California

-

- Op/Ed: California's Zero-emission Domino Theory Marine News, Apr 2018 #24

The Domino Theory was the Cold War concept that if communism obtained a foothold in a region – say Vietnam in Southeast Asia – other countries would soon fall like a perfectly aligned row of dominoes to communism (e.g., Cambodia and Laos). Whether one supports the theory or not, it has at least one strong point: it was a simple story to tell.

It feels like California has adopted its own version of the Domino Theory: if California pushes the regulatory envelope for zero emissions, other states and countries will certainly adopt similar strategies. The narrative’s importance is that it counters the argument that California is building a regulatory state that will leave it hamstrung with costs and uncompetitive in a global marketplace.This zero-emission Domino Theory is on full display in California’s maritime industry where port authorities and regulators are working to reduce emissions from port-related activities. California port authorities have led the way in establishing themselves as global green port leaders. It is a well-earned reputation. During the past decade, ports have reduced diesel particulate matter, a pollutant of particular concern to local communities, between 76 percent to 88 percent, depending on the port complex. That reduction is no mean feat. It translates to meaningful improvements in air quality and reductions in health risk.But part of the argument for being a green leader is that other ports will follow California’s example. The dominoes must fall at each port around the country and, when it happens, California will not stand alone. We will have started the movement. Yet, to date, no has followed California’s green leadership; the dominoes remain upright.No port outside of California requires or incentivizes the use of shore power for cargo vessels. No port has developed a meaningful Clean Trucks Program to accelerate the turnover of drayage trucks. Those ports that do have green port programs on paper are letting time, rather than command-and-control regulation, do the heavy lifting. With time, older, more polluting equipment is replaced with modern equipment that has the latest emissions control systems. This is the same strategy that has successfully reduced emissions from passenger vehicles across the country. In addition to achieving the same emission reductions, the time approach also eliminates stranded asset costs and the need to incentivize equipment replacement saving billions.As California ports look to further burnish their environmental credentials, they face a difficult challenge. Because all available feasible, cost-effective technology has been deployed, two paths exist to further emission reductions. One is incremental through the use of near-zero technologies. In this case, incremental means achieving an additional 90 percent reduction on top of a previous 90 percent reduction in emissions standards for on-road and off-road equipment. For the mathematically challenged, that would be the equivalent of a 99 percent emissions reduction. The only hurdle to this pathway is that equipment is just now becoming commercially available and a new (California-only, of course) engine standard requiring equipment manufacturers to sell cleaner equipment is not expected until the 2023 timeframe and may only apply to on-road engines.The other pathway is a paradigm shift with a move straight to zero-emissions. This pathway’s main hurdle is that the equipment available today is fully automated and costs about $35 billion to address just cargo-handling equipment statewide. This equipment makes-up only 4 percent of port-related diesel emissions and less than 1 percent of regional diesel emissions. Or, we can place our bets on electrified versions of the existing diesel-powered equipment marine terminals currently use. It should be noted that this equipment does not currently exist and nor does any of the supporting infrastructure necessary to power it. To further complicate matters, tackling zero emission “solutions” for other port-related equipment (locomotives, drayage trucks, harbor craft and tugs) is even more challenging and more expensive.How California ports accomplish this transition to zero-emissions while remaining both competitive and an industry leader remains unanswered.Not to be out done, California’s regulators are taking a cue from the ports and pressing for even more aggressive action. In a proposal heard by the California Air Resources Board (CARB) at the end of March, California will lay out their new vision for tackling emissions. This updated vision calls for beginning the transition to zero-emission cargo-handling equipment early, in 2026, despite the fact that no equipment capable of successfully operating in a marine terminal environment exists.Even more disturbing, it upends the traditional approach to improving air quality. Normally, the State would require equipment manufacturers to build and sell equipment that meets an emissions performance standard. California would sometimes match that demand with a requirement that forces users to retire the oldest equipment to accelerate the introduction of the newest, cleanest equipment. This time, no proposal for tighter (or even zero) emission standards exists and there is no requirement for equipment manufacturers to sell zero emission equipment. Instead, it appears that California will give the equipment users a hearty “good luck” and the sole burden to find such equipment.California regulators have targeted the maritime industry to lead the way on zero emissions because it can. State regulators are poised to set aggressive maritime sector targets that are decades ahead of the requirements proposed for other California industrial sectors. In doing so, it shifts the costs of technology development from all California industrial sectors to the maritime sector. The maritime sector will have to bear the burden of technology development that the rest of the State will be able to rely on to meet their requirements decades later.All of this “leadership” is happening in the context of a decade-long slide in California ports’ market share – a trend that isn’t likely to end soon. Both California ports and regulators assure stakeholders that they will proceed judiciously and do not wish to harm the source of tens of thousands of jobs statewide. To that end, both port authorities and the State have repeatedly called for other jurisdictions to follow their lead to help maintain an even playing field. No one has followed.Despite efforts by California ports and regulators to form partnerships outside of California, no dominoes have fallen elsewhere. The question to be asked, after more than a decade of California “leading” the way, is anyone willing to follow? Or, will California and its ports continue to stand alone?The AuthorThomas A. Jelenić is Vice President for Pacific Merchant Shipping Association (PMSA). Mr. Jelenić works with policy makers, regulators, industry leaders and other entities to help ensure that sound science and industry issues are part of the discussion as California continues to call for the increased use of zero and near-zero emissions equipment at California’s ports and throughout the goods movement industry. Jelenić has two decades of maritime industry experience, including more than 14 years in environmental and planning positions at the Port of Long Beach, the nation’s second busiest seaport, and senior management roles in private consulting and logistics development.(As published in the April 2018 edition of Marine News) -

