WIIN signed into law. “In addition to many new projects, WIIN covers policy issues that will affect our marketplace for years to come,” Hanson said. “Among them are the cost-sharing provisions for maintenance dredging, continued HMTF reform, emphasis on regional sediment management and beneficial use of dredged material.”

Magnolia Dredge Replenishes Marshland

In a project completed early last year, Magnolia Dredge & Dock – working as a subcontractor – pumped material from the bottom of Lake Borgne at Alligator Point to assist in recreating nearly 500 acres of marsh, where land had eroded, Magnolia sales manager Michael Johnson in Mandeville, La. said. Healthy marsh absorbs storm surge and floodwater, protecting the coast. The project was under the auspices of a mitigation bank managed by Ecosystem Investment Partners, a private equity firm in Baltimore, Maryland.

Since the early 1980s, the nation's mitigation banks have helped manage natural resources longer term. In south Louisiana, mitigation banking sets standards for land restoration in compliance with a “no net-loss of wetlands” provision in the Clean Water Act. Credits for restoration are sold to developers with projects that might impact ecosystems adversely.

Separately, “other recent work by Magnolia includes industrial-environmental dredging to remove contaminants from waterways, and to restore and clean process ponds for South Louisiana’s petrochemical plants and paper mills,” Johnson said.

Potential big WIIN for the Mississippi

WIIN, which includes the Water Resources Development Act of 2016 or WRDA 2016, increases opportunities for the dredging industry. “The most important WRDA 2016 project for our Big River Coalition membership is deepening the Mississippi River ship channel from Baton Rouge to the Gulf to 50 feet,” Sean Duffy said. “WRDA 2016 reduces the non-federal, cost-share of channel deepening up to a threshold of 50 feet, from 50-percent federal and 50-percent non-federal to 75-percent federal and 25-percent non-federal. It expedites feasibility studies for three navigation-related projects and makes incremental improvements in Army Corps processes and data transparency, in harbor-maintenance spending targets, and in non-federal options for maintaining navigation channels.”

“If Congress provides the authorized funding, and the Corps completes these projects, WRDA 2016 will increase supply-chain transportation and port options and efficiencies,” Duffy predicted. Late last year, the Big River Coalition was glad to see the Army Corps' draft report and its Supplemental Environmental Impact Statement on deepening the Mississippi River ship channel, or MRSC, to 50 feet, Duffy said. The Coalition has been engaged with the Corps and its non-federal sponsor--the Louisiana Department of Transportation and Development--on this effort and believes that bringing the MRSC into the neopanamax future is critical. The Coalition will continue to assist the Corps and LDOTD to ensure the channel is deepened.

Equipment Availability Depends on Government Decisions

Nationally, “there weren't always enough hopper dredges in recent years to respond to needs,” Duffy said. “But by the end of this year, two new large hoppers will be available. Great Lakes Dredge & Dock will have their new ELLIS ISLAND, the largest hopper dredge in the nation, ready to begin work towards the second quarter of 2017. And Weeks Marine is constructing a large hopper dredge that should be on line by the end of the year.”

The navigation and dredging industries depend on federal appropriations, and if increased funding were annually consistent, industry would respond by building new equipment, Duffy said. Navigation would benefit from having better-maintained channels. Meanwhile, the average, per-cubic-yard cost of using cutterhead dredges declined in the last few years because of a perceived abundance of cutterheads, he said.

(As published in the February 2017 edition of Marine News)

Read Louisiana Dredging Outlook in Pdf, Flash or Html5 edition of February 2017 Marine News

Other stories from February 2017 issue

Content

- Interview: Rear Admiral Paul Thomas, USCG page: 12

- Plan for Safety: Leadership is Key page: 20

- ShipConstructor Drives Automatic Welding Robots page: 24

- The Looming sVGP Deadline page: 28

- Louisiana Dredging Outlook page: 31

- DSC Dredge Digs In page: 36

- WRDA 2016: Reclaiming Our Transportation Infrastructure page: 41

- Best Practices for Successful Casualty Investigations page: 44

- Marine News Boat of the Month: February 2017 page: 52

- Tech File: Harken’s TR31 Tight Radius Rail and Trolley System page: 77