President International Maritime Associates Inc

-

- Navy Repair And Overhaul Market Maritime Reporter, Apr 1984 #36

The Navy has clearly become the dominant source of ship repair, as well as new ship construction in the United' States. Ten years ago Navy business accounted for 36 percent of ship repair employment and 58 percent of new ship construction employment in U.S. shipyards. The figures are now 78 percent and 87 percent, respectively (see Exhibit 1).

In June 1983, IMA published a report on the Navy new construction market. A second report, on the Navy repair and overhaul market, is now being prepared.

Some information to be presented is highlighted in this article.

Future Business Opportunities The Navy has asked Congress for $2.8 billion in FY 1985 to fund 56 scheduled Navy ship overhauls.

This compares to $2.4 billion for 54 overhauls in FY 1984, and $2.5 billion for 59 overhauls in FY 1983.

Past policy has been to assign about 35 percent of this work to private shipyards. The remaining 65 percent of the work, especially overhaul of complex combatants, is performed in one of eight Navyowned shipyards.

Exhibits 2 and 3 list the scheduled overhauls of Navy and MSC ships over the next 12—24 months.

Forty-nine Navy and 28 MSC ship overhauls are scheduled. These jobs are to be awarded to commercial shipyards.

There are constraints on the competition: • Some have already been awarded as part of a multiship contract.

• To maintain crew morale, Navy's policy is to restrict competition on about one-third of overhauls to homeport shipyards. This policy doesn't affect MSC ships. But the ship relocation cost effectively limits Atlantic/Gulf shipyards to competing for Atlantic fleet MSC ships, and West Coast yards compete for Pacific fleet ships.

• NAVSEA and MSC are required to reserve some overhauls to competition among shipyards qualifying as small business firms. This particularly affects MSC overhauls as almost all are reserved for small businesses.

Equipment Sales Each overhaul requires replacement or addition of equipment. An example of the equipment variety and planned expenditure is provided in Exhibit 4. This shows equipment required for scheduled alterations planned for USS Simon Lake, a 20-year-old submarine tender.

Most long lead time equipment is directly purchased by Navy and provided to the shipyard as Government Furnished Equipment (GFE). More common equipment (e.g., refrigerators, hydraulic bench press, etc.) are typically included in the specification as items to be purchased by the shipyard as Contractor Supplied Equipment (CFE).

Our survey indicated a large percentage of mechanical, electrical and outfit equipment is purchased by the shipyard. Electronics equipment is purchased about evenly by Navy and contractor. Ordnance equipment is mostly purchased by Navy.

About 30-40 percent of the cost of a typical combatant overhaul will be subcontracted by the shipyard for material purchase. A large integrated yard le.g., Bath, Ingalls) will subcontract 2-5 percent for outside labor. Smaller yards may subcontract out 50 percent for specialized services.

Profitability of Navy Overhaul We asked master ship repair contractors about the profits in Navy overhaul work. Of 22 responses: • 9 respondents said Navy overhauls were less profitable than commercial repairs • 11 thought the Navy and commercial repair business had comparable profits • 2 said Navy was more profitable than commercial work Of the 49 Navy ship overhauls scheduled for the private sector over the next two years: • 31 will be fixed-price contracts • 14 will be cost-plus-award-fee contract • 4 will be cost-plus-fixed-fee contracts Fixed-price contracts squeeze profits from bidders in an industry hungry for work. U.S. ship repair yards are increasingly hungry for work! It is highly probable that Navy overhaul will be a low profit business over the next few years.

Technical Competitive Factors We asked master ship repair contractors to rank technical factors which affect award of Navy overhaul contracts. Exhibit 5 shows the response of 22 shipyards.

A peculiar pattern appears in these responses. Atlantic yards give high ranking to quality assurance, management experience in Navy work, in-place management, and previous performance on Navy contracts. Important factors to Pacific yards are political support in Congress, combat systems capability and drydocking capability.

Problems in Navy Overhaul Shipyards were also asked to rank problems in performing Navy overhaul work. Exhibit 6 shows the response.