- OIL SPILL CONFERENCE Maritime Reporter, Feb 15, 1985 #30

between oil slicks applied with dispersants and those not, application of dispersants from boats, and the use of dispersants in southern California. One session will highlight the interagency dispersant decision process. In-depth case histories of oil spill cleanup efforts will detail a pipeline

-

- INTERNATIONAL OIL SPILL CONFERENCE Maritime Reporter, Feb 15, 1983 #14

Product Edward M. Minugh, Environmental Emergency Services Company, Portland, Oregon; Dorothy A. Keech, Chevron Oil Field Research Company, La Habra, California; Jeffrey J. Patry, Chevron U.S.A., Inc., Concord, California; William R. Leek, Chevron U.S.A., Inc., San Francisco, California 9:45 a.m. Mission

-

- Offshore Wind: California's New Gold Rush Maritime Reporter, May 2019 #16

California Dreamin': In CA, offshore wind has unlimited potentialWhen it comes to States promoting renewable, non-fossil electricity generation, California surely leads the list, from utility-scale regional grids to individual rooftop solar panels.In fact, a December 2018 update from the California Energy

-

- A Closer Look at the Effects of ECAs Marine News, Dec 2013 #8

oil to cleaner burning distillates on oceangoing craft is anything but a routine event for some vessels. But, don’t take our word for it – the State of California does a pretty good job of recordkeeping, and the numbers don’t lie. It’s probably a good thing, then, that the U.S. Coast Guard in September published

-

- Paclines To Carry Cargo California To Hawaii Using Tug And Superbarge Maritime Reporter, Feb 1974 #31

A superbarge, capable of carrying as much cargo as a World War II Liberty ship, is the mainstay of a new shipping service between the Port of Oakland, Calif., and Hawaii. Paclines, operator of the service, employs a barge 336 feet long and 98 feet wide, towed by a 5,000-horsepower twin-screw tug in

-

- Harwich Tonnage, Inc. Formed In California Maritime Reporter, Feb 15, 1974 #15

Harwich Tonnage, Inc. was recently formed to provide consulting and management services to the marine transportation industry, with offices at 17835 Ventura Boulevard, Encino, Calif. 91316. The president of the new firm is C.R. Andrews, formerly assistant vice president with Navios Corporation

-

- Lockheed Oil Recovery Device Passes Tests Off California Coast Maritime Reporter, Apr 1974 #41

oil spills was taken recently when a Lockheedbuilt experimental oil skimmer and its Coast Guard escorts rode through a storm off the northern California coast. This demonstration of survival capability may have been the final open-sea test for the High-seas Oil Recovery 'System protoype built

-

- No. California SNAME Discusses Ships And Terminals For Nodules Mined From Deep Pacific Ocean Maritime Reporter, Jul 15, 1978 #33

entitled "Transport Ships and Marine Terminals for Manganese Nodules Mined from the Deep Pacific Ocean," at a recent dinner meeting of the Northern California Section of The Society of Naval Architects and Marine Engineers, held at the Engineers Club in San Francisco, Calif. Mr. Andrews presented a

-

- California SNAME Sections Announce Joint Meeting Maritime Reporter, Sep 1978 #56

The Los Angeles Metropolitan Section of The Society of Naval Architects and Marine Engineers (SNAME) has announced details of the California Sections joint meeting, to be held in conjunction with the Northern California Section and the San Diego Section on October 13, 14 and 15. The meeting place is

-

- SNAME San Diego Section Told Of 'LNG For California' Plans Maritime Reporter, Apr 1977 #51

Viscosity and Density of Fresh and Salt Water. Rudi G. Terry, the guest speaker for the technical section, presented his paper, "LNG for California," which was co-authored by J.A. Aspland. Mr. Terry's presentation described Pacific Lighting Corporation's plans for development of two large-scale

