Affordable SATCOM for Workboat Applications

SATCOM edges closer to providing standardized services to the workboat sector. It’s affordable now and someday soon, you won’t be able to afford to be without it.

Dartmouth, Nova Scotia-based JouBeh Technologies today makes it possible for far flung workboats to transmit critical data back to principals and at the same time, allow regulators and operators alike the possibility of reliable asset tracking on the water. Maybe it’s not YOUR workboat, but someday soon, it could be. As a reseller and integrator for Iridium Communications, JouBeh’s business mix penetrates many sectors. On the water, what they are doing for the federal government of Canada in two different applications has potential for North American commercial inland operators, as well.

M2M via SATCOM on the Water

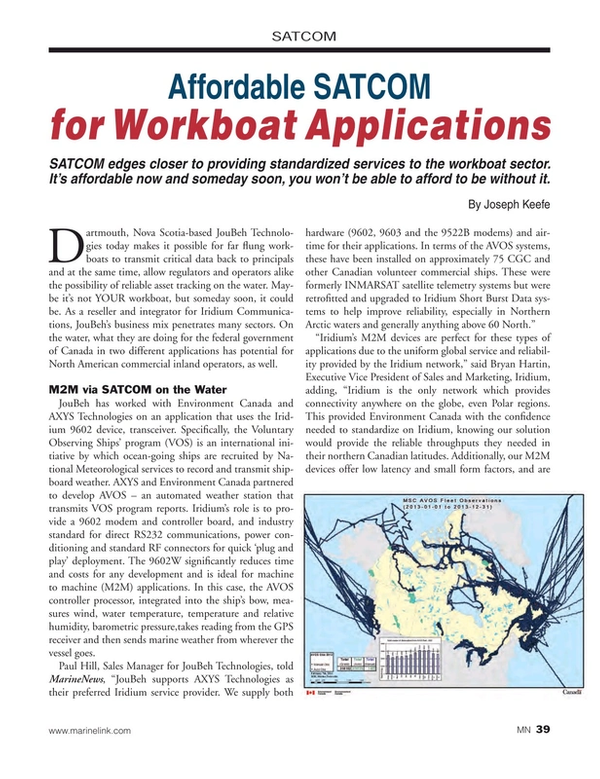

JouBeh has worked with Environment Canada and AXYS Technologies on an application that uses the Iridium 9602 device, transceiver. Specifically, the Voluntary Observing Ships’ program (VOS) is an international initiative by which ocean-going ships are recruited by National Meteorological services to record and transmit shipboard weather. AXYS and Environment Canada partnered to develop AVOS – an automated weather station that transmits VOS program reports. Iridium’s role is to provide a 9602 modem and controller board, and industry standard for direct RS232 communications, power conditioning and standard RF connectors for quick ‘plug and play’ deployment. The 9602W significantly reduces time and costs for any development and is ideal for machine to machine (M2M) applications. In this case, the AVOS controller processor, integrated into the ship’s bow, measures wind, water temperature, temperature and relative humidity, barometric pressure,takes reading from the GPS receiver and then sends marine weather from wherever the vessel goes.

Paul Hill, Sales Manager for JouBeh Technologies, told MarineNews, “JouBeh supports AXYS Technologies as their preferred Iridium service provider. We supply both hardware (9602, 9603 and the 9522B modems) and airtime for their applications. In terms of the AVOS systems, these have been installed on approximately 75 CGC and other Canadian volunteer commercial ships. These were formerly INMARSAT satellite telemetry systems but were retrofitted and upgraded to Iridium Short Burst Data systems to help improve reliability, especially in Northern Arctic waters and generally anything above 60 North.”

“Iridium’s M2M devices are perfect for these types of applications due to the uniform global service and reliability provided by the Iridium network,” said Bryan Hartin, Executive Vice President of Sales and Marketing, Iridium, adding, “Iridium is the only network which provides connectivity anywhere on the globe, even Polar regions. This provided Environment Canada with the confidence needed to standardize on Iridium, knowing our solution would provide the reliable throughputs they needed in their northern Canadian latitudes. Additionally, our M2M devices offer low latency and small form factors, and are priced affordably making them an ideal solution when you need to stay connected no matter where your work demands.”

For Environment Canada, the data is especially important because the vessels travel in areas that are data sparse. And in this case, because these vessels travel primarily in the Arctic regions, usually above 70 N latitude, the use of Iridium is critical. Hill explains, “The sovereignty issue continues to be a hot topic as the Northwest Passage continues to break earlier and earlier each year with ice retreat. Commercial shipping is very attracted to the NWP to save time and fuel to and from Asian and European markets.”

Separately, JouBeh – whose satellite footprint spans across many industry sectors and regions – also is heavily involved in the Vessel Monitoring Systems (VMS) and Global Monitoring game. One such application of VMS involves a contract with the Department of Fisheries and Oceans (DFO) on multiple projects, including their certified Vessel Monitoring Systems, using Iridium equipment and technologies. This involves as many as 1,500 fishing vessels. Using sophisticated cloud-based software allows for multiple devices to be integrated into the system, letting operators – and regulators – map, track and monitor assets in real-time.

