Cruise Share Performance

Towards the end of 1999, the stock market had shaken off concerns about the economy becoming too strong, interest rates had backed up and the general economy was sound. The S&P had moved back into positive territory, led by a rally in the technology sector and assisted by oversold sectors such as the retailers.

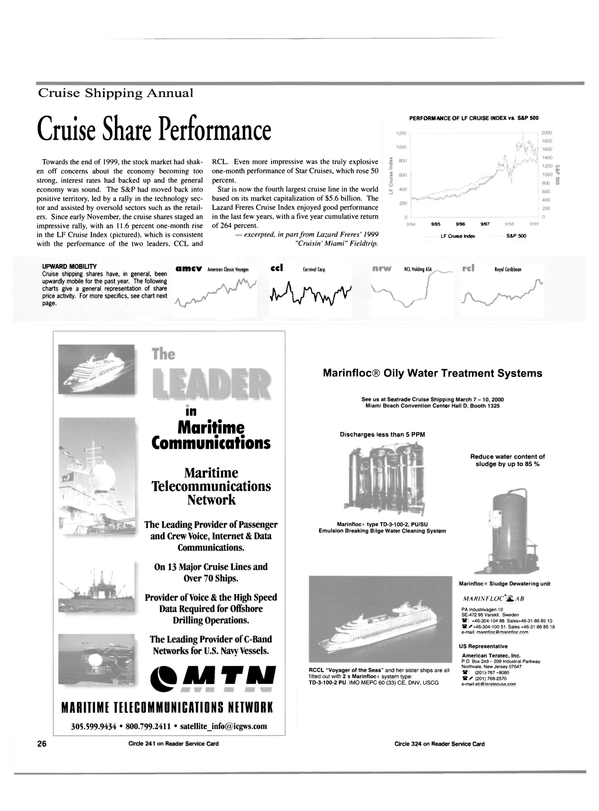

Since early November, the cruise shares staged an impressive rally, with an 11.6 percent one-month rise in the LF Cruise Index (pictured), which is consistent with the performance of the two leaders, CCL and RCL. Even more impressive was the truly explosive one-month performance of Star Cruises, which rose 50 percent.

Star is now the fourth largest cruise line in the world based on its market capitalization of $5.6 billion. The Lazard Freres Cruise Index enjoyed good performance in the last few years, with a five year cumulative return of 264 percent.

— excerpted, in part from Lazard Freres' 1999 "Cruisin' Miami" Fieldtrip

Read Cruise Share Performance in Pdf, Flash or Html5 edition of February 2000 Maritime Reporter

Other stories from February 2000 issue

Content

- Bergesen Orders Four Tankers From Hitachi page: 7

- Chuan Hup Unit Secures PB Contract page: 7

- A model approach from the Swedes page: 8

- Innovative class for the banana trade page: 9

- Propeller Milestone Achieved By U.S. Navy page: 10

- Propeller & Shafting Symposium Planned page: 11

- PropacRudder Benefits Confirmed In Service page: 12

- E&P Spending 2000: Boom or Bust? page: 14

- New Government Statistics Show Larger, Diverse Fleet page: 15

- ATB Delivered by Alabama Shipyard page: 16

- Cruise Shipping Annual The New "Class" of Celebrity's Class page: 19

- Cunard Creates The Classic Liner (Again) page: 24

- Cruise Industry Leaders To Convene At SeaTrade page: 25

- Cruise Share Performance page: 26

- Litton Marine Systems Supplies IBS Order page: 27

- MSC Europe Experiencing Steady Growth Stream page: 27

- James P. Colie Completes Cruise Ships Refurbish page: 29

- New Cruise Ship Designs Impact Terminal Ops And Logistics page: 31

- Royal Caribbean Commits To Environmental Endeavors page: 34

- Superseacat Service To Be Launched page: 35

- Strong Finish To A Strong Year In Oslo page: 37

- New MaK M 43 Series Aids German Branch page: 38

- Isotta Fraschini Marine Diesel Engines Available on W. Coast page: 38

- DeJong & Lebet Assists On Vessel Conversion page: 40

- Coastal AIS Stations with Radars: High-Efficiency Monitoring Facility page: 44

- Supporting The Technical Revolution page: 46

- Cadkey 99 Offers Powerful Features page: 48

- Where Businesses And Consumers Can Mix page: 48

- BT Unveils E-Commerce Site page: 48

- Finnish Innovation Ascends New Heights page: 50

- AKER FINNYARDS page: 50

- Keeping Machinery Spaces Safe page: 53

- Kvaerner Masa-Yards Delivers page: 54

- Record Trade Surplus Boosted By Shipsales page: 55

- Allied Systems Delivers SOLAS Approved Davit page: 55

- GDHS Launches Friobox Express page: 56

- Schoellhorn-Albrecht Supplies Deck Equipment page: 58

- Golden Ocean Reaches Agreement; Announces Resignation page: 58

- GD Appoints Welch As Snr. VP page: 60

- Furuno Introduces CH-37 Sonar page: 60

- STN Introduces New Speed Log page: 60

- NASSCO Lands First Phase Of Ship Conversion page: 65

- Derecktor Shipyard Wins Contract For Two Pilot Boats page: 66

- Gladding-Hearn to Deliver Largest Incat Fast Ferry page: 67

- Bollinger Launches Ocean Intervention II page: 70

- SeaArk Delivers Commander To Passaic Valley page: 70