-

- University Of California Plans To Build Large Oceanographic Vessel Maritime Reporter, May 1977 #24

in the Scripps fleet that have served their useful life. Scripps Institution of Oceanography is the oceanographic division of the University of California, San Diego, and has been in continuous operation for over 72 years. Scripps operates seven research ships and two research platforms (one of

-

)

May 2024 - Maritime Reporter and Engineering News page: 56

)

May 2024 - Maritime Reporter and Engineering News page: 56Reporter, he founded MRS in 2009 and has co-chaired Information Sciences Department at the Naval Postgraduate School every event since. in Monterey, California. He is a retired naval submarine of? cer. 56 Maritime Reporter & Engineering News • May 2024 MR #5 (50-60).indd 56 5/3/2024 8:11:21 A

-

)

May 2024 - Maritime Reporter and Engineering News page: 55

)

May 2024 - Maritime Reporter and Engineering News page: 55MRS is being held 11-13 June 2024, hosted by the Focus: Since 2014 Congress has tasked the administrations to Naval Postgraduate School in Monterey California as an in-per- son event. There is no cost for registration. A series of keynote develop a national maritime strategy to ensure the nation has suf- addres

-

)

May 2024 - Maritime Reporter and Engineering News page: 4

)

May 2024 - Maritime Reporter and Engineering News page: 4Department IQ and entry into the maritime f: (212) 254-6271 at the Naval Postgraduate School sector, she held Product Manag- vanAuker in Monterey, California. er positions at various late-stage Jerit VanAuker served in the startups within the technology U.S. Navy for 25 years and is DiRenzo and ?

-

)

April 2024 - Maritime Reporter and Engineering News page: 4

)

April 2024 - Maritime Reporter and Engineering News page: 4for experience as a journalist. She maritime and security issues. Chevron’s operated ? eet based in has a Master of Science research San Ramon, California. Over the degree in marine ecology as well Rokka last decade, he has represented as diplomas in journalism, com- Juha Rokka is co-founder and

-

)

April 2024 - Marine News page: 34

)

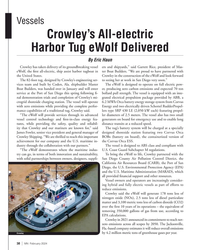

April 2024 - Marine News page: 34,” Rice said. Rice stressed the importance of teamwork between the life, Crowley partnered with the San Diego County Air Pollution Control District, the California Air Resources shipyard, electrical integrator, designer and production en- Board (CARB), the Port of San Diego, the U.S. Environ- gineering team

-

)

April 2024 - Marine News page: 11

)

April 2024 - Marine News page: 11is to be an advocate for the that we’re seeing and the introduction of legislation in industry. We want to make sure that government agencies the California assembly is re? ective of the fact that there are not making a challenge worse by what they do or fail to are serious unresolved concerns. The

-

)

February 2024 - Marine News page: 38

)

February 2024 - Marine News page: 38to life, Crowley partnered with the with solid partnerships between owners, designers, suppli- San Diego County Air Pollution Control District, the California Air Resources Board (CARB), the Port of San Diego, the U.S. Environmental Protection Agency (EPA) and the U.S. Maritime Administration (MARAD)

-

)

February 2024 - Marine News page: 16

)

February 2024 - Marine News page: 16able schedules between two designated locations, stream- ronmental toll from their operations. lining the process for electri? cation planning. The California Air Resource Board’s Commercial Har- The environmental bene? ts are indisputable. Ferry elec- bor Craft Regulation issued the most stringent of these

-

)

January 2024 - Marine Technology Reporter page: 26

)

January 2024 - Marine Technology Reporter page: 26of the ? eet’s overall XLE0 began in-water testing in Spring 2023 in Huntington capability into a relatively small number of high-value ships Beach, California. “Lessons learned from XLE0’s testing will 26 January/February 2024 MTR #1 (18-33).indd 26 1/30/2024 7:01:23 P

-

)

December 2023 - Maritime Reporter and Engineering News page: 28

)

December 2023 - Maritime Reporter and Engineering News page: 28time Academy; Lone Star State for Texas A&M Maritime for the ? ve ships. The cumulative package is delivered by GE Academy; and Golden State for California State University Power Conversion. Maritime Academy – and each had input on the design, from “It’s built from a redundancy for the safe return

-

)

December 2023 - Maritime Reporter and Engineering News page: 14

)

December 2023 - Maritime Reporter and Engineering News page: 14been four years since the fatal Conception dive boat must include clearly de? ned safety and environmental protec- ? re claimed 34 lives off the California coast, prompt- tion policies, safe operating procedures, and the business’ levels ing the National Transportation Safety Board (NTSB) of authority

-

)

November 2023 - Marine News page: 52

)

