Northern Europe

-

- Playing Catch: Northern Europe Fisheries Fleet Review Maritime Reporter, Jul 2017 #44

Maritime Reporter & Engineering News' Fisheries Fleets Review: Part 3 - Northern Europe

Record hauls of wild fish, an unprecedented return on farmed salmon, finance and subsidy garner new orders, new designs and emboldened suppliers. In Scandinavia, particularly Norway, rich, carefully managed fisheries raise just one question for the commercially minded — which wave of business to ride. A growing number of large and small players are in on the action, as historic profits are heralded up and down the supply chain.For the hardened makers of gear that know tougher times, this is the golden age. “We’ve sold record numbers of net haulers to boats up to 50 foot,” says Hydema Syd stalwart Solbjoerg Solgaard. Sales to the U.S. are soaring, she says, and Canada has picked up, especially for automatic hauling equipment.People want quality, she adds. “The year’s fish’n has been good. Prices for cod are good. The personal finances of coastal fishermen has improved and many want to invest in good equipment.”Proof is to be found at Kleven Shipyard, where seven fisheries vessels — four trawlers, a seiner, two factory vessels and a live fish carrier — are on order. The charterers are German-Faroese DFFU; French Saint Malo; Spanish Pesquera Ancora and DESS Aquaculture Shipping, a Norwegian joint venture of aquaculture giant Marine Harvest and offshore energy’s Deep Sea Supply. In shipbuilding, the distinction between fishing boat and fish farming boat is moot. All want in on all sides of the booming fishery. Good prices for wild and farmed fish are being heralded from Greenland to the Baltic Sea and up to the Barents Sea.The DESS Aqua fish harvesting (or factory vessel) SALT 425 FHV-design due to sail in 2018 is part of a trend toward large vessels (59 m and up) for the booming worldwide aquaculture industry. DESS Aqua has just declared an option to buy another wellboat for delivery in 2Q 2018.In Norway alone, seafood worth 19 billion kroner was sold in 2016, and the lion’s share of those exports are farmed salmon. The big shipbuilders — their roots in the fishery — are supremely well-informed (if understated) of this: “There’s a lot of exciting development work happening in the aquaculture industry, and this is a market we wish to be in,” says Kleven Shipyard managing director, Ståle Rasmussen, in a note to stakeholders.New-build TroveIn league with large feed and factory boats are the new 80-plus-meter well boats. Designer More Maritime of Aalesund, Norway, has had two built: their hulls fabricated in Turkey and then kitted out at in Norway at Fiskerstrand Verft for owner Froy Rederi. The Gasoe Jarl and Gasoe Viking are 84 meters long with holds of 3,200 cubic meters for salmon, fresh water, seawater and circulated salmon-lice-eating wrasse fish.One well boat owner, NTS, has made been so successful, they’ve moved to own fish farms themselves in a palpable drive seen elsewhere in fisheries circles to own as much of the value chain as possible. The trend is driving orders of all types, and umbrella group Seafood Norway says the aquaculture supply chain now adds annual value worth $2.7 billion.Niche BoatsAs the industry grows, room opens up for niche players like Harald Bigset, managing director of Point Offshore from Ulsteinvik. He’s happy to visit Turkey, where he’s talking to builders about “extreme wide-beam” Xtreme Work Boats. The trademark Point Aqua 15-10 XWB design is designed to manhandle giant fish-farm nets and launch ROVs and divers for pen inspections.XWBs have the pull to move entire farming operations behind shelter if seas get rough — or to take on other fisheries roles. Shorter than 15 meters, the Point Aquas don’t need a captain trained in DP, although they’re envisioned using fixed, bow and stern thrusters and 1,000 HP. Rig-like and getting bigger, fish farms need anchors, and the XWBs act as anchor-handlers with cranes and a stern winch.“They can carry huge loads on deck and five or 6 persons onboard,” Bigset says, adding that his aluminum hull design is stronger and safer in rough seas than a catamaran. “There are a number of tank configurations and one variant is intended for sea weed trawling (a major focus of Norway’s new Ocean Space Centre and the targeted researchers at Sintef Ocean).” He even has a variant that moves wrasse.Small TrawlSunny, southern Norway — once a base to commercial whale-oil expeditions — is home to a boatyard that packs enormous value onto a hull shorter than 15 m. Skogsoy Baat has produced over 95 boats, but vessels like the Nina Mari pack 600 horsepower, two 32 kilowatt Perkins generators and a Volvo Penta D13 engine. hese “little” Skogsoy boats sleep six in three cabins and provide luxury seating and amenities that say “modern fishing”. There’s also 70 cu. m of hold for fish caught in a variety of ways, including gillnet and longline. “We have been building fishing vessels of many sizes and shapes since 1984,” says Skogsoy manager, Andre Rustad. “Nina Mari is the first of three vessels (of her type) now being built.” In all, Mr. Rustad has 150 million kroner in builds on order until the spring of 2019.“The feedback has been good. The hull has good stability and she handles good,” Andre tells us. With so much below the waterline, it’s seems a steady seahorse.Trawler TurnoverReplacing a 1980s cod catcher was on the mind of France Pelagique, when they went to Havyard of Fosnavaag, Norway, and Dutch designer ASD to build an 80 m trawler for December 2018. The French and Dutch designed the vessel together, although a blurry illustration suggests a Havyard 535 is being customized, and the Norwegians are on call for more engineering and design help.Fishing boats orders are supplementing orders from offshore energy Westcon Yards, where a 75 m, Rolls-Royce NVC 331 pelagic trawler for Scottish company Klondyke Fishing Co. is being built. It’s due to start work in 2019 with power from a Rolls-Royce Bergen B33:40 engine, a Promas propulsion and hydraulic winch systems. Another Rolls-Royce design, an NVC 306 longliner/gillnetter for Norwegian owners Veidar, is nearer completion at SIMEK shipyard, where Sealord Group’s Skipsteknisk ST-118 stern freezer trawler is being pieced together for work-start in 2018.Polar TrawlersTo tap northern waters for whitefish, Denmark-based Royal Greenland has ordered two 82 m Skipsteknisk designs from Spanish yard Astilleros de Murueta in Bilbao.One will shrimp, and the other will trawl for ground fish. The ST-118 factory fillet trawler and ST 119 shrimp trawler were still being tailor-engineered for the Arctic as we wrote. They’ll have 6,000 kW and 7,200 kW propulsion packages installed. Crews of 30 or 40 will be accommodated and holds that freeze 90 t of produce a day have been ordered. Permanent magnet winches will be onboard when they’re delivered between December 2018 and May 2019. Royal Greenland is also launching a new pelagic company and could well order more vessels after posting record turnover of about $50 million.Making a KrillingAmong the new vessel types gaining traction in the remote southern seas are specially netted krill trawlers. Norwegian krill fisher, Rimfrost, said in April 2017 it was planning a new vessel. In May, Vard Shipyard confirmed it would build its priciest fishing boat ever — a 130-metre-long, $118 million Antarctic krill trawler for Aker BioMarine.