Joubeh’s Hill adds, “JouBeh supplies VMS service on both the west and east coasts of Canada. These are seasonal fisheries from Pacific Prawn to Snow Crab and ground fish. We resell the MetOcean Data Systems designed iTrac 2 VMS which is a SBD-based VMS system. The costs to users are typically under $100 per month for position location and e-log reports depending on the requirements of specific fisheries.”

Affordability

In September of last year, Iridium reduced the pricing of its 9602 Short Burst Data (SBD) transceivers by up to 50 percent. Ideally suited for (M2M) applications including asset tracking, monitoring, fleet management and remote worker communications in areas lacking cellular coverage, every M2M solution needs an antenna and Iridium partners with industry antenna manufacturers who offer a range of antennas from very low cost patch antennas to packages that integrate an Iridium transceiver and antenna in a single environmental enclosure. For inland operators who struggle with data comms in areas that often have spotty cellular coverage, the Iridium solution is a viable alternative to cellular comms at a comparable price.

The Canadian Federal program employing AVOS and Iridium’s 9602 uses a short burst/data package system, producing 1kb/hour at a cost of about $50 per month. In the case of weather data from Canadian Coast Guard ships (CCG) ships, data is transmitted every 30 minutes at sea. Cost per byte has therefore gone down in recent years. In fact, the AVOS system and the Iridium connection provides for full transfer of each packet in less than 10 seconds. Beyond this, the low power footprint of the transceiver means it can be operated by battery power alone, in emergency situations where perhaps a vessel has lost all other power.

For data transmission, Iridium’s solution provides real economy of scale. Paul Hill adds, “There is an at sea transmission rate of every 30 minutes and then a much slower rate if the vessel is docked. It can also completely shut down if the vessel is in dry dock for maintenance, for example. The cost of transmission has decreased steadily over the last ten years. Iridium’s voice service costs are often confused with data only transmission costs.” Nevertheless, operators can pair the Iridium data system with a voice plan, all on the same invoice.

M2M on the Water – and you?

Iridium’s satellite network provides coverage and backup capabilities for more than 80 percent of the Earth’s surface where cellular is unavailable. And the M2M market is growing on the water. Iridium’s M2M data subscribers, for example, have grown significantly and now represent 46 percent of the company’s total customer base, accounting for as much as one-fifth of commercial service revenue.

Supporting and augmenting that growth is Iridium NEXT, a project that will eventually beef up and modernize both Iridium’s global coverage, but also its bandwidth capabilities. Already underway, the program is on track for completion in 2017. “This is the key and in many ways this is the convergence in the mobile satellite service industry. Iridium NEXT will offer everything in one network that everyone wants – real time, broadband, low power, low cost and global coverage. Geo-stationary systems simply cannot do this. NEXT is due to begin to launch later this year and will come on line in 2017,” says Hill. Beyond this, Iridium NEXT will be GMDSS approved which means one day soon, NEXT will be used to send AIS.

JouBeh’s Hill says that, to an extent, SATCOM can be the answer for inland commercial applications, but also says, “Satellite systems are always a more expensive option than cellular systems. There may be cell coverage in those waterways. However, in terms of coverage satellite is always a better option. There is always a minimum of two Iridium satellites in view at any time from any place in the world. For low data throughput positioning requirements, SBD is ideal.” At this time, perhaps, the best application for inland users involves location positioning and electronic logs (ships diagnostics).

Coverage above 70 North Latitude, low cost, low power consumption and a smaller physical footprint: those are all good reasons to choose Iridium solutions, but they also represent some of the best reasons for workboat operators – plying any waters – to look into a better way to facilitate data exchange between the office and the fleet. Hill adds, “It was the coverage in the North that really drove the swap-out,” but also concedes, “INMARSAT in its own right has its strengths, too, such as bandwidth.”

Increasingly, the use and exchange of real-time operations data, vessel tracking solutions and other high tech monitoring are all becoming part of the typical workboat’s daily missions. Eventually, SATCOM will be part of that equation. In fact, it is here now. A little pricier than cellular coverage today, the only question left to answer is whether you can afford to be without SATCOM tomorrow.

(As published in the March 2015 edition of Marine News - http://magazines.marinelink.com/Magazines/MaritimeNews)

Read Affordable SATCOM for Workboat Applications in Pdf, Flash or Html5 edition of March 2015 Marine News

Other stories from March 2015 issue

Content

- Marine News Editor's Note page: 6

- Insights: Steven Candito, President & CEO, NRC page: 12

- Could Sub-$50 Crude Sink Financing in the GOM? page: 18

- Hedging Your Bets page: 24

- Will Paper Logs Sail into History? page: 30

- EPA’s SmartWay Initiative Makes Way on the Water page: 36

- Affordable SATCOM for Workboat Applications page: 39

- Dometic’s Workboat Play page: 42

- Boat of the Month: Moore Shallow Shuttle 23 page: 44

- BMT’s REMBRANDT-INLAND Simulation Tool page: 48

- HEADHUNTER Marine Sewage Treatment Systems page: 56

- H2O’s Owens CrapZapper Offers More page: 56

- EPA Nod for GE Marine’s Tier 4 Marine Diesel Engine page: 56

- New Player in the Rim Thruster Market page: 56

- Hyster Variable Power Technology Engines page: 56