Eastern Europe

-

- Resilient Dutch Network Maritime Reporter, May 2000 #8

As a bastion of ship production in the under 10,000-dwt-vessel range, the industry in the northern Netherlands continues to demonstrate true global competitiveness in its chosen fields of endeavor. While much of European shipbuilding bewails the intensified onslaught from the Orient, impinging on an ever-greater range of ship types and ever-widening circle of European shipowning communities, the yards and allied firms in the northernmost Dutch provinces are putting down building blocks in new market areas.

Key points of the investment-underwritten drive to increase market reach and develop business volume are a push towards larger vessels, up to 20,000-dwt in some cases, and the forging of new relationships with builders in Eastern Europe. Industrial evolution in the north Netherlands has involved an active policy of reinvestment and improvement in the means of shipbuilding production.

The rise of new ship and section assembly halls over the windswept landscapes fringed by the Waddenzee and the IJsselmeer is complemented by continuous design development, not least in the industry's core business of supplying dry cargo ships, multi-purpose vessels and container feeder carriers. The design effort couples 'added-value' with series production potential, and marries the vital requirement for constructionfriendly forms with a deep understanding of the needs of the ship operator and industrial freight market.

More than ever, the region's strength in shipbuilding and the allied sectors derives not only from its professional skills but also from a propensity for collaboration between like-minded, but wholly-independent firms.

Networking between assembly yards, section builders, cut steel suppliers, marine equipment makers and design engineering firms has conferred a high level of self-sufficiency, while specialization in each case has fostered very high productivity levels. While subcontracting of bare hulls to cheaper-cost countries has long been a policy of certain small-ship and craft builders in the Netherlands, the principle of networking is being extended to include stronger relationships with selected yards in Eastern Europe. Just as the new investments in shipbuilding in the northern and middle regions of the Netherlands have largely complemented rather than displaced existing facilities on the inland waterway network, augmented relationships with yards in Eastern Europe do not signify a diminution in the indigenous shipbuilding resources.

As the latest example of business verve, the recently expanded Volharding Group has signed a new agreement with Daewoo Mangalia Shipyard in Romania paving the way to a growing, annual supply of hulls for outfitting in the Netherlands. The pact with the Korean majority-owned Romanian yard, plus investments in Volharding's two shipyards, specialist outfitting facility and section building yard in Groningen province, should see the group's new- building output in 2000 rise to 18 vessels from nine last year. The typically Dutch and German client profile has been broadened by contracts from Mediterranean and Southeast Asian owners for multi-purpose vessels, while the group's market focus now extends from 1,800-dwt to 20,000-dwt, compared to the maximum 9,000-dwt hitherto.

One of the key constituents of the industry in the north is the sales, marketing and design engineering firm Conoship International. Jointly owned by the member yards, which include the Volharding Group, Conoship acts as an antenna for the individual builders in the international market, taking a proactive line in business development and the providing project support through to the contract stage, fulfilling a matchmaker role between customers and the shipyards.

Conoship is emblematic of the northern industrial structure and business ethos as a whole, since it lives by gener- ating added-value to the shipbuilders' own commercial and technical endeavors, and in turn gives succor to, and draws benefit from the integrated network.

Its impressive, newly-published portfolio of multi-purpose cargo vessels and feederships includes a 15,500-dwt general cargo carrier formulated in conjunction with the Volharding Group. The 730.000-cu ft. class signals an impending new phase in production from a region, which has recently turned out a range of vessels and designs establishing the popularity of the 9,000-dwt size in the multi-purpose scenario. Another example of a Dutch yard having coupled investment in the home ground with a link-up in Eastern Europe is Peters Scheepwerf. The commissioning in 1998 of a new hall for the construction of vessels up to 12.0()()-dwt has raised the scope of its Kampen premises on the IJssel beyond the traditional coaster sizes. At the same time, a strengthened connection with the Czech shipyard CSPL, for the supply of coaster hulls, has sharpened Peters' competitiveness at the lower end of the capacity band.

Ever-growing Damen Shipyards meanwhile, while maintaining a northern presence with its Hoogezand yard aside the Winschoter Diep near Groningen, last year acquired a majority holding in Santierul Naval Galati in Romania, following five years' cooperation between the Hoogezand and Galtaz yards.

