Page 75: of Offshore Engineer Magazine (Oct/Nov 2014)

Read this page in Pdf, Flash or Html5 edition of Oct/Nov 2014 Offshore Engineer Magazine

West Africa to these sub-regions relatively ? at. Despite

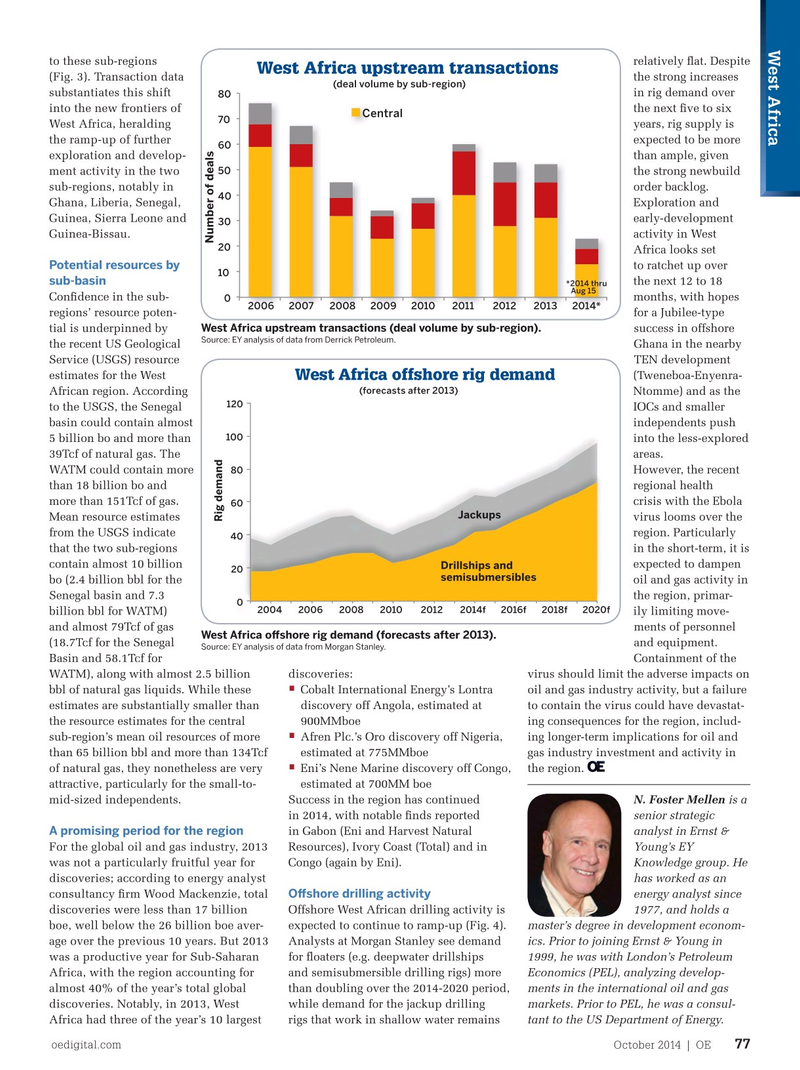

West Africa upstream transactions (Fig. 3). Transaction data the strong increases (deal volume by sub-region) substantiates this shift in rig demand over 80 into the new frontiers of the next ? ve to six

Central 70

West Africa, heralding years, rig supply is the ramp-up of further expected to be more 60 exploration and develop- than ample, given 50 ment activity in the two the strong newbuild sub-regions, notably in order backlog.

40

Ghana, Liberia, Senegal, Exploration and

Guinea, Sierra Leone and early-development 30 local ? rms. Guinea-Bissau. activity in West

Number of deals 20

The Derrick data by deal type shows Africa looks set

Potential resources by the maturation of the region since 2006. to ratchet up over 10 sub-basin

Transaction activity in the early years is the next 12 to 18 *2014 thru

Aug 15 dominated by new exploration awards Con? dence in the sub- months, with hopes 0 2006 2007 2008 2009 2010 2011 2012 2013 2014* and then, in turn, followed by increasing regions’ resource poten- for a Jubilee-type

West Africa upstream transactions (deal volume by sub-region).

farm-in activity and the inevitable relin- tial is underpinned by success in offshore

Source: EY analysis of data from Derrick Petroleum.

quishment of some blocks. A new round the recent US Geological Ghana in the nearby of exploration awards can also be seen Service (USGS) resource TEN development starting in 2010. estimates for the West (Tweneboa-Enyenra-

West Africa offshore rig demand (forecasts after 2013)

Like historical oil and African region. According Ntomme) and as the 120 gas production in the to the USGS, the Senegal IOCs and smaller region, deal activity has basin could contain almost independents push 100 been concentrated in 5 billion bo and more than into the less-explored the central sub-region, 39Tcf of natural gas. The areas. anchored by Nigeria WATM could contain more However, the recent 80 and Angola, along than 18 billion bo and regional health with Gabon, Congo, more than 151Tcf of gas. crisis with the Ebola 60

Jackups

Democratic Republic Mean resource estimates virus looms over the

Rig demand of Congo, Cameroon from the USGS indicate region. Particularly 40 and Equatorial Guinea. that the two sub-regions in the short-term, it is

However, the Derrick contain almost 10 billion expected to dampen

Drillships and 20 semisubmersibles data (Fig. 2) shows bo (2.4 billion bbl for the oil and gas activity in that transaction activ- Senegal basin and 7.3 the region, primar- 0 2004 2006 2008 2010 2012 2014f 2016f 2018f 2020f ity has increased in billion bbl for WATM) ily limiting move- the other two less- and almost 79Tcf of gas ments of personnel

West Africa o

74

74

76

76