Market Report: The Work Class ROV Market

Demand for work-class ROVs (WROV) has traditionally been determined by the state of the global offshore oil & gas industry. This is likely to remain the case in the short to medium-term. However, there’s a new kid on the block – offshore wind. Growth in this sector is seen as a key enabler for northern hemisphere countries (with access to a coastline and suitable wind conditions) to hit net zero.

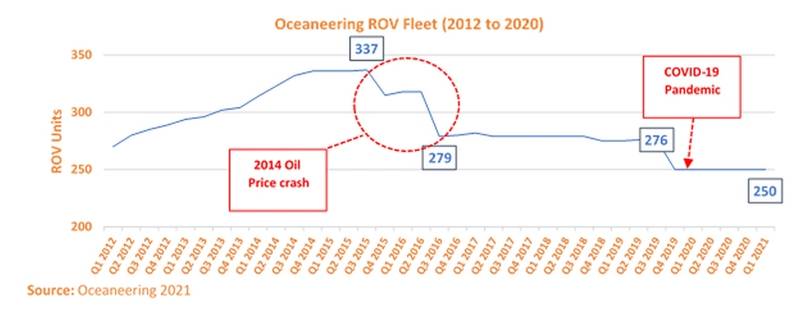

What does this mean for WROV demand? Following the 2014 oil price crash, many major ROV operators reduced their fleet size considerably. Oceaneering, which has the world’s largest fleet of WROVs, cut its fleet from 337 units in the third quarter of 2015, to 279 units by the end of the Q3 2016.

Struggling to boost utilization, many ROV operators turned towards the burgeoning offshore wind sector, particularly in Western Europe. Independent ROV operator ROVOP, for example, claims to have been ‘born’ out of the offshore wind industry, with early asset utilization coming purely from work scopes connected to offshore-wind projects. While offshore wind could not completely fill the vast void in demand left by the oil price crash, it did begin to dampen the effect and even provide opportunities, particularly to some of the smaller, independent companies in the ROV market, like ROVOP, C-Ventus, Bluestream, and more recently ROVCO.

Chart courtesy Archer Knight

Chart courtesy Archer Knight

Fast-forward a few years and just as WROV demand in the traditional oil & gas sector had stabilized and started to show signs of growth, the industry was hit with the shock of the global pandemic.We have yet to see how the sector will recover as economies begin to open and demand for energy increases. But offshore wind is again likely to dampen the effect and, as we look to the future, is set to play an increasingly significant role in the overall demand for WROVs.

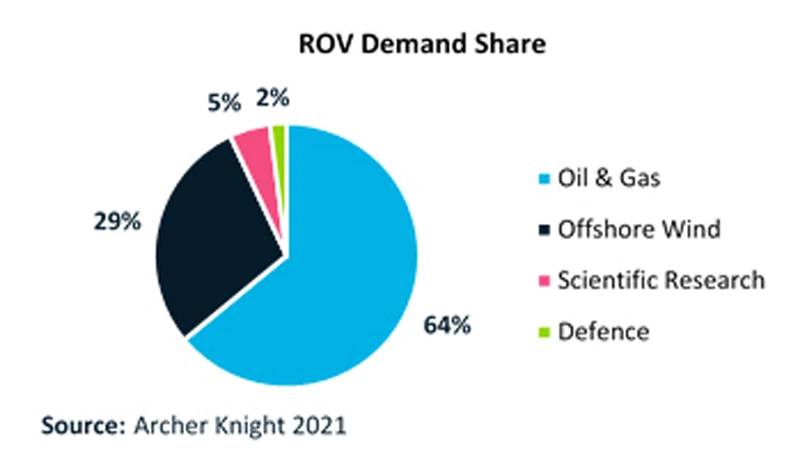

At Archer Knight, our analysis, suggests that offshore wind now accounts for around 29% of global ROV demand . However, this still leaves the oil & gas sector with around a 64% demand share, with the rest made up of demand from the defense and scientific research sectors.

As of 2021, we estimate the global fleet of WROVs to sit at around 900 units, many of these units are relatively old and operators have a decision to make: should they invest in new, more-efficient electric WROVs, or continue to operate with older fleets and attempt to extend their life.

Although, growth in offshore wind will increase demand, to date many WROV requirements have predominantly been serviced through utilization of the excess supply previously targeting the oil & gas sector.

Our view is that demand will continue for new WROV units, but we expect to see a recalibration. This will lead to the oil & gas sector WROV operators running their existing fleets for as long as possible, until they see growth both in traditional and new markets. After the struggles of the last three to five years, and the global focus on reduced emissions, more efficient, electrically powered units will also become more prevalent.

Read Market Report: The Work Class ROV Market in Pdf, Flash or Html5 edition of May 2021 Marine Technology