Teledyne Technologies

-

- Ocean Influencer: Mike Read, Teledyne Marine Marine Technology, Jun 2020 #39

Teledyne Marine is no stranger to the MTR reader, a group of leading-edge marine and subsea technology companies that are part of Teledyne Technologies Inc. and a driver of consolidation in the subsea sector for more than a decade. At the helm sits Mike Read, President, who has held a steady hand over the evolution of Teledyne Marine, through market cycles up and down.

Through acquisitions and collaboration over the past 10 years, Teledyne Marine has evolved into an industry powerhouse, bringing imaging, instruments, interconnect, seismic and vehicle technology together, today encompassing 23 brands grouped in three integrated verticals run by 1,500 employees globally.

2020 is significant for the evolution of Teledyne Marine, as it marks the culmination of its five-year effort to create ‘one’ Teledyne Marine with a one common ERP system, one global sales and service team, and one common software platform – Teledyne Marine Software (TMS) – across its 23 brands. Read said “TMS is particularly strategic, enabling the Instruments and Imaging products to communicate seamlessly. You can imagine all of the different software packages; it was all over the map, which is understandable. Now we’re working towards all of these products communicating seamlessly, producing better data, and delivering a better user experience.”

The integration of Teledyne Marine into three verticals – the large interconnect business; instruments and imaging; and vehicles – is particularly timely as one of its largest customer segments, the offshore energy business, is enduring another slump, magnified by the COVID-19 pandemic, and oil majors and large engineering firms alike are streamlining operations and technologies to be profitable with a $40 price per barrel of oil. “All operational excellence metrics are now centralized,” said Read. “We’ve made Teledyne Marine stronger, focused on global service levels, with a robust development strategy on the product side. We’ve stopped a lot of small developments, instead focusing on ‘Top 10 New projects.’ We’re looking forward to the remainder of this year, and the next five years where hopefully pandemics are not on the menu.”

People to PeopleWhile companies like Teledyne Marine are geared toward the creation of products and systems that help make the ‘dull, dirty, dangerous’ jobs safer and more efficient, ultimately it is a people business. “As effective as Zoom and Webex can been, there’s no doubt that this is a people to people business,” said Read. “We like to have our customers come in to brainstorm with our people, and our customers like to come here with their problems. In addition, we manufacture a large amount of hardware every year, so our production people have to come to work. But it’s always safety first; and (with the advent of COVID-19) we’ve been able to make our facilities even safer.”

Looking ahead, Read sees ample opportunity; “In each of the markets we serve there’s a little bit of good news.”

In Read’s estimation, the first bit of good news for Teledyne Marine is that it’s part of Teledyne Technologies, “a diverse company that has acquired more than 65 companies over the last 20 years. Our parent company is very diverse; we are strong as a company,” said Read. “At the marine level, we have a strong offshore energy business (providing) the majority of the electrical & optical interconnect to the sector. We are the market leaders.”

On the military side, Read said the company is fortunate that there are a lot of subsea defense applications, led by the U.S. Navy, whether it’s building nuclear submarines, whether it’s building mine countermeasure vessels, whether for the U.S. Coast Guard or for foreign navies. “That market today is more active than it ever has been.” He said the advantage of the integration of Teledyne Marine into ‘one’ is particularly clear on the military side, as it is able to offer bundled packages – from Gavia AUV’s, to Seabotix ROVs, to multibeam sonar on the ship itself, for example. “We do that now with one Teledyne Marine, and we could not have done that five years ago as a wholistic opportunity.”Looking for new opportunities, the company recently entered the marine construction sector. Business opportunities in dredging, as harbors deepen for ever larger ships; and in the business of clearing harbors for the decommissioning of old and construction of new bridges is vibrant and growing.

Read adds, “We continue to package and align our technologies for new and exciting emerging markets. As experts in real-time underwater vision, we’re combining our technologies and partnering with organizations such as Trimble and DSC Dredge to provide operators of heavy machinery on barges and dredges with tools to improve their efficiency and effectiveness.”

