Market Vision with Wartsila s Ole Johansson

On the occasion of the SMM 2004 exhibition in Hamburg last month. MR had the opportunity to speak with Wdrtsilci's President and CEO Ole Johansson to discuss conditions in the international maritime market.

— By Greg Trauthwein Challenges facing today's corporate manufacturing leaders — particularly those in the marine propulsion segment — are diverse and seemingly ever changing. Faced daily with a burgeoning list of technical, political, and social issues, survival for the long run seemingly depends on building and maintaining a strong organization while balancing the quickening and irreversible shift of manufacturing from the West to the Far East; the ubiquitous and ever-tightening environmental regulation; and the shipowner's demand for increased reliability.

easier maintenance and better fuel efficiency.

In a nutshell, Ole Johansson is a busy man.

Balanced with these challenges: the marine industry is embarked on a historic high. "It is a surprisingly good market ... you can feel it." said Johansson.

While 'feel' is subjective, this euphoria is backed with solid numbers, as he reported in the company's 2003 Annual Report: "The year 2003 will remain one of the most active in the history of the shipbuilding industry: the world's shipyards took in orders for more than 1,800 (vs. 1,100 the previous year) new vessels representing 108 (vs. 52) million dwt." Charged to oversee and lead Wartsila - a company with 12.000 employees and 2003 net sales exceeding 2.3 billion Euro — Johansson has been embarked to streamline the organization, postioning it as "The Ship Power Supplier", a literal one-stop-shop for marine power needs.

Bringing this strategy to fruition required several key acquisitions over the past decade, starting with the merger of New Sulzer Diesel, which allowed the company to extend its reach into the slow speed diesel engine market.

"Stepping into the low speed end of the engine market was a major piece of making Wartsila a major player in the major market." Johansson said. While he admits that the company still has much work ahead in its effort to gain market share, it is clear that this corporate integration, along w ith the purchase of John Crane Lips, helped to broaden Wartsila from an engine maker and embarked it upon the road leading to single source system provider.

While the path may be clear, the journey is not without pitfalls.

Heading East ... Far East The trend of manufacturing operations migrating from Europe to the Far East is hardly new or confined to the the shipbuilding industry. However, as shipyards in China make technological leaps, the pace will surely quicken as the country, combined with traditional powers in Japan and Korea, continue to sap business from the west. While Johansson acknowledges the sound business principles for setting up shop in China, he views the migration of manufacturing with a certain amount of trepidation.

"We have a very proud tradition of engineering, and 1 see this trend (of manufacturing moving from Europe) as irreversible." he said. While necessary to keep the corporation functional and profitable, he counts the need to close factories, which inflicts much personal hardship, as the least favorite aspect of his position. Nevertheless, Johansson is committed to ensuring that Wartsila is the single source technological and service leader, and is bound to implement a production strategy which delivers to the company's customers where ever they may be found.

Increasingly, this means China.

Starting in June of this year Wartsila- CME Zhenjiang Propeller Co. Ltd, the joint venture company set up by Wartsila and CSSC (China State Shipbuilding Corporation) to manufacture propellers in China, started operation.

The move brings Wartsila close to its Asian customers, while also allowing low-cost manufacturing and higher business volume through local manufacturing.

Wartsila-CME Zhenjiang Propeller Co. Ltd. will produce Lips- and Kaidabrand FPPs initially up to a weight of 75 tons but this will be increased to conform market requirement as production equipment is upgraded. Production volume will start at around 1,000 tons of propellers a year, growing gradually to an estimated 4.000 tons after 10 years.

In addition, Wartsila looks for opportunities to start other propulsor related production and works to explore the construction of smaller, high volume genset engines in China.

All in One The trend toward corporate consolidation is well established over the past decade, and is evident across the broad spectrum of manufacturing and service entities around the world. As Wartsila has gotten larger, so too has its clients.

"Large shipowners continue getting larger. Where as we used to discuss engines for one or two ships, we are now discussing engines for 10 or 12," said Johansson.

As owner's fleets get larger, so to does the need for uniformity, which offers obvious life-cycle benefits on the maintenance and technical sides. Johansson maintains that shipowners today are more prone to enter discussions for the larger, integrated package, and while the company is structured to provide an all in one solution, it is flexible to meet most any demand.

We basically have two types of customers, he explained. The first are shipyards that have strong engineering staffs, and have a long track record of pride and reputation. This customer is more likely to buy individual components and integrate them at the shipyard.

The other type of customer are newer shipyards with less experience, hence they have less established trust with the owners.

In this case, the integrated solution is attractive, as it lessens demands on the yard while inspiring a confidence within the shipowner.

