LNG Shipping— What Prospects Now?

In recent months, there have been many press and industry reports to suggest a growing interest in LNG shipping, the reports being a mixture of favorable and unfavorable news for owners and operators of LNG carriers, but leaning toward a generally improved outlook for LNG shipping.

This apparently improved outlook is in contrast to historical developments in world LNG shipping expectations. The anticipated future boom in LNG shipping demand, which has consistently been forecast since the inception of seaborne LNG export trades in the mid-1960s, has continually suffered postponement in the past.

The result is that at mid-1977, there were still only nine baseload LNG export trades in operation, which together generate a shipping capacity requirement of only 1.5 million cubic meters per annum, while the existing supply of LNG carriers is almost 2.9 million cubic meters, nearly double that level. Indicatively, at end-July 11, LNG carriers aggregating 1.2-million-cubic-meters capacity were laid up or had been inactive for two months or more.

At present, therefore, there is a gross oversupply of very expensive shipping capacity in the LNG trades, a situation which, on the basis of currently scheduled future developments, will not be corrected until at least 1982.

However, during the next eight years as many as 15 new LNG export projects could come onstream, and these could increase world LNG shipping requirement in 1985 to as much as 15.1 million cubic meters per annum, 7.6 million cubic meters more than the total capacity of the LNG fleet currently scheduled for 1985.

From the known planned developments in world LNG export trades and LNG shipping supply, the expected future balance in LNG shipping supply / demand, expressed in numbers of the popular-sized 125,000-cubic-meter ship, can be calculated as follows: (Supply Surplus) end of year 1977, number of ships 9; end of '78, number of ships 12; end of '79, number of ships 19; end of '80, number of ships 18; end of '81, number of ships 17; (Supply Deficit) end of '82, number of ships (8) ; end of '83, number of ships (40) ; end of '84, number of ships (53) ; and end of '85, number of ships (61).

Between now and 1985, therefore, as many as 61 new orders for 125,000-cubic-meter-sized LNG carriers could be necessary to meet the incremental LNG shipping demand forecast to be generated between 1982-85. However, the expected acceleration in LNG shipping demand in this latter period is still uncertain. The boom in LNG shipping could be postponed, once again, to beyond 1985.

Recent developments improving the outlook for LNG shipping include the coming on-stream or the impending startup of some new projects and a reaffirmation of the status of other future projects. The Abu Dhabi Das Island gas export project came on-stream at the end of April, although deliveries to Japan, and indeed the entire operation, have been held up due to the cargo contamination by metal bolts, suffered in the first shipload. This suspension (which involves stripping down most of the hardware involved — liquefaction plant, the gas carrier and reportedly the shipyard) will continue until the source of the bolts is located.

Two other major trades are due for imminent startup: (a) the first half of the Indonesia—from Badak in East Kalimantan — to Japan LNG export project due to have started August 1 (the second half — from Arun in North Sumatra — is scheduled to come on-stream early in 1978), and (b) the first major trade to USEC, known as the El Paso I project, which should be on-stream from Algeria before end-1977. Algeria has recently contracted with German and Dutch gas importers for LNG exports to Wilhelmshaven and Rotterdam beginning in 1984, while the USEC-destined Panhandle (Trunkline) project has been given FPC approval though under condition of incremental gas pricing to consumers, rather than the preferred averaged-in price system.

Elsewhere, other possible future projects have advanced, notably those in Nigeria and Malaysia, where construction of liquefaction plant is soon due to begin, also in Indonesia, where expansion of existing newbuilding gas export plant is being contemplated, and on the N.W. Shelf Australia, where gas exports by 1985 look highly likely, despite the lack of any definite plans concerning the siting of liquefaction plant, the export volumes available, or finance. In Canada, Arctic natural gas has also excited topical interest, and liquefaction plant engineering studies for Melville Island reserves are in progress, while tenders have reportedly been placed with shipyards for suitable LNG carriers. Other reports concern the possibility of massive Swedish LNG imports and the continued Soviet desire to enter the LNG exporters club with trades to the U.S. and Japan, who would also provide both finance and technology.

However, press reports unfavorable to LNG have also been in evidence, with U.S. political involvement being a major factor.

Lack of FPC approval has forced the cancellation of the Algeria- USEC Eascogas project, though this may be recontracted at lower import volumes. Two Burmahcontrolled ships for the Eascogas trade have been switched to the Indonesia-Japan trade and replace the last two newbuilding vessels required here, which now become possible cancellations. Two other Algeria-USEC projects, Tenneco and El Paso II, are still awaiting FPC approval, with decisions being expected before end-1977, while USWC LNG import projects remain highly uncertain.

FPC recommendations for pipeline imports of Alaskan gas seem to rule out new Alaskan supplies of LNG, while Californian import terminal approvals are still being sought for Indonesian LNG supplies.

If successful, environmental pressures forcing LNG reception sites offshore in California would ensure that no USWC LNG imports could begin prior to 1985.

Further reports have also detracted from the otherwise more buoyant LNG market outlook.