Challenges Ahead

Challenges abound for any leader in any industry, and when Read surveys the landscape of the markets his company serves, he still sees the need for the implementation of technology solutions to remove the human element from particularly dangerous situations previously the province of divers. In addition, he personally has been leading the charge to push for increased standardization throughout the product sectors, believing that a pervasive $40 per barrel oil price will help in this regard. He gives an example: “Instead of 800 variants of four-way electrical flying leads, you can get it down to 10, and that will help to take cost out,” he said. Summarize, Read said “we love challenges, for example the challenge to make materials last 30 years underwater; that is our sweet spot, that’s our niche. We have a materials database in Teledyne Scientific for the last 10 years which proves the reliability of the materials chosen. It’s unique, no one else has this. It’s important because the cost of failure is enormous.”Teledyne Technology Report

Teledyne Marine is a group of leading-edge subsea technology companies that are part of Teledyne Technologies Inc. Through acquisitions and collaboration, it has evolved into a powerhouse, with a large breadth of technology, including: vehicles, instruments, imaging, interconnect and seismic solutions. Here are some latest technology advances:

Z-Boat 1800T, Trimble Edition

(Teledyne Oceanscience) Teledyne Marine’s new Z-Boat 1800T ready for your next inspection or mapping project.The Z-BOAT 1800-T is a high-resolution shallow water hydrographic unmanned survey vehicle with an Odom Echotrac E20 Singlebeam Echosounder and dual antenna Trimble BX992 GNSS heading receiver. Each sensor is integrated into a compact, portable, and cost-effective package. The combination of Trimble’s precise heading and positioning/guidance paired with Teledyne’s accurate/precise sonars and rugged autonomous vehicle design, allow for best in class data collection under harsh conditions and is ideally suited for marine construction, dredging, and civil engineering tasks.

Teledyne Marine’s new Z-Boat 1800T ready for your next inspection or mapping project.The Z-BOAT 1800-T is a high-resolution shallow water hydrographic unmanned survey vehicle with an Odom Echotrac E20 Singlebeam Echosounder and dual antenna Trimble BX992 GNSS heading receiver. Each sensor is integrated into a compact, portable, and cost-effective package. The combination of Trimble’s precise heading and positioning/guidance paired with Teledyne’s accurate/precise sonars and rugged autonomous vehicle design, allow for best in class data collection under harsh conditions and is ideally suited for marine construction, dredging, and civil engineering tasks.M-Series Mk2 2D Multibeam Imaging

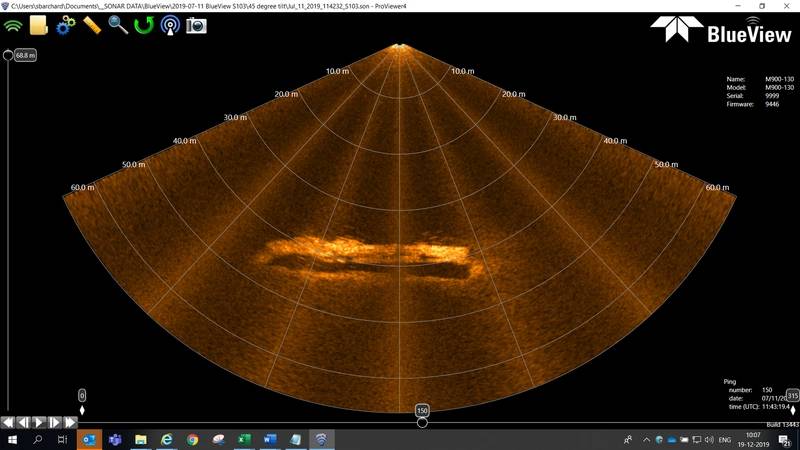

(Teledyne Blueview)

The M Series 2D multibeam imaging sonars deliver a compact form factor with low power requirements and unparalleled sonar image quality over a wide field of view. The new open nose cone design delivers optimal acoustic performance for increased image quality and improved range performance. All M Series sonars operate while in motion or from a stationary position, delivering real-time imagery and data. This product is ideally suited for diver platforms for search and recovery or ROVs for object detection and obstacle avoidance, as well as near field high-resolution object identification.