Circle 34 on Reader Service Card

-

- Mott Groom To Head Gulf Oil Trading GmbH Maritime Reporter, Mar 1977 #25

A company that will specialize in trading with Eastern European countries has been established in Vienna, Austria, by the Gulf Oil Corporation. Known as Gulf Oil Trading GmbH, the new venture will be managed by Gulf Trading and Transportation Company, (GT&T), one of seven Gulf divisional companies.

-

- LNG Capital Expenditure Maritime Reporter, Sep 2013 #34

LNG export projects reaching completion. The decline is, however, offset to some extent by significant growth in most other regions, particularly Eastern Europe & FSU, Africa and Asia. Regional Forecast Accounting for almost 40% of global expenditure, Australasia is expected to witness an increase

-

- The Rise of the Work-class ROV Market Marine Technology, Nov 2013 #30

gas developments now dominate subsea activity here, so Australasia’s demand is set to decline substantially over the forecast period. • Eastern Europe & FSU Eastern Europe & FSU is forecast to be one of the smallest regions in terms of ROV activity. However, it will experience some growth in

-

- Yachting Consult Offers MasterShip Maritime Reporter, May 2001 #37

global engineering: YC Engineering is able to deliver kits or cutting codes worldwide. This has been done to shipyards in South Africa, Middle East, Eastern Europe and lately in Singapore. During the Norshipping exhibition Yachting Consult will also promote the newest MasterSHIP edition, Master- SHIP

-

- Precision Ship-Handling Writ Large Maritime Reporter, Sep 2002 #34

from flooding, manage the drainage of water pumped from the land and lift or lower ships as is required. Before the opening of land routes to Eastern Europe from the west, the canal carried many ships to those countries. Now it is kept busy with a growing local trade of coasters taking containers

-

- Worldwide Tanker Order Book Hits 15-Year High Maritime Reporter, May 1992 #28

dwt are scheduled for delivery. About 76 percent of the orders have been placed with Far East yards, 13 percent in Western Europe, 6 percent in Eastern Europe and 5 percent in other regions. Oil tankers specified with double sides, double bottoms or double skins, account for 28 percent of the order

-

- Cargo Morphs in New Directions Maritime Reporter, Jun 2013 #16

often have enough operational life left in them to whet the appetite of potential buyers in developing countries in Africa, Asia, Latin America and Eastern Europe. Rather than turning to the scrap metal market, these owners increasingly are striking deals and shipping their used equipment to new homes overseas

-

- The European Network of National Maritime Clusters Maritime Reporter, Aug 2016 #24

unify the national maritime clusters of the ENMC into a unique harmonized and homogeneous organization. Indeed the existing national clusters – from Eastern Europe to Northern and/or Southern Europe are sometimes very different the ones from the others: differences in history, culture, or even nature (some

-

- Subsea Vessels Poised for Increased Global Demand Maritime Reporter, Oct 2013 #56

projects are due to come onstream beyond the forecast period. Field development will account for the largest demand in the region followed by IRM. Eastern Europe & FSU Vessel demand is expected to be driven by on-going pipeline projects in the region, while field development activity is expected to remain

-

- Increase in Demand for the Hot Subsea Vessel Market Marine Technology, Oct 2013 #8

projects are due to come onstream beyond the forecast period. Field development will account for the largest demand in the region followed by IRM. Eastern Europe & FSU Vessel demand is expected to be driven by ongoing pipeline projects in the region, while field development activity is expected to remain

-

- European Yard Initiative - Will it Work? Maritime Reporter, Nov 2004 #62

construction periods can be reduced. In today's buoyant market, this is particularly relevant as owners look to lesser-known newbuilding yards in Eastern Europe, for example, for prompt deliveries. Some 13 of the Intership projects will commence in the first two years of the four-year initiative, with

-

)

March 2024 - Marine Technology Reporter page: 48

)

March 2024 - Marine Technology Reporter page: 48. . . . . . . . . . . . . . . . . . . . . .www.msitransuders.com . . . . . . . . . . . . . . . . . . . . . . . . . . . .(978) 486-0404 7 . . . . . .NOAA/Eastern Region Acquisition Division . . .http://marinerhiring.noaa.gov . . . . . . . . . . . . . . . . . . . .Please visit us online 39 . . . . .R.M. YOUNG

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43“The industry is an ecosystem which includes owners, managers, mariners, shipyards, equipment makers, designers, research institutes and class societies: all of them are crucial,” – Eero Lehtovaara, Head of Regulatory & Public Affairs, ABB Marine & Ports All images courtesy ABB Marine and Ports provi