All yards felt unrealistic bid pricing is the greatest problem.

Many said competition is cutthroat.

This reflects the state of shipyard business and reliance on a small number of big jobs from one customer.

Pacific coast yards seem to have particular problems receiving GFM/ GFI, but less difficulty getting decisions from the Navy.

Yard Improvements Planned We asked what type improvements each yard plans in overhaul and repair capabilities over the next several years. Exhibit 7 shows the response.

Over half the respondents said they are planning new drydocking facilities. A large number said they plan to improve machine shops and expand their engineering staff.

IMA's full report (about 200 pps.) on the Navy overhaul market will be available in May 1984. It will be sold for $480.

This price includes the initial report plus four quarterly updates.

The report can be obtained by writing: James R.

McCaul, President, International Maritime Associates, Inc., 1800 K Street, N.W., Washington, D.C.

20006.

A special pre-publication price of $380 is available to purchasers of the report who order prior to May 1.

-

- Future Requirements for Shuttle Tankers in the Gulf Maritime Reporter, Jun 2001 #42

Ultra-deepwater plays in the Gulf of Mexico offer vast potential for oil and gas production. There are now more than 1,650 active leases in the Gulf of Mexico in water depths exceeding 5,000 ft. and, with 24 drill rigs capable of drilling at this depth now working in the Gulf, activity on these

-

- Outlook for Floating Production Systems Maritime Reporter, Sep 2003 #52

Floating production has evolved to a mature technology that opens for development oil and gas reservoirs that would be otherwise impossible or uneconomic to tap. The technology enables production far beyond the depth constraints of fixed platforms, generally considered to be 1,400 ft. (426.7 m)

-

- OUTLOOK FOR THE $35-BILLION ANNUAL NAVY SHIPBUILDING MARKET Maritime Reporter, Jul 1989 #25

Technology Development To Be Given Added Emphasis Navy Shipbuilding Program Navy ship construction has been the major business driver for shipbuilders and ship systems manufacturers in this country over the past decade. This article deals specifically with Navy ship construction over the next 10

-

- LONG TERM OUTLOOK FOR U.S. NAVY SHIPBUILDING Maritime Reporter, Feb 1989 #29

NAVY PROJECTS SPENDING $11 BILLION PER YEAR Editor's Note: This article only forecasts business opportunities in the shipbuilding sector. For a projection of business opportunities in the ship repair and maintenance sector over the next 10 years, see Mr. McCaul's article, "U.S. Ship Maintenance &

-

- $29.4-BILLION FY89 NAVY BUDGET APPROVED FOR SHIPS AND EQUIPMENT Maritime Reporter, Dec 1988 #23

earlier this year, is expected to be tied up for 12 to 14 months. BIW photo by Deb Huston. billion over FY 1988 and $1 billion less than the President's request last February. Separate legislation was passed to authorize military programs. This is the first time in several years that the defense

-

- U.S. SHIP MAINTENANCE & REPAIR— A $50 BILLION TO $60 BILLION 10-YEAR MARKET Maritime Reporter, Dec 1988 #28

10-YEAR FORECAST OF BUSINESS OPPORTUNITIES IN U.S. NAVY SHIP MAINTENANCE AND REPAIR International Maritime Associates, Inc., (IMA), Washington, D.C., has just published a 280-page report which forecasts business opportunities in Navy ship maintenance from 1989 through 1998. It addresses the

-

- U.S. NAVY SHIP REPAIR AND MODERNIZATION Maritime Reporter, Sep 1988 #33

Review of a Major Forecast and Appraisal of Business Opportunities Available to Equipment Manufacturers and Ship Repair Firms Over the next ten years the U.S. Navy will spend more than $50 billion on ship repair and modernization. Logical concerns are where these dollars will be spent, what portion

-

- BUSINESS OPPORTUNITIES IN THE NEW NAVAL TECHNOLOGY PROGRAM Maritime Reporter, Jul 1988 #31