The M Series 2D multibeam imaging sonars deliver a compact form factor with low power requirements and unparalleled sonar image quality over a wide field of view. The new open nose cone design delivers optimal acoustic performance for increased image quality and improved range performance. All M Series sonars operate while in motion or from a stationary position, delivering real-time imagery and data. This product is ideally suited for diver platforms for search and recovery or ROVs for object detection and obstacle avoidance, as well as near field high-resolution object identification.Tasman DVL

(RD Instruments)

Teledyne RDI Tasman DVL.The Tasman DVL, with its array of features, reduced size and increased range, is becoming the new standard in Doppler navigation technology. With bottom-tracking ranges from 0.15 m to 400 m in up to 6,000 m water depths, the Tasman is versatile enough to navigate small ROVs to large diameter AUVs. Key advancements include field-swappable phased array transducers, system health monitoring/leak detection, ethernet compatibility, and the ability to upgrade to collect ADCP data.

Teledyne RDI Tasman DVL.The Tasman DVL, with its array of features, reduced size and increased range, is becoming the new standard in Doppler navigation technology. With bottom-tracking ranges from 0.15 m to 400 m in up to 6,000 m water depths, the Tasman is versatile enough to navigate small ROVs to large diameter AUVs. Key advancements include field-swappable phased array transducers, system health monitoring/leak detection, ethernet compatibility, and the ability to upgrade to collect ADCP data.HydroPACT 660E

(Teledyne TSS)

Teledyne TSS HydroPACT 660E Single pod and coil.The HydroPACT 660E brings pipe tracking and UXO detection capabilities to small inspection and observation class ROVs, for applications that were previously only available on larger vehicles such as work class ROVs and trenchers. The single smaller pod reduces the installed footprint and payload of the system while maintaining an operating range of greater than 85% of that of the larger HydroPACT 440 system. The coil array features an integrated cable for even greater reliability and is very well-suited to smaller ROVs, offering users the opportunity to reduce their operating costs on future projects.

Teledyne TSS HydroPACT 660E Single pod and coil.The HydroPACT 660E brings pipe tracking and UXO detection capabilities to small inspection and observation class ROVs, for applications that were previously only available on larger vehicles such as work class ROVs and trenchers. The single smaller pod reduces the installed footprint and payload of the system while maintaining an operating range of greater than 85% of that of the larger HydroPACT 440 system. The coil array features an integrated cable for even greater reliability and is very well-suited to smaller ROVs, offering users the opportunity to reduce their operating costs on future projects. -

- MTR100: Teledyne Oil & Gas (PART II) Marine Technology, Aug 2015 #42

Mike Read is the President of Teledyne Oil & Gas, a division of Teledyne Technologies and a group he formed six years ago. MTR caught up with Read on the occasion of the MTR100 to discuss his corner of the Teledyne world and how it is faring in the subsea sector. I know your group well, but in your own

-

- Meet The "Teledyne Twelve” Marine Technology, Jul 2013 #44

the Teledyne Marine brand. Executives offering insights included Bill Kikendall, President of the newly formed Marine Sensors and Systems Group at Teledyne Technologies, Inc., Thomas W. Altshuler, PhD, VP and Group GM for Teledyne Marine Systems; as well as Andy Gardner and Maxwell Mulholland, Co-Managing Directors

-

- Teledyne Maintains Course Marine Technology, Aug 2016 #33

not familiar with the cumulative Teledyne brand, can you share some facts and figures that give size, shape and scope to your offering today. Read Teledyne Technologies Inc. (NYSE – TDY) is a $2.3B company, founded in the early 1960s that provides enabling technologies for industrial growth markets. We have

-

- MTR100: Teledyne Marine Marine Technology, Jun 2019 #46

With 23 brands, and more than 400 marine products in its portfolio, Teledyne Marine collectively offers the largest breadth of technology in the industry. From tiny connectors to 6000m rated AUVs – and virtually everything in between – Teledyne is well positioned to solve subsea’s biggest challenges.