These reports involve negotiations for the postponement of delivery of newbuilding LNG carriers, the unworkable economics of LNG exports from the Middle East Gulf to USEC and West Europe, and the reopened Algeria- Italy pipeline gas export contract (which presumably undermines a planned LNG shipping project between the same parties).

In summary, prospects for LNG shipping have improved slightly in the past half year, but the immediate outlook remains depressed due to the expected excess shipping supply up to 1982.

However, the prospect of potential LNG shipping demand growth beyond 1981 is a plus point, but this growth rests on plans that are liable to postponement in the future.

The scheduled world LNG export projects and LNG fleet statistics used here will be analyzed and discussed in detail in a forthcoming H.P. Drewry Survey, "LNG Marine Transport Costs and Revenues," which is scheduled for publication in autumn 1977. For further information, write to H.P. Drewry (Shipping Consultants) Limited, 34 Brook Street, Mayfair, London W1Y 2LL, England.

Read LNG Shipping— What Prospects Now? in Pdf, Flash or Html5 edition of October 1977 Maritime Reporter

Other stories from October 1977 issue

Content

- Ocean Orders Three Cargo Liners From British Shipyard page: 4

- $11-Million Award To Raymond Int'l For Dock Work In Nigeria page: 4

- Shipyards Will Bid On Matzer-Designed Ro/Ro Containership page: 6

- James A. Farrell Jr. Receives Admiral Of The Ocean Sea (AOTOS) Award page: 6

- Bethlehem Beaumont To Build Teledyne Drilling Platform page: 6

- Newport News Lays Keel For First ULCC In $418-Million Contract page: 6

- Chesapeake Corporation Names Elmer Curfman Marine Superintendent page: 7

- LNG Shipping— What Prospects Now? page: 8

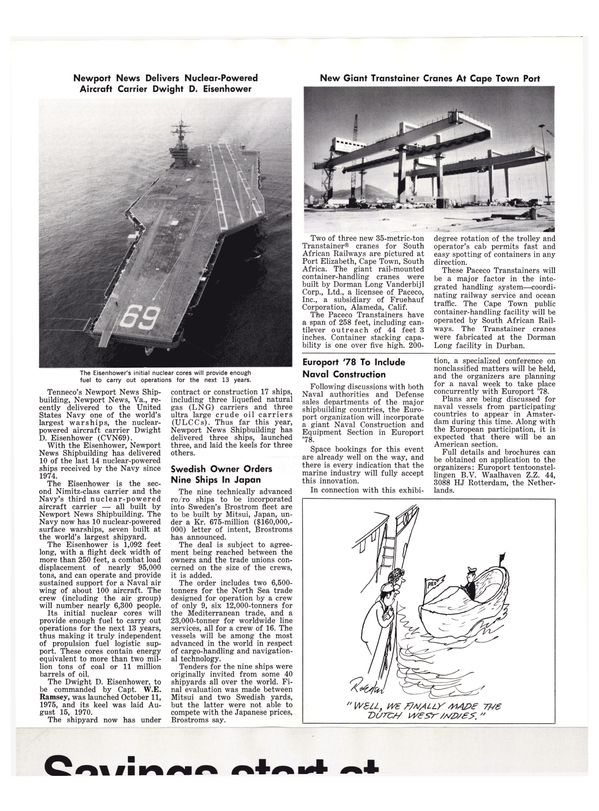

- Newport News Delivers Nuclear-Powered Aircraft Carrier Dwight D. Eisenhower page: 10

- American Bureau Of Shipping Elects Johnston President page: 10

- DeLong Corporation Appoints Ogden Chief Engineer page: 10

- Dockside To Represent Burmeister & Wain In Southern California page: 11

- Sun Company Names Maling Vice President page: 11

- Atlantic Sandblasting Receives Fourteen-Ship Mexican Contract page: 12

- Bethlehem Steel Names Thomas Robinson To Central Technical Post page: 14

- Paul Atkinson Retires, Peter Hepp Elected Sun Ship President page: 14

- Todd To Build Santa Fe Pipelaying Vessel page: 15

- OCEANS '77 Conference Set For October 17-18-19 page: 16

- Hitachi Delivers 508,731-DWT Esso Atlantic —Largest Ship Ever Built In Japan page: 18

- Alco Power Southwest Headquarters In New And Larger Houston Location page: 18

- Zapata Names Four Senior Executives To New Posts page: 18

- Booklet Describes Vinyl Coatings For Corrosion Control page: 18

- Crowley Subsidiary Awarded $39-Million Cool Barge Contract page: 20

- ABS President Foresees Trend Toward Nuclear Merchant Ships By 1990 page: 21

- Oosterhuis Industries Supplies American Brons Diesel Engines To Five New Offshore Tugs Ship Buying Spree page: 22