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41Nautel provides innovative, industry-leading solutions speci? cally designed for use in harsh maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications

-

)

April 2024 - Maritime Reporter and Engineering News page: 38

)

April 2024 - Maritime Reporter and Engineering News page: 38lique? ed natural gas (LNG)-powered containerships: Quetzal, Copan, Tiscapa and Torogoz. The 1,400 TEU ves- sels were ordered in 2022 by Singapore-based Eastern Paci? c Shipping (EPS) for scheduled delivery from South Korea’s Hyundai Mipo Dockyard in 2025. EPS will charter the ships out to Crowley, who

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32FEATURE A closeup of a blade installation process taken via drone. A blade handling system is apparent (in yellow). Images courtesy of Mammoet requirement for the development of these cranes, particularly ling area. This would result in a major time and fuel saving. in ? oating offshore wind,” says

-

)

April 2024 - Maritime Reporter and Engineering News page: 17

)

April 2024 - Maritime Reporter and Engineering News page: 17SOVs China, we do not look at demand for SOVs/CSOVs as having a linear rela- tionship to the number of wind farms or turbines installed. We look to see where a large number of wind turbines are concentrated in relatively close proximity, generally in a very large wind farm or in a project cluster

-

)

April 2024 - Maritime Reporter and Engineering News page: 7

)

April 2024 - Maritime Reporter and Engineering News page: 7REGISTER NOW Seawork celebrates its 25th anniversary in 2024! The 25th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks. Seawork delivers an international audience of visitors supported by our trusted partners. Seawork is the

-

)

April 2024 - Marine News page: 32

)

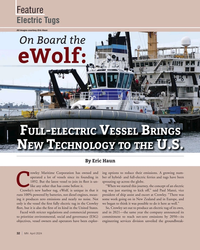

April 2024 - Marine News page: 32Feature Electric Tugs All images courtesy Eric Haun On Board the eWolf: F - V B ULL ELECTRIC ESSEL RINGS EW ECHNOLOGY TO THE N T U.S. By Eric Haun rowley Maritime Corporation has owned and ing options to reduce their emissions. A growing num- operated a lot of vessels since its founding in ber

-

)

April 2024 - Marine News page: 27

)

April 2024 - Marine News page: 27of years.” But with stronger oil and gas markets (seemingly) on the horizon, he wondered aloud whether such work might continue on a bigger scale. Eastern Shipbuilding Group is building Two 2024 announcements from Eastern Shipbuilding the ? rst four Offshore Patrol Cutters provide a window into the

-

)

April 2024 - Marine News page: 26

)

April 2024 - Marine News page: 26.S. handles Business Development, North America, for ABS, Coast Guard in construction of Offshore Patrol Cutters Joey D’Isernia, the chairman and CEO of Eastern Ship- (OPC), D’Isernia stressed the challenges of doing both building Group (with three yards in the Florida Pan- government and commercial work

-

)

February 2024 - Maritime Reporter and Engineering News page: 48

)

February 2024 - Maritime Reporter and Engineering News page: 48. . . . . . . . . . . . . . . . .www.massa.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(781) 749-4800 7 . . . . . .NOAA/Eastern Region Acquisition Division . . . . . . . . . . . . . . . . .http://marinerhiring.noaa.gov . . . . . . . . . . . . . . . . . . . . . . . . .Please

-

)

February 2024 - Maritime Reporter and Engineering News page: 28

)

February 2024 - Maritime Reporter and Engineering News page: 28COVER FEATURE times of con? ict or in other national said Ebeling. “If you look at Iraq and tors bring to the table, all provided by emergencies, and the program also Afghanistan, 98% of those cargoes the MSP ? eet, and it would cost the provides DoD access to MSP partici- were transported to the

-

)

February 2024 - Maritime Reporter and Engineering News page: 26

)

February 2024 - Maritime Reporter and Engineering News page: 26COVER FEATURE ARC KEEPING THE CARGO ROLLING With a ? eet of nine U.S.-? ag RoRo ships, American Roll-On Roll-Off Carrier Group (ARC), is the U.S.’ premier commercial RoRo carrier of U.S. government and military cargo. As the world becomes an increasingly contentious place, Eric P. Ebeling, President

-

)

February 2024 - Maritime Reporter and Engineering News page: 20

)