Read Market Vision with Wartsila s Ole Johansson in Pdf, Flash or Html5 edition of November 2004 Maritime Reporter

Other stories from November 2004 issue

Content

- Austal Launches 417 ft. Aluminum Ship page: 9

- Design Completed for Steamship Authority Ferry page: 9

- Blount to Deliver MV Isleno page: 10

- SF Bay Ferry Logs Impressive Performance page: 11

- NASSCO Holds Ceremony for Fourth BP Tanker page: 12

- K&C Wins $6M Navy Contract page: 12

- Air Emissions from Ships page: 14

- Shipboard Training Comes of Age page: 17

- Demystifying Parametric Roll page: 20

- A Bright Spot in Oil Patch Vessel Construction page: 26

- Senesco Marine Signs Contract For 140,000-Barrel DH ATB page: 30

- Coffee Company Investigates MContainer-on-BargeM Service page: 31

- USCG Invests in Low Engine Exhaust Temps page: 33

- Seacraft Delivers RV Hercules page: 36

- Caterpillar Gets "ACERT"-ive page: 37

- Making the Mark For Crescent Towing's Fleet page: 40

- The New Wartsila 46F page: 41

- Market Vision with Wartsila s Ole Johansson page: 42

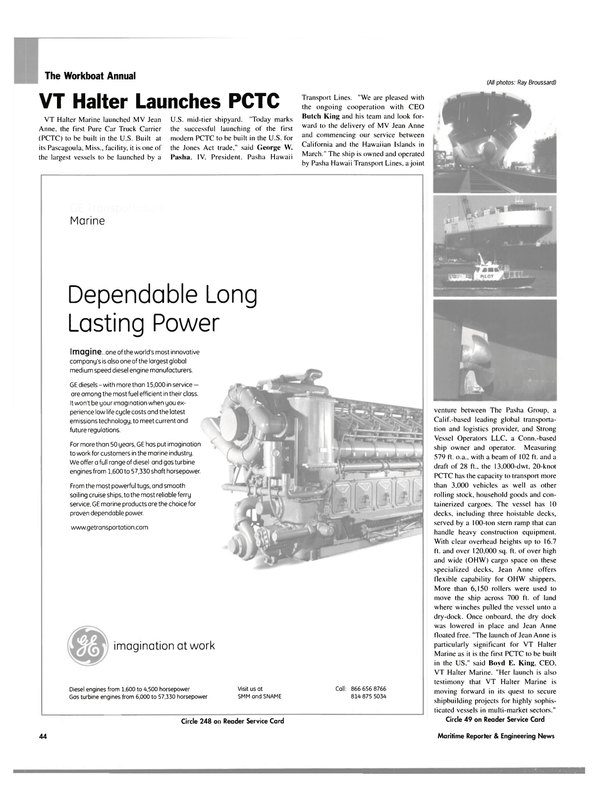

- VT Halter Launches PCTC page: 44

- Aluminum Industry Continues Support for the Marine Market page: 46

- Film Celebrates Golden Age of NW Boats page: 47

- Pressure Transmitter Receives ABS Approval page: 48

- Fire Prevention: "Rising" to the Occasion page: 48

- For Those in Peril page: 50

- A Future in Composites page: 52

- Extra Value in Chinese Construction page: 53

- Record Spend on Propulsion? page: 54

- Collaboration Creates Vehicle for CNG Solutions page: 56

- Milestone Reference with MAN B&W page: 58

- The Will for Business page: 58

- Wider Remit for Dutch Matchmaker page: 58

- 2n d Generation Onboard NAPA Tanker Released page: 58

- Nichols Named "Maritime Man of the Year" page: 59

- ACBL Makes Appointments page: 59

- International Paint Japan K.K. - Open for Business page: 60

- European Yard Initiative - Will it Work? page: 62

- A.P. Meller-Maersk Creates Dedicated Tech Group page: 64

- SembCorp Signs Breakthrough, Long Term LNG Deal page: 66

- Keppel Batangas Completes SemiSub Repair page: 68

- A&P Tyne Re-Delivers FPSO Haewene Brim page: 68

- Crane Materials Launches TimberGuard page: 70

- Fincantieri Orders Water- Lubed Shaft Bearings page: 70

- Bilge Water Treatment Unit Approved By LR page: 71

- Electric Propulsion for Coastal Ships page: 72

- ALSTOM Wins $102M Navy Deal page: 73

- Offshore & Marine Chose Vacon AC Drives page: 73

- Successful Full Load Operation of 5-MW Ship Propulsion Motor page: 74

- Innovative Tweendeck Patented in U.S. page: 76

- MAN B&W Records Busy Hamburg Show page: 77

- Transas Demonstrates New Tech at SMM page: 77

- BV Launches Project Management Solution page: 78

- Xantic Offers New Web-Based Tool page: 79

- New AIS Targets U.S. Workboat Market page: 80

- Hepworth Makes a Good Show at SMM page: 80

- New PVC-Free Alternatives for Interior Decoration page: 80

- A High-End Global Satcom Presence page: 82

- IPS Marine Lands New Blue Chip Casino page: 85

- Rigdon Marine Promotes Harkness to CFO Post page: 85

- Tidewater: Effects of New Tax Bill Are Positive page: 86

- Bollinger to Design, Build Five DH Hot Oil Barges page: 87

- B+V Wins Passenger Ship Contract page: 88

- In Remembrance: Captain Fred Kosnac Jr. (1928-2004) page: 92

- Electronic Charting Aboard APL China page: 93

- Electric Boat Optimizes Nuclear Sub Repairs page: 94

- Kramek, Liu Snare Top SNAME Honors page: 97