Danish RevivalWhile Norway might be awash in orders, more business is due Danish builders soon, as Copenhagen recently decided to fund the fishery’s modernization. A billion Danish kroner is available over two years for newbuilds, retrofits and aquaculture vessels. Across the Skaggerak in Norway, subsidies aimed at adopting locally available innovation, including energy storage and propulsion systems, are helping some decide to spend. Fortunately for the Danes, big and small Norwegian owners still prefer Danish shipyards for the full gamut of services. An example is the building at Karstensen Skibsvǣrft of Strand Havfiske’s Wärtsilä-powered, 75 m combination trawler and purse-seiner.This his mini-survey of ours counted no fewer than a half-dozen fish delivery vessels, or well boats, either newly commissioned or just built. Wellboat technology — sorting, sterilizing, cooling and de-licing — is increasingly found aboard fishing boats, including aboard a Danish vessel we couldn’t confirm. Fish slaughter equipment has made its way onto aquaculture vessels.The Norwegian supply chain, according to a researcher at Sintef, has doubled in size in just 10 years. Recently, salmon farming has outpaced the wild catch.“One’s status as a fisherman (or gear maker) is higher now than earlier due to the opportunity to earn good money,” says Mrs. Solgaard. “Youth now search out the profession with little or no recruitment.”(As published in the July 2017 edition of Maritime Reporter & Engineering News) -

- Grimaldi Continues Fast Track Expansion Maritime Reporter, Mar 2004 #38

are newbuilds. including five under construction. The Naples group operates shipping lines to over 100 ports in 40 countries in the Mediterranean, Northern Europe, Scandinavia, British Isles, West Africa and North and South America. Since 1997 the company has spent approximately $1.3 billion modernizing