-

- Ocean Aero All About Ocean Observation Marine Technology, Oct 2014 #48

that do not want the capital investment but need to the data that we can gather with the vessel,” he says. The Teledyne Connection Teledyne Technologies recently invested in and entered into a strategic partnership with Ocean Aero. “The investment in Ocean Aero further broadens Teledyne’s portfolio

-

- Middle Market Mergers and Acquisitions: A Primer Maritime Logistics Professional, Q1 2015 #10

. Two examples of prolific public company acquirers in the maritime and offshore industries are Kirby Corporation (NYSE: KEX), and more recently Teledyne Technologies (NYSE: TDY). Kirby made a number of strategic acquisitions in the liquid tug and barge transport market, particularly between 2010 and 2012

-

- Energy Growth Fuels Transactions Maritime Logistics Professional, Q1 2014 #10

have seen overall demand increase, and there has been a noticeable increase in the number of middle market M&A deals in the space. Late in 2013, Teledyne Technologies (NYSE:TDY) acquired CD Limited (CDL), a supplier of subsea inertial navigation systems and motion sensors for marine and offshore applications

-

- 5 Minutes with Mike Read, President, Teledyne Marine Marine Technology, Jul 2018 #30

Center located in Thousand Oaks California.Teledyne Marine GroupTeledyne Marine is comprised of 23 undersea technology brands assembled by Teledyne Technologies Inc. Teledyne Marine’s technologies are broken out into five categories:Teledyne Marine ImagingTeledyne Marine Imaging group develops and manufactur

-

)

September 2022 - Marine Technology Reporter page: 64

)

September 2022 - Marine Technology Reporter page: 64resources industries, and for this year’s MTR100 we interviewed Dan Shropshire, VP, Marine Vehicles, Teledyne Marine. Teledyne Marine is part of Teledyne Technologies Incorpo- rated, an organization with an approximate market capitaliza- tion of $16B. Teledyne Marine has evolved into an industry powerhouse

-

)

May 2022 - Marine Technology Reporter page: 15

)

May 2022 - Marine Technology Reporter page: 15download data with ease. Speci? cally, its SeaRAY AOPS is “a moored con? guration con- © 2022 Teledyne Optech and Teledyne CARIS, are both Teledyne Technologies companies. sisting of a surface wave power system; All rights reserved. Speci?cations are subject to change. a single, combined mooring

-

)

July 2020 - Marine Technology Reporter page: 40

)

July 2020 - Marine Technology Reporter page: 40safer and good news for Teledyne Marine is that streamlining operations and technolo- more ef? cient, ultimately it is a people it’s part of Teledyne Technologies, gies to be pro? table with a $40 price business. “As effective as Zoom and “a diverse company that has acquired per barrel of oil. “All

-

)

July 2018 - Marine Technology Reporter page: 32

)

July 2018 - Marine Technology Reporter page: 32Group Teledyne Marine is comprised of 23 undersea technology water unmanned vehicles and towed systems. Vehicles brands brands assembled by Teledyne Technologies Inc. Teledyne include: Benthos, Gavia, Oceanscience, SeaBotix, and Webb Marine’s technologies are broken out into

-

)

October 2016 - Marine Technology Reporter page: 53

)

October 2016 - Marine Technology Reporter page: 53, underwater modems and locator devises. In tively ? at, hard surface with 22 kgf (48 lbf) of attraction force. 2006, Benthos was acquired by Teledyne Technologies Incor- With no relative motion between the inspection surface and porated and is now known as Teledyne Benthos. the sensors, output data