Over the next two years the U.S. Navy will spend more than $18 billion on developing new systems and equipment. The program offers many exciting business opportunities for manufacturers, engineering firms, systems integrators, etc. Spending Is Up For New Technology Navy R&D spending has grown impres

-

- THE $34-BILLION ANNUAL U.S. NAVY MARKET Maritime Reporter, Jun 1988 #24

authorization bill. Differences between the two bills will be negotiated by House/Senate conferees. A compromise final version will be sent to the President for signature. An appropriations bill must also be passed by each chamber, providing funding for ship and other defense procurements. A compromise

-

- Future Business Opportunities In Navy Ship Procurement, Ship Maintenance And Navy Technology Development Maritime Reporter, May 1988 #25

International Maritime Associates, Inc. (IMA) prepares detailed business reports covering the U.S. Navy market. They deal with future business opportunities available to shipyards, manufacturers, engineering firms and other marine suppliers. This article is based on information contained in recent

-

- NAVY WILL SPEND OVER $9 BILLION IN FY 1988 ON R&D Maritime Reporter, Mar 1988 #27

Increasing R&D Budgets Offers Many Business Opportunities For Navy Suppliers This year the U.S. Navy will spend over $9 billion for research and development—generating a flow of business opportunities for equipment manufacturers, technology firms, computer software and hardware suppliers, engineerin

-

)

March 2024 - Marine Technology Reporter page: 48

)

March 2024 - Marine Technology Reporter page: 48Index page MTR MarApr2024:MTR Layouts 4/4/2024 3:19 PM Page 1 Advertiser Index PageCompany Website Phone# 17 . . . . .Airmar Technology Corporation . . . . . . . . . .www.airmar.com . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .(603) 673-9570 9 . . . . . .Birns, Inc. . . . . . . . . . .

-

)

March 2024 - Marine Technology Reporter page: 46

)

March 2024 - Marine Technology Reporter page: 46NEW TECH OCEANOLOGY INTERNATIONAL 2024 MTR TV’s professional video team was out and about at Oi in London for nearly 20 executive interviews, including [clockwise, starting top left]: Cellula Robotics’ CEO Neil Manning; Rob Dewell, Integration Engineer, Saab UK who put the new eM1-7 electric manipulator

-

)

March 2024 - Marine Technology Reporter page: 45

)

March 2024 - Marine Technology Reporter page: 45ronments. The new agreement will address speci? c techni- cal gaps in the UUV defense and offshore energy markets especially for long duration, multi-payload mission opera- tions where communications are often denied or restricted. As part of the new alliance, Metron’s Resilient Mission Autonomy portfolio

-

)

March 2024 - Marine Technology Reporter page: 44

)

March 2024 - Marine Technology Reporter page: 44MD, Valeport and Ole Søe-Pedersen, VP & Image courtesy Teledyne Marine GM Teledyne Marine announce the deal in London. Pictured (L-R): Cellula Robotics, President, Eric Jackson, Metron Inc. President and CEO, Van Gurley, and Cellula Robotics CEO, Neil Manning. Chris Blake, VP Survey, Unique Group; Martin

-

)

March 2024 - Marine Technology Reporter page: 42

)

March 2024 - Marine Technology Reporter page: 42NEW TECH OCEANOLOGY INTERNATIONAL 2024 Image courtesy Greg Trauthwein Image courtesy BIRNS MacArtney launches the new ultra-compact ø12.7 mm SubConn Nano connector. Innovative connectivity built on 45 years of ? eld-proven and market-trusted design. Image courtesy MacArtney Birns celebrated its 70th

-

)

March 2024 - Marine Technology Reporter page: 40

)

March 2024 - Marine Technology Reporter page: 40NEW TECH OCEANOLOGY INTERNATIONAL 2024 All photos courtesy MTR unless otherwise noted NEW TECH, PARTNERSHIPS LAUNCH IN LONDON With Oceanology International now one month in the rear-view mirror, MTR takes a look at some of the interesting technologies launched before, during and after the London event.

