Could Sub-$50 Crude Sink Financing in the GOM?

The Gulf of Mexico basin is comprised of areas of various depths. Approximately 38% is shallow (about 65’ deep); the continental shelf and slope account for another 44% (down to about 6800’); the balance is deeper than 6,800’ and is, in some areas over 10,000’ deep. It covers an area of over 579,000 square miles running 994 miles east to west and 559 miles north to south.

If the Midwest is the breadbasket of America, then the Gulf State’s region and offshore areas are America’s gas station. According to the U.S. Energy Information Administration, offshore oil production in the Gulf accounts for 17% of total U.S. crude oil production, 5% of the natural gas, and 45% of U.S. oil refining and 51% of natural gas processing plant capacity.

In 1991, a gallon of regular unleaded gasoline was about $1.00 at the pump. At the time of this column being written, after 17 straight weeks of declining prices, the national average is just above $2.00. It’s been as high as $4.25 in New York – and not too long ago, at that. With a worldwide glut of oil and refined petroleum products, demand nevertheless remains strong with the average consumer keeping as much as $750.00 in gasoline costs in their pockets.

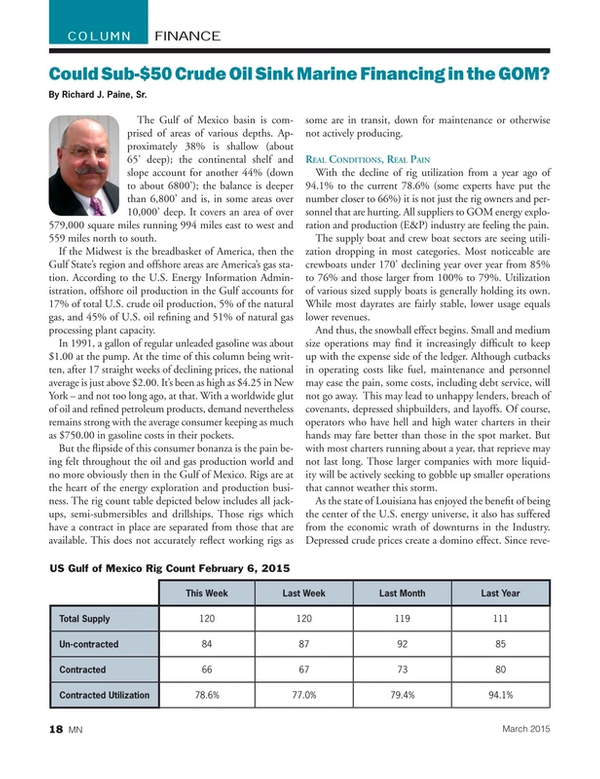

But the flipside of this consumer bonanza is the pain being felt throughout the oil and gas production world and no more obviously then in the Gulf of Mexico. Rigs are at the heart of the energy exploration and production business. The rig count table depicted below includes all jackups, semi-submersibles and drillships. Those rigs which have a contract in place are separated from those that are available. This does not accurately reflect working rigs as some are in transit, down for maintenance or otherwise not actively producing.

Real Conditions, Real Pain

With the decline of rig utilization from a year ago of 94.1% to the current 78.6% (some experts have put the number closer to 66%) it is not just the rig owners and personnel that are hurting. All suppliers to GOM energy exploration and production (E&P) industry are feeling the pain.

The supply boat and crew boat sectors are seeing utilization dropping in most categories. Most noticeable are crewboats under 170’ declining year over year from 85% to 76% and those larger from 100% to 79%. Utilization of various sized supply boats is generally holding its own. While most dayrates are fairly stable, lower usage equals lower revenues.

And thus, the snowball effect begins. Small and medium size operations may find it increasingly difficult to keep up with the expense side of the ledger. Although cutbacks in operating costs like fuel, maintenance and personnel may ease the pain, some costs, including debt service, will not go away. This may lead to unhappy lenders, breach of covenants, depressed shipbuilders, and layoffs. Of course, operators who have hell and high water charters in their hands may fare better than those in the spot market. But with most charters running about a year, that reprieve may not last long. Those larger companies with more liquidity will be actively seeking to gobble up smaller operations that cannot weather this storm.