-

- SeaHow Skimmer System Marine Technology, Apr 2015 #57

both light and heavy oils efficiently – can be implemented to almost any workboat, starting with vessels only six meters long. SeaHow operates one of northern Europe’s largest fleets of oil spill response vessels, and its hands-on experience for more than 30 years was central to the three years in developing

-

- Market Report: FPSOs ... Charting the Path Ahead Maritime Reporter, Feb 2021 #34

mooring system. More than 90% of FPSOs now in service are located in six major regions. Brazil accounts for 29%, West Africa 24%, SE Asia 15%, Northern Europe 13%, China 7%, and Australia 5%. The remaining 7% are spread over the Gulf of Mexico, Eastern Canada, SW Asia, and the Mediterranean.Ownership

-

- 92nd SNAME Annual Meeting Third International Maritime Exposition Maritime Reporter, Nov 1984 #46

discussed are the cause and correction of propeller-induced vibration, noise reduction for U.S. Coast Guard patrol boats, ship manning trends in Northern Europe, and government policies affecting maritime innovation. At the luncheon on Thursday, November 8, SNAME president and chairman/chief executive

-

- A Full Agenda for the International Container Trades Maritime Logistics Professional, May/Jun 2017 #10

, while Aliança claims 59 percent in the trade. Moreover, conditions of the approval require Hamburg Süd to withdraw from five consortia trade routes - Northern Europe and Central America/Caribbean (Eurosal 1/SAWC), Northern Europe and West Coast South America (Eurosal 2/SAWC), Northern Europe and Middle East

-

- SeaHow Skimmer System Maritime Reporter, Apr 2015 #100

both light and heavy oils efficiently – can be implemented in almost any work boat, starting with vessels only six meters long. SeaHow operates one of northern Europe’s largest fleets of oil spill response vessels, and its hands-on experience of more than 30 years was central to the three years in developing

-

- Floating Production: Huge Opportunity for Shipyards, Manufacturers Maritime Reporter, Nov 2014 #98

floating production systems now on order are destined for four major locations. 26% of the units on order are to be installed offshore Brazil, 19% off Northern Europe, 14% in SE Asia and 10% off West Africa. Six units on order are being built on speculation and do not have an installation contract. In

-

- Falmouth Shiprepair Offers Free Color Brochure On Facilities And Services Maritime Reporter, Oct 1986 #11

class service to shipowners that stretches back to 1894. Located in the world's third largest natural harbor adjoining the shipping lanes to Northern Europe, the yard is said to offer ideal climatic conditions and exceptional deepwater facilities at a convenient location to shipowners. The color

-

- WORLDWIDE SHIP REPAIR Maritime Reporter, May 1985 #22

yet to become active in the shiprepair market, it seems only a matter of time before it becomes a major force to be reckoned with. Meanwhile in Northern Europe and the United Kingdom the theme has been reorganization and rationalization. Although most repair yards have set tariffs for work, these

-

- Moran Expands Container Barge Service To Ports Of Philadelphia And Baltimore Maritime Reporter, Mar 1985 #50

trade routes to Philadelphia and Baltimore. The company will load containers for this service in New York at the Global Marine Terminal, destined for Northern Shipping Terminal in Philadelphia and the Dundalk Marine Terminal in Baltimore. Moran entered the container feeder barge service last year, operating

-

- Jurgen Manske Named Representative For Hapag-Lloyd Service Maritime Reporter, Jul 15, 1980 #24

operations. In 1972, he was assigned to Houston to coordinate the startup of Hapag-Lloyd's full container s e r v i c e f r om the U.S. Gulf to Northern Europe

-

)

April 2024 - Maritime Reporter and Engineering News page: 43

)

April 2024 - Maritime Reporter and Engineering News page: 43“The industry is an ecosystem which includes owners, managers, mariners, shipyards, equipment makers, designers, research institutes and class societies: all of them are crucial,” – Eero Lehtovaara, Head of Regulatory & Public Affairs, ABB Marine & Ports All images courtesy ABB Marine and Ports provi

-

)

April 2024 - Maritime Reporter and Engineering News page: 41

)

April 2024 - Maritime Reporter and Engineering News page: 41Nautel provides innovative, industry-leading solutions speci? cally designed for use in harsh maritime environments: • GMDSS/NAVTEX/NAVDAT coastal surveillance and transmission systems • Offshore NDB non-directional radio beacon systems for oil platform, support vessel & wind farm applications