-

)

July 2016 - Marine Technology Reporter page: 35

)

July 2016 - Marine Technology Reporter page: 35look”, Teledyne Marine is able to support our custom- ers quickly, ensuring the utilization of their investment. We are fortunate that within Teledyne Technologies we have a customer and company sponsored ap- plied research center that strengthens our product development expertise, and combined with

-

)

July 2016 - Marine Technology Reporter page: 33

)

July 2016 - Marine Technology Reporter page: 33customers in their markets, ensuring YOUR OFFERING TODAY. This enables us to offer integrated tech- that we maximize the return on invest- Read Teledyne Technologies Inc. nologies to solve our customers’ most ment for our customers through lever- (NYSE – TDY) is a $2.3B company, challenging problems. aging

-

)

November 2015 - Marine Technology Reporter page: 46

)

November 2015 - Marine Technology Reporter page: 46Marine) (L to R): EuroROV co-founders, Sebastain Ruiz, Adrian Tramallino, Sebastian Ruggirello. ogies in challenging environments rang- of Teledyne Technologies provided in- Sonardyne Appoints Bjorøy Sonardyne International Ltd. appointed ing from the shallowest streams to the sight into Teledyne

-

)

July 2015 - Marine Technology Reporter page: 40

)

July 2015 - Marine Technology Reporter page: 40Greg Trauthwein ike Read is the President of Teledyne Oil & Gas, a solutions that allow electrical power and electro-optical data division of Teledyne Technologies and a group he transmission between these modules, providing the functional- Mformed six years ago. MTR caught up with Read on ity for the

-

)

Q1 2015 - Maritime Logistics Professional page: 9

)

Q1 2015 - Maritime Logistics Professional page: 9...................................12 Jiangnan Shipyard .................................18 OPA 90 ...........................................39, 56 Teledyne Technologies ...........................10 CLIA ...............................................59, 60 Jones Act .......................................32

-

)

October 2014 - Marine Technology Reporter page: 49

)

October 2014 - Marine Technology Reporter page: 49The Teledyne Connection Teledyne Technologies recently in- vested in and entered into a strategic partnership with Ocean Aero. ?The investment in Ocean Aero fur- ther broadens Teledyne?s portfolio of marine technologies and autonomous systems,? said Robert Mehrabian, chairman, president and chief execu-

-

)

Q3 2014 - Maritime Logistics Professional page: 17

)

Q3 2014 - Maritime Logistics Professional page: 17com- mercial maritime industry. Videotel products enable KVH to continue to provide valuable content to their critical maritime niche. Finally, Teledyne Technologies (NYSE:TDY) conÞ rmed its focus on the autonomous marine vehicle market by entering a strategic partnership with an investment in San Diego-based

-

)

Q3 2014 - Maritime Logistics Professional page: 9

)

Q3 2014 - Maritime Logistics Professional page: 9.......................................26 SUNY Maritime College ..........................63 TE Connectivity .....................................17 Teledyne Technologies ...........................17 Texas A&M ............................................63 Thomas Nelson Community College ........58 Tidewater

-

)

Q1 2014 - Maritime Logistics Professional page: 10

)

Q1 2014 - Maritime Logistics Professional page: 10seen over- all demand increase, and there has been a noticeable increase in the number of middle market M&A deals in the space. Late in 2013, Teledyne Technologies (NYSE:TDY) acquired CD Limited (CDL), a supplier of subsea inertial navigation sys- tems and motion sensors for marine and offshore applications

-

)

Q1 2014 - Maritime Logistics Professional page: 9

)

Q1 2014 - Maritime Logistics Professional page: 9........................... 41 State Class Tankers ............................... 10 Teekay.................................................. 56 Teledyne Technologies ........................... 10 U, V, W, X, Y, Z Ueda, Noboru ......... 42, 43, 44, 47, 48, 49 United Nations ..........................