February 2024 - Maritime Reporter and Engineering News page: 20MARKETS FPSO technology dominates the region’s FPS demand. duction and storage of low and zero emission energy carriers, In all, 18 countries in West and East Africa are expected such as methanol and ammonia. One exciting development to receive new FPSOs, FLNGs and FPUs between 2024 and leverages

-

)

February 2024 - Maritime Reporter and Engineering News page: 16

)

February 2024 - Maritime Reporter and Engineering News page: 16THE PATH TO ZERO Methanol’s Superstorage Solution Technical inquiries to SRC Group ramped up after it received Approval in Principle (AIP) for a concept which ‘reinvented methanol fuel storage’ on board ships. Delivering the answers has seen technical talk converting into project discussions

-

)

February 2024 - Maritime Reporter and Engineering News page: 13

)

February 2024 - Maritime Reporter and Engineering News page: 13motion, strikes, riots, and looting, is a new top ? ve risk for the marine and shipping industry this year at 23%. Businesses and their supply chains face considerable geo- political risks with war in Ukraine, con? ict in the Middle East, and ongoing tensions around the world. Political risk in 2023

-

)

February 2024 - Maritime Reporter and Engineering News page: 12

)

February 2024 - Maritime Reporter and Engineering News page: 12Maritime Risk Top Marine Business Risks in 2024 By Rich Soja, North American Head Marine, Allianz Commercial yber incidents such as ransomware attacks, data linked to several large ? re incidents at sea in recent years. breaches, and IT disruptions are the biggest worry Regularly assessing and updating

-

)

February 2024 - Marine News page: 48

)

February 2024 - Marine News page: 48964-0447 1 Marine Systems, Inc www.marinesystemsinc.com (985) 223-7100 37 McDonough Marine Service www.mcdonoughmarine.com (504) 780-8100 7 NOAA/Eastern Region Acquisition Division MarinerHiring.noaa.gov (833) 724-5872 C4 R.W. Fernstrum & Company www.fernstrum.com (906) 863-5553 5 Thordon Bearings

-

)

February 2024 - Marine News page: 40

)

February 2024 - Marine News page: 40contracts were wrongfully termi- nated. Gulf Island and Hornbeck settled in October 2023, clearing way for the builds to be completed by another yard. Eastern secured the contract to complete the builds from Zurich American Insurance Company, the issuer of the performance bonds for the original MPSV contracts

-

)

February 2024 - Marine News page: 31

)

February 2024 - Marine News page: 31Ørsted vessel rates, and these impacts are felt more strongly in the U.S. than they are in Europe, Møller said. “Now we are paying the premium, because the oil market is high. But going further down, probably oil market is going to take a turn again and our business will become equally cheap, because

-

)

February 2024 - Marine News page: 30

)

February 2024 - Marine News page: 30Feature Offshore Wind Ørsted “There is momentum in the wind market right now.” Ron MacInnes, President, Seatrium Offshore & Marine USA back the other way, become more mature, more stable, that supply chain, that project pipeline, is going to exist, more evenly distributed, basically, with your risk

-

)

January 2024 - Marine Technology Reporter page: 64

)

January 2024 - Marine Technology Reporter page: 64. . . . . . . . . . . . . . . . . . . . . .www.msitransuders.com . . . . . . . . . . . . . . . . . . . . . . . . . . . .(978) 486-0404 17 . . . . .NOAA/Eastern Region Acquisition Division . . .http://marinerhiring.noaa.gov . . . . . . . . . . . . . . . . . . . .Please visit us online 62 . . . . .Oceanology

-

)

January 2024 - Marine Technology Reporter page: 56

)

January 2024 - Marine Technology Reporter page: 56FLOATING OFFSHORE WIND GAZELLE WIND POWER We’re already working on the pre-FEED, and now we’re go- clude 70 turbines of 15MW each, and has preselected Gazelle ing to be working on the engineering portion. Our main goal as one of the providers for the offshore wind platform. So, is to prove the concept

-

)

January 2024 - Marine Technology Reporter page: 37

)

January 2024 - Marine Technology Reporter page: 37an online dashboard will convey ? ndings and share stories. GETTING UNDERWAY Sailing to remote parts of the ocean between June and Oc- “A modern-day warrior is not about war. It’s about the per- tober, Ocean Warrior intends to cover 10,000 nautical miles son—honesty, integrity, empathy, intelligence