-

)

April 2024 - Maritime Reporter and Engineering News page: 32

)

April 2024 - Maritime Reporter and Engineering News page: 32FEATURE A closeup of a blade installation process taken via drone. A blade handling system is apparent (in yellow). Images courtesy of Mammoet requirement for the development of these cranes, particularly ling area. This would result in a major time and fuel saving. in ? oating offshore wind,” says

-

)

April 2024 - Maritime Reporter and Engineering News page: 17

)

April 2024 - Maritime Reporter and Engineering News page: 17SOVs China, we do not look at demand for SOVs/CSOVs as having a linear rela- tionship to the number of wind farms or turbines installed. We look to see where a large number of wind turbines are concentrated in relatively close proximity, generally in a very large wind farm or in a project cluster

-

)

April 2024 - Maritime Reporter and Engineering News page: 7

)

April 2024 - Maritime Reporter and Engineering News page: 7REGISTER NOW Seawork celebrates its 25th anniversary in 2024! The 25th edition of Europe’s largest commercial marine and workboat exhibition, is a proven platform to build business networks. Seawork delivers an international audience of visitors supported by our trusted partners. Seawork is the

-

)

April 2024 - Marine News page: 41

)

April 2024 - Marine News page: 41Vessels Gripper ing European CTV operator Northern Offshore Services (N-O-S) and U.S.-based investment ? rm OIC. The vessel, based on N-O-S’ 30-meter G-class design, fea- tures Volvo Penta’s IPS propulsion system and is said to be “hybrid-ready”, meaning it was built with space reserved for all the

-

)

April 2024 - Marine News page: 32

)

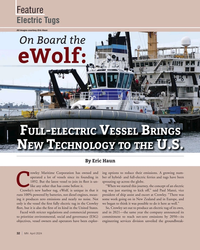

April 2024 - Marine News page: 32Feature Electric Tugs All images courtesy Eric Haun On Board the eWolf: F - V B ULL ELECTRIC ESSEL RINGS EW ECHNOLOGY TO THE N T U.S. By Eric Haun rowley Maritime Corporation has owned and ing options to reduce their emissions. A growing num- operated a lot of vessels since its founding in ber

-

)

February 2024 - Maritime Reporter and Engineering News page: 28

)

February 2024 - Maritime Reporter and Engineering News page: 28COVER FEATURE times of con? ict or in other national said Ebeling. “If you look at Iraq and tors bring to the table, all provided by emergencies, and the program also Afghanistan, 98% of those cargoes the MSP ? eet, and it would cost the provides DoD access to MSP partici- were transported to the

-

)

February 2024 - Maritime Reporter and Engineering News page: 26

)

February 2024 - Maritime Reporter and Engineering News page: 26is focused on acquiring and commodate volumes of heavy military machinery globally, predominantly operating the most militarily useful kit. into Northern Europe as of the last few and commercially viable ships for its “We need a high main deck to years. military, and commercial customers, accommodate

-

)

February 2024 - Maritime Reporter and Engineering News page: 20

)

February 2024 - Maritime Reporter and Engineering News page: 20MARKETS FPSO technology dominates the region’s FPS demand. duction and storage of low and zero emission energy carriers, In all, 18 countries in West and East Africa are expected such as methanol and ammonia. One exciting development to receive new FPSOs, FLNGs and FPUs between 2024 and leverages

-

)

February 2024 - Maritime Reporter and Engineering News page: 16

)

February 2024 - Maritime Reporter and Engineering News page: 16THE PATH TO ZERO Methanol’s Superstorage Solution Technical inquiries to SRC Group ramped up after it received Approval in Principle (AIP) for a concept which ‘reinvented methanol fuel storage’ on board ships. Delivering the answers has seen technical talk converting into project discussions

-

)

February 2024 - Maritime Reporter and Engineering News page: 13

)

February 2024 - Maritime Reporter and Engineering News page: 13motion, strikes, riots, and looting, is a new top ? ve risk for the marine and shipping industry this year at 23%. Businesses and their supply chains face considerable geo- political risks with war in Ukraine, con? ict in the Middle East, and ongoing tensions around the world. Political risk in 2023

-

)

February 2024 - Maritime Reporter and Engineering News page: 12

)

February 2024 - Maritime Reporter and Engineering News page: 12Maritime Risk Top Marine Business Risks in 2024 By Rich Soja, North American Head Marine, Allianz Commercial yber incidents such as ransomware attacks, data linked to several large ? re incidents at sea in recent years. breaches, and IT disruptions are the biggest worry Regularly assessing and updating