- Carrington Launches Self-Unloading Cement Carrier page: 22

- Bird-Johnson Appoints National And Regional Sales Managers page: 23

- Ro/Ro Shipping-An Appraisal Of Its Role In Dry Cargo Trade page: 24

- Leif Hoegh Orders Two Multipurpose Ships From Japanese Yard page: 25

- Hyundai Shipbuilding Licensed To Build B&W Diesel Engines page: 25

- Chinese On Worldwide Ship Buying Spree page: 26

- Senior USCG Advisor Robert Lakey Joins Helge Ringdal, Inc. page: 26

- Five Companies Form Technology Group To Build Canadian Ships page: 27

- Intermarine Brochure Fully Describes New Marine Radar page: 28

- Shipowners Seek To Enjoin Alaska State Tanker Law page: 28

- Avondale Launches 165,000-DWT Tanker For Standard Oil (Ohio) Alaskan Service page: 29

- R.E. Derecktor Delivers Tug To Great Lakes Dredge & Dock Co. page: 30

- Northeast Marine Terminal Announces Start Of Affiliate Operation In Savannah, Ga. page: 31

- American President Lines Names Capt. E.J. McClafferty page: 31

- Maine Maritime Academy Shipping Management Seminar Labeled Outstanding Success page: 32

- Nuclear Merchant Ship Environmental Impact Analysis Published page: 34

- Paper On Drydock Designs Presented At San Diego Meeting page: 34

- Schneider And Moody Named To New Posts At Moore-McCormack Lines page: 34

- Burmeister & Wain Opens Marine Service Center In Hong Kong page: 34

- Packet Offered On Hiring Filipino Seamen page: 35

- Prudential Lines Names Captain George Evans page: 35

- Brochure Describes Removal Of Smoke From Air Vents page: 35

- Maritime Industry Metric Conversion Study Is Available page: 36

- Interocean Conducts Inert Gas Course page: 36

- Gotaverken Delivers Third Tanker For Iraq page: 36

- Crossocean Shipping Names Thomas Giardino page: 36

- Johnston Vertical Pumps Names Hoffert Marine page: 36

- MarAd To Study Liner Segment Of U.S. Merchant Fleet page: 37

- United States Lines Names Capt. Yarborough Assistant Marine Supt. page: 39

- Varo Names Johnson Marine Coordinator page: 39

- American Club Triples Tonnage In Five Years page: 39

- Device Prevents Cable From Becoming Tangled With Buoy Lines page: 42

- Sea Power Symposium Set For Los Angeles November 4, 1977 page: 42

- MarAd Releases 15 Technical Reports On Gas Turbines page: 42

- Bath Iron Works Appoints Igo Jekkals page: 43

- Webb Institute Receives Grant For Research Facilities page: 43

- Mechling States All Modes Necessary For Sound System page: 44

- Gonsoulin Industries New Mother Company For LeBeouf Towing page: 44

- ABS Reports Increase In Classifications page: 44

- APL Team To Analyze Systems Controlling Steam Plants On Ships page: 45

- Campbell Delivers Second Offshore Vessel To Biehl page: 46

- Stow Introduces New Remote Valve Control Flexible Shaft page: 46

- U.S. Navy Officers Assigned To Kings Point page: 46

- Owners Strongly Oppose Federal Financing Bank Control Of Title XI page: 47

- World's First Naval Exposition Set For Netherlands June '78 page: 48

- Eleven New Members Elected To American Bureau Of Shipping page: 48

- CCL Shipcare Limited New Marine Service page: 48

- Camar Develops Blowers Designed For Shipboard Inlet Gas Systems page: 50

- New Maritime Firm Port Fabricators, Inc. Active In Louisiana page: 50

- Report Shows 101 Plants Locate Waterside In First Quarter Of 1977 page: 51

- Edwin G.B. Terry Joins Tidewater Marine Service page: 53

- Waterproofed Engines On Self-Righting Lifeboat Restart Following Capsize page: 53

- Port Of St. Louis Propeller Club Elects Robert Patrick page: 54

- Lloyd's Register Announces Major Changes For 1978 page: 54

- Maxon Marine Industries Delivers Specially Designed Towboat To J.L. Shiely Company page: 55

- SNAME Publishes 'Gas Trials Guide For LNG Vessels' page: 55

- DeLong Jack Systems Described In Brochure page: 55

- James J. Bolton Elected President Jered Industries page: 56

- North American Philips Offers New Radio Telex System For Shipboard Communications page: 58

- Mangone Delivers 185-Foot Supply Vessel To Briley page: 58

- Britain's P&O Group Designs New Type Naval Vessel To Be Built In Private Yards page: 60

- Equitable Lays Keel For First Of Three Breakbulk Vessels For American Atlantic Shipping page: 60

- Study Of Superports And SBMs For Tankers Published page: 63

- Blue Water Marine Forms New Division —George Gray Named page: 64

- Buenos Aires And Manila Added To ABS Network Of Technical Offices page: 64

- American Heavy Lift Shipping Company Names Two Top Executives page: 64

- W.L. Bull Jr. Named Marine Transportation Director For NLFI page: 65

- Marco's 25th Crabber Readied For King Crab Season Opening page: 66