-

)

March 2024 - Marine Technology Reporter page: 37

)

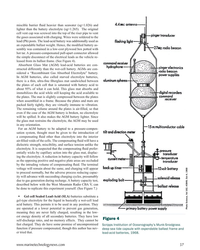

March 2024 - Marine Technology Reporter page: 37miscible barrier ? uid heavier than seawater (sg=1.026) and lighter than the battery electrolyte (sg=1.265). The original cell vent cap was screwed into the top of the riser pipe to vent the gases associated with charging. Wires were soldered to the lead (Pb) posts. The lead-acid battery was additionall

-

)

March 2024 - Marine Technology Reporter page: 29

)

March 2024 - Marine Technology Reporter page: 29n January, Norway said “yes” to sea- bed mining, adding its weight to the momentum that is likely to override the calls for a moratorium by over 20 countries and companies such as I Google, BMW, Volvo and Samsung. Those against mining aim to protect the unique and largely unknown ecology of the sea?

-

)

March 2024 - Marine Technology Reporter page: 27

)

March 2024 - Marine Technology Reporter page: 27SEA-KIT USV Maxlimer returning from HT-HH caldera in Tonga. © SEA-KIT International data and further assess ecosystem recov- ery. What is known, noted Caplan-Auer- bach, is that the impact of submarine vol- canoes on humans is rare. “The HT-HH eruption was a tragedy, but it was very unusual. It let us

-

)

March 2024 - Marine Technology Reporter page: 26

)

March 2024 - Marine Technology Reporter page: 26FEATURE OCEANOGRAPHIC INSTRUMENTATION & SENSORS Kevin Mackay, TESMaP voyage leader and Center head of the South and West Paci? c Regional Centre of Seabed 2030. Kevin in the seismic lab at Greta Point looking at the Hunga Tonga-Hunga Ha’apai volcano 3D map completed with data from the TESMaP voyage

-

)

March 2024 - Marine Technology Reporter page: 25

)

March 2024 - Marine Technology Reporter page: 25Auerbach explained that ideally, “one ? ed layers of geothermal activity,” noted changes over an area of 8,000 km2. They would have both instruments: seismom- Skett, “and the change in salinity and dis- found up to seven km3 of displaced ma- eters to detect and locate subsurface ac- solved particles for

-

)

March 2024 - Marine Technology Reporter page: 20

)

March 2024 - Marine Technology Reporter page: 202024 Editorial Calendar January/Februay 2024 February 2024 March/April 2024 Ad close Jan.31 Ad close March 21 Ad close Feb. 4 Underwater Vehicle Annual Offshore Energy Digital Edition ?2?VKRUH:LQG$)ORDWLQJ)XWXUH ?2FHDQRJUDSKLF?QVWUXPHQWDWLRQ 6HQVRUV ?6XEVHD'HIHQVH ?6XEVHD'HIHQVH7KH+XQWIRU ?0DQLS

-

)

March 2024 - Marine Technology Reporter page: 18

)

March 2024 - Marine Technology Reporter page: 18TECH FEATURE IMR There are also weaknesses in terms of accuracy because of FiGS Operations and Bene? ts signal noise and the ability to detect small ? eld gradients. In Conventional approaches to evaluating cathodic protection this process there is a risk that possible issues like coating (CP)

-

)

March 2024 - Marine Technology Reporter page: 16

)

March 2024 - Marine Technology Reporter page: 16TECH FEATURE IMR Image courtesy FORCE Technology OPTIMIZING CATHODIC PROTECTION SURVEY USING NON-CONTACT SENSORS By Svenn Magen Wigen, FORCE Technology he principle behind sacri? cial anodes, which are water structures, reducing the need for frequent repairs and used to safeguard underwater pipelines

-

)

March 2024 - Marine Technology Reporter page: 15

)

March 2024 - Marine Technology Reporter page: 15sensor options for longer mission periods. About the Author For glider users working in ? sheries and conservation, Shea Quinn is the Product Line Manager the Sentinel can run several high-energy passive and active of the Slocum Glider at Teledyne Webb acoustic sensors, on-board processing, and imaging