As the state of Louisiana has enjoyed the benefit of being the center of the U.S. energy universe, it also has suffered from the economic wrath of downturns in the Industry. Depressed crude prices create a domino effect. Since revenue from oil and gas exploration and production accounts for about 14% of the state’s general fund, subtract it and deficits rise. Construction projects are put on hold, social services are curtailed, personal spending is down, and even the local Mom & Pop corner grocery takes a hit.

Then there are the lenders. Undoubtedly, financial statements will look a lot like the 2010 deepwater drilling moratorium was still in place. Falling revenue and declining vessel prices will skew a company’s tangible net worth. Declining key ratios used in determining financial the condition of an obligor (liquidity, leverage, debt, return on assets and equity etc.) will make borrowing more difficult and certainly more expensive. Cautious to a fault and due in part to banking regulations, lenders will be reticent to provide financing on vessels that are in certain segments of the oil and gas business.

Bright Spots, Market Realities

But not all vessels in that sector may become temporary pariahs. As E&P on the continental shelf and slope becomes economically unfeasible, the mobility of jack-up rigs and other shallow water equipment allows them to be moved out of the area, reassigned or cold stacked to save money. However, deepwater semi-submersible rigs cost between $500 - $775 million, drill ships range from $550 million to $1.2 billion installation, installation, risers, riser tensioners, mud pumps, anchor winches, drill strings and mud storage facilities add many more millions of dollars and such rigs are not easily moved from place to place. Ramp-up to production status is expensive and reflects a large capital investment by the rig owner. Average day rates for various drillships and semi-submersibles range from $257,000 to $442,000 (as of February 2015) and currently, world-wide utilization of deepwater rigs is about 75%. With the cost of the rig, installation and operation being extremely expensive, the investment in each rig necessitates continued operation regardless of the current low price per barrel of crude.

Companies that provide services to the deepwater sector moving crew, parts, supplies, consumables, food and other necessities will continue for the foreseeable future, to keep their crewboats, platform and offshore supply vessels and anchor handling tugs, crews and vendors operating. For how long is the question.

As a reasonably seasoned commercial marine lender, I am hesitant to use the word never ... as in “I will never lend to a (insert adjective here) operator.” For a qualified obligor, there would be little to stop me even if we were in a temporary downturn. Good lenders understand cyclicality and when one looks in retrospect at the ups and downs of this industry, somehow the sun always comes out after the storm passes. There is no doubt in my mind that this storm shall too pass. It may be rough going for a while, and there certainly will be changes in the cast of characters, but at the end of the day, all will be well and knowledgeable lenders will still be there when you need them.

Savvy stakeholders use this time to batten down the hatches, minimize expenses, and assiduously keep their financial records in order. Beyond this, it is a time to use available credit wisely and be on the lookout for opportunities. In the meantime, that motor home road trip beckons, buoyed by bargain gasoline and a look towards better times.

About the Author

Richard J. Paine, Sr. is National Marine Sales Manager at Signature Financial LLC.

(As published in the March 2015 edition of Marine News - http://magazines.marinelink.com/Magazines/MaritimeNews)

Read Could Sub-$50 Crude Sink Financing in the GOM? in Pdf, Flash or Html5 edition of March 2015 Marine News

Other stories from March 2015 issue

Content

- Marine News Editor's Note page: 6

- Insights: Steven Candito, President & CEO, NRC page: 12

- Could Sub-$50 Crude Sink Financing in the GOM? page: 18

- Hedging Your Bets page: 24

- Will Paper Logs Sail into History? page: 30

- EPA’s SmartWay Initiative Makes Way on the Water page: 36

- Affordable SATCOM for Workboat Applications page: 39

- Dometic’s Workboat Play page: 42

- Boat of the Month: Moore Shallow Shuttle 23 page: 44

- BMT’s REMBRANDT-INLAND Simulation Tool page: 48

- HEADHUNTER Marine Sewage Treatment Systems page: 56

- H2O’s Owens CrapZapper Offers More page: 56

- EPA Nod for GE Marine’s Tier 4 Marine Diesel Engine page: 56

- New Player in the Rim Thruster Market page: 56

- Hyster Variable Power Technology Engines page: 56