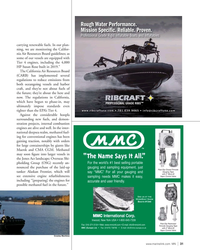

November 2023 - Marine News page: 52, features operational speed and endurance demands while also com- Humphree interceptors for a smoother ride, and sound plying with U.S. EPA Tier 4 and California Air Resources levels at full throttle are 64dBA. A robust HVAC system Board (CARB) emissions requirements. provides fresh air and humidity control

-

)

November 2023 - Marine News page: 45

)

November 2023 - Marine News page: 45Maritime Academy), and the yard is slated to begin con- in that there are two separate engine rooms with a pair of struction for the ? fth NSMV (California Maritime Acad- diesel generators in each, both feeding dual high voltage emy) later this year for delivery in 2026. www.marinelink.com MN 45

-

)

November 2023 - Marine News page: 33

)

November 2023 - Marine News page: 33reduce emissions. promising frontier in the United States. A re- “That’s how we look at it,” said Jack Cammarota, director A port by the University of California Berkeley released in of marine operations at Blue Ocean Transfers. Blue Ocean August concluded that due to the nation’s long coastlines Transfers

-

)

November 2023 - Marine News page: 31

)

November 2023 - Marine News page: 31Air Resources Board guidelines; as some of our vessels are equipped with Tier 4 engines, including the 4,000 HP Susan Rose built in 2019.” The California Air Resources Board (CARB) has implemented several regulations to reduce emissions from both oceangoing vessels and harbor craft, and they’re

-

)

November 2023 - Marine News page: 30

)

November 2023 - Marine News page: 30maritime sectors, has been involved in successful testing alongside utility Southern Company, Terra Power, a business incubator tied to Bill Gates. California’s push for ‘green’ Alex Parker, managing partner at Rose Cay Maritime, which currently operates a large tug and barge ? eet, de- ployed primarily

-

)

November 2023 - Marine News page: 21

)

November 2023 - Marine News page: 21to regulatory patchworks, or impose infeasible requirements support the adoption of sustainable technologies. like we have regrettably seen with the California Air Re- The tugboat, towboat and barge industry is a critical sources Board’s insistence on unsafe technologies and un- economic driver and indispensable

-

)

September 2023 - Marine Technology Reporter page: 72

)

September 2023 - Marine Technology Reporter page: 72forecasting to help and connectors in their garage in Gar- monitoring of water quality and oceano- communities prepare for and respond to dena, California. Beginning with three graphic parameters. SubCtech reaches emergency ? ooding. Hohonu’s process divisions under the parent corporation all target

-

)

September 2023 - Marine Technology Reporter page: 65

)

September 2023 - Marine Technology Reporter page: 65and recy- U.S. Navy photo by John F. Williams/Released Oceanography at University cling facility. Last month, a formal good-bye ceremony was of California, conducts investigations in a number hosted by the Marine Physical Laboratory at the University of fields, including of California, San Diego

-

)

September 2023 - Marine Technology Reporter page: 23

)

September 2023 - Marine Technology Reporter page: 23time communications from mercially by DMO under exclusive license from the Uni- both the Wirewalker and from numerous ? xed sensors. The versity of California. Systems are in the ? eld globally, sup- design combines a conventional taut mooring from the sea porting coastal pollution monitoring, aquaculture

-

)

October 2023 - Marine News page: 26

)

October 2023 - Marine News page: 26Partner’s core focus areas is supporting the maritime industry’s energy Ecosystem activities included meetings with the SF cham- ber of commerce, the California Air Resources Board and transition efforts. Sea Change, built by All American Marine, is slated to be the United States’ first H2 ferry. All

-

)

October 2023 - Marine News page: 24

)

October 2023 - Marine News page: 24said that H2 has been used for decades. H2 is not novel, for how the barge will work. Preliminary modeling is done particularly in San Francisco and California where there are for ? lling 250-bar tanks on H2 ferries (“bar” is term refer- already a few public facilities used for hydrogen automobiles. encing

-

)

September 2023 - Maritime Reporter and Engineering News page: 26

)

September 2023 - Maritime Reporter and Engineering News page: 26for Mas- sachusetts Maritime Academy; State of Maine for Maine Maritime Academy; Lone Star State for Texas A&M Maritime Academy; and Golden State for California State University Maritime Academy – and each had input on the design, from the size and con? gu- ration of classrooms and berthing areas, all

-

)

June 2023 - Marine News page: 33

)

June 2023 - Marine News page: 33and across federal agencies. On the West Coast, for exam- channels open and ? nding creative ways to fund non-stop ple, in USEPA Region 9 (Arizona, California, Hawaii, Ne- dredging operations. We never lost our ability to operate vada, the Paci? c Islands, and 148 Tribal Nations) EPA and on the rivers