-

)

January 2014 - Marine Technology Reporter page: 51

)

January 2014 - Marine Technology Reporter page: 51as MBARI looks to the future and conceives our technical roadmap.? Teledyne Opens Technology Center Teledyne Oil & Gas, a business unit of Teledyne Technologies Incorporated, recently held a Grand Opening celebra-tion of its new 52,000-sq. ft. Technology Development Center in Daytona Beach. The Technology

-

)

November 2013 - Marine Technology Reporter page: 55

)

November 2013 - Marine Technology Reporter page: 55Teledyne Acquires CDL Teledyne Technologies said its sub- sidiary, Teledyne Limited, has ac- quired C.D. Limited (CDL). Head-quartered in Aberdeen, Scotland, CDL is a supplier of subsea inertial navigation systems and motion sen- sors for a variety of marine applica- tions. Terms of the transaction were

-

)

July 2013 - Marine Technology Reporter page: 45

)

July 2013 - Marine Technology Reporter page: 45offered with Teledyne components. This approach allows our customers to choose the individual components that best meet their overall objective. Teledyne Technologies, our parent company, is a diverse and TELEDYNE RD I NSTRUMENTS ? TSS ? GEOPHYSICAL INSTRUMENTS ? BENTHOS ? WEBB RESEARCH ? GAVIA

-

)

April 2013 - Marine Technology Reporter page: 53

)

April 2013 - Marine Technology Reporter page: 53. ABB will supply an advanced complete power and diesel electric system package, con-sisting of medium voltage switchboards Teledyne Buys Reson Teledyne Technologies Incorporated completed the acquisition of Reson. Reson, headquartered in Slangerup, Denmark, provides high-resolution marine acoustic imaging

-

)

November 2012 - Marine Technology Reporter page: 40

)

November 2012 - Marine Technology Reporter page: 40trend will likely continue in the future, especially as a way for large Þ rms to acquire innovative technology. One example in the industry is Teledyne Technologies (pro- Þ led in the September issue of Marine Technology Reporter ). Since 2005, it has acquired 26 Þ rms: in 2005, Cougar Com- ponents, RD

-

)

October 2012 - Marine Technology Reporter page: 54

)

October 2012 - Marine Technology Reporter page: 54Webb who still works at the company as Senior Di- rector of Technology added, ?we?re just getting started?. Webb Research became a member of the Teledyne Technologies group of companies in 2008.People & Company News (Photo: Ben Allsup, Teledyne Webb Research) 54 MTROctober 2012MTR #8 (50-64).indd 54MTR

-

)

September 2012 - Marine Technology Reporter page: 21

)

September 2012 - Marine Technology Reporter page: 21marine represent-ed just under 4% of total sales. In 2011, our marine businesses accounted for 19% of Teledyne?s total revenues.? Jim Davis, SVP, Teledyne Technologies www.seadiscovery.com Marine Technology Reporter 21MTR #7 (18-33).indd 21MTR #7 (18-33).indd 219/10/2012 9:26:11 AM9/10/2012 9:26:11 A

-

)

September 2012 - Marine Technology Reporter page: 20

)

September 2012 - Marine Technology Reporter page: 20Teledyne Technologies has emerged as one of the pre- eminent global forces in the subsea sector, growing both organically and through acquisition to build a formidable corporation. The growth has been dra- matic and rapid, with revenue generated from the marine sector growing better than ten-fold between

-

)

September 2012 - Marine Technology Reporter page: 2

)

September 2012 - Marine Technology Reporter page: 212 Whales & ROVs Animal & machine interact off of Patagonia.by Christian Haag 381220Image Courtesy: Ulstein Group; Vasco Pinhol Photo Credit: Teledyne Technologies Interview 20 Jim Davis, Teledyne Technologies Jim Davis delivers insights on Teledyne?s acquisition binge. by Greg Trauthwein Offshore