-

)

March 2024 - Marine Technology Reporter page: 14

)

March 2024 - Marine Technology Reporter page: 14to bring this new product and capability to The Slocum Sentinel Glider will be driven by the industry’s our customers,” said Dan Shropshire, Vice President Business largest buoyancy engine, with a volumetric capacity of 4 li- Development and Program Execution, Marine Vehicles, “The ters – more than

-

)

March 2024 - Marine Technology Reporter page: 11

)

March 2024 - Marine Technology Reporter page: 11assist in identifying mines and act as a neutralization device. About the Author Bottom mines pose even greater chal- David R. Strachan is a defense analyst and founder of lenges. Unlike contact mines, bottom Strikepod Systems, a research and strategic advisory mines utilize a range of sensors to

-

)

March 2024 - Marine Technology Reporter page: 8

)

March 2024 - Marine Technology Reporter page: 8INSIGHTS SUBSEA DEFENSE Copyright RomanenkoAlexey/AdobeStock WHEN THE SHOOTING STOPS: BLACK SEA MINE CLEARANCE WILL FEATURE ADVANCED TECH, CONOPS By David Strachan, Senior Analyst, Strikepod Systems ince the beginning of the war in Ukraine, mine warfare mines have been the weapon of choice for both

-

)

March 2024 - Marine Technology Reporter page: 7

)

March 2024 - Marine Technology Reporter page: 7Set a Course for your Career Become a NOAA professional mariner! Sail with NOAA’s fleet of research marinerhiring.noaa.gov 1-833-SAIL-USA (724-5872) and survey ships! - Detects all iron and steel Get your next salvage - Locate pipelines, anchors and job done faster chains with a JW Fishers

-

)

March 2024 - Marine Technology Reporter page: 6

)

March 2024 - Marine Technology Reporter page: 6MTR Editorial Advisors Gallaudet Hardy The Honorable Tim Gallaudet, Kevin Hardy is President PhD, Rear Admiral, U.S. of Global Ocean Design, Navy (ret) is the CEO of creating components and Ocean STL Consulting and subsystems for unmanned host of The American Blue vehicles, following a career

-

)

March 2024 - Marine Technology Reporter page: 4

)

March 2024 - Marine Technology Reporter page: 4.com Personally, it was my ? rst return to London for this event since 2018, as the 2020 ‘50th Anniversary’ edition of Oi was relegated to an President & COO online only event; and the 2022 version – fresh off (most of) the world opening up post- Gregory R. Trauthwein [email protected] COVID

-

)

March 2024 - Marine Technology Reporter page: 2

)

March 2024 - Marine Technology Reporter page: 2March/April 2024 On the Cover Volume 67 • Number 3 Image courtesy NIWA-Nippon Foundation TESMaP / Rebekah Parsons-King 8 Subsea Defense Black Sea Mines When the shooting stops in the Ukraine, the tough work of clearing mines will commence. By David Strachan 12 Gliders Slocum Sentinel 22 Teledyne

-

)

April 2024 - Maritime Reporter and Engineering News page: 48

)

April 2024 - Maritime Reporter and Engineering News page: 48Index page MR Apr2024:MN INDEX PAGE 4/5/2024 1:33 PM Page 1 ANCHORS & CHAINS MILITARY SONAR SYSTEMS tel:+44 (0) 1752 723330, [email protected] , www.siliconsensing.com Anchor Marine & Supply, INC., 6545 Lindbergh Houston, Massa Products Corporation, 280 Lincoln Street, SONAR TRANSDUCERS

-

)

April 2024 - Maritime Reporter and Engineering News page: 46

)

April 2024 - Maritime Reporter and Engineering News page: 46MARKETPLACE Professional www.MaritimeProfessional.com GILBERT ASSOCIATES, INC.GILBERT ASSOCIATES, INC. Naval Architects and Marine Engineers SHIP DESIGN & ENGINEERING SERVICES Join the industry’s #1 Linkedin group )NNOVATION