-

)

February 2024 - Marine News page: 31

)

February 2024 - Marine News page: 31Ørsted vessel rates, and these impacts are felt more strongly in the U.S. than they are in Europe, Møller said. “Now we are paying the premium, because the oil market is high. But going further down, probably oil market is going to take a turn again and our business will become equally cheap, because

-

)

February 2024 - Marine News page: 30

)

February 2024 - Marine News page: 30Feature Offshore Wind Ørsted “There is momentum in the wind market right now.” Ron MacInnes, President, Seatrium Offshore & Marine USA back the other way, become more mature, more stable, that supply chain, that project pipeline, is going to exist, more evenly distributed, basically, with your risk

-

)

January 2024 - Marine Technology Reporter page: 56

)

January 2024 - Marine Technology Reporter page: 56FLOATING OFFSHORE WIND GAZELLE WIND POWER We’re already working on the pre-FEED, and now we’re go- clude 70 turbines of 15MW each, and has preselected Gazelle ing to be working on the engineering portion. Our main goal as one of the providers for the offshore wind platform. So, is to prove the concept

-

)

January 2024 - Marine Technology Reporter page: 55

)

January 2024 - Marine Technology Reporter page: 55and materials, while also Imperial College in London, in Plymouth, England as well helping to eliminate seabed scouring and installation impact. as in Northern Spain. “So far, the results at a very small scale The Gazelle platform’s unique geometry provides reduced have been successful. So our next steps

-

)

January 2024 - Marine Technology Reporter page: 37

)

January 2024 - Marine Technology Reporter page: 37an online dashboard will convey ? ndings and share stories. GETTING UNDERWAY Sailing to remote parts of the ocean between June and Oc- “A modern-day warrior is not about war. It’s about the per- tober, Ocean Warrior intends to cover 10,000 nautical miles son—honesty, integrity, empathy, intelligence

-

)

January 2024 - Marine Technology Reporter page: 8

)

January 2024 - Marine Technology Reporter page: 8supply line to Rus- Israeli Defense Forces (IDF) as it was being deployed from sian operations on the Crimean peninsula. Given these highly a beach in northern Gaza, reportedly to attack an offshore asymmetric effects, naval planners and strategists around the installation. And in December, 2023, images

-

)

January 2024 - Maritime Reporter and Engineering News page: 40

)

January 2024 - Maritime Reporter and Engineering News page: 40of cylindrical cargo tanks at a maximum 19 bar(g) pressure and minimum -35°C temperature, and is committed to a long-term time charter agreement with Northern Lights. The newbuilding ordered now is the ? rst ship of this type for the Bernhard Schulte ? eet and the fourth CO2 carrier for Northern Lights

-

)

January 2024 - Maritime Reporter and Engineering News page: 26

)

January 2024 - Maritime Reporter and Engineering News page: 26, and group, it could be the start of a green deployed on major sea routes, including speci? cally the CMB.TECH team took ? eet,” said Campe. northern Europe, the Mediterranean, a marinized Volvo Penta engine and As word started to get out, Campe North Africa and West Africa. modi? ed it so that

-

)

January 2024 - Maritime Reporter and Engineering News page: 14

)

January 2024 - Maritime Reporter and Engineering News page: 14The Path to Zero work to make OceanWings suitable for lyzed the vessel’s behavior in relation to its maiden voyage – marking it as the commercial vessels was actually a scale the use of its four OceanWings. ? rst modern wind assisted modern ship down of the original design. The wing- Their goals went

-

)

November 2023 - Marine Technology Reporter page: 22

)

November 2023 - Marine Technology Reporter page: 22time on the water and ves- in over three decades is now undergoing sea trials in sel emissions – while working seamlessly within the ship’s wider the Northern Paci? c, testing an integrated technology operational and processing parameters to optimize pro? tability. Tpackage from Kongsberg Discovery tailored

-

)

November 2023 - Marine Technology Reporter page: 19

)

November 2023 - Marine Technology Reporter page: 19to see if it can be increased. ISO-NE noted the upper limit About the Authors for a single system contingency to be 2,000 MW -- instead of the stated 2,200 MW -- and sought study up to that lower Paradise 2,000 MW limit. While a 2,000 MW operating ceiling would Theodore Paradise is a accommodate the